Developed by Japanese technician Goichi Ichimoku within the Thirties, the Ichimoku Kinko Hyo, which interprets to “equilibrium chart at a look,” is a multifaceted indicator that comes with a number of timeframes right into a single chart. This holistic method paints a transparent image of the prevailing pattern, potential assist and resistance zones, and underlying shopping for or promoting stress.

Think about having a private market whisperer always feeding you worthwhile insights – that’s the essence of the Ichimoku indicator for MT5 customers.

A Glimpse into the Historical past of the Ichimoku Indicator

The Ichimoku indicator boasts a wealthy historical past, rooted on the earth of Japanese candlestick evaluation. Whereas the precise origins stay shrouded in some thriller, it’s extensively acknowledged that Goichi Ichimoku spent years meticulously crafting this indicator to seize the essence of market conduct. His deal with incorporating parts from a number of timeframes right into a single visible illustration revolutionized technical evaluation for generations of merchants.

Why Embrace the Ichimoku Indicator in MT5?

Within the fast-paced world of foreign currency trading, having a dependable and versatile instrument at your disposal is paramount. The Ichimoku indicator seamlessly integrates with the MT5 platform, providing a number of distinct benefits:

- Multi-Timeframe Evaluation: By factoring in knowledge from totally different time horizons, the Ichimoku indicator supplies a complete view of the market, serving to you determine long-term tendencies whereas pinpointing potential entry and exit factors on decrease timeframes.

- Affirmation Alerts: The Ichimoku indicator doesn’t rely solely on a single line or knowledge level. As an alternative, it generates affirmation indicators by interactions between its varied elements, fostering a extra sturdy buying and selling technique.

- Person-Pleasant Integration: The MT5 platform boasts a user-friendly interface, making it straightforward so as to add and customise the Ichimoku indicator. With just a few clicks, you possibly can have this highly effective instrument at your fingertips, prepared to investigate any forex pair or asset class.

Unveiling the Elements of the Ichimoku Indicator

The Ichimoku indicator would possibly seem advanced at first look, however understanding its elements is vital to unlocking its full potential. Right here’s a breakdown of the 5 key parts that type the core of this versatile instrument:

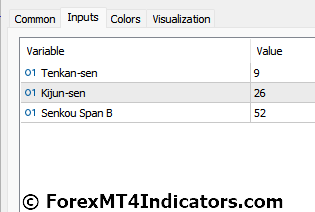

- Tenkan-sen (Conversion Line): This line represents the typical of the very best and lowest costs over a particular interval, sometimes 9 days. Consider it as a snapshot of the short-term market sentiment.

- Kijun-sen (Base Line): The Kijun-sen acts as a mid-term pattern indicator, calculated as the typical of the Tenkan-sen and the closing value over the previous 26 days. It supplies a smoother line in comparison with the Tenkan-sen, providing a clearer view of the prevailing pattern route.

- Senkou Span A (Main Span A): This main indicator is constructed by taking the typical of the Tenkan-sen and Kijun-sen, projected ahead 26 days into the longer term. Think about it as a sneak peek into the place the value is likely to be headed primarily based on present market situations.

- Senkou Span B (Main Span B): Shaped by taking the closing value of the previous 52 days and projecting it ahead 26 days, the Senkou Span B varieties the underside half of the Ichimoku Cloud. Along with Senkou Span A, they create a visible illustration of potential assist and resistance zones.

- Chikou Span (Lagging Span): This line displays the closing value of a particular interval (sometimes 26 days) however is plotted 26 days behind the precise value motion.

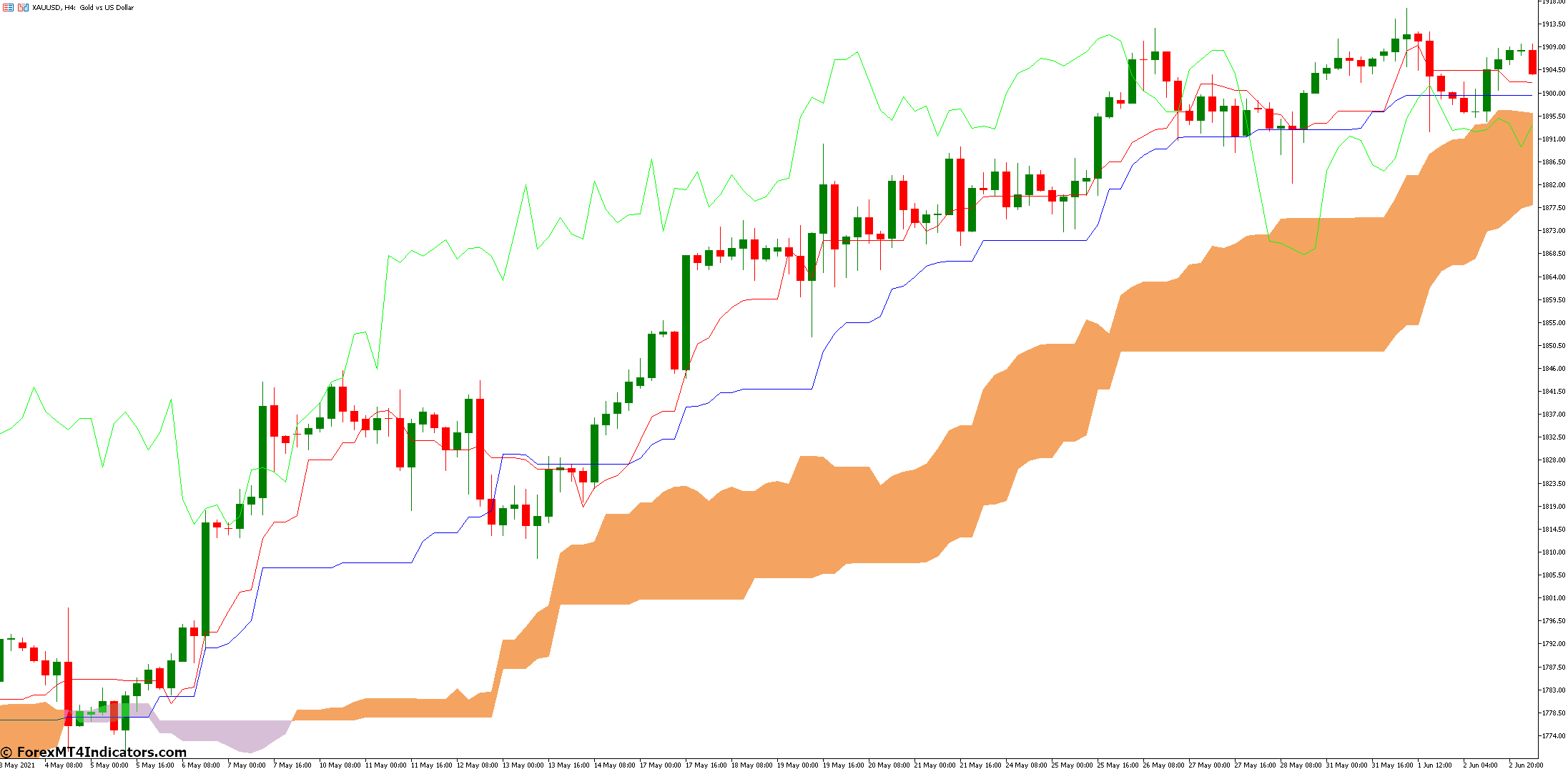

The Energy of the Cloud: Decoding the Ichimoku Cloud

One of the crucial distinctive options of the Ichimoku indicator is the Ichimoku Cloud, shaped by the intersection of Senkou Span A and Senkou Span B. This dynamic cloud presents worthwhile insights into market tendencies and potential assist/resistance zones.

- Cloud Development: The thickness of the cloud is instantly associated to the volatility of the market. A thick cloud signifies excessive volatility, whereas a skinny cloud suggests a extra secure market surroundings.

- Development Route: The slope of the cloud is an important indicator of the prevailing pattern. An upward-sloping cloud suggests a bullish pattern, whereas a downward-sloping cloud signifies a bearish bias.

- Buying and selling with the Cloud: The value interplay with the cloud supplies worthwhile buying and selling indicators. When the value is buying and selling above the cloud, it usually signifies an uptrend, whereas a value buying and selling beneath the cloud suggests a downtrend.

Taking Your Buying and selling to the Subsequent Degree

The Ichimoku indicator shines when mixed with different technical evaluation instruments. Listed below are some superior methods to contemplate:

- Combining Ichimoku with Different Indicators: The Ichimoku indicator will be successfully mixed with different common indicators just like the Relative Energy Index (RSI), Shifting Common Convergence Divergence (MACD), or Stochastic Oscillator to generate extra complete indicators.

- Using Ichimoku on Completely different Timeframes: The Ichimoku indicator’s versatility means that you can analyze charts on varied timeframes. As an example, you should use weekly and each day charts to determine long-term tendencies after which swap to decrease timeframes just like the 4-hour chart to pinpoint potential entry and exit factors.

- Backtesting Ichimoku Methods: Earlier than deploying your Ichimoku-based methods with actual capital, think about backtesting them on historic knowledge utilizing the MT5 platform’s built-in technique tester. This lets you refine your method and achieve confidence earlier than risking actual cash.

Understanding the Limitations

Whereas the Ichimoku indicator is a robust instrument, it’s important to acknowledge its limitations:

- Lagging Nature: The Ichimoku indicator, by its design, incorporates previous value knowledge. This inherent lag can typically trigger it to overlook out on capturing very quick market actions.

- False Alerts in Ranging Markets: In intervals of consolidation or ranging markets, the place value fluctuates inside a particular zone, the Ichimoku cloud can flatten, probably producing false indicators.

The way to Commerce with Ichimoku Indicator

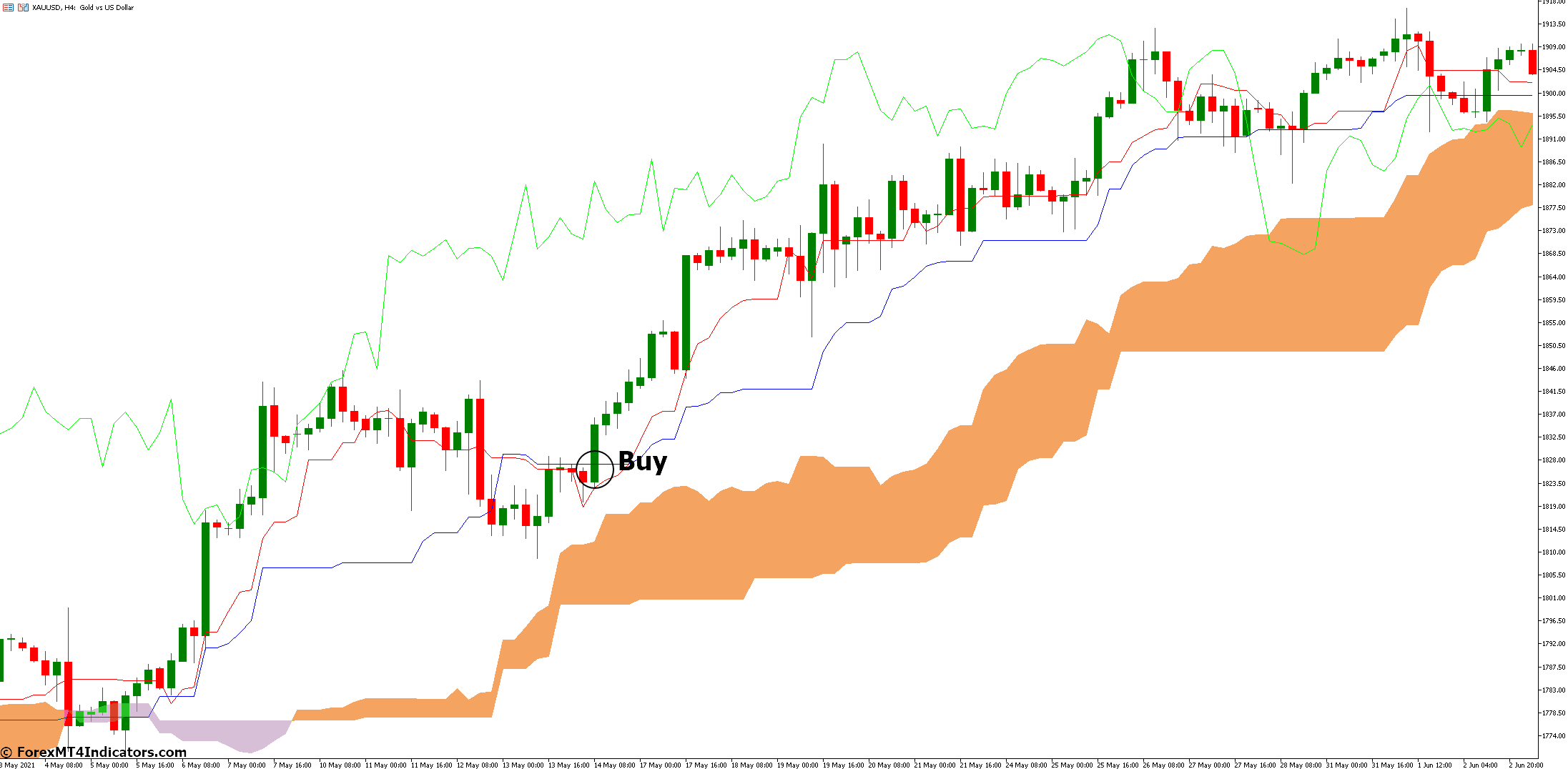

Purchase Entry

- Affirmation: Value is buying and selling above the Ichimoku Cloud.

- Entry: Value breaks above the Tenkan-sen (conversion line) and Kijun-sen (baseline) with a bullish crossover (Tenkan-sen crosses above Kijun-sen).

- Cease-Loss: Place beneath the current swing low or the Kijun-sen, whichever is stricter.

- Take-Revenue: Take into account taking revenue on the prime of the Ichimoku Cloud or a predetermined revenue goal primarily based in your risk-reward ratio.

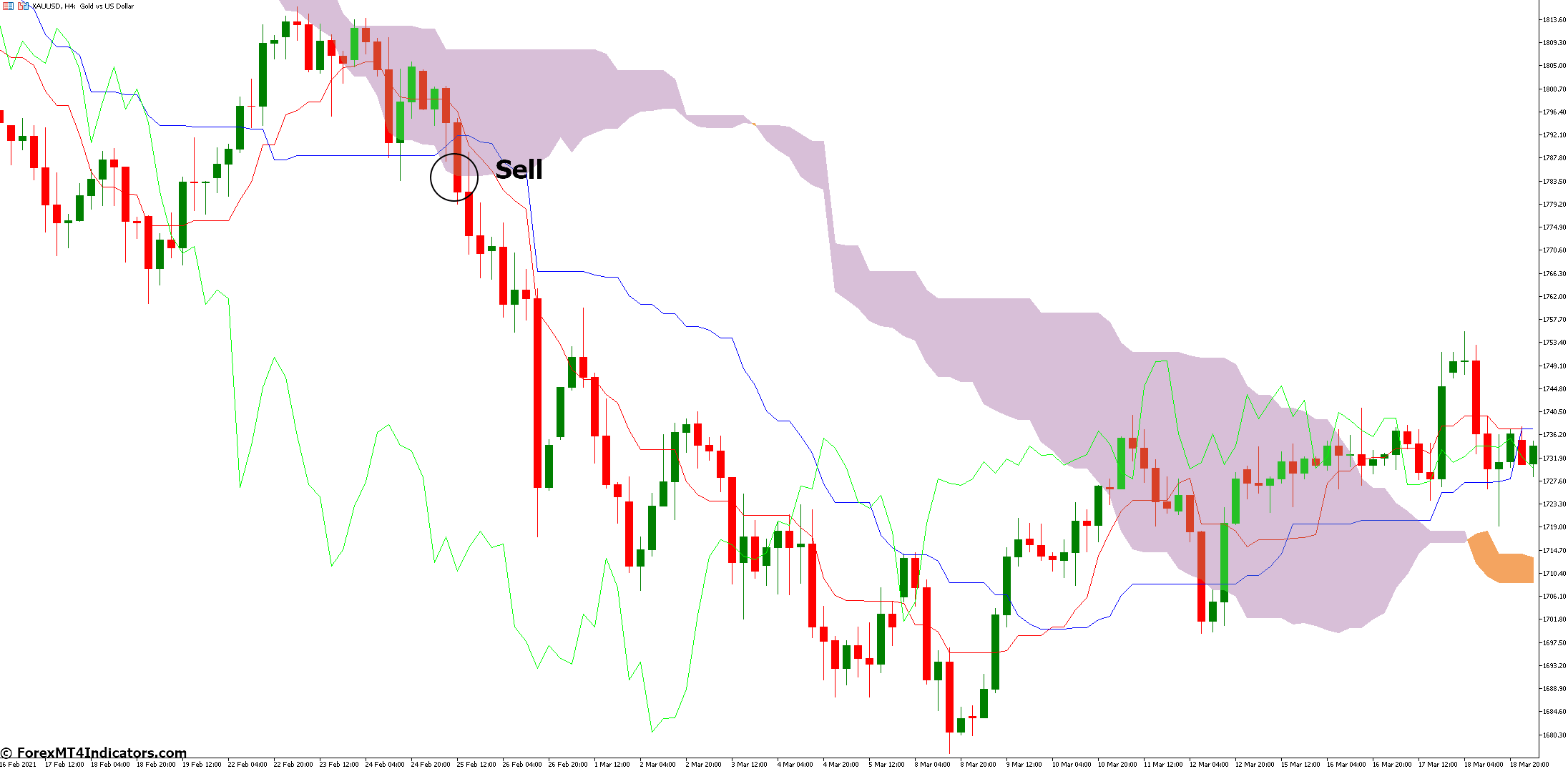

Promote Entry

- Affirmation: Value is buying and selling beneath the Ichimoku Cloud.

- Entry: Value breaks beneath the Tenkan-sen and Kijun-sen with a bearish crossover (Tenkan-sen crosses beneath Kijun-sen).

- Cease-Loss: Place above the current swing excessive or above the Kijun-sen, whichever is stricter.

- Take-Revenue: Take into account taking revenue on the backside of the Ichimoku Cloud or a predetermined revenue goal primarily based in your risk-reward ratio.

Ichimoku Indicator Settings

Conclusion

The Ichimoku Kinko Hyo indicator, seamlessly built-in with the MT5 platform, empowers you to change into a extra knowledgeable and assured foreign exchange dealer. By understanding its elements, decoding the generated indicators, and using it strategically, you’ll achieve a worthwhile edge in navigating the ever-changing foreign exchange market panorama.

Beneficial MT4 Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

(Free MT4 Indicators Obtain)

Click on right here beneath to obtain: