This text might comprise references to a few of our promoting companions. Must you click on on these hyperlinks, we could also be compensated. For extra about our promoting insurance policies, learn our full disclosure assertion right here.

Editor’s Be aware: This Liberty HealthShare evaluation was final up to date in November 2020. It’s an correct portrayal of our previous expertise as Liberty HealthShare members. Though we have been pleased with Liberty Healthshare for years, as of 2022, we’re not members of Liberty Healthshare.

Open enrollment for medical insurance is again, and you’ll rely me as underwhelmed. In the event you’re caught trying to find an inexpensive plan on the open market – information flash – the choices ain’t fairly.

As self-employed people, our household has been coping with the results of the Inexpensive Care Act because it was totally applied in 2014. Yearly, I seek for inexpensive medical insurance choices in my space’s medical insurance market. Yearly, I come away feeling extra upset than the final.

Relying on the place you reside, premiums proceed to extend, advantages proceed to be slashed, and lots of insurers have pulled out of {the marketplace} altogether. In lots of locations, together with my very own space, potential prospects have only one or two insurers accessible to them. Confronted with large month-to-month premiums, excessive deductibles, and restricted networks, it’s secure to say that households across the nation are feeling the pinch.

Like a lot of you, we discovered ourselves in a troublesome scenario. That’s after we found medical value sharing ministries, together with Liberty HealthShare. Certain, it’s an imperfect resolution to a troublesome drawback, however we’ve been utilizing LHS for about seven years. Throughout that point, we’ve had youngsters break bones, undergone a number of surgical procedures, and extra. We are going to proceed utilizing Liberty HealthShare to satisfy our wants in 2021.

With this Liberty HealthShare evaluation, I hope to assist others discover a resolution to this troublesome monetary problem. I’ll clarify why we selected Liberty HealthShare, how they’ve dealt with our private claims, and canopy the professionals and cons of signing up. I can even try and reply a number of the most typical questions requested about Liberty HealthShare and clarify the assorted sharing choices accessible to members.

Let’s get began!

Liberty HealthShare: At a Look

Healthcare sharing ministry

Healthcare sharing ministry- In existence since 1995

- Members share medical bills with different members

- 4 totally different sharing plans to satisfy member wants

- Month-to-month sharing contributions from $199-$675 monthly

- Annual unshared quantities (excluding Liberty Choose Plan) – $1,000 single, $1,750 couple, $2,250 household

- As much as $1,000,000 shareable per incident (relying on plan)

- Select your personal physician; no networks

What’s Liberty HealthShare?

Liberty HealthShare is a healthcare sharing ministry whose members share medical bills. Members pay a month-to-month “sharing” contribution which pays for the medical bills of different members. Then, once they have wants, they first should meet an “annual unshared quantity” (just like a deductible) earlier than their bills are eligible for sharing.

Remember, this isn’t medical insurance nor are you protected by the identical insurance coverage guidelines and laws that conventional medical insurance supplies. The don’t merely use totally different vocabulary; a sharing program is modeled otherwise.

As with different healthcare sharing teams, Liberty HealthShare members comply with pay for medical bills by sharing the prices with different members in accordance with the group’s pointers. Whereas not ideally suited, for our scenario, it has simply been essentially the most inexpensive healthcare possibility at our disposal.

Liberty HealthShare can be a faith-based group. On the time of this writing, this medical value sharing ministry has nicely over 200,000 members.

Liberty HealthShare: How It Works

In contrast to the ACA-approved medical insurance plans, Liberty HealthShare and different Christian sharing ministries don’t have to just accept everybody who applies. (Once more, this isn’t insurance coverage.) They aren’t required to just accept folks no matter pre-existing situations they usually don’t take people who smoke.

That doesn’t imply you’ll by no means be accepted when you have pre-existing situations. These situations simply is probably not eligible for sharing instantly. Additionally when you have a power well being situation, or are in any other case unhealthy as a consequence of weight or another situation, chances are you’ll be requested to affix their provisional program.

In my view, this is without doubt one of the largest drawbacks of sharing plans. On the flip facet, not accepting these with current well being issues and “dangerous” existence does assist to maintain prices down.

With that mentioned, even when you have a few of these situations all just isn’t misplaced. In the event you’re severe about turning into more healthy, you should still be eligible to affix below Liberty’s provisional membership program known as HealthTrac™. It is a “well being teaching” possibility, and we’ll speak a extra about this in a bit!

Liberty HealthShare Applications and Pricing

Liberty HealthShare now presents 4 totally different ranges of sharing. I’ll clarify the one my household selected in a minute, however let’s first check out all three.

Along with the month-to-month share contribution, remember the fact that members are additionally required to pay membership dues. The preliminary $125 payment is added to your first month’s sharing contribution and is decreased to only $75 after your first 12 months. That’s actually not a lot but it surely’s nonetheless price mentioning.I’ll clarify the one my household selected in a minute, however let’s first check out all 4.

| Month-to-month Share Quantity | Annual Unshared Quantity (AUA) | |

|---|---|---|

| Single | $399 | $1,000 |

| Couple | $499 | $1,750 |

| Household | $675 | $2,250 |

- $1,000,000 shareable per incident after Annual Unshared Quantity (AUA)

- Entry to SavNet reductions on imaginative and prescient, dental, listening to, and chiropractic

- Prescription financial savings plan by means of HealthShareRX

- Entry to Liberty TeleHealth digital healthcare app and net portal

Liberty Full is essentially the most complete of the packages. With this selection, a household of 4 pays $675 monthly whereas {couples} and singles pay even much less.

On this program, members share prices as much as $1,000,000 per incident or sickness based mostly on the rules after assembly the “annual unshared quantity.” Annual unshared quantities are: $2,250 per household, $1,750 for a pair, or $1,000 for a single member.

| | Month-to-month Share Quantity | Annual Unshared Quantity (AUA) |

|---|---|---|

| Single | $374 | $1,000 |

| Couple | $474 | $1,750 |

| Household | $624 | $2,250 |

- $125,000 shareable per incident after Annual Unshared Quantity (AUA)

- Entry to SavNet reductions on imaginative and prescient, dental, listening to, and chiropractic

- Prescription financial savings plan by means of HealthShareRX

- Entry to Liberty TeleHealth digital healthcare app and net portal

Liberty Plus prices barely much less every month however presents a considerably decrease degree of sharing. A household of 4 would pay $624 monthly with {couples} and singles paying even much less.

The identical annual unshared quantities apply ($2,250 per household, $1,750 for a pair, or $1,000 for a single member). With this program, nevertheless, sharing is restricted to only $125,000 per incident or sickness.

| | Month-to-month Share Quantity | Annual Unshared Quantity (AUA) |

|---|---|---|

| Single | $349 | $1,000 |

| Couple | $449 | $1,750 |

| Household | $599 | $2,250 |

- 70% of eligible medical payments shared (as much as $125,000) after Annual Unshared Quantity (AUA)

- Contains doctor, emergency room, pressing care, clinic, inpatient/outpatient hospital therapy

- Prescription financial savings plan by means of HealthShareRX

- Entry to Liberty TeleHealth digital healthcare app and net portal

With the Liberty Share possibility, a household of 4 would pay $599 monthly. {Couples} and singles nonetheless pay much less, and the annual deductibles keep the identical because the beforehand talked about plans.

The most important distinction with the Liberty Share possibility is the best way that bills are dealt with. Slightly than sharing 100% of prices after assembly an annual unshared quantity, with this selection, medical bills are shared at solely 70% per incident. Sharing can be capped at $125,000 per incident, as per the rules.

| | Month-to-month Share Quantity | Annual Unshared Quantity (AUA) |

|---|---|---|

| Single | $199 | $6,000 |

| Couple | $299 | $12,000 |

| Household | $399 | $15,000 |

- $500,000 sharable per incident after Annual Unshared Quantity (AUA)

- Eligible wellness screenings sharable as much as $400 per membership 12 months (not topic to AUA)

- Excludes maternity

- Prescription financial savings plan by means of HealthShareRX

- Entry to Liberty TeleHealth digital healthcare app and net portal

Liberty Choose is the latest and least costly possibility supplied by Liberty HealthShare. Though members will solely pay between $199-$399 a month, the Annual Unshared Quantities are a lot increased. Single members have an AUA of $6,000, {couples} are at $12,000, and households have a $15,000 AUA.

Members also needs to remember the fact that, even with excessive AUAs, this selection solely permits for $500,000 in shareable bills after you meet the AUA. Additionally of be aware, maternity bills aren’t eligible for sharing with Liberty Choose.

Submitting Bills Eligible for Sharing

In relation to submitting medical bills, Liberty HealthShare (like different healthcare sharing ministries) might require a bit extra work in your half. The truth is, if might imply taking considerably extra motion and management over your medical bills than you’re used to.

That is vital, so listen right here: If you use a healthcare sharing ministry, YOU are liable for ensuring your medical payments are submitted. This may increasingly require a number of telephone calls.

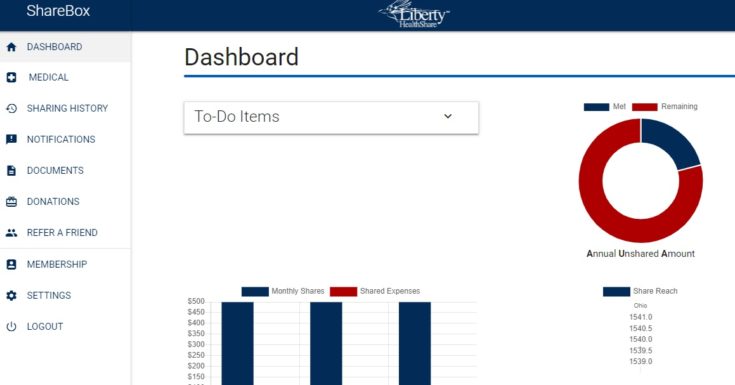

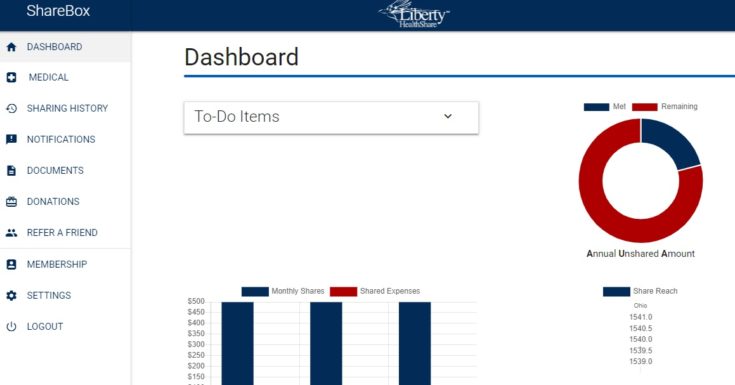

In lots of circumstances, your healthcare supplier will submit payments on to Liberty HealthShare for you. Different occasions, you will want to scan the payments and add them into the cost system your self. LHS makes this straightforward. Merely log into your private account/dashboard and add your payments by means of the “Medical” tab.

Personally, I don’t thoughts monitoring our healthcare payments myself. I prefer to maintain our spending in verify anyway, and it’s tremendous straightforward to scan and submit payments by means of the web site.

On the flip facet, I respect it when our physician’s workplace takes care of this job for us. Once we first joined, I might say this duty fell us roughly 50 % of the time. Now that many medical doctors workplaces are conversant in sufferers utilizing value sharing packages, we hardly ever must submit our personal payments. Keep in mind, although, it’s at all times your duty to verify that they’ve been submitted correctly.

With that being mentioned, right here’s what my Liberty HealthShare “inbox” appears like:

To see which payments have been submitted, when every was paid, and the way a lot your duty could be, merely click on on the “Medical” tab within the left menu. There, you’ll discover a checklist of all the things you want.

Apart from how payments are submitted and the truth that healthcare sharing ministries could be choosy about who they settle for, the method may be very acquainted. For instance, with most Liberty HealthShare plans, annual wellness visits are included (see the rules for particulars.) Whereas it isn’t at all times essential, that idea itself saves us round $600 per 12 months.

Like I discussed earlier, we even have an “annual unshared quantity” that’s just like a medical insurance deductible. After we meet that unshared quantity, 100% of our prices are shared by the members – as much as $1 million {dollars} per incident, based mostly on the rules.

Our Expertise with Liberty HealthShare

Now that you understand in regards to the Liberty HealthShare plans and choices, I believed it could be useful to learn the way my household selected LHS within the first place.

Shortly after the Affected person Safety and Inexpensive Care Act (PPACA) was rolled out, my household was confronted with a close to not possible determination. Our outdated medical insurance plan, which value $393 monthly and got here with an $11,000 household deductible, was being cancelled as a result of it didn’t meet ACA necessities. But, the brand new Obamacare plans value greater than twice as a lot AND got here with even increased household deductibles as well!

It shortly turned clear that we would have liked to decide out of the ACA utterly. Nonetheless we would have liked an answer to assist us cowl the price of catastrophic medical bills.

After a number of months of digging, I found how another households have been planning for unexpected medical payments. The reply: Healthcare sharing ministries. After some severe evaluating a number of healthcare sharing ministries, my household joined Liberty HealthShare in January of 2014.

I needed to put in writing a Liberty HealthShare evaluation instantly, however the first few years have been fairly uneventful. Other than our common annual visits, none of us went to the physician. So, I didn’t have an excellent thought of whether or not this system was going to work or not.

Quick ahead to right now, and we’ve been with Liberty HealthShare for about seven years. We’ve all of us seen the physician and have even had a number of procedures accomplished – together with some main surgical procedures. Now that we now have some actual claims historical past to report, a Liberty HealthShare evaluation makes extra sense.

Coping with Main Surgical procedures

In 2018, we skilled our first main medical want as members of Liberty HealthShare. That summer season, my seven-year-old daughter broke her arm. She ended up having surgical procedure at our native youngsters’s hospital, which meant over she racked up over $30,000 in medical payments. (Facet be aware: The youngsters’s hospital wouldn’t have been coated below the Bronze ACA plans accessible in our space.)

Fortunately, Liberty HealthShare and their members helped us share the price of these payments precisely as we deliberate.

Now, that’s to not say that all the things went completely. The method itself was not notably easy.

We spent a number of hours following up with each LHS and physician’s workplaces to get these payments paid. Over the course of about ten months, we made a number of calls and despatched round a dozen emails. Whereas it was a ache, Liberty finally coated their portion of the payments.

For us, the time and problem spent on these payments was price it. As a result of we save hundreds on our healthcare by means of Liberty, we’re keen to place in some further “leg work” to get our medical payments shared. That is one thing it’s best to consider earlier than selecting Liberty HealthShare to your healthcare wants.

Since then, in our expertise, the method has improved significantly. Our different daughter broke her arm in 2020. This time, wee have been assigned a private consultant to deal with our account. Issues went a lot smoother, and it has been our expertise that most of the kinks that have been current earlier than have now been labored out.

Liberty HealthShare Benefits

- Low annual unshared quantities: With all Liberty HealthShare plans, your “annual unshared quantity” is restricted to $2,250 per 12 months for a household, $1,750 for a pair, or $1,000 for singles.

- Know the place your healthcare {dollars} are going: Since healthcare sharing ministries don’t share prices for sure procedures that the group finds “morally objectionable,” you’ll be able to relaxation assured your {dollars} are being spent on healthcare procedures you agree with.

- You’ll be able to see any physician you need: Liberty HealthShare enables you to see any physician of your selecting. All they ask is that you just store round and negotiate for the very best charges.

- Share precise prices: Liberty HealthShare retains their administrative prices low. A small share of sharing {dollars} are spent on administrative bills as they study prices up entrance. Your sharing {dollars} are used to pay for the precise medical prices incurred by others locally.

- Well being consciousness: As a result of Liberty HealthShare members are inclined to stay wholesome existence, their prices are sometimes much less. Liberty emphasizes non secular rules of wellness, well being and prevention. Well being acutely aware folks are inclined to have fewer payments, decrease prices, and extra speedy recoveries.

Liberty HealthShare Disadvantages

- It’s possible you’ll not qualify: In the event you smoke, are overweight, or have a power well being situation, chances are you’ll not qualify for a healthcare sharing ministry. Nevertheless, in case you are dedicated to enhancing your well being, chances are you’ll qualify for HealthTrac™. It is a well being teaching program designed to enhance your well being and should mean you can turn into a member.

- It is a faith-based group. These packages are faith-based organizations. You will need to maintain related beliefs to qualify to take part.

- It’s possible you’ll not contribute to a Well being Financial savings Account (HSA). Sadly, since medical value sharing packages aren’t medical insurance, you aren’t allowed to contribute tax-free cash to a Well being Financial savings Account (HSA).

- It is advisable monitor your personal payments carefully. Whereas your physician’s workplace might deal with your declare for you, you’ll want to observe your bills on-line to ensure they put up accurately.

- There are arguments over whether or not or not your month-to-month shared quantity is deductible if you happen to personal a enterprise. Since this isn’t insurance coverage, some accountants argue you can not deduct your month-to-month share quantity if you happen to personal a enterprise. There’s undoubtedly a grey space right here.

- Medical value sharing just isn’t limitless. Liberty HealthShare members solely share prices as much as $125,000 or $1,000,000 per sickness or incident, based mostly on the group’s pointers. In the event you ended up with an extremely costly sickness or harm, you possibly can probably blow by means of that restrict quick.

Associated: Medi-Share Overview – A Christian Healthcare Plan Choice

Who Ought to Think about Liberty HealthShare?

Self-employed enterprise homeowners – In case you are a self-employed proprietor of a small enterprise, likelihood is good that your solely possibility for securing medical insurance is on the open market. Though it’s not “medical insurance,” Liberty HealthShare is an alternative choice for assembly your loved ones’s healthcare wants in an inexpensive method.

Different people buying the healthcare market – Equally, in case you are purchasing for a medical insurance plan on the open market, aren’t eligible for subsidies, or don’t like the costs you see, a healthcare sharing ministry may current a potential resolution.

Christians eager to share medical bills – Liberty HealthShare is an efficient selection for Christians who’re bored with the normal healthcare system and who, as an alternative, want to share medical bills with others hat have related beliefs.

Who Ought to Keep away from Becoming a member of Liberty HealthShare?

People with entry to inexpensive medical insurance plans – You probably have entry to inexpensive medical insurance by means of work or are eligible for big authorities subsidies, the added expense of a medical value sharing program could also be pointless. (Remember, Liberty HealthShare just isn’t medical insurance coverage.)

Individuals with pre-existing situations – As a result of Liberty HealthShare just isn’t medical insurance coverage, they aren’t required to offer protection for pre-existing situations. These with pre-existing medical situations could also be accepted for membership after a time frame, however the added expense of each a medical insurance plan and turning into a medical value sharing member is probably not price it.

These unwilling or unable to trace their medical bills – You will need to do not forget that members are finally liable for monitoring (and paying) their medical payments. Whereas LHS could be an inexpensive approach to deal with your healthcare, it usually requires extra work on the member’s half to course of medical payments. In some circumstances, chances are you’ll even want to attend for reimbursement of sure payments. In case you are unable or unwilling to do that, it’s best to most likely keep away from medical value sharing packages.

Liberty HealthShare Overview: Regularly Requested Questions

Since I first posted this evaluation, I’ve acquired a whole lot of feedback, emails, and questions on this system. Whereas I’d undoubtedly suggest you contact Liberty HealthShare with questions particular to your private scenario, listed here are a number of of the most typical questions I’ve been requested.

Is Liberty HealthShare the identical as medical insurance?

No. Liberty HealthShare just isn’t medical insurance. It’s a medical value sharing program by which members share healthcare prices between them. We use Liberty HealthShare to plan for unanticipated medical bills.

Is Liberty HealthShare a rip-off?

No. It is extremely actual. In our expertise, the members of Liberty HealthShare have shared all our medical bills that have been eligible for sharing per our plan pointers.

Are healthcare sharing ministries a brand new idea?

No. Healthcare sharing ministries aren’t new, however rising medical insurance prices have undoubtedly made them extra widespread. Medical value sharing packages can hint their roots again to the mid-Eighties. As a gaggle, Liberty HealthShare’s dad or mum group (Gospel Mild Mennonite Church Medical Support Plan, Inc.) has been sharing medical prices since 1995.

Do I’ve to belong to a selected Christian denomination to turn into a member of Liberty HealthShare?

No. In comparison with some medical value sharing packages, one of many largest benefits of becoming a member of Liberty HealthShare is that you just do NOT must belong to a selected denomination.

Whereas some sharing ministries require you to be a member of an evangelical church and/or get a signed be aware out of your pastor, Liberty HealthShare merely requires that you just comply with an announcement of beliefs. This assertion basically says that you just consider in God, that each one folks have a proper to worship in their very own manner, and that folks have the appropriate to direct their very own healthcare selections free from authorities interference.

Are there another life-style necessities I must learn about?

Sure. In an effort to maintain prices down, Liberty HealthShare members comply with take accountable and affordable care of their very own well being. This consists of not consuming alcohol excessively, not utilizing tobacco, not abusing unlawful medication or prescription remedy, and getting common train.

Wait, are you saying I can’t drink or smoke?

As a member, you comply with not drink excessively or abuse alcohol. In case you are a tobacco consumer, you’ll be required to affix the provisional HealthTrac™ program which provides an extra month-to-month payment. You’re given 6 months to turn into tobacco free. Additionally, you will be required to finish nicotine testing.

Are pre-existing situations eligible for sharing with Liberty HealthShare?

Finally. Liberty HealthShare considers pre-existing situations to be “any situation on the time of enrollment that has evidenced signs, or acquired therapy or remedy prior to now 24 months.” Pre-existing situations aren’t eligible for sharing your first 12 months of membership. From there, they’re regularly eligible for extra sharing annually till they obtain full sharing standing throughout your fourth 12 months of membership.

Do Liberty HealthShare members share dental and imaginative and prescient bills?

No. Medical value sharing with Liberty doesn’t lengthen to dental or imaginative and prescient procedures or bills. With that mentioned, LHS does companion with the SavNet Well being Financial savings Program to offer reductions for dental, imaginative and prescient, and chiropractic bills.

Does Liberty HealthShare embrace sharing for prescriptions?

To maintain the price of prescription drug costs down, Liberty HealthShare members have entry to HealthShareRx. This system companions with over 64,000 pharmacies the place they will get a 21-day provide of the most typical drugs for simply $5.00. Members may take pleasure in financial savings on long-term upkeep drugs with this program.

What if I’m denied membership as a consequence of well being causes?

If one thing in your utility triggers a denial based mostly in your well being, chances are you’ll be eligible to affix the Liberty HealthTrac™ program. This program pairs members with a well being coach and helps set sensible targets for enhancing their well being.

A month-to-month participant payment is required for the HealthTrac™ program and will probably be dropped upon commencement. Whereas everyone seems to be totally different, Liberty states that they count on to see enhancements within the members well being inside a 12 months.

Will my physician settle for Liberty HealthShare?

In contrast to medical insurance plans, Liberty HealthShare doesn’t have networks. You need to use this system with any physician you select.

Merely inform them that you’re a part of a medical value sharing program, present them your card, and have them ship payments on to Liberty HealthShare. (You probably have not met your annual sharing quantity, you’ll nonetheless be liable for the overall.)

Are there limits on the quantity of sharing?

Sure. Members are presently restricted to sharing quantities of as much as $125,000 or $1,000,000 per incident, relying on this system you choose.

Does being a Liberty HealthShare member exempt me from Obamacare tax penalty?

When congress handed the December 2017 tax invoice, the Obamacare particular person mandate was repealed, efficient in 2019.

Can I cancel my Liberty HealthShare membership at any time or am I obligated to stay with this system?

You’ll be able to cancel your Liberty HealthShare membership at any time and are below no obligation to proceed with this system. Take into account that you do pay preliminary membership dues of $125.00 and annual membership dues annually thereafter of $75.00. Liberty HealthShare means that you can be part of this system for 30 days danger free. In the event you cancel inside your first 30 days, the membership payment will probably be refunded. Nevertheless, canceling after the 30-day interval ends in a forfeiture of your membership dues.

Is there a selected enrollment interval or can I be part of every time I’m prepared?

In contrast to Obamacare, you’ll be able to be part of Liberty HealthShare at any level in the course of the 12 months.

Liberty Healthshare Overview: The Backside Line

Though I nonetheless contemplate our healthcare choices yearly, after seven years with Liberty HealthShare, our household continues to stay as members. I’m pretty assured we’re making the appropriate determination. We’re saving cash each month, and we get to see any physician of our selecting. As an added bonus, our Annual Unshared Quantity is simply $2,250. This enormously reduces the quantity of out-of-pocket medical prices we could possibly be liable for in any given 12 months.

With that mentioned, the method just isn’t excellent. Nonetheless, Liberty has ultimately shared all of our eligible medical bills as outlined in our plan. Sure, it took some additional effort on our half. However, for us, the additional effort is greater than well worth the financial savings we’ve acquired.

In the event you’re contemplating a healthcare sharing ministry, it’s best to undoubtedly evaluate Liberty with the opposite choices on the market. I favored another comparable packages, however we selected to go along with Liberty HealthShare as a result of we felt that the funds and sharing association made sense for our scenario. Lastly, if you happen to’re struggling below the load and expense of unreasonable Obamacare plans, it is sensible to buy round as a lot as you’ll be able to.

Have you ever ever heard of healthcare sharing ministries? Would you be part of one? Why or why not?

Liberty HealthShare Overview

-

Vary of Product Choices

-

Shareable Quantities per Incident

-

Month-to-month Price

-

Annual “Unshared” Quantities

-

Buyer Service

-

Expense Sharing Course of

Liberty HealthShare Overview

Liberty HealthShare is a medical value sharing program that enables members to share medical bills with different members. For many who are struggling to seek out inexpensive healthcare choices, Liberty could also be a sensible choice.

Providing a number of totally different plans to satisfy members monetary wants, Liberty HealthShare members pay as little as $199 a month. With most packages, Annual Unshared Quantities vary from $1,000 for people to $2,250 for households. Relying on this system chosen, members could also be eligible for medical prices to be shared as much as $1M per incident.

Sadly, Liberty HealthShare is way from excellent. The method of submitting bills to be shared can usually take months to resolve. Members might find yourself spending a while and vitality monitoring these bills. Nonetheless, if you happen to’re struggling and fed up with the expense of healthcare, Liberty HealthShare supplies a strong resolution to satisfy your healthcare wants.