The interval main as much as the ETF launch was marked by a rise in Bitcoin’s value. And whereas the launch of the first spot ETFs within the U.S. did not create the bombastic bull rally many have been hoping for; it confirmed simply how vital native markets are in driving international costs.

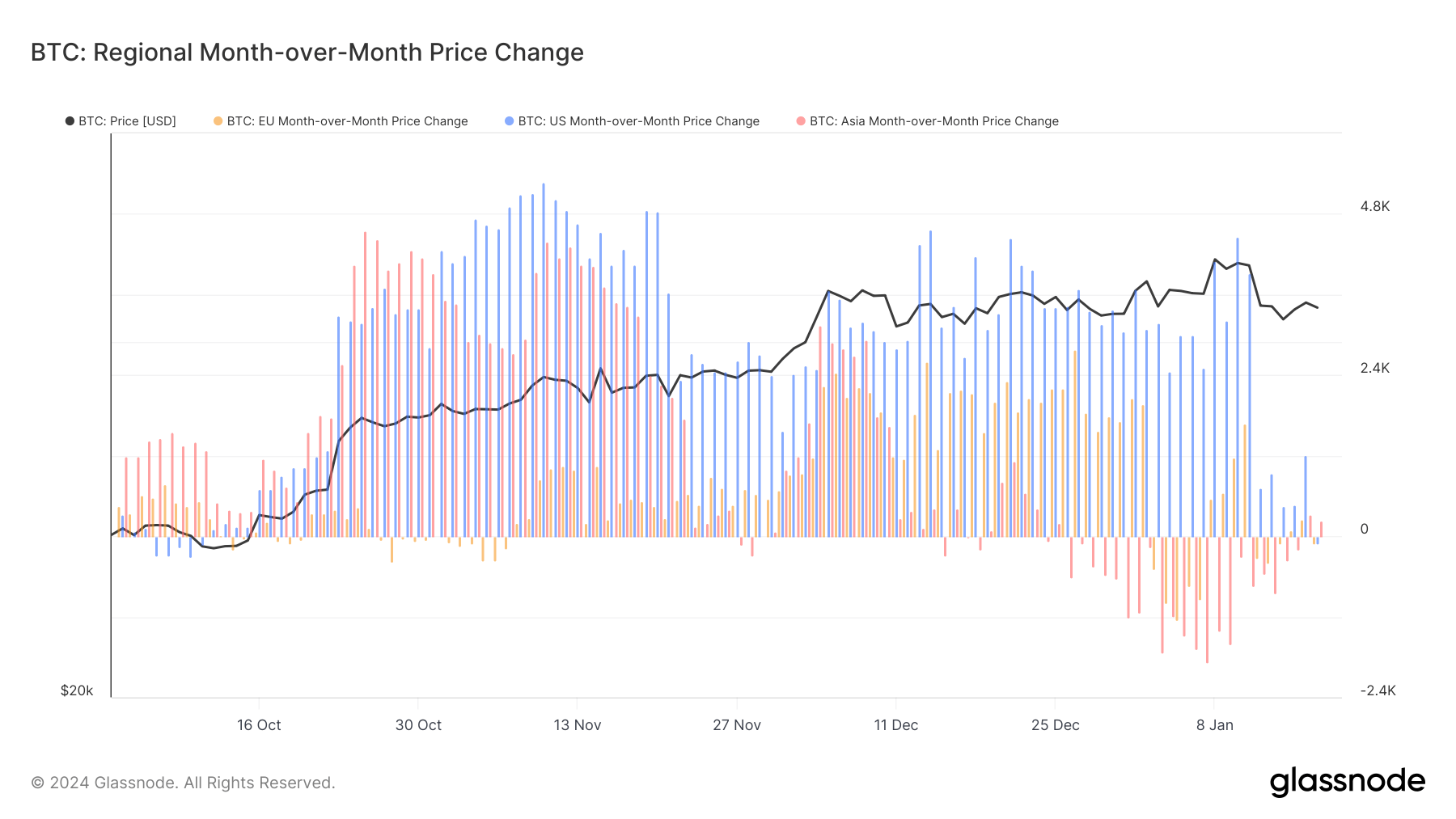

Particularly, Glassnode’s knowledge on regional month-over-month value modifications signifies that the U.S. market skilled the very best price of value improve in comparison with Asia and the E.U. This implies a rising curiosity in Bitcoin amongst U.S. traders, probably fueled by the anticipation of the ETFs’ introduction.

Such a regional surge in curiosity is critical, because it highlights how localized components, equivalent to regulatory modifications or the launch of recent monetary merchandise, can considerably affect the market.

The U.S. market considerably influences international Bitcoin costs on account of its key position within the international monetary system. As dwelling to a lot of influential traders and a serious hub for technological and monetary innovation, traits within the U.S. typically form international market sentiments. Moreover, the U.S. greenback’s standing as the first international reserve foreign money implies that monetary actions within the U.S., together with within the cryptocurrency sector, have wider international repercussions.

Traditionally, launching new funding autos like ETFs can create bullish sentiment, particularly within the area the place they’re launched, as they supply a extra regulated and doubtlessly safer approach to put money into cryptocurrencies.

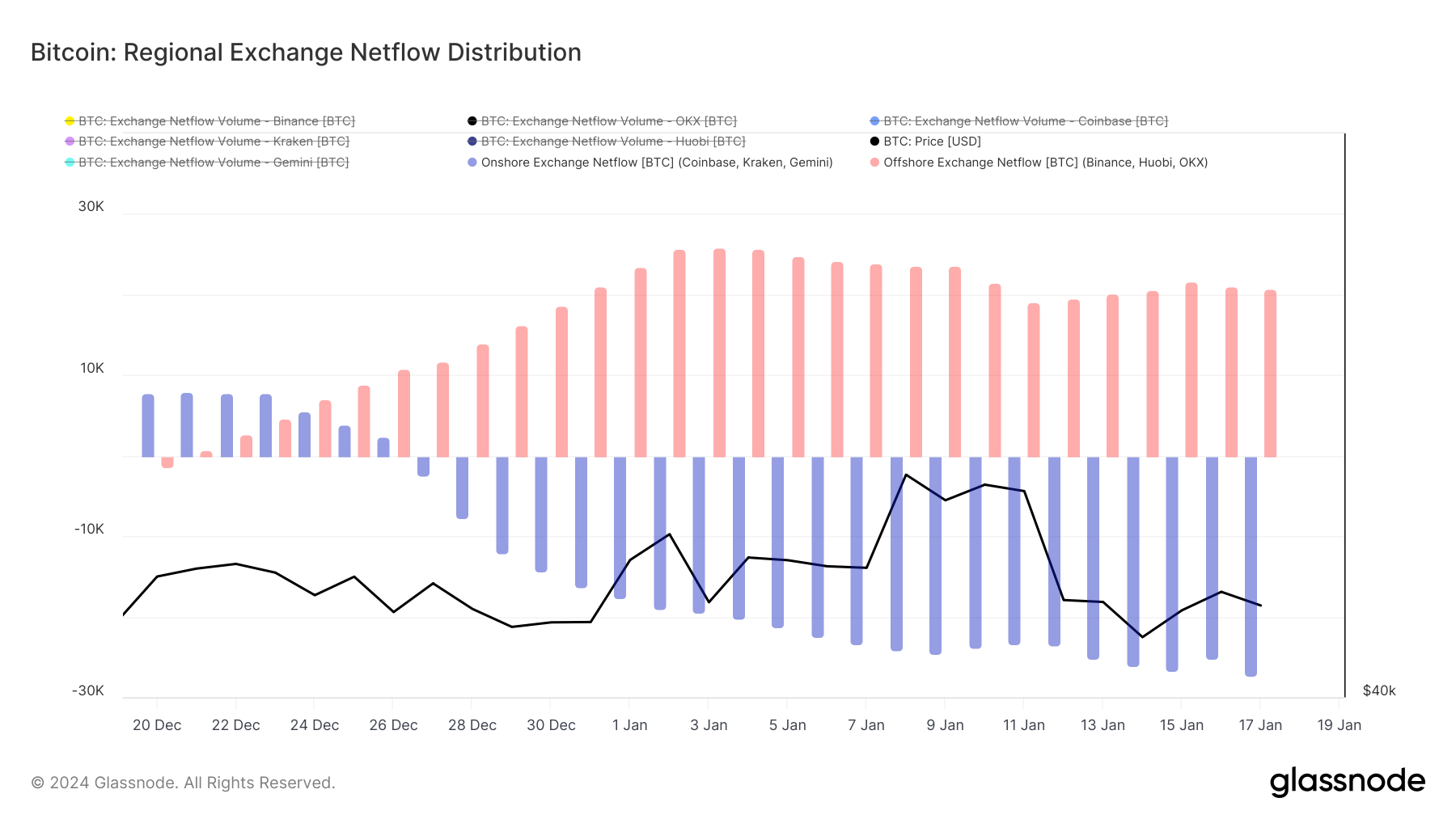

Additional supporting this speculation is the evaluation of alternate netflow distribution, a measure of how a lot Bitcoin is getting into or leaving exchanges, which exhibits a constant sample of Bitcoin outflows from U.S.-based exchanges like Coinbase, Kraken, and Gemini. Ranging from late December 2023, these outflows elevated, culminating in a peak on Jan. 17, 2024.

This motion of Bitcoin away from exchanges and certain into personal wallets or longer-term holdings suggests a strategic shift by U.S. traders in direction of holding Bitcoin in anticipation of the ETFs’ launch. Such a shift would naturally lower the liquid provide on exchanges, creating upward strain on costs.

The worth drop post-ETF launch, from $46,944 to $42,730, illustrates the market’s response to the materialization of a much-anticipated occasion. This sort of value correction just isn’t unusual in monetary markets following the build-up to main occasions, reflecting the adage “purchase the rumor, promote the information.”

The info from Glassnode demonstrated the numerous affect of the U.S. market on Bitcoin’s value improve within the months main as much as the launch of the U.S. spot Bitcoin ETFs. Contemplating these findings, it is going to be attention-grabbing to watch how the American market continues to form international cryptocurrency traits sooner or later. This additional confirms that constructive native market sentiments, influenced both by favorable regulatory information or broader monetary market traits, can have a spillover impact on the worldwide markets.

The submit How rising U.S. curiosity formed Bitcoin’s value forward of the ETF appeared first on CryptoSlate.