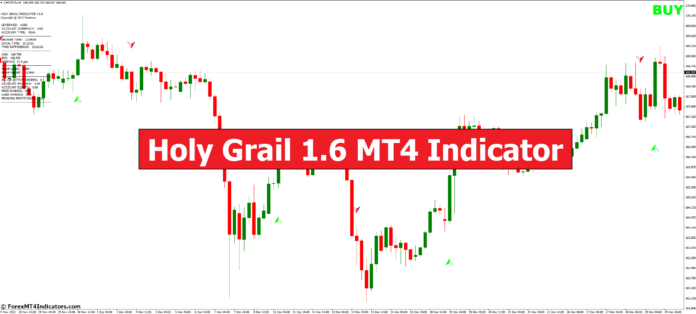

The attract of a shortcut to success is simple, and that’s exactly why the Holy Grail 1.6 MT4 Indicator has captured the creativeness of many foreign exchange merchants. This indicator guarantees to simplify the advanced world of technical evaluation by producing purchase and promote alerts, however is it really a magic bullet or simply intelligent advertising and marketing? This complete information will dissect the Holy Grail 1.6 MT4 Indicator, exploring its performance, strengths, limitations, and the way it can match into your general buying and selling technique.

Understanding MT4 and Technical Indicators

Earlier than diving into the Holy Grail itself, let’s set up a basis. The MT4 platform, or MetaTrader 4, is a extensively used software program platform for foreign exchange and CFD buying and selling. It presents an enormous array of charting instruments and technical indicators, that are mathematical calculations primarily based on historic value knowledge. Technical indicators will help establish traits, gauge market sentiment, and doubtlessly generate buying and selling alerts. Nevertheless, it’s essential to keep in mind that indicators are simply instruments, not crystal balls.

Dissecting the Holy Grail 1.6 Elements and Performance

The Holy Grail 1.6 is an indicator constructed on the premise of mixing two common technical instruments: Exponential Transferring Averages (EMAs) and the Common Directional Motion Index (ADX). EMAs clean out value fluctuations to disclose the underlying pattern, whereas the ADX measures the power of that pattern. The indicator supposedly generates purchase alerts when the value touches and bounces off an EMA whereas the ADX signifies a robust pattern. Conversely, promote alerts are triggered when the value breaks beneath the EMA with a excessive ADX studying.

Strengths and Limitations of the Holy Grail 1.6

Like every instrument, the Holy Grail 1.6 has its professionals and cons.

Potential Benefits

- Simplicity: The indicator presents a seemingly simple strategy to establish potential entry and exit factors.

- Customization: Some variations of the Holy Grail 1.6 enable for personalization of parameters, permitting you to tailor it to your buying and selling fashion.

Addressing Drawbacks and False Alerts

- Lag: Indicators are inherently reactive, which means they base their alerts on previous value knowledge. This may result in lagging behind precise value actions and producing false alerts.

- Overfitting: Overly personalized indicators can turn out to be “overfitted” to historic knowledge, resulting in poor efficiency in real-time buying and selling.

- Repainting: Be cautious of indicators that repaint their alerts after the very fact. This may create a false sense of accuracy and hinder your potential to study from previous errors. Search for indicators with a great fame for not repainting alerts.

The Psychology of Buying and selling

Buying and selling psychology is simply as essential as technical evaluation. Widespread biases like affirmation bias, the place we are inclined to favor info that confirms our present beliefs, can cloud our judgment and result in poor buying and selling selections. Right here’s find out how to handle your feelings and develop a disciplined buying and selling mindset:

- Acknowledge Biases: Educate your self on frequent cognitive biases that may affect your buying and selling selections.

- Preserve Self-discipline: Develop a buying and selling plan and persist with it, avoiding impulsive actions primarily based on concern or greed.

- The Significance of Emotional Management: Feelings may be the enemy of a rational dealer. Be taught to handle your feelings and detach your self from the end result of particular person trades.

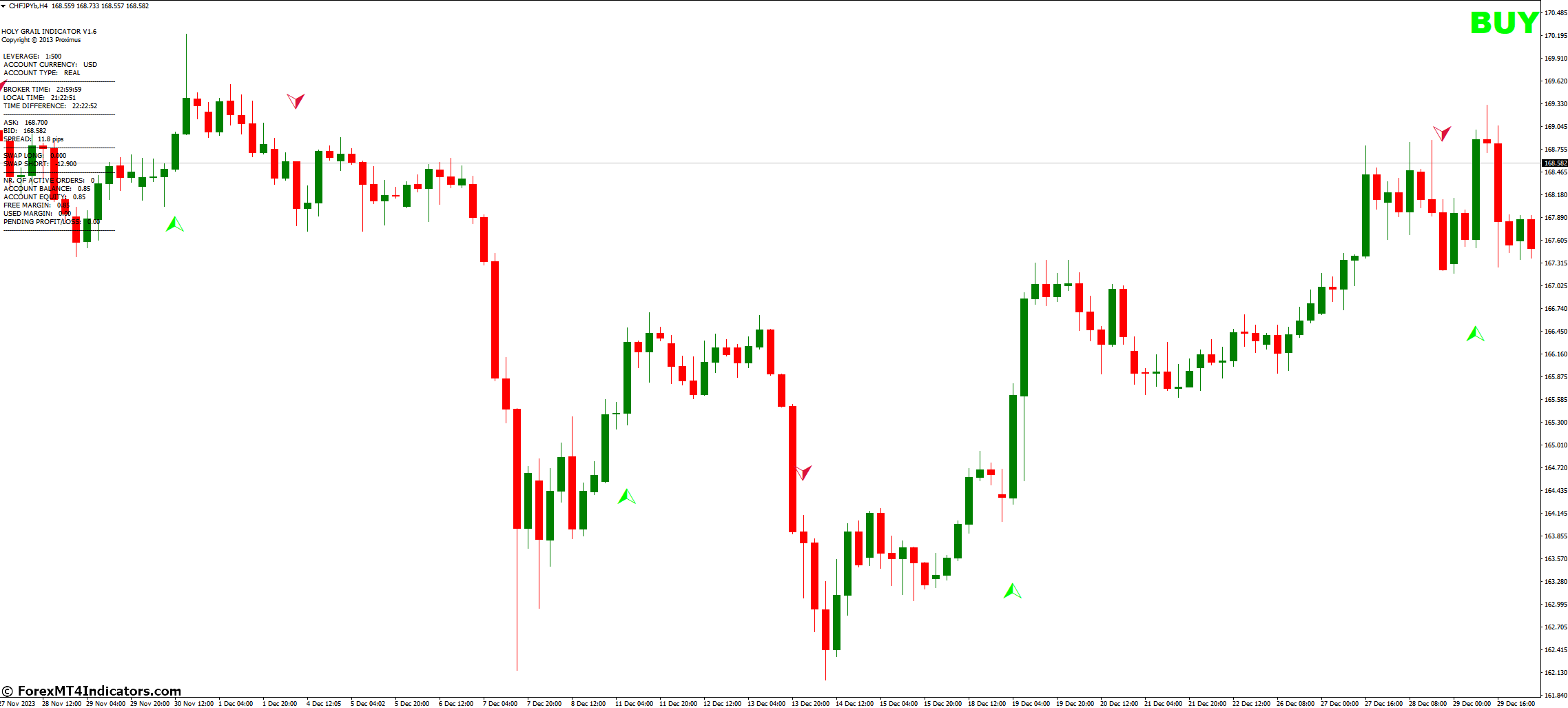

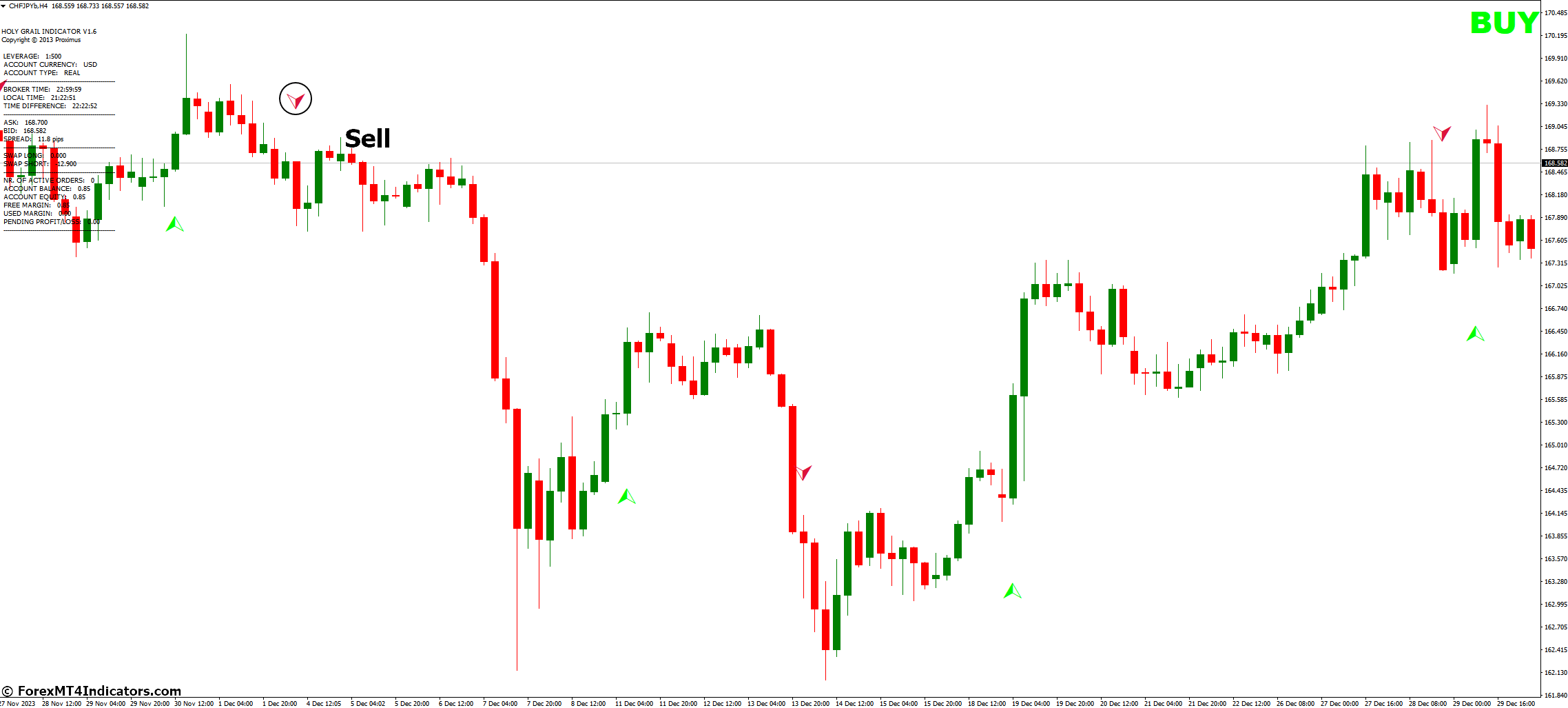

Methods to Commerce with Holy Grail 1.6 Indicator

Purchase Entry

- Sign: A inexperienced arrow seems on the chart, ideally close to the assist zone (recognized via value motion or different indicators).

- Affirmation: Search for a bullish candlestick sample (e.g., hammer, engulfing bar) coinciding with the inexperienced arrow.

- Entry: Place a purchase order barely above the inexperienced arrow (e.g., just a few pips).

- Cease-Loss: Set a stop-loss order beneath the latest swing low (earlier than the inexperienced arrow) or beneath assist.

- Take-Revenue: Take into account a risk-reward ratio of 1:2 (goal revenue twice the space of your stop-loss). Alternatively, goal a close-by resistance degree (recognized via value motion or different indicators).

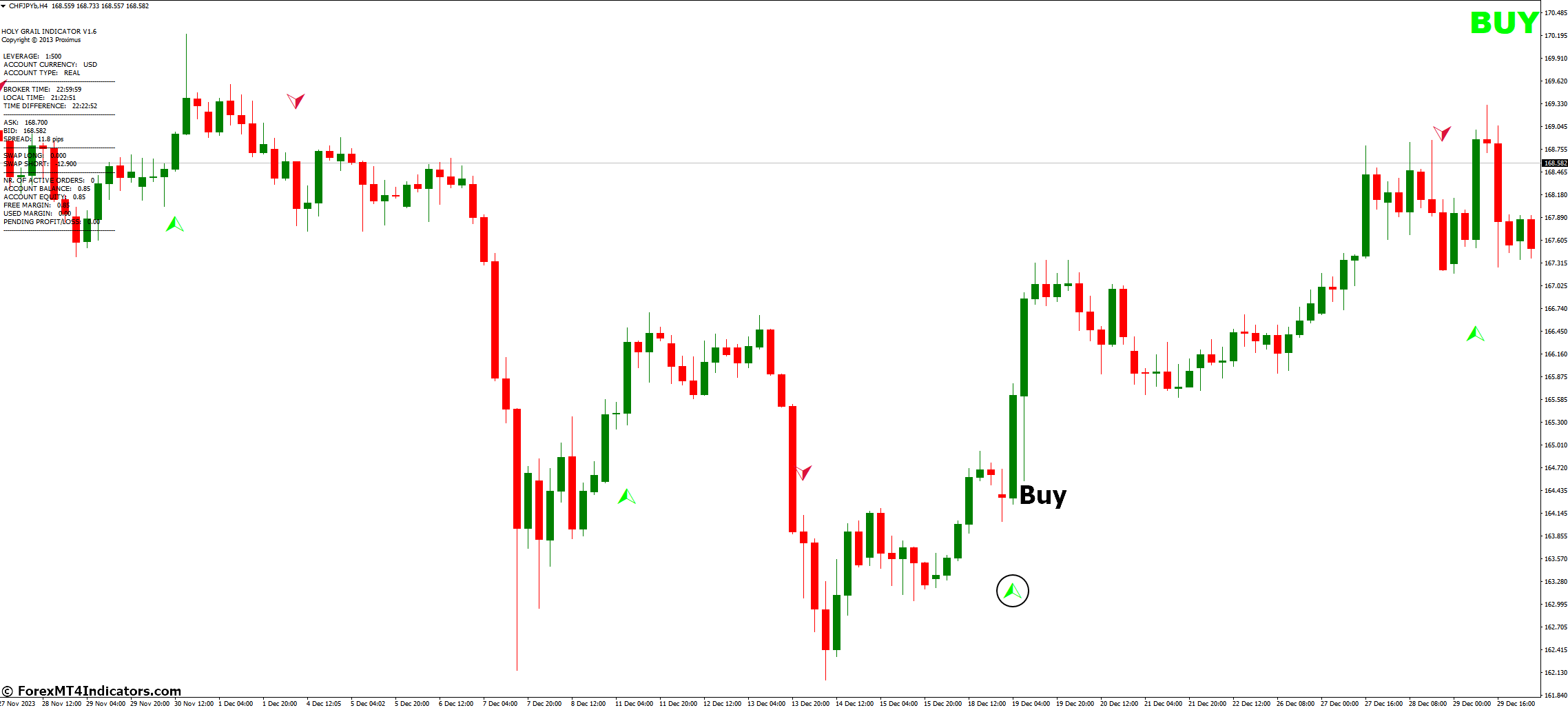

Promote Entry

- Sign: A crimson arrow seems on the chart, ideally close to the resistance zone.

- Affirmation: Search for a bearish candlestick sample (e.g., taking pictures star, bearish engulfing) coinciding with the crimson arrow.

- Entry: Place a promote order barely beneath the crimson arrow.

- Cease-Loss: Set a stop-loss order above the latest swing excessive (earlier than the crimson arrow) or above resistance.

- Take-Revenue: Take into account a risk-reward ratio of 1:2 (goal revenue twice the space of your stop-loss). Alternatively, goal a close-by assist degree.

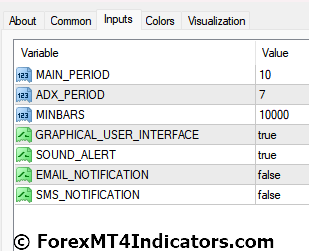

Holy Grail 1.6 Indicator Settings

Conclusion

The Holy Grail 1.6 MT4 Indicator could be a pal to merchants who use it with the correct method. It could possibly simplify technical evaluation and provide a place to begin for figuring out buying and selling alternatives. Nevertheless, it’s not a magic bullet, and relying solely on its alerts may be perilous.

Advisable MT4 Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

(Free MT4 Indicators Obtain)

Click on right here beneath to obtain: