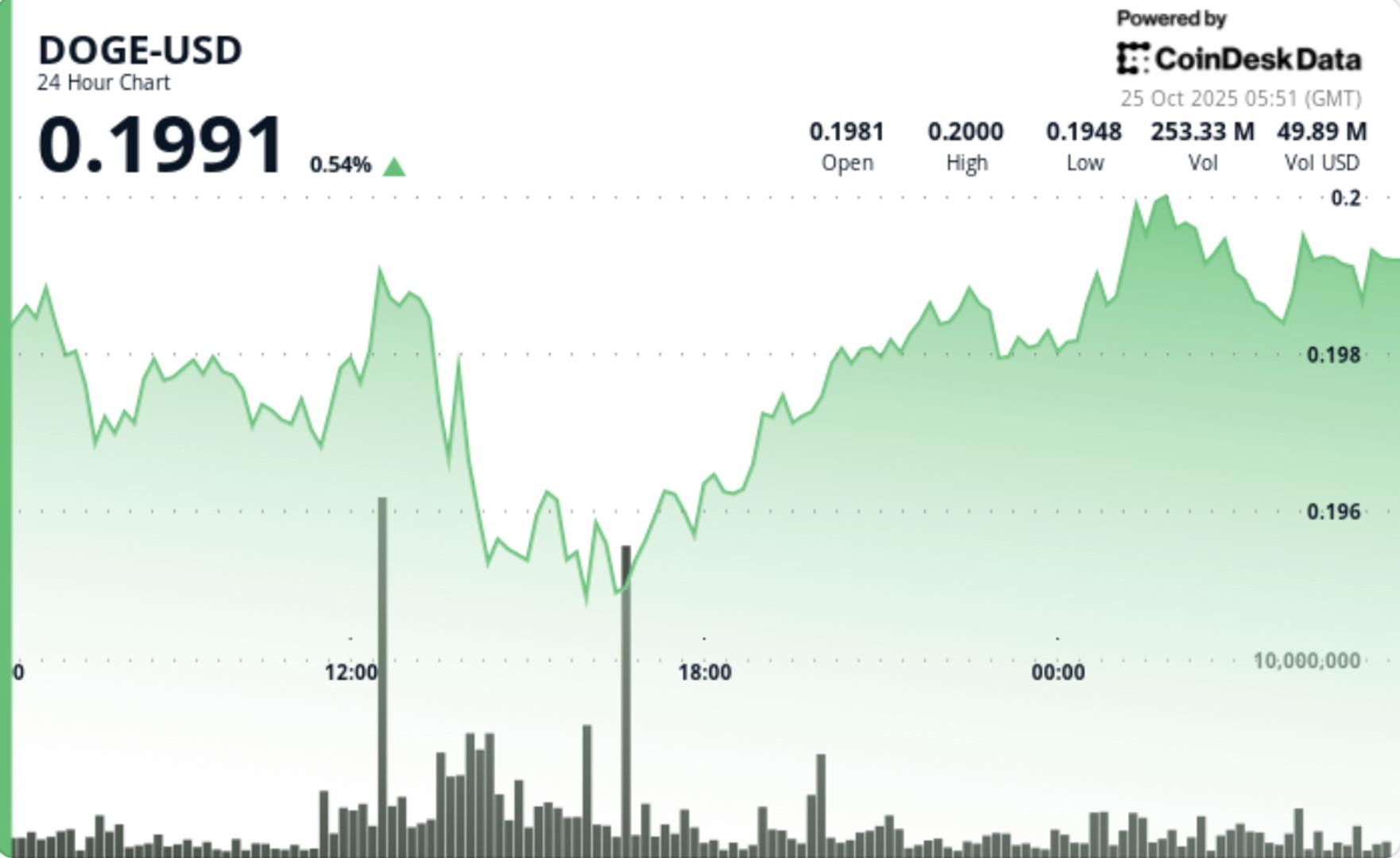

DOGE pushes by essential resistance ranges in a 1.8% advance as buying and selling exercise surges 170% above common, confirming accumulation patterns close to the psychological $0.20 zone.

Information Background

- Dogecoin gained 1.8% throughout Tuesday’s session, rising from $0.19 to $0.19 after breaking decisively by the $0.1988 resistance stage.

- The transfer got here on heavy buying and selling quantity of 674.52 million tokens — 170% above the 24-hour common — signaling renewed institutional participation following per week of consolidation beneath the $0.195 barrier.

- The meme token established a collection of upper lows from the $0.19 base, confirming a strengthening technical basis.

- Analysts famous the breakout occurred in keeping with broader risk-on sentiment throughout digital belongings as Bitcoin and Ethereum prolonged early-week positive aspects, reinforcing DOGE’s correlation to large-cap market momentum.

- DOGE briefly examined the $0.20 psychological threshold earlier than coming into a managed consolidation part close to session highs, with consumers defending positive aspects regardless of late-session profit-taking.

Worth Motion Abstract

- The breakout part started through the 23 October 11:00 window, when DOGE surged from $0.1963 to $0.1995 on explosive quantity. Institutional inflows dominated throughout this era, with 674.52M tokens traded — practically triple the day by day common — marking probably the most lively hours of the month.

- Following the preliminary breakout, DOGE consolidated tightly between $0.1990–$0.2003, exhibiting robust equilibrium between profit-taking and continued shopping for curiosity.

- Brief-term momentum remained constructive, with intraday lows persistently defended above $0.1974 and rising hourly help confirming accumulation habits relatively than distribution.

- The worth construction into the shut instructed stabilization above former resistance, with market depth knowledge exhibiting elevated bid liquidity round $0.1980-$0.1985.

Technical Evaluation

- DOGE’s present construction aligns with a continuation sample forming inside a managed ascending channel. The clear breakout by $0.1988 resistance validates the bullish bias, whereas consolidation on the $0.2000 mark signifies preparation for the following impulse transfer greater.

- Momentum indicators (MACD, RSI) stay supportive, exhibiting modest bullish divergence throughout hourly frames.

- Quantity dynamics reinforce the institutional narrative — the 170% surge confirms lively positioning throughout breakout circumstances, whereas subsequent normalization implies measured distribution with out structural deterioration.

- Analysts spotlight the $0.1974-$0.1980 area as key help, with a confirmed shut above $0.2003 prone to prolong positive aspects towards the $0.2020–$0.2050 vary.

What Merchants Are Watching

- Market contributors are monitoring whether or not DOGE can maintain above the $0.1985–$0.1990 help zone, a stage that has change into the intraday pivot for continuation setups.

- A confirmed breakout above $0.2003 might entice momentum consumers and set off algorithmic follow-through towards greater resistance bands at $0.2030–$0.2050.

- On-chain and order guide knowledge recommend ongoing accumulation, with whale pockets inflows growing 2.1% over the previous 48 hours.

- Merchants notice that additional affirmation of this development would validate the bullish accumulation thesis and strengthen conviction in a near-term retest of the $0.21 deal with.

- Failure to take care of present ranges, nonetheless, might reintroduce short-term volatility and immediate a retracement towards the $0.1940–$0.1950 help vary.