The sudden and violent market correction triggered by geopolitical shockwaves served as an unprecedented stress check for your entire cryptocurrency ecosystem, exposing important variations in community structure. Whereas the multi-billion-dollar liquidation occasion despatched costs plunging throughout the board, Solana demonstrated exceptional resilience, whereas the Ethereum community and liquidity thinned in the course of the peak volatility.

Why Solana Excessive-Efficiency Design Continues To Shine

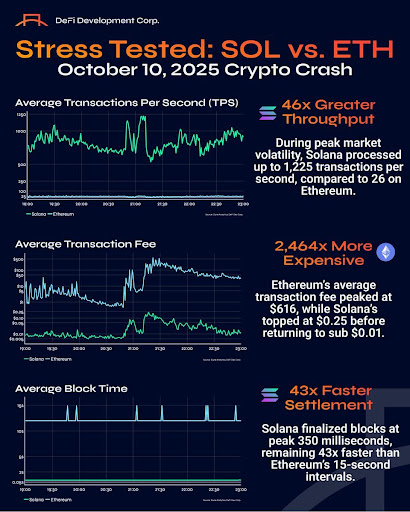

In an X submit, the Nasdaq-listed go-to Solana Digital Asset Treasury (DAT), DefDevCorp, has revealed that when the most important liquidation occasion in crypto historical past hit final Friday, a lot of the market froze, and Ethereum stumbled. Nonetheless, Solana didn’t flinch, powering via one of the chaotic buying and selling classes ever recorded.

Associated Studying

On the peak of volatility, Solana sustained 1,225 transactions per second, finalized blocks in simply 350 milliseconds, and noticed transaction charges briefly rise to $0.25 earlier than normalizing beneath $0.01. In the meantime, ETH’s infrastructure buckled beneath demand because the community struggled to course of past 26 TPS. Its block instances prolonged to fifteen seconds, and noticed common fuel charges explode to $616, successfully locking out customers and rendering the chain unusable in the course of the disaster. ETH grew to become unreliable, impractical, and successfully unusable in the course of the chaos.

As DefiDevCorp famous, when customers are priced out and transactions can’t clear, the community may as properly be offline. In moments of excessive load, the core promise of a blockchain to stay accessible, reasonably priced, and dependable should maintain. Nonetheless, after practically 20 months of uninterrupted uptime, weathering its busiest moments, it’s abundantly clear that SOL’s continued upgrades and optimizations have paid off dramatically.

DefiDevCorp concluded that no different chain at present comes near dealing with world worth switch at this scale, beneath such excessive circumstances, with the identical degree of efficiency. The takeaway from the agency’s submit is that solely SOL stays quick, low cost, and usable, even when world markets soften down.

Why SOL Value Doesn’t Match Its Reliability

A Researcher at alphapleaseHQ and Advisor at KaminoFinance, Aylo, has additionally talked about that he had property and Decentralized Finance (DeFi) positions open on each Solana and Ethereum when the crypto market collapsed final Friday. Throughout this time, he had zero points utilizing the SOL community, whereas the ETH community was unusable because of the prices, which regularly led to market crashes, and the Rabby pockets additionally went down.

Associated Studying

Aylo added that the ETH maxis needs to be a lot angrier in regards to the efficiency of their L1. With this improvement, SOL continues to show it’s essentially the most performant and dependable blockchain beneath real-world stress that we have now in crypto. He identified that SOL’s valuation doesn’t mirror the resilience it’s proving within the digital world.

Featured picture from Adobe Inventory, chart from Tradingview.com