2022 wasn’t an awesome 12 months for CeFi, and 2023 would not appear to be extra promising. We analyzed the highest CeFi lawsuits of 2022 – and their repercussions.

Picture by Documerica on Unsplash

2022 wasn’t the perfect 12 months for centralized finance (CeFi). And it appears like 2023 isn’t going higher.

The previous 12 months closed with plenty of lawsuits that hit main centralized monetary establishments and corporations, together with some circumstances associated to scams and sadly, fintech was concerned.

On this article, we are going to cowl the highest 12 2022 lawsuits – and see why 2023 doesn’t appear to proceed higher.

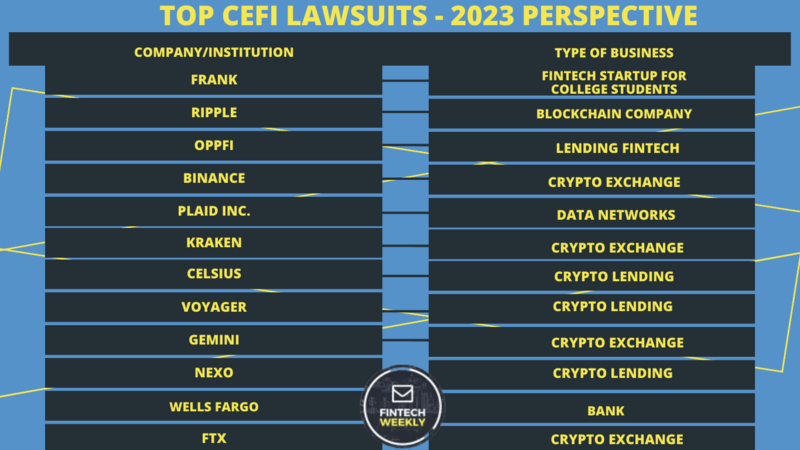

High CeFi lawsuits in 2022

| Firm / Establishment | Sort of enterprise |

What occurred & How regulators reacted |

| Frank | Frank was a fintech startup centered on serving to faculty college students to get monetary assist. | The SEC charged Charlie Javice, founding father of the startup, with fraud. |

| Ripple | Ripple Labs is a fintech firm centered on utilizing blockchain to simplify cross-border transactions. |

The SEC charged Ripple for allegedly utilizing unregistered securities. |

| OppFi | OppFi is a fintech firm centered on facilitating lending. | The corporate was sued by the DFPI in California and Texan authorities. In Texas, the category motion in opposition to OppFi was dismissed. |

| Binance | Binance is the biggest centralized crypto trade. | The corporate was sued by each particular person prospects and US authorities for allegedly misrepresenting info and promoting unregistered securities. |

| Plaid Inc. | Plaid Inc. is a fintech firm specialised in creating information networks for monetary providers. |

The fintech firm was sued for taking prospects’ information with out their consent. The US District Courtroom for the Northern District of California imposed a $58 million high-quality and compelled Plaid to vary its privateness insurance policies. |

| Kraken | Kraken is among the hottest centralized crypto exchanges. | Kraken accepted, in 2023, to pay a high-quality price $30 million imposed by the SEC. |

| Celsius Community | Crypto lending community. | The community was initially sued for lack of transparency and liquidity by a former funding supervisor. The corporate filed for chapter in 2022. |

| Voyager Digital Ltd. | Crypto lending platform. | The corporate filed for chapter in 2022, amid the crypto market collapse and the rising rates of interest that made traders transfer to much less unstable monetary belongings. |

| Gemini Belief Co. | Crypto trade. | The corporate was sued by prospects for allegedly promoting unregistered securities. The corporate needed to shut its Gemini Earn program. |

| Nexo | Crypto lending platform and centralized trade. | The platform was sued by a number of US states for allegedly promoting unregistered securities. The corporate selected to pay a $45 million high-quality in 2023. |

| Wells Fargo | Financial institution. | Wells Fargo was sued by the Client Monetary Safety Bureau (CFPB) for misconduct. The selections taken by the financial institution have been making folks lose cash and belongings. The financial institution needed to pay a document penalty price $3.7 billion. |

| FTX | Crypto CeFi trade. | The SEC charged Sam Bankman-Fried, CEO of the corporate, with fraud. Then, he was arrested. |

1. Frank Lawsuit

This lawsuit includes the favored financial institution JP Morgan and Frank, a fintech startup created to assist faculty college students who search for monetary assist.

In 2021, this fintech startup was acquired by JP Morgan for $175 million. Issues arose when the financial institution began its e-mail advertising and marketing course of. It turned out that 70% of these emails bounced again: whereas the startup was offered with a buyer base that amounted to over 4 million folks, the true prospects appeared to be solely 300,000.

The financial institution sued Charlie Javice, founding father of the fintech startup. In April 2023, the SEC (Securities and Trade Commision), charged Javice with fraud for allegedly orchestrating a plan to offer false information, for what issues each the variety of prospects and the success of the fintech in serving to college students.

2. Ripple Lawsuit

The case between the SEC and Ripple Labs began in 2020.

The blockchain firm based in 2012 was born to simplify and pace up cross-border transactions. On this case, the issue was the launch of the digital forex XRP: based on the SEC, the corporate launched an IPO (Preliminary Public Providing) to lift funds. The purpose is that the corporate used, based on the regulator, an unregistered safety.

After plenty of fashionable de-listings of XRP from centralized crypto exchanges (like within the case of Coinbase), and repartees, in 2022 Ripple obtained the assist of a number of blockchain associations and corporations: actually, the fintech firm accuses the SEC of undue and unreasonable management over the crypto business.

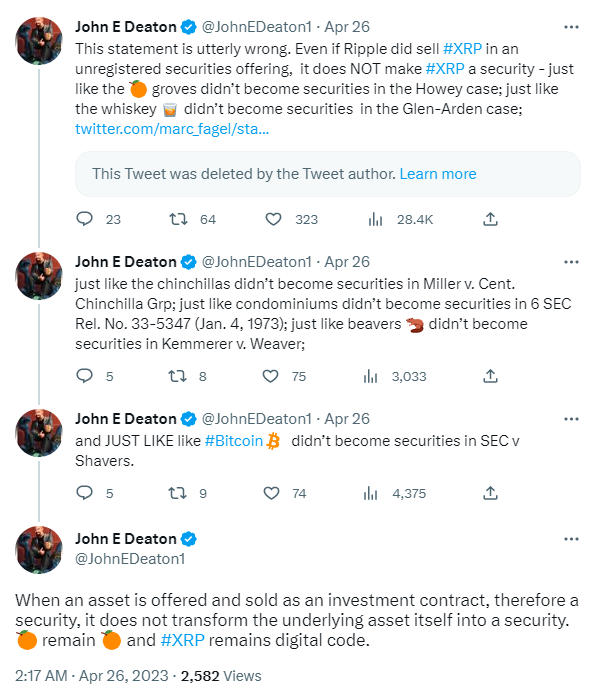

Lately, John E. Deaton, a authorized skilled, issued an Amicus Transient the place he analyzed related circumstances that occurred in previous a long time, and assessed that “when an asset is obtainable and offered as an funding contract, subsequently a safety, it doesn’t rework the underlying asset itself right into a safety.”

The case continues to be ongoing.

Supply: Twitter

3. OppFi (Alternative Monetary) Lawsuit

In 2022, the DFPI – the Division of Monetary Safety and Innovation, sued OppFi, a fintech firm centered on facilitating lending, for making use of rates of interest increased than the caps imposed in California.

Whereas the state has a cap for rates of interest that quantities to 36%, the fintech used to use over 150% rates of interest.

The fintech firm replied that it operates beneath Federal legal guidelines that permit corporations to fall beneath their state rules – and the corporate relies in Utah.

Throughout the identical 12 months, the fintech was concerned in an analogous litigation in Texas. In Texas, the category motion in opposition to OppFi was dismissed in 2023, whereas the fintech nonetheless faces the identical situation in California.

4. Binance Lawsuit

In 2022, Binance was sued by a Utah resident, Jeffrey Lockhart, for selling Terra as a secure and absolutely fiat-backed cryptocurrency – the collapse of Terra proved that this wasn’t true.

That is solely one of many lawsuits in opposition to the biggest centralized crypto trade, which is accused of promoting unregistered securities by the Commodity Futures Buying and selling Fee (CFTC).

Lately, the president of Ava Labs, John Wu, addressed the problem confronted by crypto corporations within the US saying that “The U.S. when it comes to creating certainty is simply falling behind everybody else”.

5. Plaid Inc. Lawsuit

The fintech firm Plaid Inc., specialised in creating information networks for monetary providers, in 2022 was concerned in a category motion that accused the corporate of taking prospects’ information with out their consent.

The US District Courtroom for the Northern District of California permitted a $58 million settlement and compelled the corporate to vary its insurance policies regarding privateness.

6. Kraken Lawsuit

Kraken is among the largest centralized crypto exchanges obtainable out there. After dealing with troubles for being accused of promoting cryptocurrencies in nations hit by worldwide sanctions, was sued for the kind of belongings it sells – thought-about as unregistered securities.

Kraken has at all times tried to respect the rules behind cryptos – that’s, the liberty they permit. However lastly, in 2023 it accepted to pay a high-quality price $30 million, imposed by the SEC, and to delist staking merchandise.

7. Celsius Community Lawsuit

This crypto lending community was initially sued by Jason Stone, a former funding supervisor, who accused the community as a result of he thought-about Celsius a fraudulent firm. The explanations behind this have been the dearth of funds to completely cowl deposits, and processes much like Ponzi schemes: based on the supervisor, Celsius was inflating the worth of CEL, the crypto related to the community, to pay the upper rates of interest promised to prospects who selected to retailer extra CEL.

Celsius really didn’t have a powerful monetary infrastructure, and it filed for chapter in July 2022, through the downturn that hit the crypto market and that pressured different crypto companies to shut.

8. Voyager Digital Ltd. Lawsuit

Equally, the crypto lender Voyager Digital filed for chapter in 2022, after a few of its over 3 million prospects misplaced their cash.

The lender was accused of improperly working the enterprise: the rising rates of interest imposed by US regulators, together with a disaster that made retail inventors transfer to much less dangerous belongings, created a liquidity downside for a lender with out a wholesome monetary state of affairs.

9. Gemini Belief Co. Lawsuit

Within the case of the crypto trade Gemini, the issue arose particularly due to Gemini Earn, this system that allowed customers to earn curiosity on their belongings.

In keeping with prospects, the monetary merchandise weren’t in step with regulation regarding securities, working really as unregistered securities, one thing that didn’t permit prospects to completely assess dangers.

The corporate needed to shut down this system, and likewise delayed withdrawals due to liquidity points.

10. Nexo Lawsuit

The crypto lending and centralized trade platform Nexo was sued by eight US states – at all times for allegedly providing unregistered securities.

In January 2023, the fintech firm selected to pay $45 million to the SEC.

11. Wells Fargo Lawsuit

The Client Monetary Safety Bureau (CFPB) sued the favored financial institution Wells Fargo for misconduct associated particularly to the increase of curiosity with out prior discover, repossessed automobiles (with out discover) in case of loans, even once they didn’t have the proper to do this, and the identical utilized to homes in circumstances of mortgage.

This conduct made folks lose cash, homes and automobiles.

In 2022, the financial institution agreed to pay a document penalty: $1.7 billion for the civil penalty, plus one other $2 billion to prospects.

12. FTX Lawsuit

FTX represented one of the spectacular collapses in crypto house. It turned out that this trade, based and managed by Sam Bankman-Fried, was only a means for its founder to get cash to spend it in political donations, homes and to make dangerous investments.

All this was attainable as a result of Bankman used to divert prospects’ funds to his personal hedge fund, Alameda Analysis. The SEC charged Bankman with fraud and he was arrested.

The state of CeFi – Let’s draw some conclusions

All these lawsuits, together with the banking disaster that hit the business in 2023, did not positively contribute to the status of centralized finance.

Many of the lawsuits we listed should do with crypto and blockchain corporations, however these nonetheless fall beneath the class of CeFi since their administration isn’t decentralized and distributed, however centralized and beneath the management of single people.

All these lawsuits permit us to attract some conclusions, since in all circumstances there are some traits that assist perceive why these corporations failed or have been sued:

- Lack of transparency,

- Lack of correct and accountable administration,

- Lack of funds,

- Falsification of information.

The case of Frank, for example, tells us that it was too straightforward for a Fintech startup to be acquired, particularly through the fintech growth that occurred proper after the breakout of the pandemic.

In another circumstances, like FTX, for example, irresponsible administration, extra centered on private benefits, and the dearth of transparency have been the primary causes of the failure (even when, additionally in that case, there was a board of traders, and a public unprofessional conduct of the CEO).

And final, however not least, circumstances like Ripple, which have been lasting for years, nonetheless ongoing, and the place regulators nonetheless did not handle to provide proof for his or her accusations.

Within the meantime, prospects and companies concerned proceed to lose cash, to have their funds blocked by delayed withdrawals – and it isn’t at all times attainable to recuperate their funds.

Regardless of all this unfavourable information and penalties, the state of affairs would not appear to enhance in 2023.

New lawsuits within the fintech business – the CoinLoan case

One other crypto firm goes to face troubles. As soon as once more, this might need a domino impact – however this time we’re in Europe.

The Estonia-based CoinLoan, a crypto lending platform, was sued by the Estonian authorities and the enterprise needed to stop operations.

The platform acquired a Discover of restraint on April 24, 2023, and it needed to halt any operations – together with withdrawals – from April 25.

The funds of the crypto lending firm may be moved solely with the authorization of a provisional liquidator. In keeping with the fintech firm, the restraint was surprising, and so they have “no alternative however to adjust to the stated necessities”.

Regardless of the necessity of a liquidator, the corporate didn’t file for chapter. And it is perhaps higher for its prospects to not attain that time.

We talked about the domino impact as a result of Vauld – one other troubled crypto firm that filed for chapter in 2022 – is concerned and is among the many collectors of CoinLoan. In case of chapter, the CoinLoan would possibly obtain monetary safety till there’s sufficient liquidity to repay collectors.

Bit4you – a Belgium-based crypto trade – was additionally concerned, and so they’re ceasing operations since they used CoinLoan as a supplier.

In keeping with our sources, this is perhaps a type of circumstances by which a crypto firm lacks transparency – and honesty: really, the issue is perhaps associated to the promise of over collateralized loans, whereas in actuality providing under-collateralized loans.

Which means there is perhaps a excessive likelihood of counterparty danger – one thing that occurs when one of many events can’t meet contractual obligations. On this case, CoinLoan is each blocking withdrawals and never paying curiosity on lended funds.

Last ideas

CeFi failed once more, and this time it’s even more durable to swallow since most of the corporations concerned in lawsuits and litigations use cryptocurrencies and blockchain – a know-how born to present folks a extra reliable monetary system.

The purpose is that typically, the failure of the corporate wasn’t because of exterior components, however to misconduct and irresponsible administration.

Regulators selected to develop into extra extreme, and this could be a double-edged sword: if because of this it is perhaps simpler to deal with fraudsters, it additionally implies that corporations that select to comply with rules will also be concerned in litigations born from extreme (and generally unreasonable) management. Or, that corporations would possibly resolve to maneuver or keep away from innovation in sectors that aren’t absolutely regulated but.

Within the meantime, the implications for folks and companies may be dramatic.

If you wish to keep forward of competitors and uncover fintech information, insights and occasions, subscribe to FinTech Weekly E-newsletter!