The cryptocurrency market rose 1.56% within the final 24 hours, extending its weekly positive aspects by almost 7%. This upward momentum is attributed to bettering investor confidence and threat sentiment as altcoins achieve momentum over Bitcoin and institutional inflows surge.

In response to our evaluation, the most effective cryptos to purchase now are: HiFi Finance (HIFI), Pepe ($PEPE), and SatLayer ($SLAY). These alts are rallying on the again of catalysts similar to altcoin rotation, alternate listings, whale accumulation, and bullish technical indicators.

Immediately’s Altcoin Season Index studying of 69/100 means that alts are outperforming Bitcoin. BTC dominance fell 0.89 proportion factors to 56.6%, whereas the altseason index is up 64% month-over-month, signaling capital rotation from BTC to alts, largely pushed by Ethereum ETF inflows and the expansion of the Solana ecosystem. Merchants are diversifying into altcoins, in search of larger beta performs, as Bitcoin consolidates close to $113,000.

Tether minted $2 billion USDT this week, whereas Circle created $5.9 billion USDC, which boosted market liquidity. This was fueled by the September Fed fee minimize odds hitting 97%, and threat urge for food favoring alts like BNB, XRP, SOL, and ETH. Look ahead to the BTC dominance threshold at 50%, as a break beneath might sign a broader altseason. The Federal Reserve’s September 18 assembly can be essential as a result of a fee minimize might prolong the capital rotation, however hawkish indicators would possibly set off profit-taking.

3 Finest Cryptos To Purchase Now (09/13): $HIFI, $PEPE, $SLAY

| Token | 24h Efficiency | Market Cap / Liquidity | 2025 Worth Forecast (Min / Avg / Max) | Threat Stage |

|---|---|---|---|---|

| Hifi Finance (HIFI) | 🚀 +656% | $88M market cap, turnover ratio 7.64x | $0.298 / $0.348 / $0.486 | ⚠️ Very Excessive (pump-risk, correction doubtless) |

| Pepe Coin (PEPE) | +13.17% (24h), +23.8% (7d) | $1.33B 24h quantity, OI $606M | $0.00000829 / $0.00000929 / $0.00001203 | ⚠️ Excessive (whale-driven, leveraged longs) |

| SatLayer (SLAY) | +29.18% (24h) | $38.7M 24h quantity, turnover 2.95x | $0.0199 / $0.0223 / $0.0289 | ⚠️ Medium-Excessive (fragile confidence, down 39% in 30d) |

1. Hifi Finance (HIFI)

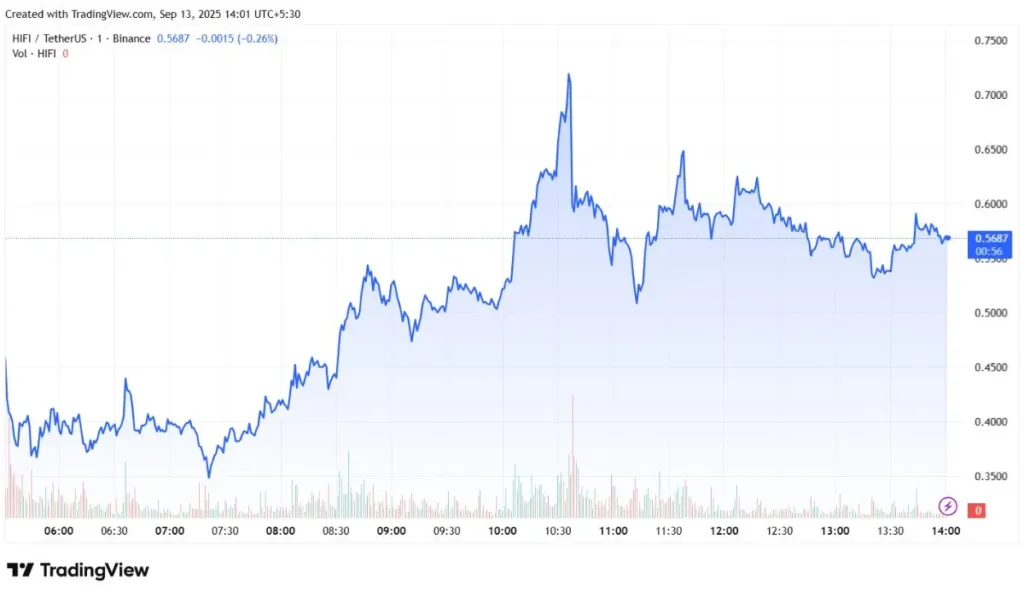

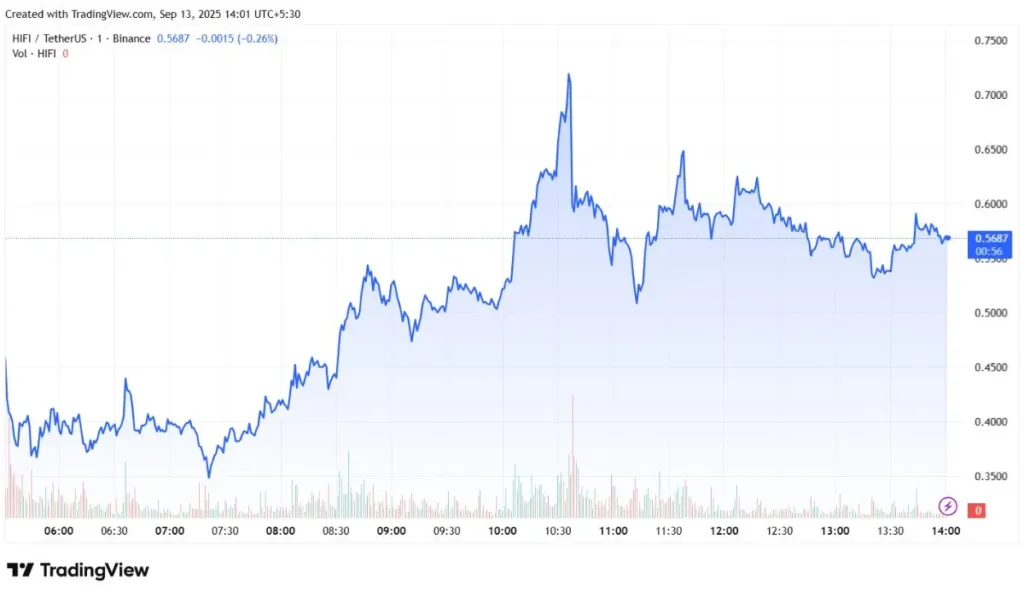

HIFI surged 656% in 24 hours, outpacing the broader crypto market’s development. Its rally was pushed by macro liquidity shifts, altcoin rotation, and constructive technical momentum.

HIFI has reclaimed its 200-day SMA at $0.1839, whereas its 14-day RSI spiked from oversold situations within the 30 vary to an excessive overbought stage at 92.7, and MACD histogram hit its strongest bullish divergence since Might. The rally began as a brief squeeze after extended undervaluation and was amplified by stop-loss triggers and momentum merchants chasing volatility. Excessive turnover ratio of seven.64x confirms speculative exercise. Merchants have to look out for RSI14 above 90, which traditionally precedes 30-50% corrections. The 38.2% Fibonacci retracement at $0.53 now acts as near-term assist.

The Altcoin Season Index hit 69/100, with HIFI’s weekly positive aspects beating 95% of the highest 500 cryptocurrencies by market capitalization. This implies traders are rotating capital from Bitcoin into high-risk/reward alts. HiFi’s low market cap of $88 million, in comparison with its buying and selling quantity, makes it weak to pumps but additionally aware of sentiment shifts.

In the meantime, the U.S. cash market funds hit a document $7.26 trillion, with analysts predicting {that a} Fed fee minimize might redirect capital to risk-on belongings like crypto. HIFI stands to profit from a story proxy, with its 2025 lows coinciding with peak Treasury yields, whereas the present rally aligns with declining conventional yields.

| $HIFI Market Worth | Minimal Worth (2025) | Common Worth (2025) | Most Worth (2025) |

| $0.6833 | $0.2984 | $0.3485 | $0.4866 |

2. Pepe Coin (PEPE)

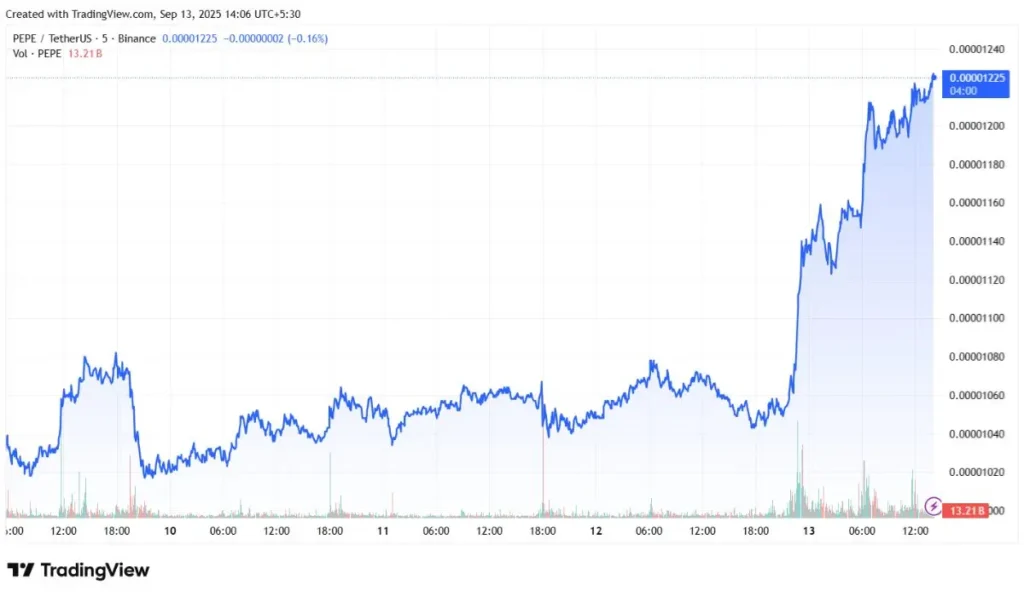

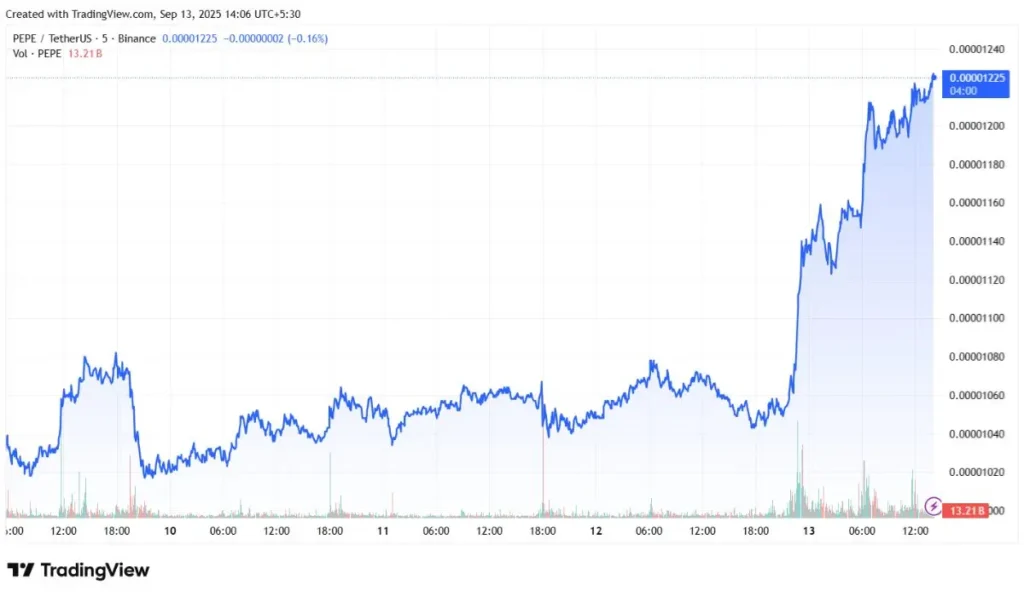

PEPE rose 13.17% over the past 24 hours, outpacing the broader crypto market’s 1.45% achieve. This transfer aligns with a 23.86% weekly surge however stays down 2.69% month-to-month. The important thing catalysts behind the rally embody constructive technical breakout, memecoin rotation, and elevated whale exercise.

PEPE broke above its $0.00001132 resistance stage on September 12, triggering a cascade of purchase orders. Its value is now testing the 23.6% Fibonacci retracement stage at $0.000011826, with the 7-day RSI at 80.08 signalling overbought situations within the short-term. This breakout confirms a bullish ascending channel, with merchants focusing on $0.00001350 – $0.00001400. Nevertheless, the 200-day EMA at $0.000011284 acts as a dynamic assist, as an in depth beneath might invalidate the uptrend. Sustained every day buying and selling quantity above $1.38 billion and a constructive MACD histogram can be key to extending the rally.

PEPE’s 24-hour buying and selling quantity spiked 143% to $1.33 billion, outperforming 93% of the highest 100 cryptocurrencies. Retail merchants are chasing memecoins amid impartial market sentiment, as mirrored by the Worry & Greed Index studying of 53. Binance South Asia supplied a voucher marketing campaign to spice up PEPE’s market accessibility. Look ahead to a drop in BTC dominance beneath 55%, which might additional prolong altcoin rallies.

PEPE futures open curiosity rose 10% to $606.59 million, whereas whales have amassed 4.02 trillion tokens since August. Giant-scale holders are positioning themselves for prolonged positive aspects, however funding charges are displaying a market dominated by leveraged longs, rising liquidation dangers if the continued momentum stalls.

| $PEPE Market Worth | Minimal Worth (2025) | Common Worth (2025) | Most Worth (2025) |

| $0.00001199 | $0.00000829 | $0.00000929 | $0.00001203 |

3. SatLayer (SLAY)

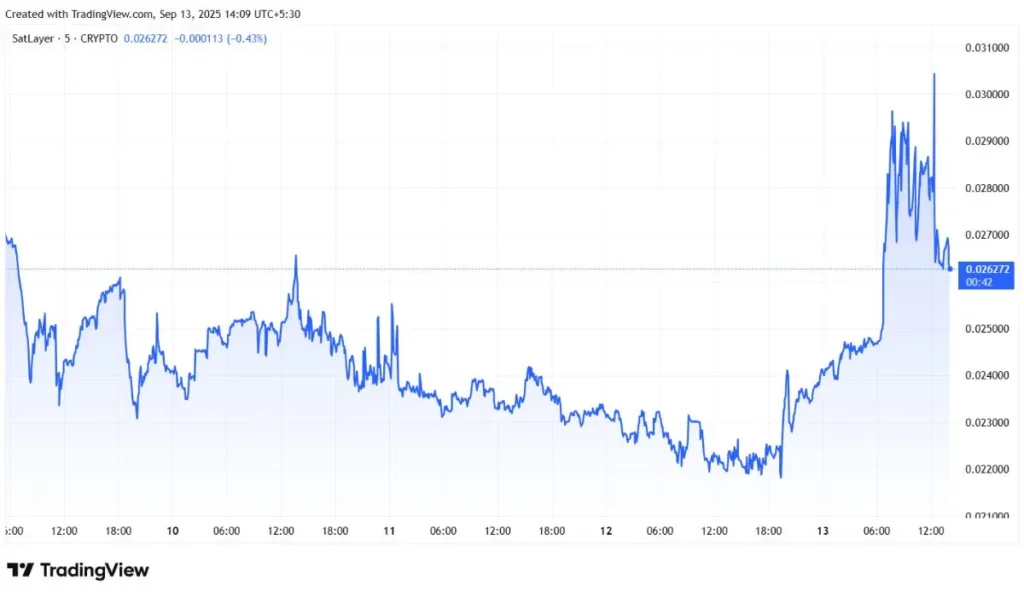

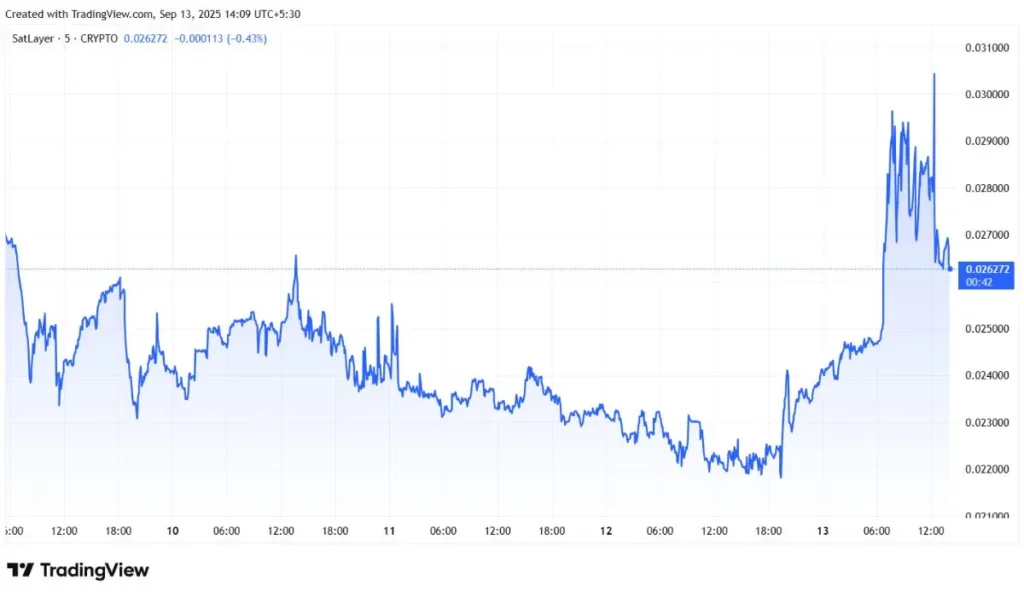

SLAY surged 29.18% up to now 24 hours, outpacing the broader crypto market’s 1.03% achieve. Key drivers behind the rally embody alternate listings, airdrop incentives, and technical momentum.

SLAY’s value broke above its 7-day SMA at $0.025 and 30-day SMA at $0.26, with RSI14 at 39.08 mendacity beneath overbought thresholds. Merchants might interpret this as a bullish divergence, particularly with the 24-hour buying and selling quantity surge confirming upward momentum. The closest Fibonacci resistance is on the 38.2% retracement at $0.0358. SLAY should maintain above $0.028 if Bitcoin retests the $122,000 resistance.

Toobit alternate listed SLAY for spot buying and selling on August 12, increasing SatLayer’s entry to retail merchants. The token’s 24-hour buying and selling quantity spiked 7.04% to $38.7 million following the launch, with a turnover ratio sitting at 2.95x, indicating excessive liquidity demand. New listings usually set off short-term shopping for strain as merchants front-run perceived liquidity inflows. SLAY’s surge coincides with its market place as a re-staking protocol for BTC, aligning with the Altcoin Season Index’s 70/100 studying.

On August 14, Binance Alpha introduced an airdrop for the OVL token, which was allotted to customers holding 200+ Alpha Factors. Whereas OVL isn’t linked to SLAY, it drove consideration to BNB-linked platforms like SatLayer, spurring cross-platform exercise. Nevertheless, SLAY’s 30-day value stays down 39.66%, suggesting fragile investor confidence. Look ahead to post-airdrop promote strain if members begin to rotate capital.

| $SLAY Market Worth | Minimal Worth (2025) | Common Worth (2025) | Most Worth (2025) |

| $0.02804 | $0.019937 | $0.022332 | $0.028939 |

Ultimate Ideas on Finest Cryptos to Purchase Now

The rallies of as we speak’s best-performing cryptocurrencies – $PEPE, $SLAY, $HIFI – will be attributed to the broader altcoin market outperforming Bitcoin.

BTC’s market share fell to 56.55%, whereas the altcoin season index jumped to its highest stage since December 2024 at 70/100. That is mirrored by a $166 billion liquidity shift to alts over the previous week, largely pushed by Ethereum Alternate Traded Fund ETF influx momentum and Solana’s ecosystem development, suggesting that merchants are rotating income from BTC into higher-beta alts.

In the meantime, altcoins comprised 71% of Binance futures every day buying and selling quantity, with perpetuals funding charges turning constructive for tokens like ETH. Open curiosity for SOL and XRP futures rose 22% in 48 hours. This implies leveraged merchants are backing altcoins to increase their positive aspects, although rising leverage will increase short-term volatility.

Readers ought to observe that cryptocurrencies are extremely speculative and risky belongings, and it is strongly recommended that you just conduct correct due diligence and search professional opinion earlier than investing choice. Moreover, the contents of this text are for informational functions and shouldn’t be construed as funding recommendation.