The foreign exchange market strikes in a fractal method. The patterns you’ll observe on the long-term horizon additionally happen on the short-term horizon. Even market traits are fractal. The market might development each on the short-term momentum and on the mid- or long-term horizon. The important thing to buying and selling development continuation setups efficiently is find the confluences between traits each on the short-term and long-term horizon. The technique mentioned beneath exhibits us an instance of methods to commerce on the confluence of traits and momentum utilizing two technical indicators.

Heiken Ashi Candlesticks

The phrase Heiken Ashi means “common bars” in Japanese. The Heiken Ashi Candlesticks is appropriately named as such as a result of it plots worth bars primarily based on common costs.

The Heiken Ashi Candlestick is a comparatively new technique of charting worth actions. This charting technique plots worth candles or bars with a modified open and shut stage, each of that are primarily based on common costs. The Open Value stage is the midpoint of the open and shut worth of the earlier bar. It’s calculated by including the open and shut worth of the earlier bar, then dividing it by two.

Open = (Open of Earlier Bar + Shut of Earlier Bar) / 2

The Shut Value then again is considerably a modified model of the Weighted Value. It’s calculated by including the open, excessive, low, and shut of the present bar, then dividing the sum by 4.

Shut = (Open + Excessive + Low + Shut) / 4

The Highs and Lows of every bar nevertheless stay the identical.

This technique of plotting worth candles or bars deviates from the usual technique whereby the colour of the bar would change relying on whether or not the closing worth is greater or decrease than the opening worth. As an alternative, this technique leads to a worth chart whereby the bars would solely change colour each time the course of the short-term momentum has shifted.

Merchants can interpret the altering of the colour of the Heiken Ashi bars as a sign of a momentum shift or reversal, which might then be used as a foundation for commerce entry and exit indicators.

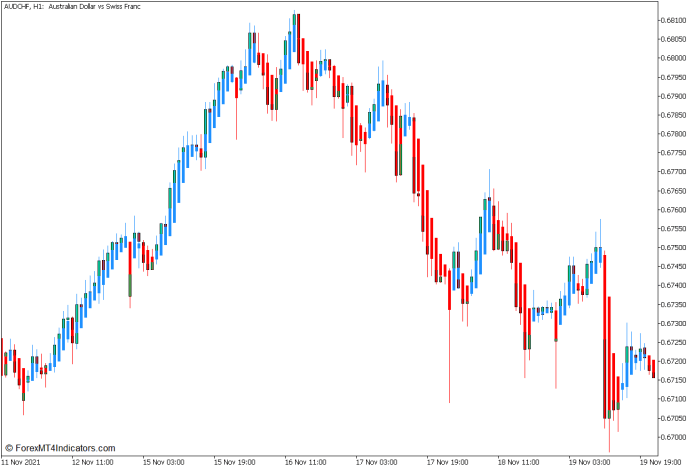

This model of the Heiken Ashi indicator overlays dodger blue bars to point a bullish momentum and crimson bars to point a bearish momentum.

Supertrend Indicator

As its identify suggests, the Supertrend indicator is a trend-following indicator. This indicator detects development instructions primarily based on the idea of utilizing the Common True Vary (ATR) as a foundation for figuring out development reversals.

A method merchants establish traits relies on the ATR. On this technique, merchants would merely multiply the ATR by a preset multiplier, which is often both two or three. This then turns into the edge distance from the best excessive or lowest low which might verify the continuation of the development. For instance, if the market is in an uptrend, the product of the ATR and the multiplier is subtracted from the best excessive.

If the worth drops beneath this threshold, the market is taken into account to have reversed. Inversely, if the market is in a downtrend, the product of the ATR and the multiplier is added to the bottom low. If the worth breaches above this threshold, then the market is taken into account to have reversed to an uptrend.

The Supertrend Indicator relies on the idea mentioned above. What it does is that it visually plots the thresholds both beneath or above worth motion relying on the course of the development. It plots the edge line beneath worth motion throughout an uptrend and shades the world pale inexperienced. Inversely, it plots the edge line above worth motion throughout a downtrend and shades the world bisque. The road shifts solely when the worth has breached and closed on the alternative facet of the edge line.

This indicator is greatest used for figuring out development course. Merchants can both filter out trades primarily based on the course of the development as indicated by the Supertrend indicator or use the shifting of the road as a development reversal sign.

Buying and selling Technique Idea

This buying and selling technique is a straightforward development continuation technique that makes use of the confluence of the mid-term development course and the short-term momentum course as a foundation for coming into trades. It’s basically a commerce entry on the resumption of the development proper after the pullback.

The Supertrend indicator is used primarily to establish the course of the development. That is primarily based on the situation of the road about worth motion, in addition to the colour of the shaded space. Merchants ought to commerce solely within the course of the development.

As quickly because the development course is recognized, commerce entry alternatives may be noticed. These are primarily based on the altering of the colour of the Heiken Ashi bars in confluence with the course of the development. This sometimes happens throughout market pullbacks which don’t break the development.

Purchase Commerce Setup

Entry

- The Supertrend line needs to be beneath worth motion whereas the indicator paints a pale inexperienced shade.

- Anticipate a market pullback which ought to trigger the Heiken Ashi bars to quickly change to crimson.

- Open a purchase order as quickly because the Heiken Ashi bars change to Dodger blue.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Shut the commerce as quickly because the Heiken Ashi bars revert to crimson.

Promote Commerce Setup

Entry

- The Supertrend line needs to be above worth motion whereas the indicator paints a bisque shade.

- Anticipate a market pullback which ought to trigger the Heiken Ashi bars to quickly change to dodger blue.

- Open a promote order as quickly because the Heiken Ashi bars change to crimson.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the Heiken Ashi bars revert to dodger blue.

Conclusion

This buying and selling technique generally is a good systematic technique to commerce development continuations. It is extremely goal and may be simply understood. Nonetheless, merchants shouldn’t anticipate a wonderfully correct buying and selling technique when utilizing this technique. It might probably produce wonderful commerce alternatives each time the market is trending with simply the correct amount of market swing, however it’s also ineffective each time it’s utilized in a uneven non-trending market atmosphere. The important thing to utilizing this technique efficiently is to use it solely throughout trending market circumstances.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past information and buying and selling indicators.

This MT5 technique gives a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Tips on how to set up This MT5 Technique?

- Obtain the Zip file beneath

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick the MT5 technique

- You will note technique setup is out there in your Chart

*Word: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: