The cryptocurrency market rose 0.91% over the previous 24 hours, persevering with its weekly uptrend, which was pushed by ETF hypothesis, momentum surrounding the US Bitcoin reserve coverage, and elevated exercise within the by-product market.

The broader market’s surge was mirrored in altcoins outperforming Bitcoin, with right this moment’s Altcoin Season Index studying of 70/100 indicating that alts are gaining momentum, whereas BTC dominance dipped to 57.52%. The alt rally was largely pushed by sector-wide surges for DeFi and meme cash, outpacing BTC’s 0.9% market cap progress.

Based on our evaluation, one of the best cryptos to purchase now are: STBL ($STBL), Hemi ($HEMI), and Filecoin ($FIL). Their rallies may be attributed to technical breakouts, altcoin season momentum, new trade listings, and a surge in market liquidity.

Tuttle Capital’s newest submitting for spot ETFs pegged to Litecoin (LTC), Sui (SUI), and Bonk (BONK) boosted the general altcoin sentiment. In the meantime, crypto trade leaders met with lawmakers in Washington to advance the BITCOIN Act for establishing the U.S. Strategic Bitcoin Reserve, signalling institutional adoption narratives. Crypto perpetuals quantity hit $400.59 trillion, up 17.27% weekly, which supported value stability regardless of a dip in open market curiosity for derivatives.

Greatest Cryptos to Purchase Now (09/17): $STBL, $HEMI, $FIL

The perfect cryptocurrencies to purchase proper now on 09/17 embrace $STBL, $HEMI, and $FIL, providing robust potential and energetic market curiosity.

1. STBL ($STBL)

Supply: TradingView

STBL rose 386.32% during the last 24 hours, extending its 7-day rally. Its surge coincides with bullish information in regards to the platform’s novel stablecoin mannequin and the token hitting new all-time highs.

On September 16, STBL hit an ATH of $0.185, which was amplified by social media traction, with buying and selling volumes hovering 16,604% in 24 hours to $404 million.

New highs typically set off algorithmic shopping for and retail FOMO, particularly in low-float tokens like STBL, which has a circulating provide of 500 million versus a ten billion whole provide. Its quantity/market cap turnover ratio of 4.83 confirms excessive liquidity, lowering slippage dangers for big trades.

STBL’s father or mother firm, led by Tether CEO Reeve Collins, has launched a three-token ecosystem consisting of the $USST stablecoin, a yield-bearing NFT referred to as YLD, and the $STBL token for governance. The Decentralized Software (DApp) was launched in beta on September 15, sparking important curiosity from customers for its “spend stablecoins whereas retaining yield” mechanism.

This specific mannequin addresses a key stablecoin limitation, with customers sometimes sacrificing yield for liquidity. By decoupling utility and yield, the STBL ecosystem might appeal to investor capital looking for twin advantages, driving demand for its governance token.

The surge in STBL’s 24-hour buying and selling quantity dwarfed its $87.3 million market cap. Throughout this time, derivatives exercise throughout the crypto market rose 19.4%, however STBL lacked futures/perpetuals knowledge, suggesting that its rally was purely spot-driven.

Excessive spike in buying and selling quantity for low-cap property typically precedes volatility. Whereas that is bullish within the brief time period, the dearth of sustained use circumstances past hypothesis raises sustainability considerations.

| $STBL Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $0.1691 | $0.05788 | $0.102467 | $0.173658 | +0.2% |

2. Hemi ($HEMI)

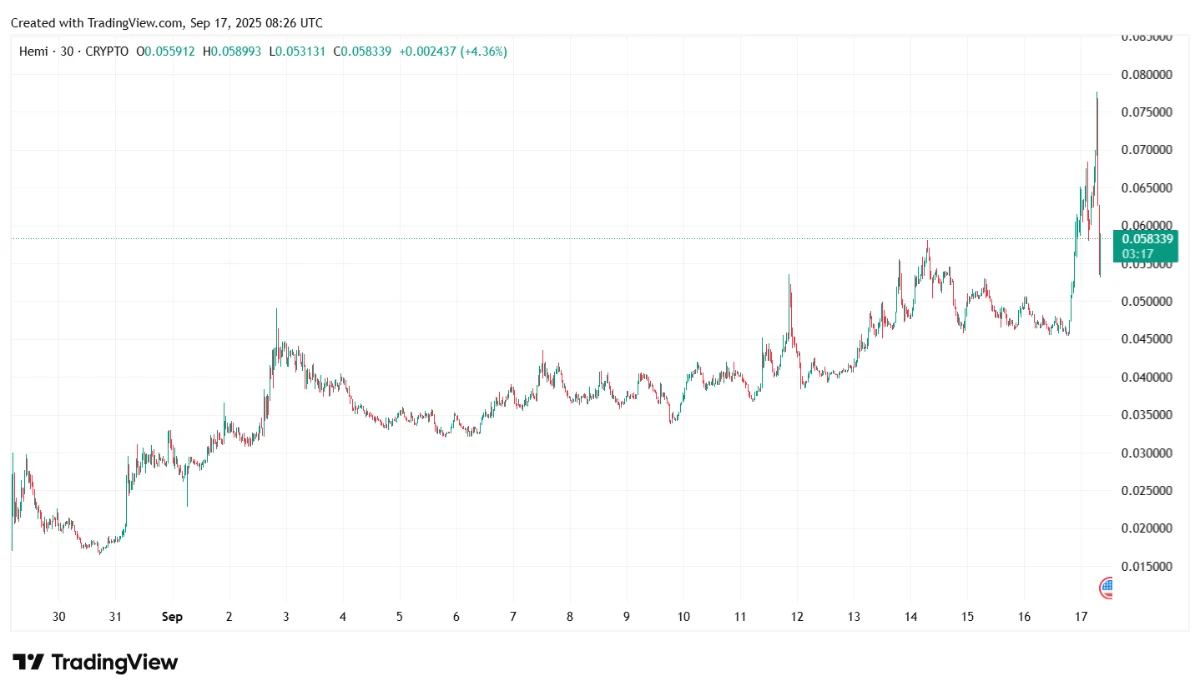

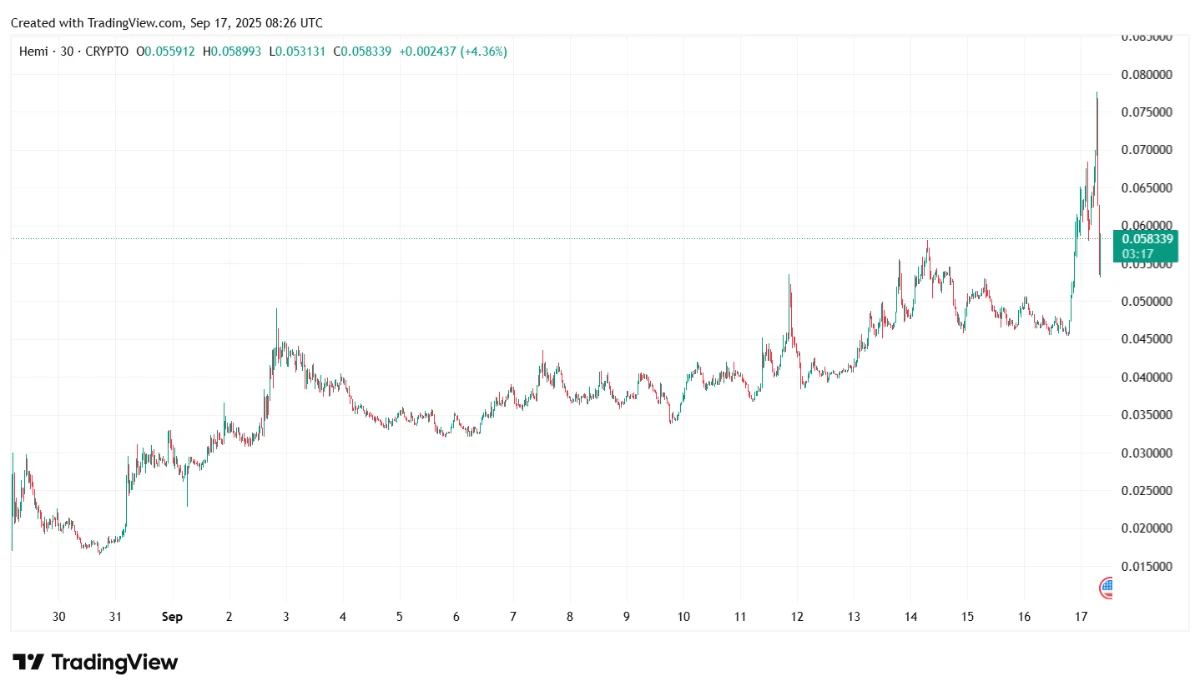

Supply: TradingView

HEMI rose 34.18% during the last 24 hours, extending its 7-day acquire to 56.23% and 30-day acquire to 261.3%. This transfer has outpaced the broader crypto market’s acquire throughout the identical interval and is pushed by trade listings, bullish sentiment, and technical momentum.

HEMI’s 14-day RSI hit 81.11 on September 17, deep in overbought territory past the 70 threshold. Its 7-day SMA at $0.0477 sits far beneath its present value of $0.0635, indicating a possible correction. Whereas robust momentum can persist in altcoins as RSI above 80 traditionally precedes pullbacks, merchants might probably take income if shopping for quantity for Hemi slows down.

HEMI was listed on the Toobit and BYDFi exchanges, enabling spot buying and selling within the HEMI/USDT pair. These listings expanded entry to retail merchants, coinciding with a 27.87% rise in HEMI’s 24-hour buying and selling quantity to $481 million.

Trade listings typically set off short-term demand spikes as new buyers enter the market. HEMI’s turnover ratio is 7.76, signaling excessive liquidity, lowering slippage dangers whereas attracting day merchants. Look ahead to sustained quantity post-listing and potential launch on Tier-1 exchanges.

Social media posts claimed that HEMI was undervalued in opposition to Bitcoin Layer-2 SEI, which has a market cap of $1.8 billion in comparison with HEMI’s $62 million. Narratives round small-cap “gems” can gas speculative rallies, however reliance on hype raises volatility dangers. HEMI’s 261% month-to-month acquire suggests momentum merchants are energetic out there.

| $HEMI Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $0.06377 | $0.043493 | $0.047556 | $0.059595 | -11.26% |

3. Filecoin ($FIL)

Supply: TradingView

FIL rose 6.68% previously 24 hours, outpacing the broader crypto market’s 0.78% acquire. Key drivers behind the rally embrace technical bullish indicators, elevated altcoin rotation, and ecosystem adoption momentum.

FIL broke above its 7-day SMA at $2.53 and 30-day SMA at $2.40, with the MACD histogram turning optimistic for the primary time in two weeks. The 14-day RSI at 56.17 suggests room for additional upside earlier than hitting overbought situations.

Merchants are prone to interpret this crossover above key averages as a momentum shift, triggering algorithmic shopping for. The $2.68 Fibonacci extension degree now acts as near-term resistance for FIL, and a break above might goal $2.78. Look ahead to sustained quantity above $275 million to substantiate bullish conviction.

The Altcoin Season Index hitting 70/100 signalled capital rotation from BTC into smaller-cap alts. FIL’s 90-day return presently lags behind AI and DePin-native tokens, making it a candidate to catch as much as the market development.

Merchants could also be positioning themselves in undervalued infrastructure property like FIL amid bettering threat urge for food. Nevertheless, Filecoin’s 24-hour turnover ratio of 15.6 indicators thinner liquidity than main alts, amplifying volatility dangers.

On August 10, Filecoin introduced a partnership with Blockfirst to broaden its decentralized storage redundancy to Cardano-native DApps, increasing real-world use circumstances for FIL. Whereas this was not a direct catalyst for the token’s surge during the last 24 hours, it aligns with rising demand for decentralized alternate options to centralized cloud storage options.

Storage networks like FIL stand to profit from AI/knowledge sovereignty developments, with energetic addresses and deal counts serving as elementary well being metrics. FIL’s circulating provide stays steady at 689 million cash, lowering inflationary stress.

| $FIL Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $2.55 | $2.53 | $2.75 | $2.64 | +7.83% |

Last Ideas on At this time’s (09/17) Greatest-Performing Cryptocurrencies: $STBL, $HEMI, $FIL

The rallies behind right this moment’s best-performing altcoins – $STBL, $HEMI, and $FIL – may be attributed to the market development of altcoins presently outperforming Bitcoin. BTC dominance dipped 0.13 factors to 57.52%, whereas the Altcoin Season Index held firmly within the “Altcoin Season” territory of 70, signalling sustained capital rotation from Bitcoin to alts. This implies buyers are diversifying their crypto holdings past BTC, looking for increased returns in riskier property amid a liquidity-rich atmosphere.

Perpetual futures open curiosity rose 1.08% in 24 hours, however common funding charges dipped 51.15%, suggesting leveraged merchants are chasing alt rallies cautiously. Whereas speculative demand exists, merchants are hedging bets, which is a combined sign for the sturdiness of a possible alt season.

Total, altcoins are outperforming BTC, pushed by sector-specific hype and exchange-driven liquidity. Nevertheless, Bitcoin’s market dominance stays elevated, and the U.S. Federal Reserve’s upcoming rate of interest choice on September 17 might reshuffle capital flows. Keep watch over BTC’s response to the $115,000 resistance, as a breakout there may reverse the altseason narrative.