The cryptocurrency market declined 0.52% over the previous 24 hours, largely on account of consolidation following a 5.43% weekly achieve, profit-taking by short-term merchants, combined expectations for ETFs, and volatility in stablecoins.

Nonetheless, altcoins continued their development of outperforming Bitcoin, per in the present day’s Altcoin Season Index studying of 74/100, which is inside touching distance of triggering an alt season. BTC dominance is down 0.69 share factors to 56.91% whereas the alt season index surged 48% in 7 days, signalling capital rotation from Bitcoin to altcoins.

In line with our evaluation, the highest cryptos to purchase now are: Cudis ($CUDIS), Mitosis ($MITO), and Flare ($FLR). Their rallies have been pushed by change listing-led narratives, bullish technicals, and rising Decentralized Finance (DeFi) adoption.

Regardless of a minor dip, the broader market week-long uptrend stays intact, because it doesn’t replicate any systemic weak spot, with the notion supported by rising institutional demand for BTC and alts balancing out retail warning.

The Fed’s September 18 choice on U.S. rates of interest is vital for the market’s bullishness, as a charge lower may reignite the momentum, whereas a delay would possibly prolong consolidation.

Greatest Altcoins to Purchase In the present day (09/15): $CUDIS, $MITO, $FLR

| Token | Present Worth | Quick-Time period Threat | Key Assist / Resistance | 2025 Worth Forecast (Min–Max) |

|---|---|---|---|---|

| CUDIS ($CUDIS) | $0.045 | Excessive volatility after latest surge, threat of short-term pullback | Assist: $0.040, Resistance: $0.050 / $0.060 | $0.035 – $0.060 |

| MITO ($MITO) | $0.12 | Reasonable liquidity, threat of retracement close to $0.13 | Assist: $0.11, Resistance: $0.13 / $0.15 | $0.10 – $0.16 |

| FLR ($FLR) | $0.0088 | Skinny order e book, potential rejection at resistance | Assist: $0.0080, Resistance: $0.0095 / $0.010 | $0.0075 – $0.0105 |

1. Cudis (CUDIS)

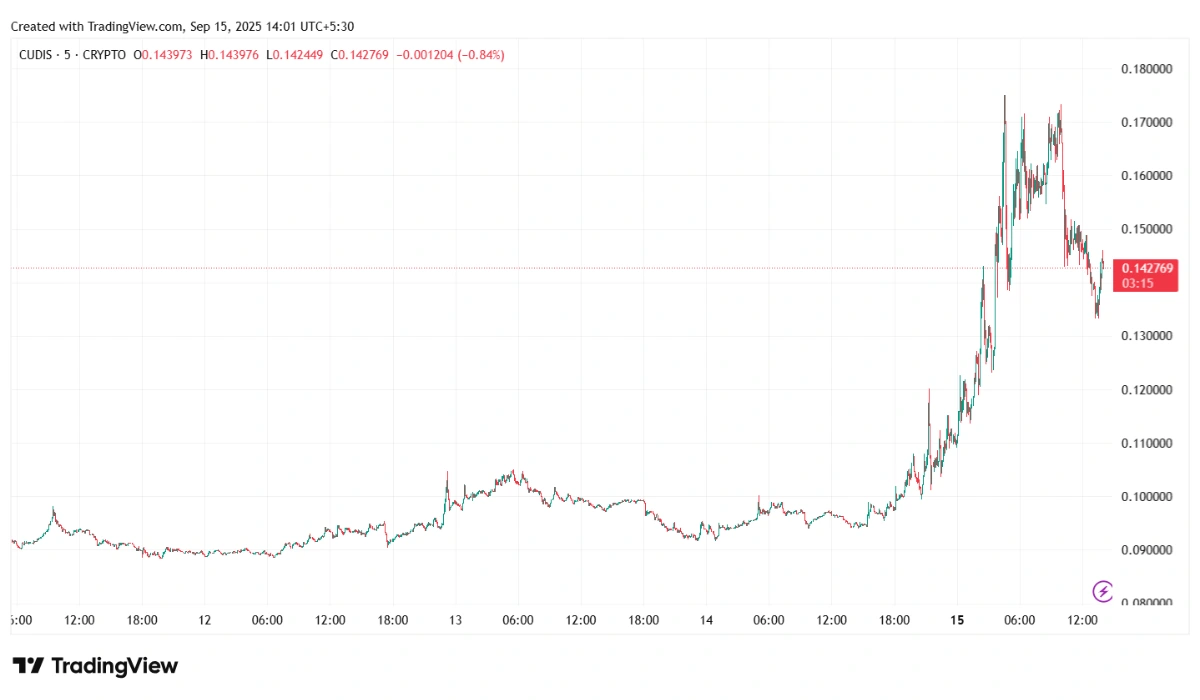

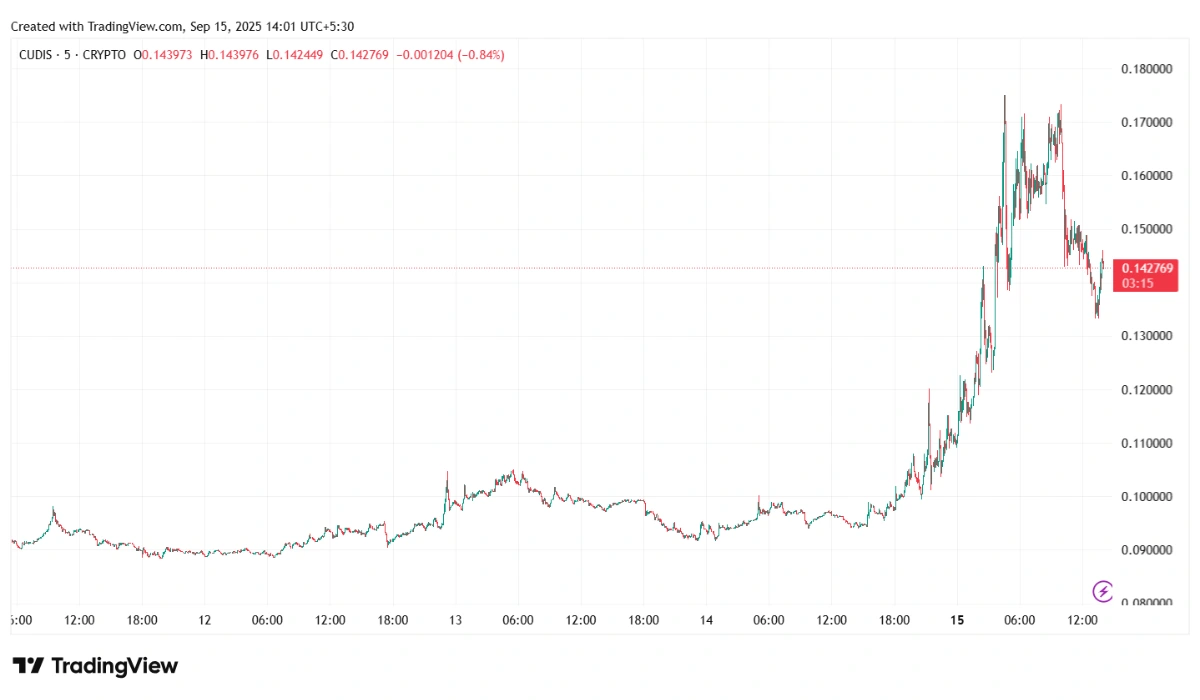

Supply: TradingView

CUDIS surged 73.9% in 24 hours, making it one of many top-performing altcoins of the day. The rally has managed to outpace the token’s weekly and month-to-month beneficial properties, and is pushed by derivatives itemizing on KuCoin change, bullish technicals, and altcoin market rotation.

CUDIS’s 14-day RSI sits above the overbought situation at 75.74, whereas its MACD histogram turning constructive hints at sturdy bullish momentum. Its worth has damaged previous the 23.6% Fibonacci retracement degree at $0.15078.

Merchants might interpret the RSI degree as a contrarian warning, however the MACD divergence means that the bull market may persist within the brief time period. CUDIS’s subsequent resistance lies on the 38.2% Fib degree at $0.13638, however a detailed under $0.15 may set off profit-taking.

On August 20, KuCoin Futures launched a CUDISUSDT perpetual contract with as much as 30x leverage. This got here following CUDIS spot listings on different standard exchanges like Bybit, Binance Alpha, and HTX, increasing entry to the token for speculative merchants.

Derivatives listings typically set off short-term volatility, as seen by a 119.63% spike in CUDIS’s 24-hour buying and selling quantity. Increased leverage is prone to have amplified shopping for strain, though it additionally raises liquidation threat if the bullish momentum reverses.

CUDIS additionally benefited from the altcoin season index surging 72% over the previous 30 days to 74/100, which led to sector-wide capital rotation. The undertaking’s AI and healthtech narrative aligns with this yr’s development of specializing in platforms providing real-world utility.

Retail merchants are chasing high-beta alts like CUDIS, as evidenced by its 24-hour buying and selling quantity, which grew 2x its market cap. Nonetheless, Bitcoin’s market dominance stays elevated at 56.9%, indicating fragile threat urge for food.

| $CUDIS Market Worth | Minimal Worth (2025) | Common Worth (2025) | Most Worth (2025) | ROI |

| $0.1692 | $0.117531 | $0.12871 | $0.162505 | +9.36 |

2. Mitosis (MITO)

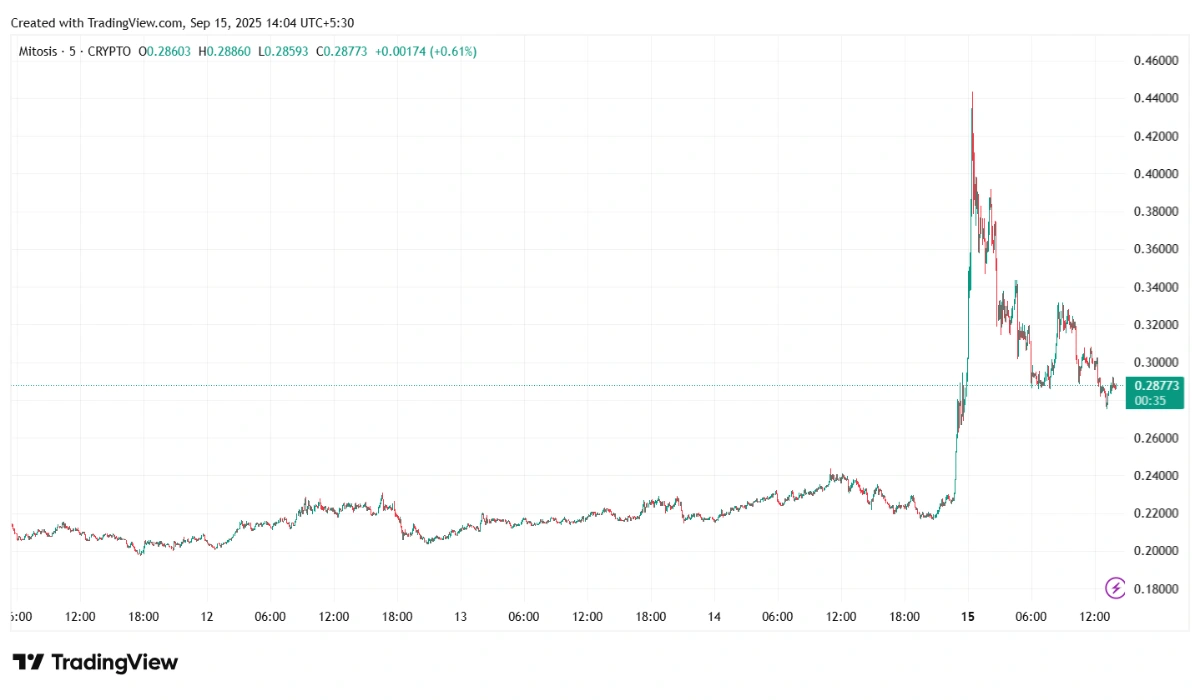

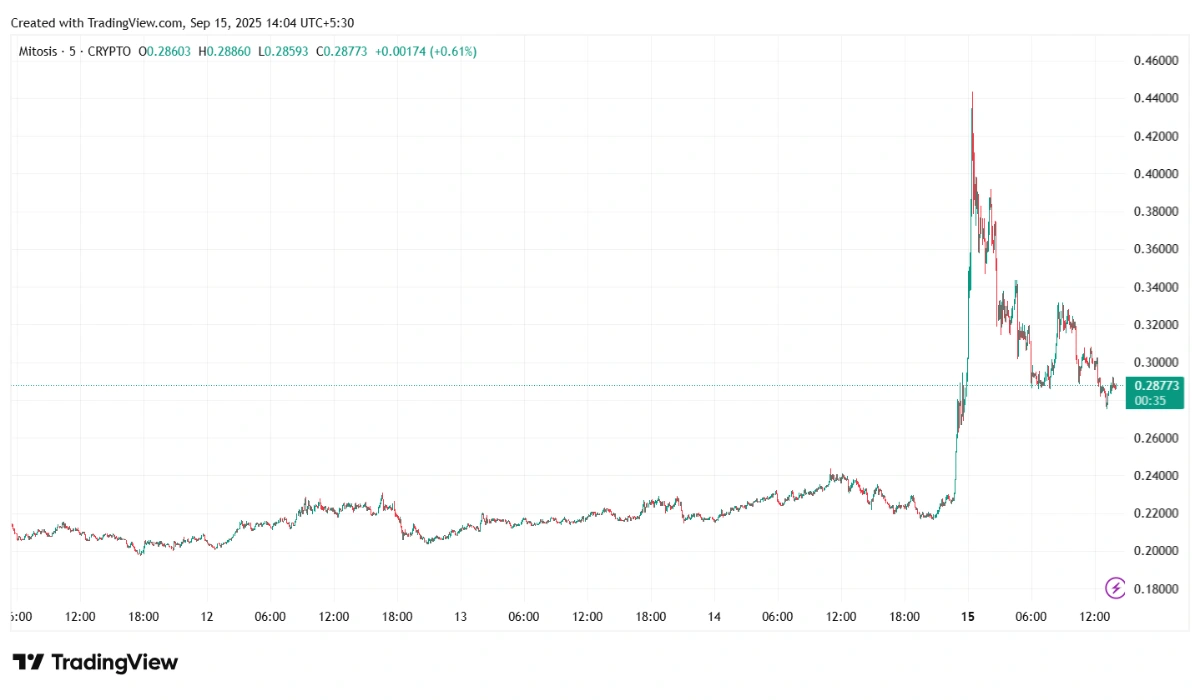

Supply: TradingView

MITO rose 39.57% during the last 24 hours, outpacing its 7-day and 30-day beneficial properties. Its surge aligns with bullish airdrop momentum, staking incentives, and altcoin market rotation.

MITO’s low market cap and excessive volatility have made it a goal for merchants in search of leverage whereas shifting capital from BTC to alts. The token benefited from a broader risk-on sentiment, however its reliance on market-wide development makes it susceptible to sudden rotations again to Bitcoin, as mirrored by the alpha crypto’s 56.88% market dominance.

It is going to be key for MITO to carry above its 7-day SMA at $0.234, however its 14-day RSI at 70.48 indicators overbought circumstances, elevating short-term correction dangers.

MITO’s Genesis airdrop of two.5 million tokens ended on September 11. Mitosis burned the unclaimed tokens, decreasing its whole provide. Token recipients rushed to commerce newly claimed tokens, amplifying the 539% surge in its 24-hour buying and selling quantity, which hit $633 million on that day.

Token burn-led provide shortage and speculative buying and selling post-airdrop are prone to have fueled demand. There was additionally an intra-day spike in MITO, reflecting retail FOMO. Sustained quantity post-airdrop is vital for its bullish technicals, and if the buying and selling momentum cools, then it may set off profit-taking, reversing its present beneficial properties.

The Mitosis mainnet has enabled staking for $MITO and $tMITO tokens, which can earn customers rewards in $gMITO that’s 1:1 convertible.

Customers reported receiving strong yields from short-term token locking, considerably decreasing MITO’s promote strain. Staking locks liquidity, creating synthetic shortage. With 18.1% of the utmost provide nonetheless in circulation, even a minor demand spike may impression MITO’s worth.

| $MITO Market Worth | Minimal Worth (2025) | Common Worth (2025) | Most Worth (2025) | ROI |

| $0.3193 | $0.207278 | $0.23099 | $0.302668 | +1.03% |

3. Flare (FLR)

Supply: TradingView

FLR rose 7.98% over the previous 24 hours, outpacing the broader crypto market throughout that point. This surge aligns with bullish technical indicators, rising Decentralized Finance (DeFi) adoption, and a significant partnership with Revolut.

FLR broke above its 7-day SMA at $0.0227 and 30-day SMA at $0.0223, with its 14-day RSI at 63.15, suggesting a “impartial” demand, however it’s trending upward.

The token’s MACD histogram turned constructive, indicating bullish momentum. This implies merchants are concentrating on the three.6% Fibonacci retracement at $0.0244. A detailed above $0.025 may set off FOMO shopping for.

Flare joined Revolut’s Be taught & Earn program on August 13, which is about to reward the platform’s 400,000+ customers with FLR rewards for finishing blockchain and DeFi-related programs.

Over 90% of previous Revolut L2E individuals have been first-time token holders, which reduces quick promote strain. FLR’s visibility will increase as customers lock their rewards, that are non-withdrawable, additional tightening the provision.

Nasdaq-listed VivoPower deployed $100 million in XRP on the Flare community for yield technology, whereas Crypto.com built-in XRP staking by way of Flare’s FAssets.

This implies FLR is required as collateral, 0.5% of XRP’s worth, for minting FXRP, which has created structural demand for FLR. For each $1 million in XRP that’s locked, $5,000 in FLR is required, tying the token’s utility to XRP’s $130 billion market cap.

| $FLR Market Worth | Minimal Worth (2025) | Common Worth (2025) | Most Worth (2025) | ROI |

| $0.02462 | $0.016523 | $0.018297 | $0.023661 | -2.45% |

Remaining Ideas on the Greatest Cryptos to Purchase Now: $CUDIS, $MITO, $FLR

The rallies of in the present day’s best-performing altcoins – Cudis (CUDIS), Mitosis (MITO), and Flare (FLR) – will be attributed to the broader development of alts outperforming Bitcoin, supported by sector-specific catalysts. Infrastructure performs and real-world asset tokenization are driving altcoin management.

SOL rallied 57% weekly, flipping BNB to develop into the fifth largest cryptocurrency by market. This surge was fueled by Galaxy Digital’s $1.65 billion treasury allocation for Solana and the blockchain’s dominance in DEX buying and selling quantity. Tokenized belongings and actual property narratives have added momentum to the continuing alt rally.

ETH and XRP additionally benefited from $405 million in ETF inflows and Nasdaq’s plans to launch tokenized shares. In the meantime, stablecoin quantity surged 112% in 24 hours, signalling recent capital getting into the altcoin house. Control the BTC dominance chart, as a break under 56% may affirm a chronic altseason.

Readers ought to notice that cryptocurrencies are extremely speculative and unstable belongings, and it is suggested that you just conduct correct due diligence and search knowledgeable opinion earlier than investing choice. Moreover, the contents of this text are for informational functions and shouldn’t be construed as funding recommendation.