The cryptocurrency market rose 1.25% during the last 24 hours, extending its weekly beneficial properties by 5.51%. This uptrend happens amid institutional demand for crypto belongings and technical momentum that overshadows short-term volatility.

Altcoins are gaining momentum, as mirrored by immediately’s Altcoin Season Index studying of 64/100 and BTC dominance dipping to 57.23% – its lowest degree since June 2025 as alt inflows rise. In response to our evaluation, the highest altcoins to purchase now are: Ondo ($ONDO) and Pump.enjoyable ($PUMP), and INFINIT ($IN).

Their rallies might be linked to rising altcoin momentum as merchants rotate income from BTC into higher-beta belongings. The alt season index has surged 91% month-to-month to 65, with Layer-1 cash like Solana (SOL), XRP, and Cardano (ADA), and memecoins outperforming BTC, fueled by on-chain developer exercise, institutional partnerships, and speculative buying and selling for newly listed memecoins.

Retail merchants are at present front-running a possible altcoin season, however the pattern’s sustainability relies on Bitcoin persevering with to carry its $113,000 assist degree. Look ahead to the ASI crossing 75/100 and BTC dominance breaking beneath 56% for affirmation of a sustained alt rally, and regulate the U.S. Federal Reserve’s coverage bulletins for near-term course.

Greatest-Performing Altcoins of the Day (09/12): $ONDO, $PUMP, $IN

| Token | Present Value | Quick-Time period Danger | Key Assist / Resistance | 2025 Value Forecast (Min–Max) |

|---|---|---|---|---|

| Ondo (ONDO) | $0.96 | Robust 24h momentum, threat of retracement close to $1.00 mark | Assist: $0.85, Resistance: $1.00 / $1.20 | $0.80 – $1.20 |

| Pump (PUMP) | $0.0082 | Excessive volatility with skinny liquidity, threat of a pointy pullback | Assist: $0.0070, Resistance: $0.0090 / $0.010 | $0.006 – $0.010 |

| In (IN) | $0.0035 | Fast surge, attainable rejection at resistance ranges | Assist: $0.0030, Resistance: $0.0040 / $0.0048 | $0.0025 – $0.0048 |

1. Ondo Finance (ONDO)

Supply: TradingView

ONDO rose 8.55% during the last 24 hours, outpacing the broader crypto market’s 1.07% acquire. Key drivers embody momentum throughout the real-world asset (RWA) tokenization sector, strategic institutional strikes, and bullish technicals.

Tokenized belongings like U.S. Treasury bonds are gaining traction as establishments search yield and regulatory compliance. Whole worth locked (TVL) on Ondo surged to $1.38 billion, with merchandise just like the USDY yield-bearing stablecoin and OUSG tokenized treasuries driving adoption.

ONDO’s dominance within the RWA sector positions it as a proxy for institutional crypto demand. The White Home’s digital belongings report from July highlighted the Ondo Finance infrastructure, reinforcing its position in bringing collectively TradeFi and DeFi.

In July, Ondo acquired Oasis Professional, an SEC-registered broker-dealer, gaining licenses to supply tokenized securities within the US. ONDO is now built-in with the BNB Chain ecosystem, enabling greater than 100 million tokenized belongings on Binance, the world’s largest cryptocurrency alternate by buying and selling quantity.

These strikes have diminished regulatory threat and expanded Ondo’s institutional attain even additional. The World Markets Alliance, which has over 25 companions, together with Solana and BitGo, goals to standardize RWA infrastructure, enhancing liquidity and interoperability.

ONDO broke above its 23.5% Fibonacci resistance at $1.05 with a bullish MACD crossover. Its RSI studying is 65.52, suggesting there’s extra room for upside earlier than hitting overbought circumstances. Merchants are reacting to the breakout, concentrating on the following Fib degree at $1.14.

On-chain knowledge reveals whale accumulation, with high addresses rising their holdings by 20% in late August. Look ahead to sustained closes above $1.10 may validate a run towards $1.50.

| $ONDO Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $1.10 | $0.7571 | $0.8501 | $1.102 | +1.15 |

2. Pump.Enjoyable (PUMP)

Supply: TradingView

PUMP rose over 4.29% within the final 24 hours, extending its 40.85% weekly acquire. Its rally was pushed by Pump.Enjoyable’s platform dominance, strategic token buybacks, and exchange-driven momentum.

The memecoin launchpad controls over 90% of all memecoin launches on Solana, producing $1.35 million in day by day charges from its 1% transaction tax. Its most important rivals, like LetsBonk.enjoyable, noticed their day by day revenues drop from $1 million to $30,000.

This reveals that market management attracts builders and merchants, creating community ripple results. Pump.enjoyable’s $814 million lifetime income funds ecosystem incentives, reinforcing PUMP’s utility because the platform’s native token.

Since August, the platform has allotted $33 million to repurchase PUMP from the open market at costs as much as 87% above the market price. This has resulted in roughly 3 billion PUMP tokens being faraway from circulation.

Buyback alerts confidence and tightens provide, countering post-ICO promote strain. Nevertheless, critics have observed declining platform income, which is down 97% from January 2025 peaks, limiting sustainability.

MEXC alternate listed TBCN, a memecoin launched on Pump.Enjoyable, on September 8, which drove speculative curiosity. WLFI perpetual futures additionally not directly boosted PUMP’s visibility. Trade listings develop entry however threat volatility.

54% of PUMP holders are underwater because it dropped beneath its $0.004 Preliminary Coin Providing (ICO) value, creating sell-wall dangers close to $0.0062. It is going to be key for PUMP to carry above its 7-day SMA at $0.00501 amid rising RSI, which is nearing overbought circumstances.

| $PUMP Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $0.006248 | $0.00432 | $0.00484 | $0.006278 | +2.11% |

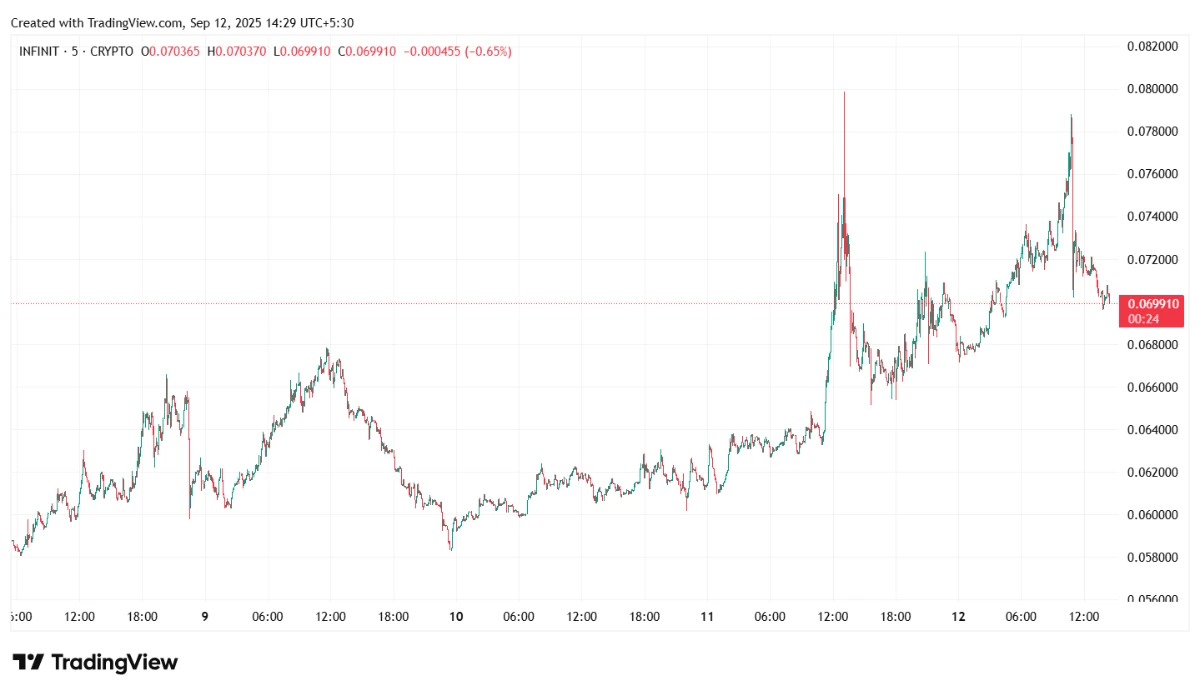

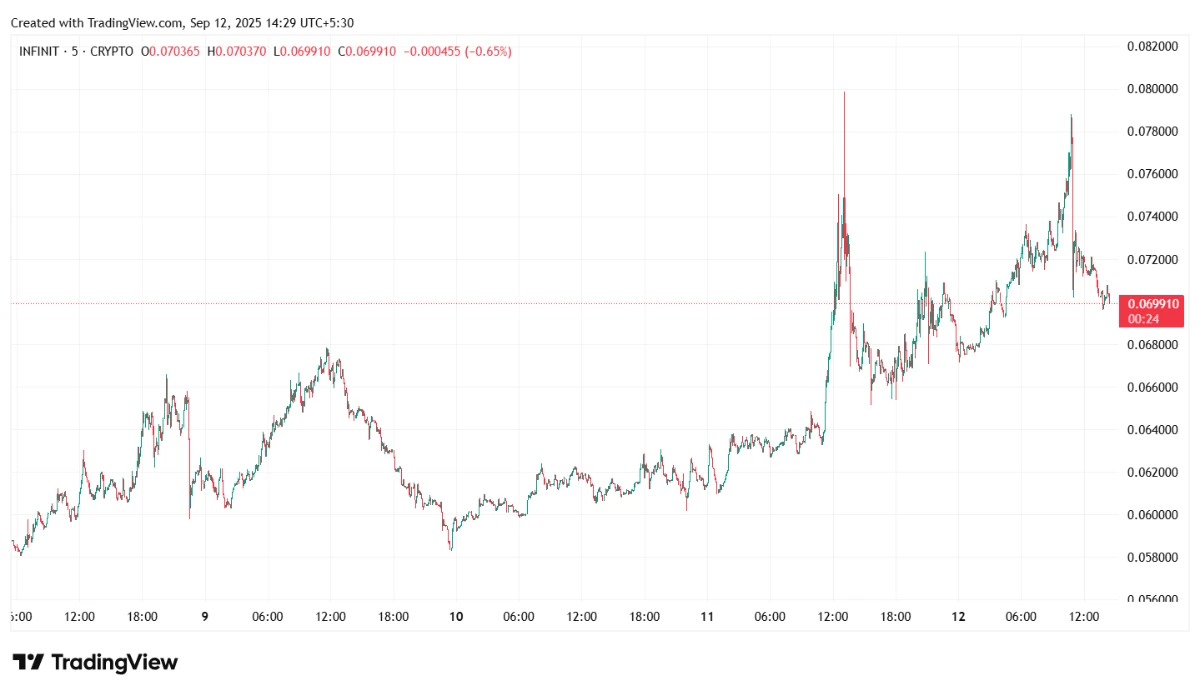

3. INFINIT (IN)

Supply: TradingView

IN rose 7.18% during the last 24 hours, rebounding from a 37.18% month-to-month decline. Its surge aligns with exchange-driven liquidity and bullish technical alerts.

INFINIT’s value surged following listings on Binance Alpha and Gate.io/Bitget launching IN derivatives with 50x leverage, which drove 24-hour buying and selling quantity to $35.8 million. On August 10, Binance Alpha airdropped 50 million tokens for Alpha Factors holders, creating rapid demand, with 500 IN tokens distributed per eligible pockets.

Tier-1 alternate listings sometimes enhance liquidity and dealer participation, whereas airdrops incentivize holding and assist cut back sell-side strain. IN’s 2.19 turnover ratio alerts excessive liquidity, decreasing slippage dangers.

The Altcoin Season Index surged 94.12% in 30 days, with Decentralized Finance (DeFi) and AI-related tokens like IN outperforming the broader market. INFINIT’s AI-driven DeFi instruments align with this pattern, highlighted by the V2 launch on August 20, which added cross-chain automation and a creator financial system.

Buyers are favoring utility-driven altcoins over speculative narratives. INFINIT’s 18,400 beta customers and strategic partnerships validate its use case, attracting capital from GameFi and SocialFi sectors, which have underperformed.

IN’s value crossed its 7-day SMA at $0.061 and EMA at $0.064, whereas its 7-day RSI at 61.81 exited impartial territory, and the MACD histogram turned optimistic at +0.0016, suggesting bullish momentum. Quick-term merchants entered the market on the RSI uptick, however resistance close to the 30-day SMA at $0.073 may cap the beneficial properties.

An in depth above $0.073 would possibly affirm a pattern reversal, whereas failure dangers a restest of the August swing low of $0.053. Be careful for a break above the 23.6% Fibonacci retracement degree at $0.104, which may prolong IN’s upside.

| $IN Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $0.07175 | $0.04865 | $0.054655 | $0.07093 | -1.27% |

Additionally Learn: Nexchain Airdrop Information 2025 – Learn how to Declare $5M in NEX Rewards

Remaining Ideas on the Greatest Altcoins to Purchase Now: $ONDO, $PUMP, $IN

The rallies behind immediately’s best-performing altcoins – $ONDO, $PUMP, $IN – might be attributed to the broader market surge that noticed the Altcoin Season Index rising 1.54% to 66/100, crossing into the coveted “Altcoin Season” territory, whereas Bitcoin’s market share fell 0.42 share factors to 57.16%. This marks a significant pattern reversal from July 2025, when BTC dominance peaked at 65.12%.

This means that merchants are more and more rotating capital from Bitcoin into alts as BTC consolidates close to latest highs. Historic knowledge reveals dominance drops typically precede mult-week alt rallies. In the meantime, infrastructure-focused altcoins like ETH, XRP, BNB, ADA, and SOL are absorbing liquidity, fueled by ETF hypothesis and key protocol upgrades.

Altcoins comprised 71% of Binance Futures buying and selling quantity over the previous 24 hours, with open curiosity shifting to SOL, Tron (TRX), and ETH. Perpetual funding charges stay optimistic, suggesting leveraged bets on additional upside. Merchants are positioning for an prolonged altseason, significantly in cash with clear use circumstances in DeFi and staking, and low float.

Readers ought to be aware that cryptocurrencies are extremely speculative and risky belongings, and it’s endorsed that you just conduct correct due diligence and search professional opinion earlier than investing choice. Moreover, the contents of this text are for informational functions and shouldn’t be construed as funding recommendation.