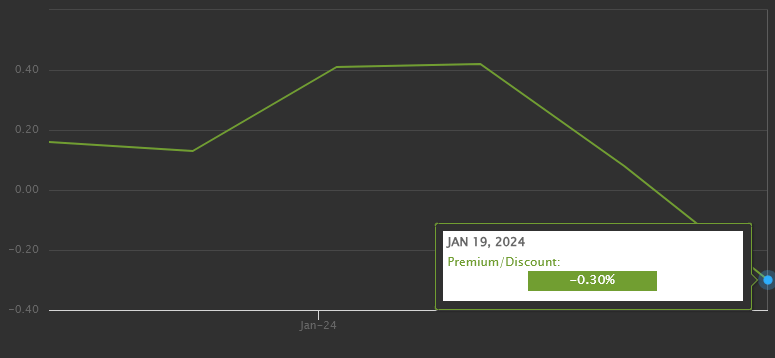

BlackRock’s iShares Bitcoin Belief recorded its first low cost to its Internet Asset Worth (NAV) on Jan. 19, dropping to a reduced charge of -0.30%, in line with official BlackRock knowledge.

“The above desk and line graph current details about the variations between the every day closing worth for shares of the fund and the fund’s web asset worth. The closing costs are decided by the fund’s itemizing alternate.” – BlackRock

Conversely, after a chronic interval at a heavy low cost, Grayscale’s (GBTC) NAV is now barely tighter at simply -0.27%, in accordance to Y Charts knowledge. GBTC noticed a staggering 48% low cost to NAV on Dec. 22. Nevertheless, as anticipation of its conversion to a spot, Bitcoin ETF rose, the low cost closed, reaching simply -1.55% on the day it was transformed. The low cost has continued to shut and has surpassed even a few of the ‘New child 9’ Bitcoin ETFs, akin to IBIT.

In its first week, the iShares Bitcoin Belief skilled a diverse NAV per share, starting at $26.59 and seeing a lower to $23.87 by Jan. 19. The belief’s excellent shares confirmed a major improve from 400,000 to over 50 million throughout the identical interval.

The NAV premium/low cost fluctuated modestly, recording a premium of 0.16% on launch day, peaking at 0.42% by Jan. 17, earlier than declining to a reduction. This modification signifies the traders’ valuation of the shares relative to the underlying Bitcoin belongings held by the belief. A premium suggests shares are valued larger than the NAV, whereas a reduction signifies a decrease valuation. The reference charge for Bitcoin used was $41,898, calculated between 8 pm and 9 pm GMT (3 pm – 4 pm EST), as highlighted within the chart under.

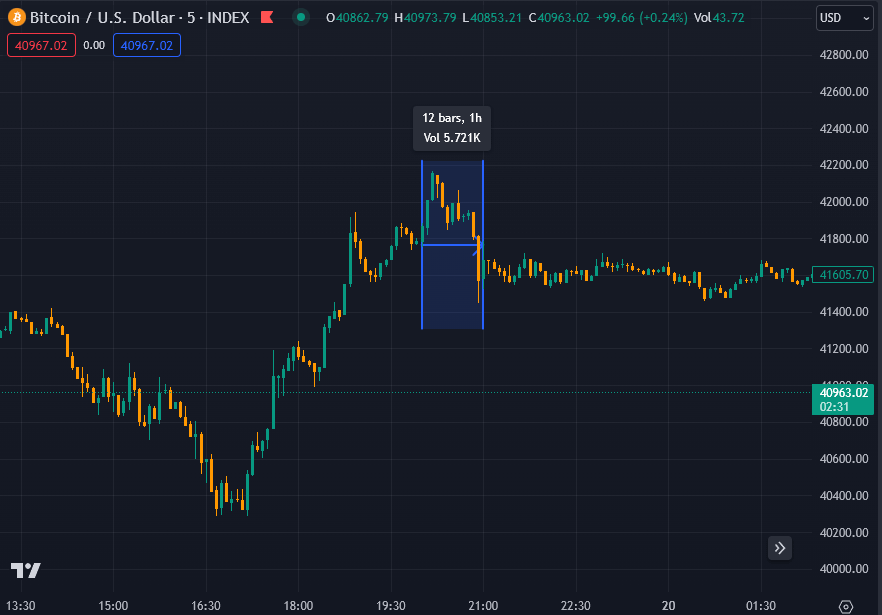

The underlying Bitcoin worth has declined towards the psychological assist of $40,000, buying and selling at $40,840 as of press time, whereas IBIT shares are buying and selling at $23.39 pre-market after closing at $23.80 on Friday, Jan. 19.

Subsequently, IBIT shares have declined 1.72% since Friday’s buying and selling session. In distinction, the underlying asset, Bitcoin, may have fallen round 2.5% if it doesn’t get better earlier than the reference charge (BRRNY) is calculated later right this moment. Ought to IBIT shares commerce in step with Bitcoin all through Jan. 22, it can seemingly reverse the low cost and rise to a premium probably as excessive as 0.7% based mostly on present calculations. Nevertheless, with the first market not opening for a number of hours, IBIT might shut this hole throughout official buying and selling hours.

Given the time lag in reporting ETF knowledge, the affect of the reported NAV is proscribed. In its prospectus, BlackRock mentioned it will publish an intra-day indicative nav (IIV). Nonetheless, this knowledge is just not printed on its official web site however needs to be out there beneath IBIT.IIV by way of Nasdaq buying and selling terminals.

Since its launch, the Belongings Underneath Administration (AUM) of the iShares Bitcoin Belief have reached $1,346,912,907.59, with 33,430 BTC beneath administration, emphasizing the size at which the belief is working and the extent of funding that it has attracted in a brief interval. Tied with the rise in excellent shares, the general well being of the belief suggests a rising investor curiosity because the variety of shares is greater than tenfold.