Gold Scalping vs. Swing Buying and selling:

Which Technique Carried out Greatest in 2025?

The 12 months 2025 has been a turbulent but extremely worthwhile interval for gold merchants. With XAUUSD volatility at elevated ranges because of world macroeconomic uncertainty, merchants have more and more debated one crucial query: Is scalping or swing buying and selling simpler on the subject of gold buying and selling methods in 2025?

On this article, we are going to examine gold scalping vs. swing buying and selling, analyze their efficiency throughout 2025, and spotlight the professionals and cons of every methodology. By the tip, you’ll have a clearer understanding of which method is healthier suited to your buying and selling fashion.

What Is Gold Scalping?

Gold scalping refers to a short-term buying and selling method the place merchants goal small value actions in XAUUSD over very quick timeframes, reminiscent of M1, M5, or M15 charts. Scalpers usually depend on:

-

Tight spreads (low-cost brokers are crucial).

-

Quick execution and generally Skilled Advisors (EAs).

-

Excessive liquidity durations (often overlapping London and New York periods).

In 2025, gold’s common day by day vary typically exceeded $40–$50, making scalping extremely engaging for merchants who can shortly capitalize on intraday volatility.

What Is Swing Buying and selling Gold?

Swing buying and selling gold takes a medium-term method, holding trades for a number of days and even weeks. Swing merchants use H1, H4, and Day by day timeframes to seize bigger value strikes. Key traits embody:

-

Technical setups reminiscent of breakouts, Fibonacci retracements, and shifting common crossovers.

-

Persistence and bigger stop-losses.

-

Reliance on elementary drivers reminiscent of Fed rate of interest choices, inflation experiences, and geopolitical danger.

In 2025, when central banks continued adjusting coverage charges and inflation remained sticky, swing buying and selling gold provided alternatives to experience longer-term traits.

Efficiency Comparability in 2025

Scalping Gold in 2025 – Excessive Volatility, Excessive Potential

Throughout 2025, gold’s value motion created frequent scalping setups because of sharp intraday strikes triggered by:

Scalpers who mastered danger administration in gold scalping and used strict stop-losses have been capable of persistently extract 5–15 pips per commerce, accumulating earnings over a number of periods.

Greatest time to scalp gold XAUUSD remained in the course of the London–New York overlap, when spreads tightened, and liquidity was at its peak.

Swing Buying and selling Gold in 2025 – Driving the Macro Tendencies

For swing merchants, 2025 was outlined by macro-driven strikes in gold. The commodity regularly broke out of consolidation ranges, creating alternatives to experience $100+ strikes over a number of weeks.

For instance:

-

January–March 2025: Gold surged as markets priced in slower Fed tightening.

-

June–August 2025: A pointy correction occurred because the US greenback strengthened.

-

October–December 2025: Renewed demand for safe-havens pushed gold again towards yearly highs.

Swing merchants who caught these macro-driven strikes benefited considerably, although they wanted bigger capital buffers to face up to drawdowns.

Professionals and Cons of Gold Scalping vs Swing Buying and selling:

Benefits of Scalping Gold

-

Fast earnings with a number of alternatives per session.

-

Decreased publicity to in a single day danger.

-

Excellent for merchants with smaller accounts.

Disadvantages of Scalping Gold

-

Requires intense focus and quick execution.

-

Increased transaction prices because of frequent trades.

-

Weak to false breakouts throughout low liquidity.

Benefits of Swing Buying and selling Gold

-

Captures giant market strikes with fewer trades.

-

Higher alignment with macro fundamentals.

-

Much less worrying in comparison with fast scalping.

Disadvantages of Swing Buying and selling Gold

-

Requires endurance and self-discipline.

-

Publicity to in a single day dangers (gaps, information occasions).

-

Bigger stop-losses demand stronger danger administration.

Which Carried out Greatest in 2025?

The reply depends upon the dealer’s profile:

-

Scalping gold in 2025 outperformed for merchants who thrive in high-frequency environments, can shortly adapt to market volatility, and use strong scalping methods. Many intraday scalpers reported increased win charges because of constant volatility in XAUUSD.

- Swing buying and selling gold in 2025 delivered the largest returns for merchants who caught the multi-week traits and had sufficient margin to face up to retracements. Those that traded primarily based on macroeconomic catalysts typically made vital good points from prolonged strikes.

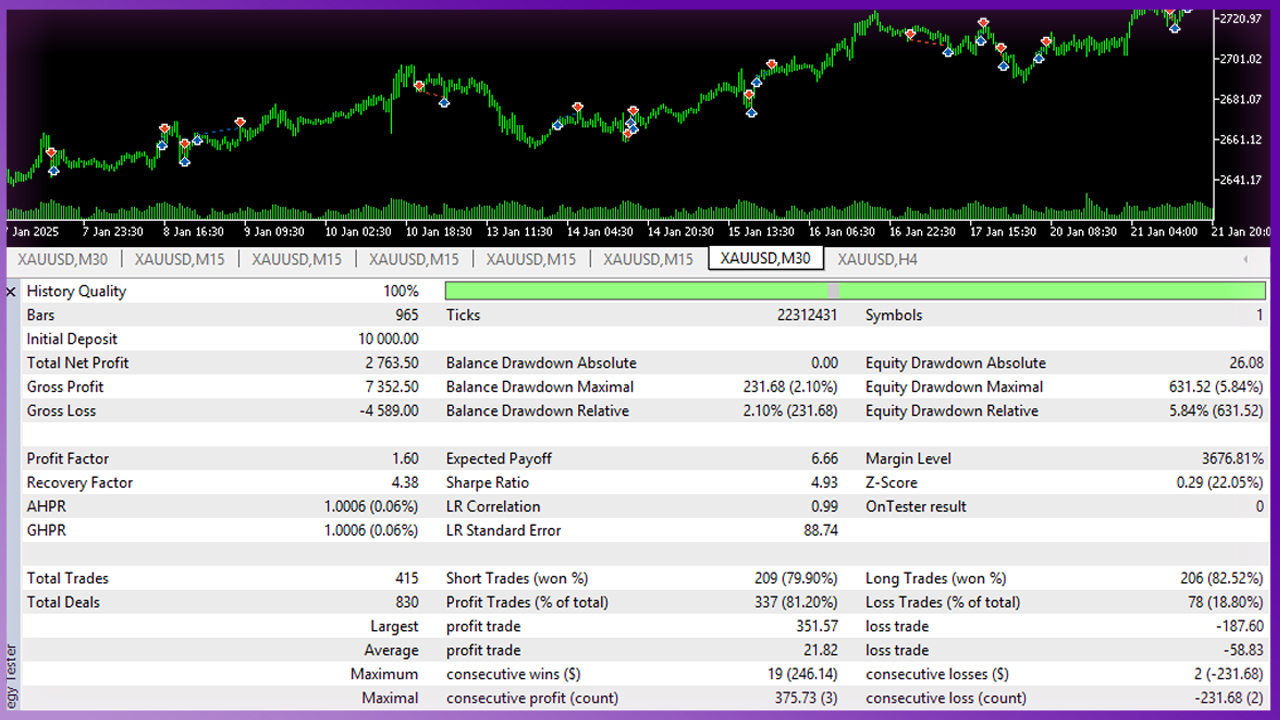

Scalping vs Swing Buying and selling Backtest Outcomes

A number of backtests performed on gold buying and selling methods in 2025 revealed:

-

Scalping methods yielded regular however smaller cumulative good points, averaging 8–12% month-to-month with excessive commerce frequency.

-

Swing buying and selling methods delivered bigger however much less constant earnings, with potential month-to-month good points above 20%, however increased drawdowns.

This reveals that scalping provided stability and consistency, whereas swing buying and selling rewarded endurance and robust nerves with greater payoffs.

Remaining Verdict – Which Technique Ought to You Select?

So, which is healthier: scalping or swing buying and selling gold in 2025?

-

For those who desire fast-paced buying and selling, get pleasure from a number of setups day by day, and may dedicate full consideration to charts, then gold scalping methods are a fantastic match.

-

For those who lean towards a macro-driven method, desire fewer trades, and have the endurance to experience bigger traits, then swing buying and selling gold could outperform for you.

Finally, many profitable merchants in 2025 mixed each approaches: scalping throughout excessive volatility periods whereas holding swing trades aligned with macro fundamentals. This hybrid methodology maximized alternatives throughout completely different market situations.

Conclusion

In 2025, each gold scalping and swing buying and selling XAUUSD proved worthwhile when executed with self-discipline, danger administration, and the suitable technique. Scalping provided consistency and frequent alternatives, whereas swing buying and selling supplied bigger earnings from macro traits.

The true winner relies upon not on the technique itself, however on the dealer’s timeframe desire, danger tolerance, and psychological strengths.

For merchants looking forward to 2026, combining the greatest gold scalping methods with swing buying and selling setups could present probably the most balanced and worthwhile method to XAUUSD buying and selling methods.

You probably have anysuggestions or face any points, be happy to chat with us.

The Commerce Wizard Crew needs you success and prosperity with peace of thoughts.

The Commerce Wizard Crew needs you success and prosperity with peace of thoughts.