American Categorical India is again on their aggressive mode simply as we lately noticed the Plat Cost improve provide by early Jan 2024 and now they’ve despatched out a focused spend primarily based provide to pick bank card members at the moment (twenty fourth Jan 2024). Right here’s all the things it’s essential to find out about it:

Provide Particulars

| Provide | Get Rs.X eVouchers on spending Rs.Y |

| Max. Voucher Worth | Rs.35,000 on Rs.10L spend (so far as I do know) |

| Spend Requirement | Dynamic (probably primarily based on earlier utilization) |

| Provide Interval | 24 Jan 2024 – 5 April 2024 |

| Fulfilment | tenth July 2024 |

| Return on Spend | Upto 4% + Common Rewards |

| Supply | Electronic mail |

Its a easy and straight-forward provide from Amex as common and the return on spend too is much like what we noticed throughout Feb 2023 promo. And like final 12 months, this 12 months too the provide interval is nice sufficient to satisfy the required spends.

Provide Variants – Common Playing cards

- Spend 25K & get Rs.1K eVoucher

- Spend 50K & get Rs.1.5K eVoucher

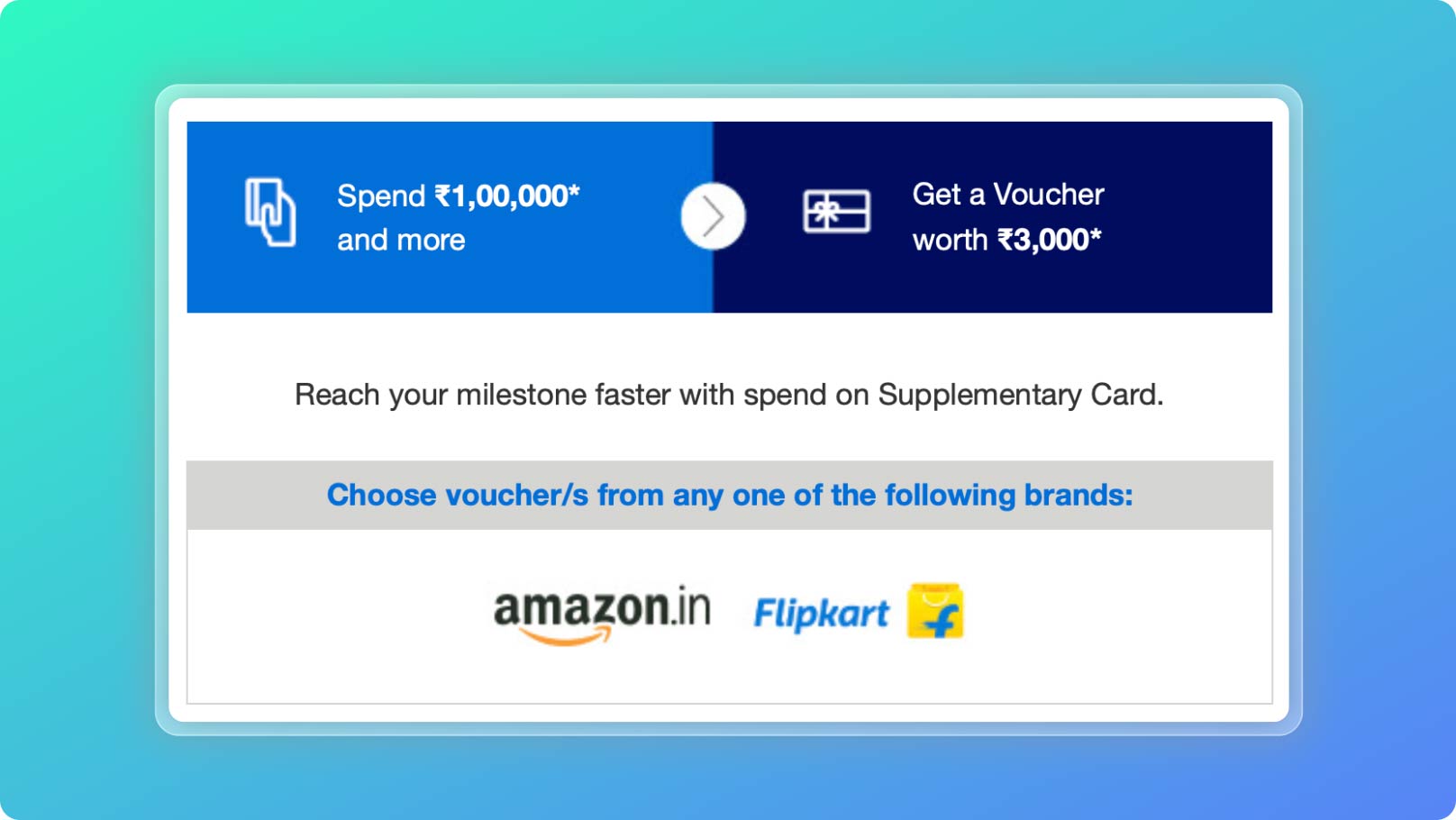

- Spend 1L & get Rs.3K eVoucher

- Spend 2L & get Rs.8K Taj voucher

- Spend 3L & get Rs.12K Taj voucher

- Spend 4L & get Rs.15K Taj voucher

- Spend 5L & get Rs.20K Taj voucher

- Spend 7L & get Rs.25K Taj voucher

Above provide is supposed for normal playing cards like MRCC, Plat journey, Gold Cost & Sensible Earn.

Provide Variants – Plat Cost

- Spend 1L & get Rs.3K eVoucher

- Spend 2L & get Rs.6K eVoucher

- Spend 3L & get Rs.10K Taj voucher

- Spend 5L & get Rs.18K Taj voucher

- Spend 7L & get Rs.25K Taj voucher

- Spend 10L & get Rs.35K Taj voucher

Other than the common t&c, this time I see one thing new, which is “The provide is legitimate on purchases made on all of your American Categorical® Playing cards” which implies, you may spend on any of your American Categorical Credit score Playing cards they usually’ll take all of the spends into consideration.

This doesn’t solely imply supplementary playing cards, but additionally different Amex card variants. However because it’s new, it’s higher to have a affirmation with them over name earlier than you proceed.

Having stated that, traditionally Amex all the time takes spends on all card accounts beneath your PAN to set off the provide variant on the highest tier variant, so I assume this needs to be easy as effectively.

Closing Ideas

Total a good provide as all the time with 3-4% return on spend, aside from the common rewards. Simply incase for those who’ve not acquired the provide, likelihood is you’re both spending too excessive (or) too low for them to give you one.

As you may already know, that is one approach to extract greater reward fee from Amex playing cards that usually has low ongoing rewards and it’s good to see that American Categorical is operating such focused provides typically within the final 2 years.

In case you’re new to Amex, that is maybe the very best time to use for American Categorical Playing cards as you may avail them as First Yr Free:

Are you receiving the Amex spend primarily based provides for previous 3 months? Do tell us within the feedback beneath.