Private debt is an almost common expertise in the US, however every technology carries this burden another way. The sort and quantity of debt somebody holds can depend upon their stage of life and monetary circumstances. Latest surveys reveal that some generations usually tend to carry non-mortgage debt, whereas others shoulder the best general balances or really feel the heaviest burden of unmanageable private debt.

Gen Z, the youngest grownup technology, hasn’t had as a lot time to borrow, however they’re getting into maturity beneath distinctive monetary pressures and technology-heavy trendy credit score markets.

Which Era Has the Most Debt?

There is probably not a single technology that clearly holds probably the most debt.

- Child Boomers and Gen Xers could also be extra more likely to carry bigger balances tied to mortgages and bank cards.

- Millennials are usually probably the most burdened by pupil loans.

- Gen Z is a bit totally different. The general particular person debt balances could also be decrease for this group, as youthful folks have had much less time to borrow, in any case. However knowledge suggests Gen Z has entered maturity with extra private debt than anticipated.

A round-up of debt-related stats by technology hints on the advanced nature of this query.

Information from Go Banking Charges signifies that Gen Z carries a median of $94,101 in private debt. That’s greater than the averages it studies for Millennial and Gen X people, that are each lower than $60,000.

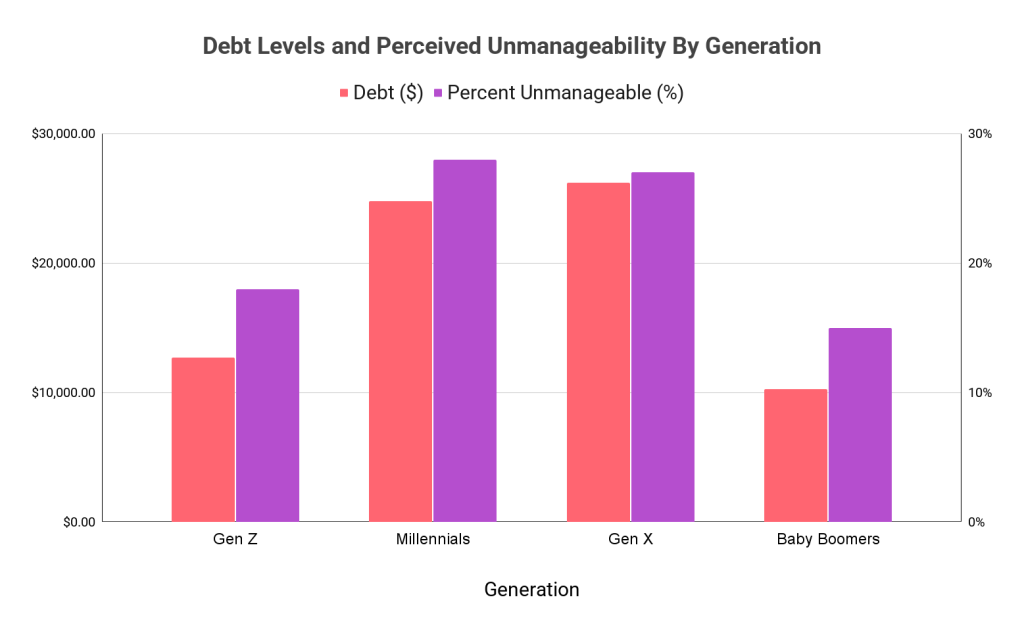

Relating to non-mortgage debt, Gen X might have extra. Evaluation of greater than 500,000 anonymized credit score studies by LendingTree researchers indicated a median median non-mortgage debt for every technology of:

- Gen Xers: $26,207

- Millennials: $24,810

- Gen Zers: $12,715

- Child Boomers: $10,272

Outcomes from an Experian survey indicated how folks in every technology felt about their private debt degree. Right here’s the % of every group that stated their unsecured debt was “unmanageable”:

- Millennials: 28%

- Gen Xers: 27%

- Gen Zers: 18%

- Child Boomers: 15%

Although fewer Gen Z debtors describe their debt as “unmanageable,” the rising use of credit score merchandise means their monetary relationship with debt is taking form rapidly. This rising sample raises questions that reach past the quantity of debt Gen Z holds, akin to why they’re accumulating it and what that reveals about their distinctive monetary challenges.

Why Is Gen Z in So A lot Debt?

Gen Z’s outsized debt isn’t pushed by one trigger however by a mixture of robust financial situations and altering monetary habits.

Inflation and rising prices

The Bureau of Labor Statistics reported a year-over-year improve within the Client Value Index for the value of all items of two.7% as of July 2025. Inflation and value will increase are hitting Gen Z exhausting, and the vast majority of youthful folks say their month-to-month bills are greater than anticipated in classes like:

- Groceries (63%)

- Hire and utilities (47%)

- Eating out (42%)

Larger costs could also be driving Gen Z to dwell exterior of its means through the use of revolving credit score like bank cards to cowl the dinner verify or weekly grocery run.

Stagnant wages

The Atlanta Fed’s Wage Development Tracker exhibits an general decline in 3-month shifting common median wage progress from July 2022 by July 2025. In July 2022, general unweighted wage progress for hourly positions was round 6.7%. Three years later, it was near 4%.

With out stagnant wages, many Gen Zers are struggling to maintain tempo with the financial necessities of each day life.

Doom spending

Doom spending means spending cash, usually on non-essentials, as a option to cope with stress and anxiousness.

Little deal with tradition, which has normalized a number of costly drinks or takeout purchases weekly, is a possible instance. Greater than half of Gen Zers say they buy treats as soon as per week or extra to cut back stress or have a good time small wins — and nearly 60% word this results in overspending.

Common credit score utilization

All these elements have contributed to Gen Z’s early adoption of credit score. By 2024, Gen Z carried a median of $2,834 in bank card debt. It may not sound like a lot, however that’s 25% greater than Millennials carried on the identical age.

Bank cards and different revolving credit score choices, together with buy-now, pay-later providers, are deeply ingrained in trendy spending processes. They’re embedded in carts, pushed as safer methods to buy and marketed with rewards and loyalty packages, growing the draw for Gen Z.

How Debt Is Affecting Gen Z

From missed funds to psychological well being considerations, the affect is multifaceted. Results embrace:

- Will increase in delinquencies

- Extra monetary instability

- Delayed monetary targets

- Psychological well being pressure

- Reliance on different monetary merchandise

Will increase in delinquencies

Client credit score knowledge from the New York Fed famous that 15.3% of Gen Z bank card holders had maxed out their limits in 2024 — a better fee than another technology. Maxed limits and rising fee delinquency are a priority for folks beneath 40, together with Gen Z.

Extra monetary instability

In a Deloitte survey, 73% of Gen Zers reported dwelling paycheck to paycheck, resulting in higher reliance on short-term and revolving debt merchandise.

Delayed monetary targets

Once more, the vast majority of Gen Zers stated it was tough to avoid wasting. Different monetary targets many wrestle with as they face rising prices and debt embrace paying down unsecured debt, dwelling on a single earnings, and shopping for a house.

Psychological well being pressure

Greater than 40% of People say cash struggles negatively affect their psychological well being. Gen Z, like different generations, faces anxiousness, stress, lack of sleep, and different well being impacts attributable to private debt.

How Gen Z Is Coping

As debt challenges mount, proactive Gen Zers discover methods to adapt and achieve management over their funds.

Use of other fee strategies and associated instruments

BNPL platforms are a preferred option to unfold out prices to make purchases extra accessible. However they transcend a debt alternative for Gen Z. Many are evolving into credit-building or cash administration instruments.

- Sezzle’s Sezzle Up program offers buyers the choice to report funds to the credit score bureaus, serving to customers set up a constructive credit score historical past.

- Klarna affords budgeting and spending insights by its app.

Splitit lets bank card holders make interest-free installments on purchases utilizing their current bank card restrict, decreasing potential debt prices whereas maximizing card reward advantages.

Proactive and tech-savvy monetary administration

Many Gen Zers are turning to budgeting apps and digital wallets to remain on high of their funds. Round 55% of this technology makes use of superior budgeting instruments. That’s greater than in another age group.

It’s not stunning that the technology that grew up with smartphones is implementing these instruments into cash administration. Some different monetary merchandise like BNPLs are paying attention to this and have developed budgeting instruments and monetary sources to empower younger customers and encourage accountable spending. These good instruments assist examine costs, create watchlists, set budgets, and most significantly, create financially literate customers.

Working to enhance monetary literacy

The tech-savvy technology is commonly keen to confess when it must hit the books — or the YouTube channels. Many flip to instruments like Mint and YNAB for greater than tappable price range administration. They learn articles, watch movies, and in any other case hunt down recommendation on dealing with cash and planning for the long run.

Is Gen Z Extra Financially Savvy?

Whereas Gen Z faces rising debt and monetary pressures, they might be higher ready to cope with these challenges than earlier generations have been. Many youthful adults are adopting digital instruments to trace spending, looking for monetary data early, and experimenting with methods to construct credit score.

Non-traditional credit-building packages, akin to Sezzle Up, and the general flexibility of contemporary fee platforms, together with purchase now, pay later platforms, may assist Gen Z benefit from the sources they’ve.

Whereas Gen Zers aren’t immune to private debt dangers, their monetary journey is just simply beginning. They’ve a protracted option to go, and it appears they’ve rather a lot to show to their older counterparts.