A uncommon confluence of macro catalysts will put danger property—and by extension crypto—on edge this Friday. The US Bureau of Labor Statistics (BLS) has confirmed it can publish the delayed September Client Worth Index at 8:30 a.m. ET on Friday, October 24, whilst most federal knowledge stay frozen by the continued authorities shutdown. In a brief discover, the company underscored the exceptionality of the transfer and added that “no different releases shall be rescheduled or produced till the resumption of standard authorities providers.”

Crypto Bulls On Alert

The timing is uncommon on two counts. First, CPI is never a Friday print; The Kobeissi Letter famous through X that it might be the primary Friday CPI since January 2018. Second, it lands 5 days earlier than the Federal Open Market Committee (FOMC) meets on October 28–29, compressing the policy-reaction window for the one marquee knowledge.

As Adam Kobeissi framed it: “One thing uncommon is occurring this week: On Friday, we’re receiving CPI inflation knowledge DURING the US authorities shutdown… Not solely is it 5 days earlier than the October twenty ninth Fed assembly, however it’s the first time CPI knowledge shall be reported on a Friday since January 2018.”

Associated Studying

Towards that backdrop, crypto strategist Nik Patel captured prevailing risk-tone logic in a morning observe through X: with scarce knowledge in a “speech-heavy” week, any print that leans above survey “shall be of significance.”

He argued: “Would even count on a reasonably above consensus inflation print to be welcomed by the markets — I wish to see inflation breakevens backside out right here and switch greater once more (and make no mistake the Fed will nonetheless be slicing into this and this mix could be bullish danger). Progress, Inflation continues to be what I count on of the subsequent 6 months however proper now we’re chewing by a interval of fears round each.”

The Macro Backdrop

To know why this specific CPI issues for crypto property, take into account the near-term inflation pattern and the state of the Fed debate. Headline CPI rose 0.4% month-over-month in August after 0.2% in July; the year-over-year price accelerated to 2.9% from 2.7%. Core CPI held at 3.1% YoY.

Again-to-back prints earlier in the summertime had steered headline inflation was stabilizing within the high-2s: June CPI ran at 2.7% year-over-year with a 0.3% month-to-month achieve, and July matched 2.7% YoY whereas core posted its largest month-to-month improve since January. The August re-acceleration nudged debate away from a straight-line disinflation narrative and towards a extra nuanced view—one delicate to tariffs.

Associated Studying: Crypto Bulls Odor Blood: SOFR–RRP Unfold Hints QT Pivot By October

The Fed preview is subsequently unusually binary—even when the assembly dates themselves are typical. The central financial institution’s October 28–29 gathering is reside, with charges markets leaning towards one other quarter-point lower, adopted by a extra contested December. However the knowledge blackout has amplified CPI’s leverage over the coverage narrative, which is why a single launch can swing the perceived odds of each the October transfer’s measurement and the steering for year-end.

All of this collides with crypto’s macro-beta actuality. When liquidity expectations enhance—through simpler monetary circumstances and falling actual yields—large-cap tokens usually outperform; when coverage turns cautious, crypto’s duration-like traits can lower the opposite manner. That’s why the market is latched onto the shutdown-Friday CPI quirk.

The underside line for crypto members is simple. Friday’s CPI isn’t just “one other inflation print.” It’s a uncommon Friday launch, arriving in a knowledge drought 5 days earlier than an FOMC resolution, with PMIs and sentiment hitting hours later. If it cools meaningfully, easing expectations may agency into month-end.

If it surprises sizzling and re-validates August’s firmness, markets should try to spin it as growth-positive—as Nik Patel steered—as long as the Fed indicators it can hold slicing. Both manner, by compressing sign and coverage right into a single information cycle, the shutdown has turned one morning into the fulcrum for October’s crypto narrative.

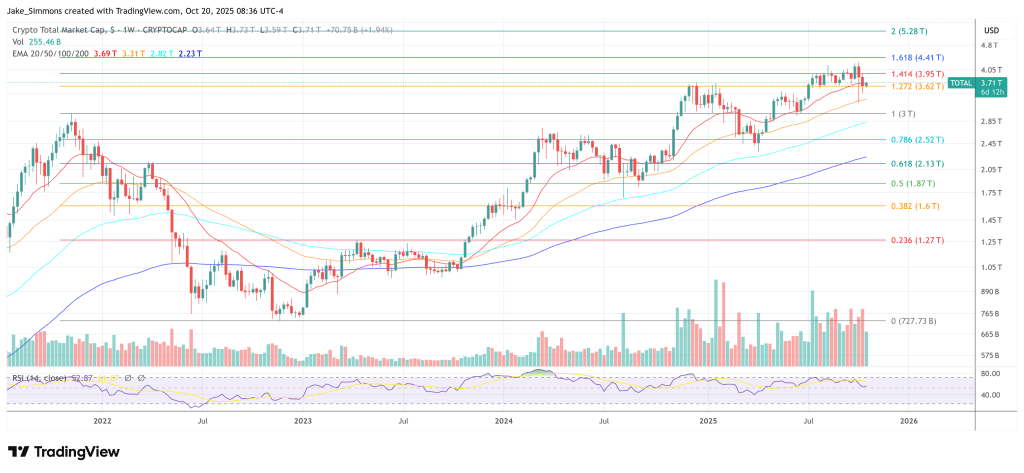

At press time, the whole crypto market cap stood at $3.71 trillion.

Featured picture created with DALL.E, chart from TradingView.com