EUR/USD: Switzerland Strengthens the Greenback

● The important thing occasion of the previous week was undoubtedly the FOMC (Federal Open Market Committee) assembly of the US Federal Reserve on March 20. As anticipated, the American Central Financial institution unanimously determined to take care of the important thing rate of interest at its highest degree in 23 years, 5.50%, for the fifth consecutive assembly. Because the charge was anticipated, market members had been considerably extra within the feedback and forecasts of the Fed’s management. Crucial assertion got here from the top of the regulator, Jerome Powell, who talked about the consideration of three levels of borrowing value discount this yr, totalling 75 foundation factors (bps). The long-term charge forecast was raised from 2.50% to 2.60%.

In feedback following the assembly, strong progress in america financial system was famous. The GDP forecast for this yr was elevated from 1.4% to 2.1%, and for 2025 from 1.8% to 2.0%. The labour market additionally seems to be in good well being, with unemployment at a low degree. In accordance with the brand new forecast, it might attain 4.0%, in comparison with the beforehand anticipated 4.1%. The variety of new jobs created outdoors of the agriculture sector (NonFarm Payrolls) in February was 275K, considerably exceeding each the earlier determine of 229K and the forecast of 198K.

● Relating to inflation, whereas it has eased, it stays “elevated,” as famous within the assertion. Shopper Worth Index (CPI) figures for February confirmed a 3.2% improve on a year-over-year foundation. Inflation is anticipated to settle at 2.4% by the top of 2024, with the core Private Consumption Expenditures (PCE) index anticipated to be at 2.6%. Beforehand, each figures had been forecasted to be 2.4% in December.

The feedback emphasised that the long-term goal is to convey inflation all the way down to 2.0% whereas reaching most employment. Thus, the Federal Reserve will stay vigilant about inflationary dangers. Changes to financial coverage parameters could also be made if components emerge that impede its targets. These components embrace, however are usually not restricted to, the labor market scenario, financial progress, inflation within the US, the state of the worldwide financial system, and worldwide occasions.

As already talked about, the principal situation for 2024 contains three charge reductions of 25 foundation factors every. Nonetheless, members of the FOMC haven’t discounted the opportunity of there being simply two and even one discount. A survey by Reuters discovered that 72 out of 108 economists, or two-thirds, anticipate the primary charge reduce to happen in June, with the next ones anticipated within the fall of this yr.

● The inventory market responded positively to the outcomes of the Federal Reserve’s assembly. The S&P 500, Dow Jones, and Nasdaq indices all moved greater, a response not mirrored by the Greenback Index (DXY), as information of the start of financial coverage easing didn’t please traders. Consequently, EUR/USD surged sharply. Nevertheless, on March 21, the American forex recouped its losses after the Swiss Nationwide Financial institution (SNB) unexpectedly diminished its key rate of interest by 25 foundation factors to 1.5% at its quarterly assembly, opposite to market expectations of sustaining the speed at 1.75%.

“The easing of financial coverage was made doable due to the efficient fight towards inflation over the past two and a half years,” the SNB acknowledged. “Inflation has been beneath 2% for a number of months and is inside the vary that corresponds to the definition of value stability. In accordance with the most recent forecast, inflation is predicted to stay inside this vary within the coming years.”

Thus, the SNB turned the primary main central financial institution to start out easing its coverage after an extended cycle of charge will increase because of the COVID-19 pandemic. Consequently, merchants “forgot” in regards to the Fed’s charge reduce indicators and commenced shopping for {dollars}, as they at present stay the one high-yield forex with a low danger degree.

● Help for the greenback in the direction of the top of the working week was additionally offered by the enterprise exercise knowledge within the US printed on March 21. The S&P World Composite PMI index elevated to 52.5 from 52.2, and whereas the PMI index for the providers sector decreased from 52.3 to 51.7, it remained above the 50.0 threshold that separates financial progress from contraction. In the meantime, the Philadelphia manufacturing sector enterprise exercise index exceeded forecasts, reaching 3.2, and the variety of preliminary jobless claims within the US for the week fell from 215K to 210K.

● EUR/USD concluded the previous five-day week at a mark of 1.0808. Relating to the forecast for the close to future, as of the writing of this overview on the night of Friday, March 22, 50% of consultants voted for the strengthening of the greenback and additional decline of the pair. 20% sided with the euro, and 30% took a impartial stance. Among the many oscillators on D1, solely 15% are colored inexperienced, 85% are colored purple, with 1 / 4 of them indicating the pair is oversold. For development indicators, the greens have 10%, whereas the reds maintain an absolute majority of 90%. The closest help for the pair is situated within the zone of 1.0795-1.0800, adopted by 1.0725, 1.0680-1.0695, 1.0620, 1.0495-1.0515, and 1.0450. Resistance zones are discovered within the areas of 1.0835-1.0865, 1.0900-1.0920, 1.0965-1.0980, 1.1015, 1.1050, and 1.1100-1.1140.

● The upcoming buying and selling week might be shorter than normal because of Good Friday in Catholic nations, the place banks and inventory exchanges might be closed. It can even be the final week of the month and the primary quarter. Market members might be summarizing the quarter, and there might be few vital statistical releases. However, notable within the calendar is Thursday, March 28, when knowledge on retail gross sales in Germany might be launched, in addition to revised annual knowledge on the US GDP and the amount of jobless claims. On Friday, March 29, regardless of the vacation, statistics on the patron market in america might be launched, and Federal Reserve Chair Jerome Powell is scheduled to talk.

GBP/USD: BoE Hawks Morph into Doves

● Information on client inflation within the UK, launched on Wednesday, March 20, a day forward of the Financial institution of England (BoE) assembly, indicated a slight deceleration and fell a bit beneath expectations. The year-on-year CPI slowed from 4.0% to three.4%, towards the anticipated 3.5%. February’s core CPI, on an annual foundation, dropped to 4.5% after three months of stability at 5.1%. Conversely, the CPI noticed a month-on-month improve of 0.6% following a decline of the identical magnitude in January, but this improve nonetheless fell in need of the market’s 0.7% expectation. February noticed producer buy costs lower by 0.4%, with a year-on-year lack of 2.7%, returning to ranges seen in Could 2022 because of decreases in power, metals, and a few agricultural product costs.

Just some hours earlier than the regulator’s assembly, preliminary enterprise exercise knowledge had been additionally launched, exhibiting constructive however blended outcomes. The Manufacturing PMI rose to 49.9, carefully approaching the essential 50.0 mark (with a forecast of 47.8 and a earlier worth of 47.5). The providers sector index, in distinction, dropped from 53.8 to 53.4, regardless of expectations that it will maintain regular. Consequently, the Composite PMI edged down from 53.0 to 52.9, remaining inside the progress zone of the financial system.

● Relating to the Financial institution of England’s assembly on Thursday, March 21, as anticipated, the regulator saved the important thing rate of interest for the pound unchanged at 5.25% for the fifth consecutive assembly. The Governor, Andrew Bailey, acknowledged that the financial system has not but reached the stage the place charges will be lowered however added that every part is shifting within the “proper route.”

● The shock got here when two members of the BoE’s Financial Coverage Committee, who had beforehand voted for a charge improve, reversed their place, resulting in renewed promoting of the pound. In accordance with economists at Japan’s MUFG Financial institution, the voting end result “justifies an elevated chance of an earlier charge reduce than we had anticipated. […] Whether or not the Financial institution of England makes the ultimate choice in June or August stays an open query. We keep our view that there might be a charge reduce of 100 foundation factors this yr.” “The pound might undergo additional within the brief time period if the market’s conviction in a June charge reduce strengthens, together with the potential magnitude of charge cuts for this yr,” the MUFG specialists added.

● “Certainly, the Financial institution of England has taken one other step in the direction of decreasing rates of interest,” echo their colleagues at Germany’s Commerzbank. “However whether or not this may occur before anticipated, just because not one of the policymakers voted for a charge improve, isn’t completely clear but.” Commerzbank believes that “towards the backdrop of the general dovish sentiment triggered by the SNB’s sudden charge reduce, the pound ended up on the dropping aspect and have become the second-worst forex. Additionally, relying on market sentiments, it has the possibility to develop into some of the weak currencies.”

● Beginning the previous week at a degree of 1.2734, GBP/USD concluded it at 1.2599. Analyst opinions on its near-term route had been break up: half (50%) voted for the pair’s decline, 25% for its rise, and 25% maintained neutrality. The indicator readings on D1 are precisely the identical as for EUR/USD. Amongst oscillators, solely 15% look north, 85% south, with 1 / 4 of them signalling the pair is oversold. For development indicators, 10% suggest shopping for, and 90% promoting. Ought to the pair transfer southward, it would encounter help ranges and zones at 1.2575, 1.2500-1.2535, 1.2450, 1.2375, 1.2330, 1.2085-1.2210, 1.2110, 1.2035-1.2070. Within the occasion of an upward motion, resistance might be met at ranges 1.2635, 1.2730-1.2755, 1.2800-1.2820, 1.2880-1.2900, 1.2940, 1.3000, and 1.3140.

● No important occasions associated to the financial system of the UK are scheduled for the upcoming week. Merchants also needs to keep in mind that March 29 is a public vacation within the nation because of Good Friday.

USD/JPY: How the BoJ Sank the Yen

● In idea, if the rate of interest rises, the forex strengthens. However that is simply in idea. Actuality can differ considerably, as demonstrated by the Financial institution of Japan’s (BoJ) assembly on Tuesday, March 19.

Till that time, the BoJ had been the one central financial institution on the earth to take care of a detrimental rate of interest degree of -0.1% since February 2016. Now, for the primary time in 17 years, the regulator raised it to a spread of 0.0-0.1% every year. It additionally deserted management over the yield of ten-year authorities bonds (YCC). As media reviews, this transfer “represents a departure from essentially the most aggressive and unconventional financial easing coverage we’ve seen in trendy historical past.” But, following this momentous choice, as an alternative of appreciating, the yen … plummeted, and USD/JPY reached a excessive of 151.85. Analysts consider this occurred as a result of every of those central financial institution actions met market expectations and had already been priced in.

● Information on inflation in Japan for February, printed in the direction of the top of the workweek, supplied some help to the Japanese forex. The nation’s Statistical Bureau reported that the annual nationwide Shopper Worth Index (CPI) rose by 2.8%, up from 2.2% beforehand. Consequently, traders concluded that the persistence of value stress above the goal degree of two.0% would permit the Financial institution of Japan to take care of rates of interest at a constructive degree.

Nevertheless, sustaining charges doesn’t imply rising them. And as economists from ING, the most important banking group within the Netherlands, wrote, the yen’s place relies upon extra on the Federal Reserve’s charge cuts than on a charge hike by the BoJ. They acknowledged: “Will probably be tough for the yen to sustainably strengthen past volatility across the charge hike till charges within the US are lowered.”

● The yen obtained one other, however very weak, help from rising speculations about doable intervention by the Japanese authorities within the forex sphere, in easier phrases, about forex interventions. Japan’s Finance Minister, Shunichi Suzuki, did declare that forex actions needs to be secure and that he’s carefully monitoring alternate charge fluctuations. Nevertheless, these had been merely phrases, not concrete actions, thus they did not considerably assist the nationwide forex. Consequently, the week concluded with the pair marking the ultimate word at 151.43.

● Relating to the close to way forward for USD/JPY, the bearish camp for the pair includes 50% of consultants, 40% stay undecided, and 10% voted for additional strengthening of the US forex. Technical evaluation instruments appear to be unaware of rumours about doable forex interventions. Consequently, all 100% of development indicators and oscillators on D1 are pointing upwards, with 20% of the latter within the overbought zone. The closest help ranges are discovered at 150.85, 149.70, 148.40, 147.30-147.60, 146.50, 145.90, 144.90-145.30, 143.40-143.75, 142.20, and 140.25-140.60. Resistance ranges and zones are situated at 151.85-152.00, 153.15, and 156.25.

● On Friday, March 29, the Shopper Worth Index (CPI) values for the Tokyo area might be printed. Moreover this, no different important occasions associated to the Japanese financial system are scheduled for the approaching days.

CRYPTOCURRENCIES: Bitcoin – The Calm Earlier than the Halving

● After bitcoin reached a brand new all-time excessive of $73,743 on March 14, a wave of selloffs and profit-taking by short-term speculators adopted. BTC/USD sharply retreated, dropping roughly 17.5%. An area minimal was recorded at $60,778, after which the main cryptocurrency, in anticipation of the halving, started to realize momentum once more.

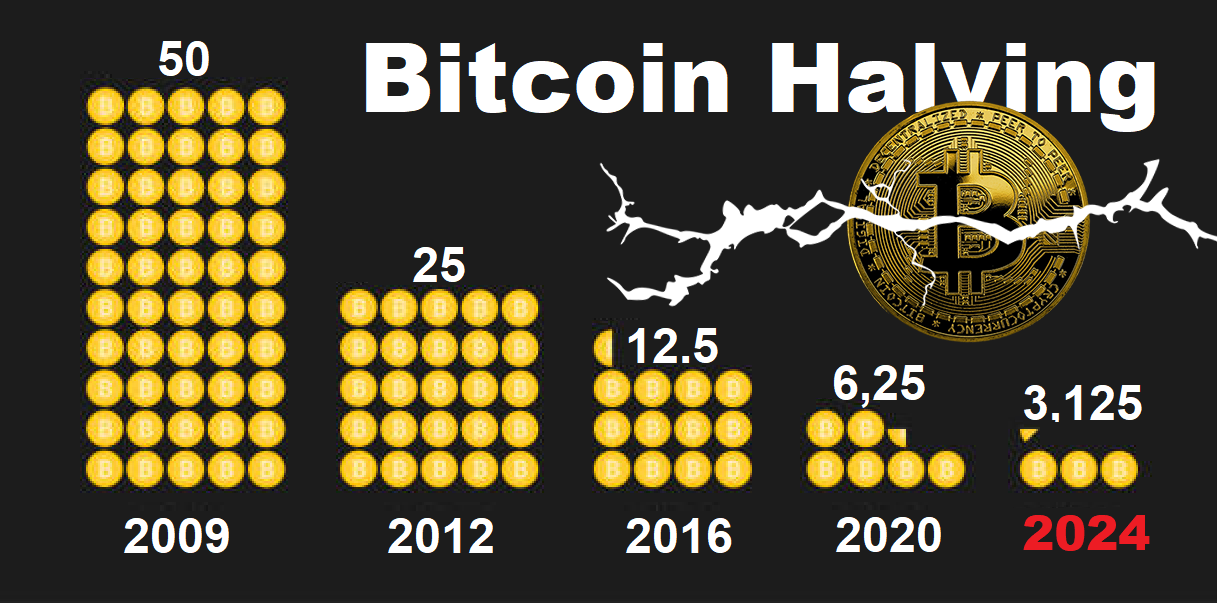

It is price recalling {that a} halving is an occasion that happens roughly each 4 years, after one other 210,000 blocks have been mined, and ends in the mining reward for a brand new block within the bitcoin blockchain being reduce in half. This naturally raises the query: why is that this executed? The halving is designed as a mechanism to fight inflation. As miners’ rewards lower, fewer new cash are produced with every spherical. That is meant to take care of a shortage of bitcoin out there and positively affect the token’s value from a provide and demand perspective.

The overall issuance of bitcoin is capped at 21 million cash. As of December 2023, miners have already extracted 19.5 million cash, which is almost 93% of the entire quantity. Halvings will proceed till the final bitcoin is mined, which is forecasted to happen someday between 2040 and 2048. In 2040 (the eighth halving), miners’ rewards might be 0.1953125 BTC, and in 2048 (the tenth halving) – 0.048828125 BTC. After this, miners will earn earnings solely from transaction charges. The upcoming, fourth halving is almost certainly to happen on April 20 this yr, with the reward for mined blocks reducing from 6.25 BTC to three.125 BTC.

● Due to the hype surrounding spot bitcoin ETFs and the FOMO (Worry of Lacking Out) impact in anticipation of the halving, a sure shortage of the principle cryptocurrency is already observable. In accordance with Bitcointreasuries, a good portion of BTC is owned by state and personal funding corporations, governments, alternate and funding funds. In complete, they maintain roughly 12% of the entire quantity of bitcoins. About 10% is saved on centralized cryptocurrency exchanges, and one other 8.09% belongs to accounts which were inactive for a few years. Including to those figures the share of the asset attributed to bitcoin’s founder, Satoshi Nakamoto (4.76%), it may be concluded that about 35% of mined cash are already unavailable to different personal traders.

Grayscale Bitcoin Belief, iShares Bitcoin Belief, and Constancy Smart Origin Bitcoin Fund lead by way of bitcoin possession volumes with 380,241 BTC, 230,617 BTC, and 132,571 BTC, respectively. MicroStrategy has develop into the most important holder of bitcoins amongst public corporations with 205,000 BTC on its steadiness sheet. Marathon Digital holds the second place with 15,741 BTC, whereas Tesla and Coinbase World share the third and fourth locations with 9,720 BTC and 9,480 BTC, respectively. Amongst different, private, personal corporations, Block.one leads in possession degree with 164,000 BTC, in accordance with obtainable info. It’s adopted by the MTGOX alternate with a steadiness of 141,686 BTC. Stablecoin issuer Tether owns 66,465 BTC. The fourth place is taken by the BitMEX alternate with 57,672 BTC.

Within the rating of bitcoin possession amongst nations, the USA leads with 215,000 BTC, adopted by China with 190,000 BTC, the UK with 61,000 BTC, and Germany with 50,000 BTC.

● Analysts at Commonplace Chartered Financial institution have revised their bitcoin value goal for the top of 2024 from $100,000 to $150,000, with ethereum doubtlessly reaching $8,000 by the identical interval. By the top of 2025, the primary and second cryptocurrencies might respect to $200,000 and $14,000, respectively. The specialists justify their forecast by the dynamics of gold following the approval of bitcoin ETFs and the optimization of the dear metallic to its digital counterpart in an 80% to twenty% ratio.

In accordance with Commonplace Chartered consultants, bitcoin might respect additional – as much as $250,000 – if inflows into ETFs attain $75 billion. Sovereign funding funds’ actions might additionally speed up progress charges. “We see an rising chance that main reserve managers would possibly announce bitcoin purchases in 2024,” say the financial institution’s analysts.

● Dan Tapiero, CEO of funding agency 10T Holdings, talked about an analogous determine – $200,000. “I do not assume it is that loopy,” he acknowledged. In accordance with the financier’s calculations, the potential to triple from the present value roughly corresponds to the share distinction between the peaks of 2017 and 2021. Moreover, from the bear market lows to the 2021 peak, digital gold elevated in worth 20 occasions. This means a $300,000 goal as a constructive situation.

“It is onerous to pinpoint precise markers and timing in these issues. I believe we’ll attain that [zone] inside the subsequent 18-24 months, even perhaps sooner,” Tapiero believes. “The availability reduce throughout the speedy improve in demand for ETFs together with the halving point out a big progress potential. I believe the primary cryptocurrency will pull the remainder together with it.” The CEO of 10T Holdings additionally famous “good probabilities” for the approval of ETFs based mostly on Ethereum. Nevertheless, he hesitated to say whether or not these ETFs could be registered in Could or if it will occur later.

● OpenAI’s ChatGPT, when requested whether or not the BTC value might attain the $100,000 mark earlier than the halving, deemed this goal believable. In accordance with the AI’s calculations, the latest correction doesn’t have an effect on progress prospects and solely confirms the inaccuracy of short-term forecasts. ChatGPT estimated the likelihood of reaching $100,000 at 40%, whereas the chance of hitting the $85,000 mark was assessed at 60%.

● As of the writing of this overview, on the night of Friday, March 22, BTC/USD is buying and selling round $63,000. The overall market capitalization of cryptocurrencies has decreased to $2.39 trillion (from $2.58 trillion every week in the past). The Crypto Worry & Greed Index has dropped from 83 to 75 factors, shifting from the Excessive Greed zone to the Greed zone.

● Regardless of the latest halt in bitcoin’s decline, some consultants don’t rule out the likelihood that BTC/USD might take one other dip southward. As an illustration, Kris Marszalek, CEO of Crypto.com, believes that the present volatility of BTC remains to be low in comparison with earlier cycles. This suggests that with a rise in volatility, not solely new highs but in addition new lows may very well be set.

Analysts at JPMorgan consider that bitcoin might fall by 33% after the halving. In the meantime, Mike Novogratz, CEO of Galaxy Digital, is assured that the ground is at $50,000, and the worth of the coin won’t ever fall beneath that degree except some dramatic occasion happens. In accordance with him, bitcoin’s progress is primarily pushed by traders’ insatiable urge for food for the token, somewhat than macroeconomic components such because the coverage of the US Federal Reserve. This was evidenced by the truth that the worth of bitcoin hardly observed the Federal Reserve’s assembly on March 20.

NordFX Analytical Group

Discover: These supplies are usually not funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx