EUR/USD: A Week of Blended Information

● The macroeconomic statistics launched final week had been blended in each the USA and the Eurozone. In consequence, EUR/USD failed to interrupt by means of both the 1.0700 help or the 1.0800 resistance, persevering with to maneuver inside a slim sideways channel.

● The US greenback obtained a robust bullish impulse on Tuesday, February 14, following the discharge of US inflation information. The Greenback Index (DXY) surged by greater than 0.5% and practically reached the 105.00 resistance stage. Consequently, EUR/USD moved downward, in direction of the decrease boundary of the required sideways vary. In the meantime, the S&P 500 inventory index fell from 5051 to 4922 factors.

It may be mentioned that the US inflation information caught the markets off guard. Some analysts even described them as stunning. It turned out that the ultimate victory over costs is just not as shut because it appeared earlier than, and that the Federal Reserve is unlikely to start out reducing rates of interest anytime quickly.

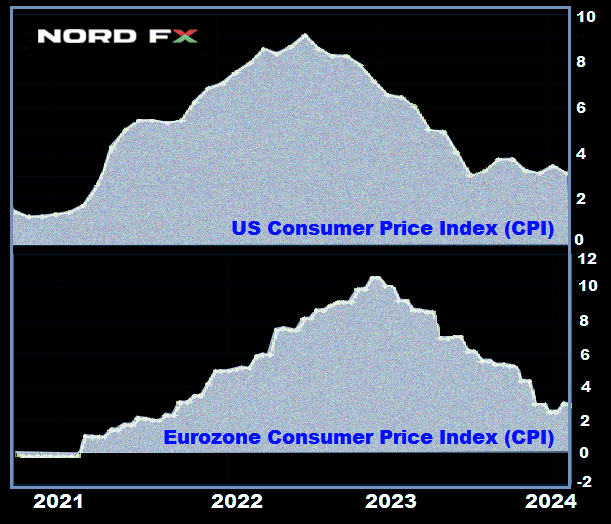

In January, the Client Worth Index (CPI) sharply elevated towards the backdrop of a big rise in the price of hire, meals, and healthcare companies. On a month-to-month foundation, the general index accelerated from 0.2% to 0.3%. On an annual foundation, the CPI was 3.1%, which is beneath the earlier worth of three.4%, however considerably above the forecast of two.9%. Excluding the unstable costs of meals and power, inflation in January rose from 0.3% to 0.4% month-on-month, whereas the annual core CPI remained on the earlier stage of three.9%, though analysts had forecast a lower to three.8%. Notably sharp was the rise in so-called “super-core inflation,” which additionally excludes housing prices. In January, on a month-to-month foundation, it reached 0.8%: the very best stage since April 2022.

● Definitely, the Federal Reserve’s achievements in combating inflation are important. It’s price recalling that in the summertime of 2022, the CPI reached a 40-year peak at 9.1%. Nevertheless, the present inflation charge remains to be nearly twice the goal stage of two.0%. Primarily based on this, the market concluded that the Federal Reserve is now unlikely to hurry into easing financial coverage and can most likely preserve excessive rates of interest for longer than beforehand anticipated. In the beginning of January, in line with the FedWatch Device, the likelihood of a 25 foundation level (bp) charge reduce in Could was 54.1%. After the inflation report was launched, this determine dropped to 35%. A good decrease likelihood is given by the monitoring instrument developed by Investing.com. The potential for a dovish pivot in March, in line with its readings, stands at 5%, and in Could – round 30% (just some weeks in the past, it was over 90%). As for the start of summer time, the likelihood of a discount in the price of borrowing by means of federal funds in June is estimated at 75%.

● The inflation report was a boon for greenback bulls, however their pleasure was short-lived. The information on industrial manufacturing and retail gross sales within the US launched on Thursday, February 16, had been weaker than anticipated. In January, retail gross sales confirmed a decline of -0.8% in comparison with the December improve of 0.4% and the forecast of -0.1%. In consequence, the greenback was beneath strain, and the EUR/USD pendulum swung in the wrong way: the pair headed in direction of the higher boundary of the 1.0700-1.0800 channel.

The greenback obtained a slight enhance on the very finish of the workweek. On Friday, February 16, the Producer Worth Index (PPI) indicated that industrial inflation in January rose simply as client inflation did. In opposition to a forecast of 0.1%, the precise improve was 0.3% month-on-month, which is 0.4% larger than December’s determine. On an annual foundation, the PPI rose by 2.0% (forecast 1.6%, earlier worth 1.7%). Nevertheless, this help was quickly offset by a drop within the College of Michigan’s US Client Confidence Index, which, though it elevated from 79.0 to 79.6, was beneath the forecast of 80.0 factors.

● On the opposite facet of the Atlantic, the information was additionally moderately contradictory, ensuing within the European statistics not with the ability to considerably help its foreign money. The February Financial Sentiment Index from ZEW in Germany improved greater than anticipated, rising to 19.9 from 15.2 within the earlier month. The financial sentiment indicator for the Eurozone as an entire additionally confirmed development, shifting from 22.7 factors to 25.0. Nevertheless, the evaluation of the present scenario fell to -81.7, the bottom stage since June 2020.

Preliminary GDP information for This autumn 2023, launched on Wednesday, February 14, confirmed that the Eurozone is in a state of stagnation. On a quarterly foundation, the figures remained at 0%, and on an annual foundation, they had been at 0.1%, precisely matching forecasts. This statistic didn’t add optimism, and markets continued to train warning, fearing that the Eurozone financial system may slip into recession.

● Europe faces a considerably sharper selection between supporting the financial system and preventing inflation in comparison with the USA. Isabel Schnabel, a member of the Government Board of the ECB and a well known hawk, said on Friday, February 16, that the regulator’s financial coverage should stay restrictive till the ECB is assured that inflation has sustainably returned to the medium-term goal stage of two.0%. Moreover, Ms. Schnabel believes that persistently low labour productiveness development will increase the danger that corporations might move their larger labour prices on to customers, which may delay the achievement of the inflation goal.

Nevertheless, regardless of such hawkish statements, in line with a ZEW survey, greater than two-thirds of enterprise representatives nonetheless hope for an easing of the ECB’s financial coverage inside the subsequent six months. The likelihood of a charge reduce for the euro in April is at the moment estimated by the markets at about 53%.

● After all of the fluctuations of EUR/USD, the ultimate word of the previous week was struck on the stage of 1.0776. On the time of scripting this evaluation, on the night of Friday, February 16, 55% of consultants voted for the strengthening of the greenback within the close to future and the additional fall of the pair. 30% sided with the euro, whereas 15% took a impartial stance. Among the many oscillators on D1, 60% are colored crimson, 40% in neutral-grey, and none in inexperienced. The ratio amongst pattern indicators is totally different: 60% crimson and 40% inexperienced. The closest help for the pair is situated within the zone of 1.0725-1.0740, adopted by 1.0695, 1.0620, 1.0495-1.0515, 1.0450. Bulls will encounter resistance within the areas of 1.0800-1.0820, 1.0865, 1.0925, 1.0985-1.1015, 1.1110-1.1140, 1.1230-1.1275.

● Among the many occasions of the upcoming week, the minutes from the final assembly of the Federal Open Market Committee (FOMC) of the US Federal Reserve, which can be printed on Wednesday, February 21, are of nice curiosity. The next day, a robust stream of knowledge on enterprise exercise (PMI) in Germany, the Eurozone, and the US can be launched. Furthermore, on Thursday, February 22, the January determine for the Client Worth Index (CPI) within the Eurozone and the variety of preliminary jobless claims within the US can be recognized. In direction of the very finish of the workweek, on Friday, February 23, information on Germany’s GDP, the principle engine of the European financial system, will arrive. Moreover, merchants ought to understand that Monday, February 19, is a vacation in the USA: the nation observes Presidents’ Day.

GBP/USD: What’s Occurring with the UK Economic system?

● As is understood, following the assembly that concluded on February 1, the Financial institution of England (BoE) introduced the upkeep of the financial institution charge on the earlier stage of 5.25%. The accompanying assertion talked about that “extra proof is required that the Client Worth Index will fall to 2.0% and stay at that stage earlier than contemplating charge cuts.”

● On February 15, Catharine Mann, a member of the Financial Coverage Committee (MPC) of the regulator, offered probably the most complete overview of the state of the British financial system, together with elements regarding inflation. The important thing factors of her evaluation had been as follows: “The most recent GDP information verify that the second half of 2023 was weak. Nevertheless, GDP information is a rearview mirror. Alternatively, the Buying Managers’ Index (PMI) and different main indicators look promising. The unemployment charge within the UK stays comparatively low, and the labour market continues to be tight. Wage development is slowing, however the tempo stays problematic for the goal Client Worth Index (CPI) indicator. Within the UK, items costs might turn out to be deflationary sooner or later, however not on a long-term foundation. Inflation within the UK’s companies sector is rather more persistent than within the EU or the US.” Consequently, Catharine Mann’s conclusion was: “Mitigating the sources of inflation can be essential in decision-making” and “Earlier than making a call on additional actions, the Financial institution of England must obtain a minimum of yet another inflation report.”

● Referring to particular figures, the newest information from the Workplace for Nationwide Statistics (ONS), printed on February 16, confirmed that retail gross sales within the UK in January elevated by 3.4% towards the anticipated 1.5% and a decline of -3.3% in December (month-on-month). The core determine (excluding automotive gasoline retail gross sales) rose by 3.2% over the month towards a forecast of 1.7% and -3.5% in December. On an annual foundation, retail gross sales additionally confirmed development of 0.7% towards the anticipated decline of -1.4% and a December determine of -2.4%.

Labour market information additionally helps the pound. The unemployment charge fell to three.8% from 4.2%, towards expectations of 4.0%. The discount within the variety of energetic job seekers within the labour market intensifies competitors amongst employers, which helps preserve the next wage development charge. For the three months to December, wage development was 5.8%. Such robust labour market statistics, complemented by excessive inflation (CPI 4.0% year-on-year, core CPI 5.1% year-on-year), are prone to push again the anticipated date for alleviating the Financial institution of England’s financial coverage. Many analysts don’t rule out that finally, the BoE could also be among the many final mega-regulators to chop charges this 12 months.

● GBP/USD ended the week on the stage of 1.2599. In accordance with economists at Scotiabank, the 1.2500 zone represents robust long-term help for it, and a assured transfer above 1.2610 will strengthen the pound and set GBP/USD on a development path in direction of 1.2700. Relating to the median forecast of analysts for the approaching days, 65% voted for the pair’s decline, 20% for its rise, and the remaining 15% maintained neutrality. Among the many oscillators on D1, 75% level south, the remaining 25% look east, with none prepared to maneuver north. The scenario is totally different with pattern indicators, the place there’s a slight bias in favour of the British foreign money – 60% point out north, whereas the remaining 40% level south. If the pair strikes south, it’ll encounter help ranges and zones at 1.2570, 1.2500-1.2535, 1.2450, 1.2370, 1.2330, 1.2185, 1.2070-1.2090, 1.2035. In case of a rise, the pair will meet resistance at ranges 1.2635, 1.2695-1.2725, 1.2775-1.2820, 1.2880, 1.2940, 1.3000, and 1.3140-1.3150.

● Thursday, February 22 stands out within the calendar for the upcoming week. On today, a batch of knowledge on enterprise exercise (PMI) in varied sectors of the financial system of the UK can be launched. The discharge of different important macroeconomic statistics within the coming days is just not anticipated.

USD/JPY: The Flight Continues

● On Tuesday, February 13, USD/JPY reached one other native most at 150.88. The Japanese foreign money retreated once more, this time towards the backdrop of inflation information within the US. The yen additionally continues to be beneath strain as a result of Financial institution of Japan’s (BoJ) constant dovish stance. On February 8, Deputy Governor Shinichi Uchida expressed doubts that the regulator would begin to shortly increase its benchmark charge anytime quickly. Final Friday, February 16, BoJ Governor Kazuo Ueda spoke in an analogous vein. He said that the difficulty of sustaining or altering financial coverage, together with the destructive rate of interest, would solely be thought-about “when there’s a probability of sustainable and steady achievement of the worth stage goal.” Ueda declined to touch upon short-term fluctuations within the alternate charge and the components behind these actions.

● On the whole, there’s nothing new. Nevertheless, many analysts proceed to hope that in 2024 the Financial institution of Japan will lastly determine to tighten its financial coverage. “We imagine,” write economists on the Swiss monetary holding UBS, “that the normalization of the Financial institution of Japan’s coverage this 12 months will happen towards the backdrop of robust negotiations on wage will increase and company profitability. We nonetheless imagine that the Japanese yen is probably going at a turning level after important depreciation from 2021 to 2023. Contemplating that the yield differential between 10-year U.S. and Japanese bonds will slim over the 12 months, we imagine the present entry level for purchasing yen is engaging.”

The same place is held at Danske Financial institution, the place they forecast a sustainable lower in USD/JPY beneath 140.00 on a 12-month horizon. “That is primarily as a result of we anticipate restricted development in yields within the US,” say strategists at this financial institution. “Subsequently, we anticipate the yield differential to turn out to be a tailwind for the yen all year long, because the G10 central banks, except the Financial institution of Japan, are prone to begin rate-cutting cycles.”

● Relating to the short-term outlook, specialists at Singapore’s United Abroad Financial institution Restricted imagine that the greenback nonetheless has the potential to check 151.00 earlier than weakening. “The danger of the US greenback rising to 152.00 will stay unchanged so long as it stays above 149.55,” UOB states. This place is supported by solely 25% of consultants, with the bulk (60%) already siding with the yen, and the remaining 15% preferring to keep up neutrality. Among the many pattern indicators and oscillators on D1, all 100% level north, nevertheless, 25% of the latter are within the overbought zone. The closest help stage is situated within the zone of 149.65, adopted by 148.25-148.40, 147.65, 146.65-146.85, 144.90-145.30, 143.40-143.75, 142.20, 140.25-140.60. Resistance ranges are situated on the following ranges and zones – 150.65-150.90, 151.70-152.00.

● No important occasions associated to the Japanese financial system are scheduled for the upcoming week. Furthermore, you will need to word that Friday, February 23, is a public vacation in Japan: the nation observes the Emperor’s Birthday.

CRYPTOCURRENCIES: Bitcoin Breaks Data

● Final week, the worth of bitcoin rose above $52,790, setting a brand new peak since 2021. In accordance with CoinGecko, the market capitalization of the main cryptocurrency exceeded $1.0 trillion for the primary time in two years, and the overall market capitalization of the complete crypto market rose above $2.0 trillion for the primary time since April 2022.

A lot of this bull rally is attributed to the launch of 9 main spot bitcoin ETFs. In accordance with The Block, a month after their launch, their belongings exceeded 200,000 BTC (about $10 billion). The brand new bitcoin ETFs rose to second place within the rating of US commodity exchange-traded funds by asset quantity, changing into a extra widespread funding instrument than silver ETFs. Observers word BlackRock’s assertion that “curiosity in bitcoin amongst traders stays excessive,” therefore the fund is able to purchase much more BTC.

In accordance with Documenting Bitcoin, the web curiosity from ETF issuers exceeds 12,000 BTC per day. Thus, Wall Road representatives are at the moment shopping for 12.5 instances extra BTC cash every day than the community can produce. Researchers imagine this has been a key driver of the worth improve for the flagship crypto asset.

● Morgan Creek Digital co-founder and associate Anthony Pompliano additionally highlighted the success of the newly launched spot BTC-ETFs. In accordance with him, the truth that BlackRock and Constancy managed to draw $3 billion every in document brief instances was a historic occasion for exchange-traded funds. “Wall Road isn’t just in love with bitcoin,” the financier wrote. “They’re in an energetic love affair. The every day provide of bitcoins to funds is proscribed to simply 900 BTC, which corresponds to roughly $40-45 million. In the meantime, the every day internet influx of funds into BTC-ETFs already equals $500 million (max. $651 million). It is a clear indicator of BTC shortage and its bullish affect on the cryptocurrency’s value and the market as an entire,” Pompliano said, noting the imbalance between the market provide of bitcoin and demand from Wall Road corporations. The billionaire is optimistic about BTC’s future trajectory and asserts that with continued demand from Wall Road, particularly contemplating the upcoming halving, the top-capitalization cryptocurrency may considerably exceed its historic highs.

CryptoQuant famous that, along with the demand from BTC-ETFs, the variety of energetic wallets can be considerably rising. This too signifies a long-term upward pattern. “Given the discount in provide, elevated demand, and varied financial and social points, particularly ongoing inflation, bitcoin is prone to strengthen its place as a long-term different funding asset with an upward pattern,” analysts conclude.

● SkyBridge Capital founder and former White Home senior official Anthony Scaramucci additionally emphasised inflation. Past the launch of spot BTC-ETFs and the halving, Scaramucci pointed to the financial coverage of the US Federal Reserve as a driver for Bitcoin’s development. “The US Client Worth Index (CPI) information launched on Tuesday, February 13, signalled that inflation will not be as beneath management because the Fed would love,” the investor writes. “Primarily based on information printed by the US Bureau of Labor Statistics, the buyer value index for January confirmed inflation at 3.1%. The information additionally sparked hypothesis {that a} Federal Reserve rate of interest reduce in March and Could is probably going off the desk.” Delays in charge cuts could cause turbulent buying and selling in the principle market however will function a increase for the crypto world, as Bitcoin is used as a hedge towards inflation. Subsequently, in line with Scaramucci, the time to take a position profitably in digital gold has not but handed.

Well-liked blogger and analyst Lark Davis shared an analogous place: he believes traders have about 700 days to get wealthy. Discussing the significance of market cycles and the well timed sale of belongings, the specialist famous that if merchants are attentive, they’ll make some huge cash within the subsequent two years. In accordance with the skilled, 2024 would be the final probability to purchase digital belongings, and 2025 would be the finest time to promote them. The specialist emphasised the significance of not disposing of every thing directly however step by step securing income. Lark Davis additionally warned that in 2026, a “Nice Melancholy” will start within the international financial system and the cryptocurrency market. And if not bought in time, investments may very well be misplaced.

The onset of the “Nice Melancholy” can be predicted by the well-known writer of “Wealthy Dad Poor Dad,” financier, and author Robert Kiyosaki. He believes that the S&P 500 index is on the verge of a monumental crash with a possible collapse of a full 70%. He accompanied this assertion along with his constant suggestion to put money into belongings akin to gold, silver, and bitcoins.

● Ex-CEO of the cryptocurrency alternate BitMEX, Arthur Hayes, recognized one other driver for Bitcoin’s development associated to the Federal Reserve’s financial coverage. Final week, the US banking sector was gripped by worry as New York Group Bancorp (NYCB) reported a colossal quarterly lack of $252 million. The financial institution’s complete mortgage losses elevated fivefold to $552 million, fuelled by considerations over industrial actual property. Following the discharge of this report, NYCB shares fell 40% in sooner or later, resulting in a decline within the US Regional Banks Index.

Arthur Hayes recalled the Bitcoin rally triggered by the banking disaster in March 2023, when three main American banks, Silicon Valley Financial institution, Signature Financial institution, and Silvergate Financial institution, went bankrupt inside 5 days. The disaster was attributable to a rise within the Federal Reserve’s refinancing charge and, as a consequence, the outflow of deposit accounts. Its largest victims additionally included Credit score Suisse and First Republic Financial institution. To forestall the disaster from affecting much more banks, international trade regulators, primarily the Fed, intervened to offer liquidity. “Yeah… From rock to chapter, that is the longer term. After which there can be much more cash, printers… and BTC at $1 million,” the ex-CEO of BitMEX commented on the present NYCB failure.

● Well-liked analyst on the X platform generally known as Egrag Crypto believes that by September this 12 months, Bitcoin’s market capitalization will attain $2.0 trillion. Primarily based on this, the worth of the main cryptocurrency at that second will exceed $100,000. “Prepare for the journey of your life,” Egrag Crypto urges his followers. “Maintain on tight, as you’re witnessing a cryptocurrency revolution. Do not blink, otherwise you may miss this historic second in monetary historical past!”

● As of the night of February 16, when this evaluation was written, the BTC/USD pair is buying and selling within the $52,000 zone. The whole market capitalization of the crypto market stands at $1.95 trillion ($1.78 trillion every week in the past). The Crypto Worry & Greed Index stays within the Greed zone at a stage of 72 factors.

– It is price noting that the Greed zone corresponds to a scenario the place merchants are actively shopping for an asset that’s rising in value. Nevertheless, Glassnode warns that many on-chain indicators have already entered the so-called “danger zone”. The evaluation is predicated on a gaggle of indicators that take into account a variety of knowledge relating to investor behaviour. Their mixture covers each short-term and long-term cycles. Specifically, the MVRV indicator, which tracks long-term traders, has approached the important zone. Such a excessive worth (2.06) has not been noticed for the reason that FTX collapse. The same “excessive” and “very excessive” danger standing is at the moment attribute of six out of the remaining 9 metrics. They document a comparatively low stage of realized revenue contemplating the energetic value improve in latest weeks. In accordance with observations by Glassnode specialists, a excessive danger indicator is often noticed within the early phases of a bull market. It’s because, having reached a “important stage” of profitability, hodlers might begin to safe income, which, consequently, may result in a robust correction downwards.

NordFX Analytical Group

Discover: These supplies should not funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx