XRP trades greater in managed range-bound motion as institutional participation helps accumulation above the $2.38 zone, at the same time as derivatives information level to declining speculative curiosity.

Information Background

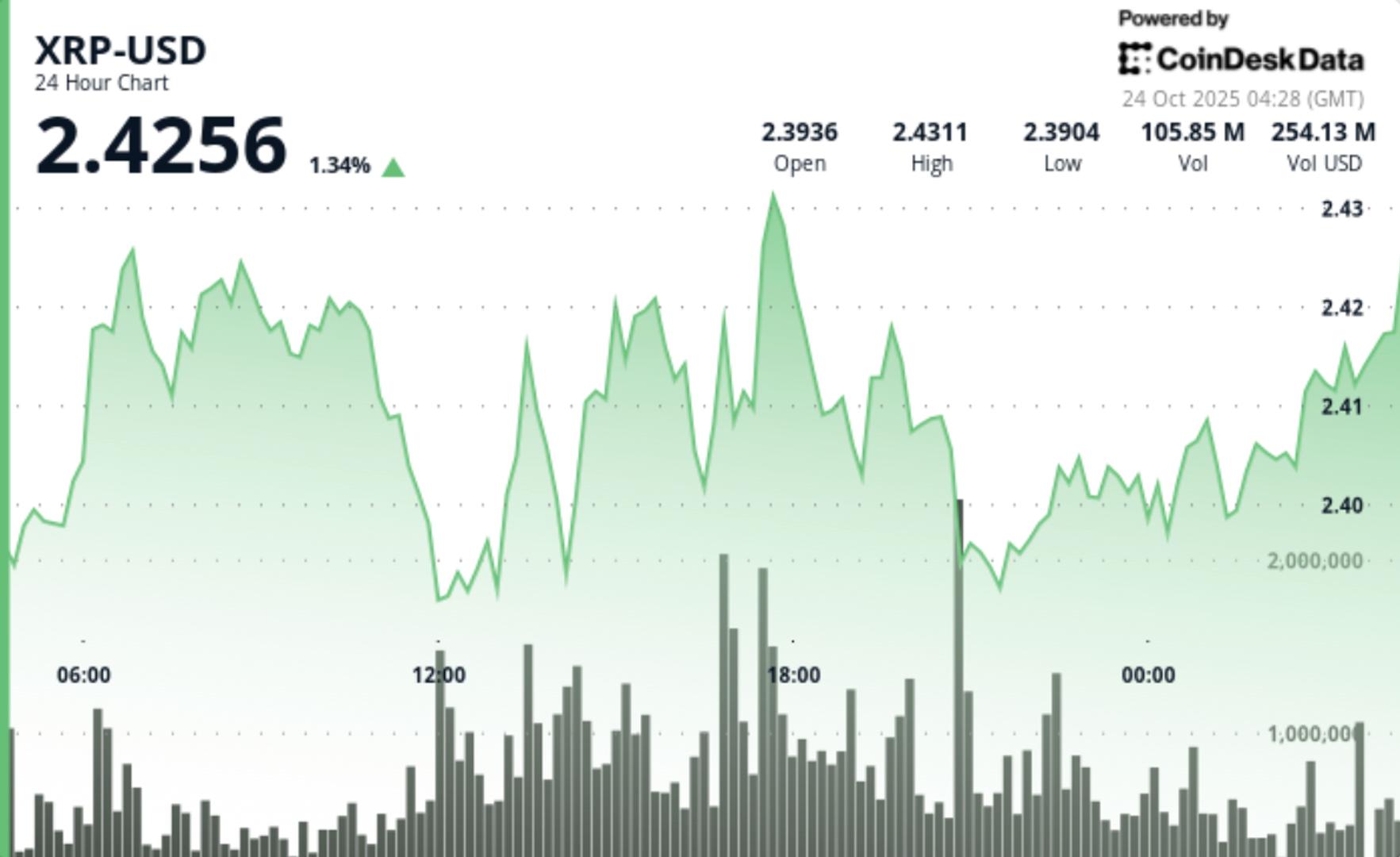

- XRP superior modestly throughout Tuesday’s session, buying and selling between $2.38 and $2.41 whereas sustaining a slim $0.05 band.

- The cryptocurrency continued consolidating above key help regardless of broader uncertainty, with a number of intraday rejections close to $2.43 resistance highlighting capped momentum.

- Buying and selling volumes reached 79.86 million — roughly 94% above the 24-hour common — throughout a noon help retest, confirming institutional presence.

- That spike coincided with a rebound from the $2.38 base, suggesting accumulation conduct from bigger holders as retail participation remained subdued.

Value Motion Abstract

- The session’s most lively window occurred throughout noon buying and selling, when sellers briefly drove XRP towards $2.38 earlier than aggressive dip-buying reversed losses.

- The next restoration to $2.41 restored the prior consolidation construction, leaving the token confined to a 2% intraday vary.

- Hourly information present a light upward bias, with XRP advancing from $2.397 to $2.405 round 01:47 on elevated quantity.

- A number of greater lows shaped alongside this stretch, supporting the short-term bullish channel at the same time as broader crypto sentiment stayed combined.

Technical Evaluation

- XRP’s chart continues to show ascending channel traits, with greater lows confirming managed accumulation.

- The $2.38–$2.39 zone stays key structural help, validated by quantity spikes throughout testing intervals. Resistance stays concentrated close to $2.43, the place repeated failures mark the higher certain of the consolidation.

- Derivatives information reveal decreased speculative exercise: open curiosity declined 1.4%, whereas whole buying and selling volumes dropped 24% day-on-day.

- Funding charges turned barely adverse at -0.0007%, suggesting merchants are leaning brief. But on-chain information present a 3.36% drop in alternate reserves since early October — a traditionally bullish sign tied to long-term whale accumulation.

What Merchants Are Watching

- XRP’s capability to maintain above the $2.38 help space retains the present accumulation thesis intact.

- A confirmed breakout above $2.43–$2.48 would reset momentum and open room towards the $2.65 extension zone. Conversely, failure to defend $2.38 dangers a pullback to $1.96 help.

- Merchants are monitoring quantity conduct intently — one other spike close to 80M+ on an upside try might affirm institutional accumulation and precede a volatility enlargement part.