BNPL is displaying no indicators of slowing down. Customers love this fintech innovation and now everybody appears to need in on the motion.

Enter Galileo, the fintech firm that powers funds, card issuing and digital banking. It first launched a BNPL providing in 2022 for banks and fintechs and in the present day it introduced expanded performance.

The important thing improvement right here is post-purchase performance. We’ve began to see this from banks and fintechs, the place shoppers can convert a bank card transaction right into a BNPL cost plan.

Now, Galileo is bringing this to the broader market. They’re concentrating on each present lenders and those that haven’t any lending program in any respect, touting this program as an incredible entry level into lending for deposit-focused fintechs.

I’ve little question that BNPL will proceed to develop and this Galileo providing makes it simpler for any financial institution or fintech to make the most of this secular development.

Featured

> Galileo Expands BNPL Providing for Banks and FinTechs

Galileo Monetary Applied sciences has launched an growth of its BNPL providing. The corporate now lets banks and FinTechs supply cardholders new post-purchase installment cost choices through their present debit or bank cards.

From Fintech Nexus

> High suggestions for companies contemplating Banking-as-a-Service

By Jean-Jacques Le Bon

Regardless of regulatory considerations banking-as-a-service continues to develop in reputation. Listed here are three suggestions for any enterprise contemplating going the BaaS route.

Podcast

Dan Arlotta, Senior Vice President of Garnet Capital Advisors on fintech mortgage portfolio gross sales

The secondary mortgage market has performed an necessary function within the historical past of fintech lending. There are few individuals who know extra…

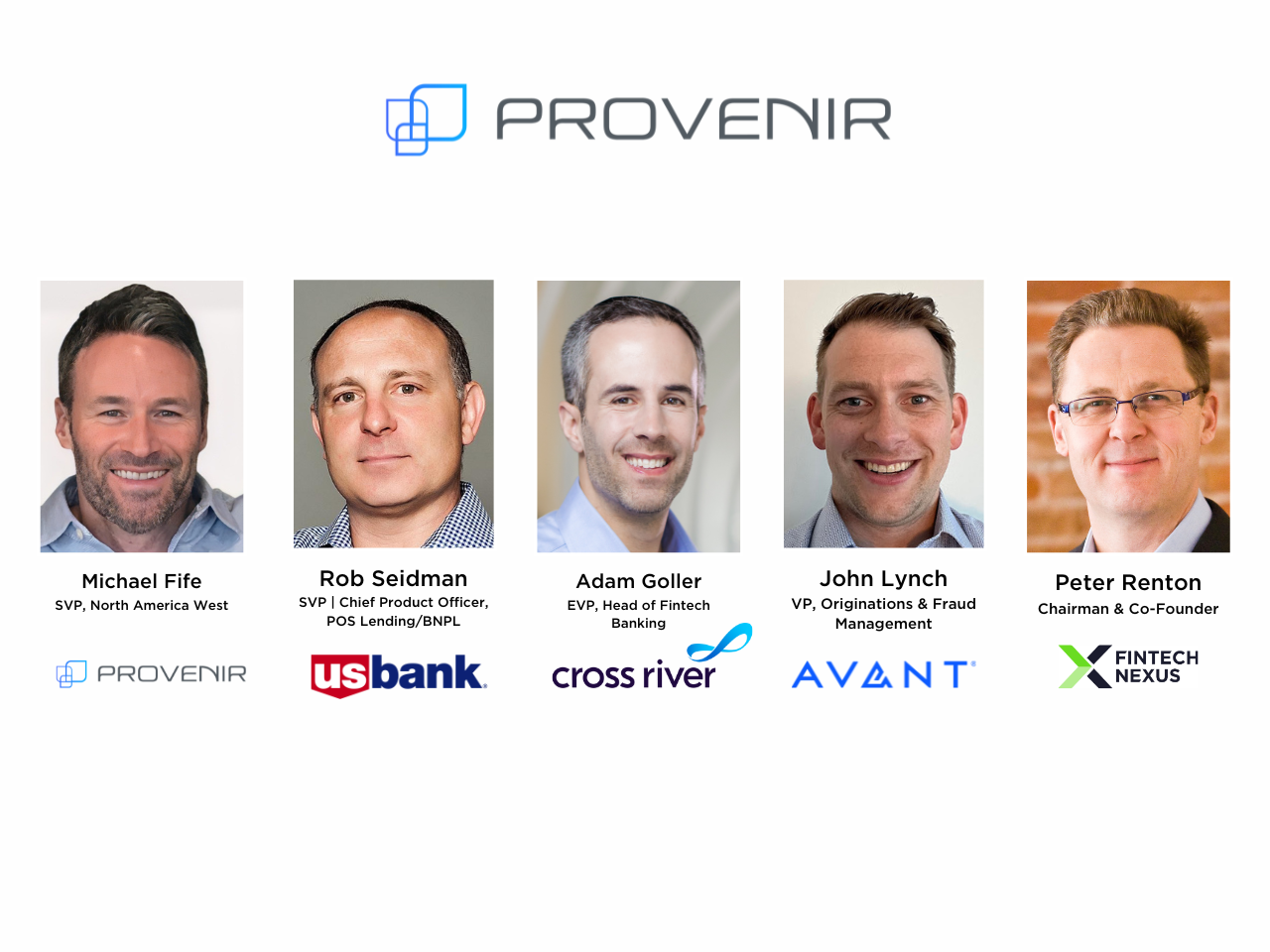

Webinar

How Client Lenders Can Cut back Friction With out Compromising on Threat and Fraud Prevention

Mar 21, 2pm EDT

Buyer expertise is extremely necessary to in the present day’s discerning shoppers, whether or not they’re searching for monetary companies…

Additionally Making Information

- World: Inside HSBC’s technique for cross-border funds

Thomas Halpin, who heads international money administration for North America, talks about real-time processing, generative AI, central financial institution digital currencies and why the ISO 20022 messaging commonplace is cool.

To sponsor our newsletters and attain 275,000 fintech lovers together with your message, contact us right here.