It was solely Thursday of final week when our lead story was in regards to the challenges banks have been going through within the Banking-as-a-Service area.

Then Friday we discovered that Blue Ridge Financial institution was hit with its second regulatory motion in lower than 18 months and is now deemed to be in a “troubled situation”.

Kudos to our unofficial fintech regulatory watchdog, Jason Mikula, for breaking this story. American Banker additionally picked it up on Friday.

Blue Ridge Financial institution is a $3.3 billion-asset financial institution primarily based in Virginia and was an early mover within the BaaS area. The consent order got here out of the OCC’s June examination and Blue Ridge claims to have made vital progress since then.

The banks must ramp up its AML controls, capital place and third social gathering administration.

It’s fascinating that business knowledgeable Jonah Crane stated “each financial institution with a big BaaS program will see some kind of regulatory motion over the subsequent yr.”

For the fintech firms that depend on these banks for banking providers, that is unhealthy information. Constructing redundancy into your banking partnerships is now important.

Featured

OCC says Blue Ridge in ‘troubled situation’ over BaaS

By Catherine Leffert

The Virginia financial institution is considered one of three which were publicly admonished by regulators this week as a consequence of issues associated to their banking-as-a-service packages.

From Fintech Nexus

> What your B2B buyer actually desires

By Tony Zerucha

As B2B cost expertise catches as much as different areas of fintech, TreviPay CEO Brandon Spear stated thrilling developments are rising. In late 2023, TreviPay launched the B2B Patrons Funds Choice Examine. It updates comparable analysis performed in 2019.

> The Evolution of Funds Rails: Shaping the Way forward for Monetary Providers

By Sameer Danave

The funds panorama is present process a major shift proper method with new funds rails gaining extra market share. And now we have solely simply begun.

Podcast

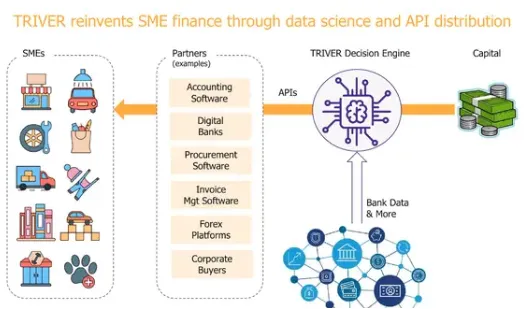

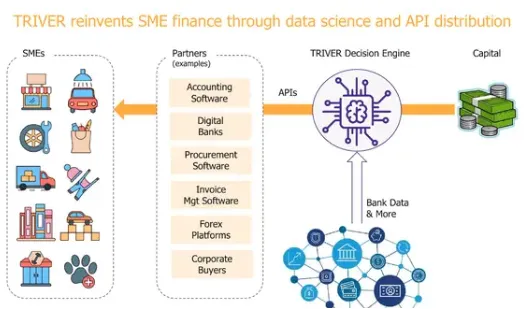

Podcast: Constructing fashionable digital lending throughout Capital One, Barclaycard, Funding Circle, and TRIVER, with TRIVER CEO Jerome Le Luel

Hello Fintech Architects, Welcome again to our podcast collection! For people who wish to subscribe in your app of alternative, you’ll be able to…

Additionally Making Information

To sponsor our newsletters and attain 220,000 fintech lovers together with your message, contact us right here.