The worldwide cryptocurrency market rose 0.62% over the previous 24 hours, extending its 2.76% weekly acquire. The important thing drivers behind the upward pattern are expectations of a Fed charge lower, capital rotation from BTC to altcoins, and a surge in derivatives buying and selling quantity.

In response to our evaluation, one of the best cryptos to purchase now are: OpenLedger ($OPEN), Increase ($BOOST), and Bedrock ($BR). The following value rallies of those alts might be linked to the broader altcoin market barely outperforming Bitcoin on the day. At this time’s Altcoin Season Index studying of 52/100 and Bitcoin Dominance studying of 57.55% recommend that altcoins are gaining momentum, missing solely a decisive breakout.

Crypto’s 24-hour correlation with the Nasdaq-100 hit +0.72, its strongest fairness hyperlink since final month. This was triggered by the most recent U.S. jobs information, which confirmed a spike in unemployment ranges at 4.3%, growing the chances of a Fed charge lower for September to 97%. Decrease charges sometimes increase the marketplace for threat belongings like cryptocurrencies. Merchants are positioning themselves for simpler financial coverage. Nonetheless, if August’s CPI information, which can be launched on September 11, exhibits greater inflation, then it might reverse rate-cut bets.

The drop in BTC dominance led to altcoins capturing 63% of the 24-hour spot buying and selling quantity, which surged to $289 billion on the again of charge lower expectations. Nonetheless, open curiosity in perpetuals fell 3.68%, indicating warning in regards to the rally’s sustainability. In the meantime, stablecoin provide hit $278 billion, offering dry powder for alt inflows.

At this time’s Finest-Performing Cryptos: $OPEN, $BOOST, $BR

| Crypto | 24h Value Change | Present Value | 2025 Forecast Vary | Avg. 2025 Value | ROI Potential (vs. now) | Danger Components |

|---|---|---|---|---|---|---|

| OpenLedger (OPEN) | +153.31% | $1.30 | $1.12 – $2.27 | $1.54 | +18.46% | Group/early investor unlocks (dilution threat) |

| Increase (BOOST) | +19.64% | $0.1131 | ~$0.09639 (end-2025) | $0.09639 | –14.8% | Submit-listing corrections, low market cap volatility |

| Bedrock (BR) | +5.79% | $0.0756 | $0.0561 – $0.0849 | $0.0637 | +8.26% | Overbought RSI, short-term profit-taking stress |

1. OpenLedger (OPEN)

OPEN surged 153.31% up to now 24 hours, considerably outpacing the broader market’s acquire. Key drivers behind the rally embrace OPEN’s Binance debut, momentum surrounding its AI-related partnership, and speculative demand round its tokenomics.

OPEN was listed on Binance’s spot market on September 8, buying and selling in opposition to USDT, USDC, BNB, FDUSD, and TRY. The change’s HODLer Airdrop marketing campaign distributed 10 million OPEN tokens, equal to 1% of its complete provide, to customers who staked BNB on the platform. This created buy-side stress pre-listing. Tier-1 change listings sometimes set off short-term volatility as liquidity surges. OPEN’s 24-hour buying and selling quantity surged to $784 million in consequence, with a turnover ratio of two.84, which displays frenetic buying and selling, additional amplified by airdrop hunters and speculative inflows.

On August 6, OpenLedger introduced a partnership with Belief Pockets, aiming to combine AI-driven pockets options to the protocol, akin to natural-language command execution and automatic on-chain actions. This collaboration positions OPEN as an infrastructure for mass-market AI and Web3 adoption. Belief Pockets’s 200M+ consumer base might drive large demand for OPEN, which is used for fuel charges and AI service funds on the OpenLedger community. Merchants have to be careful for pilot launch timelines, that are anticipated in October, and consumer adoption metrics.

OPEN’s tokenomics allocates 66% of its circulating provide to neighborhood and ecosystem rewards, incentivizing information contributors and AI mannequin builders. OpenLedger’s proof-of-attribution (PoA) consensus ensures clear income sharing, contrasting with centralized AI platforms like OpenAI’s ChatGPT or Google’s Gemini. Which means that merchants could also be pricing within the token’s long-term utility, however the 21.5% circulating provide of 215.5 million OPEN creates shortage narratives. Nonetheless, unlocks for core staff members and early adopters over 12 months might pose future dilution dangers.

On the time of writing, OpenLedger (OPEN) is buying and selling at $1.30, representing a 133.34% enhance within the final 24 hours. In response to our technical evaluation primarily based on its present market value, in 2025, OPEN is anticipated to vary palms in a buying and selling channel between $1.12 (Low) and $2.27 (Excessive), with a median annualized value of $1.54.

2. Increase (BOOST)

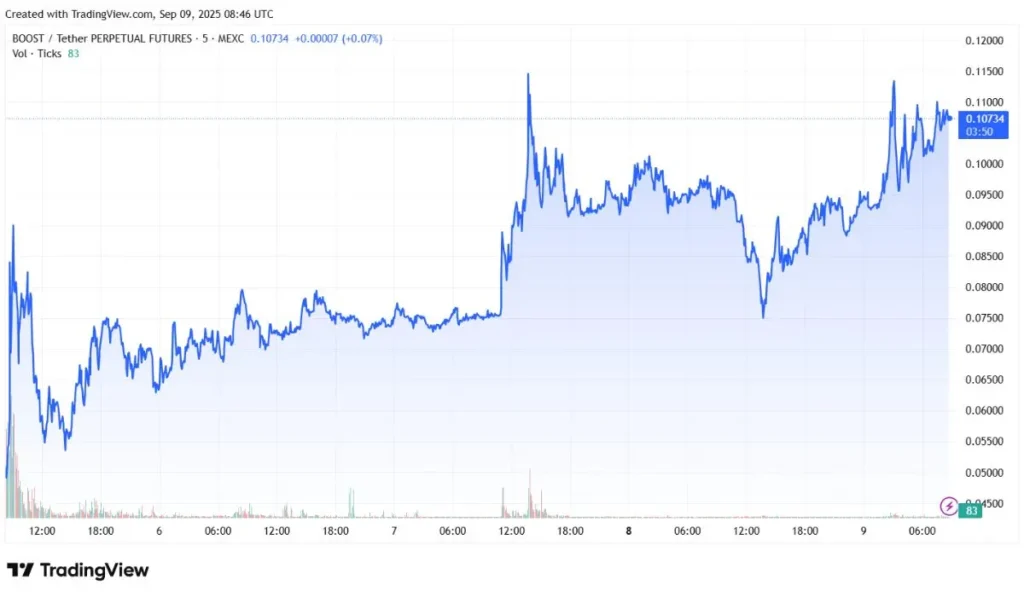

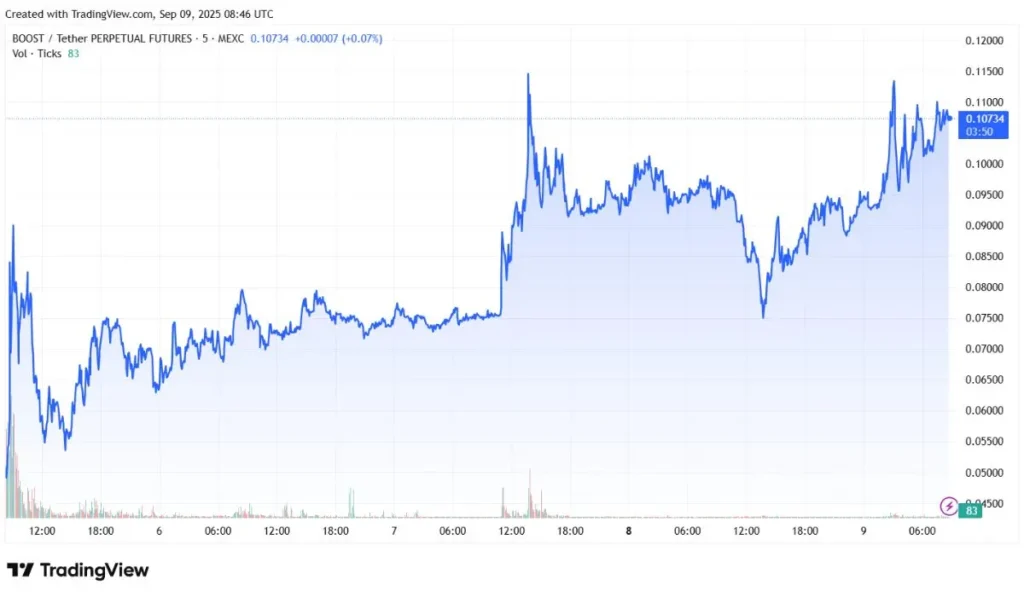

The value of BOOST rose 19.64% within the final 24 hours, outperforming each its 7-day and 30-day features. The important thing drivers behind the rally are Binance Alpha itemizing, DEX integration on OKX change, and broader capital rotation into altcoins.

BOOST was listed on Binance Alpha on September 5. Traditionally, change listings on tier-1 platforms can set off short-term value surges on account of elevated accessibility and visibility. Merchants typically front-run liquidity occasions, creating immense purchase stress. With BOOST’s 24-hour buying and selling quantity hitting $51.3 million and a turnover ratio of three.01, the itemizing is prone to have amplified FOMO for the token. Be careful for post-listing promote stress, as 60% of recent token listings have witnessed 15-30% corrections inside 48 hours of going stay on exchanges.

The Increase community was built-in with OKX DEX on September 5, rewarding the change’s customers for finishing sure duties and buying and selling BOOST tokens. Whereas this system incentivizes token utilization, some merchants could capitalize on the chance by wash buying and selling their rewards, which inversely contributes to quantity spikes however creates synthetic demand. The 19% drop in 24-hour quantity hints at early profit-taking by traders.

The Altcoin Season Index’s 30.7% surge in 30 days signaled capital rotation from BTC to small-cap tokens like BOOST. The token’s low market cap of $17 million makes it vulnerable to volatility throughout alt rallies. Nonetheless, its 121% 7-day acquire means that it’s absorbing speculative flows significantly better than its friends. Merchants are suggested to watch the order e book depth on September 6 and seven for additional readability.

On the time of writing, Increase (BOOST) is buying and selling at $0.1131, representing a 115.27% enhance within the final 24 hours. In response to our technical evaluation primarily based on its present market value, in 2025, MYX is anticipated to commerce at $0.09639 by the tip of 2025.

3. Bedrock (BR)

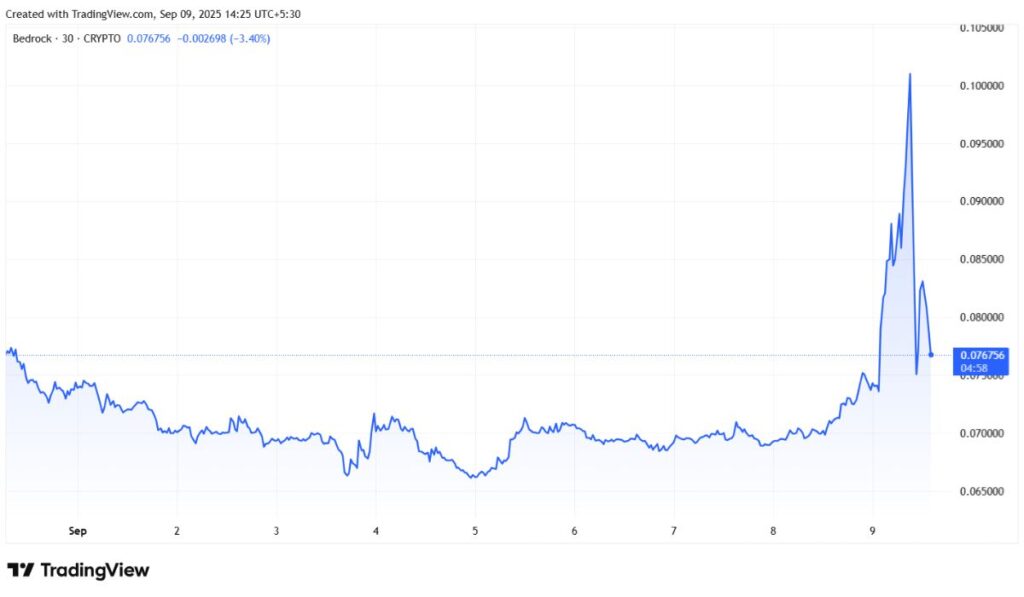

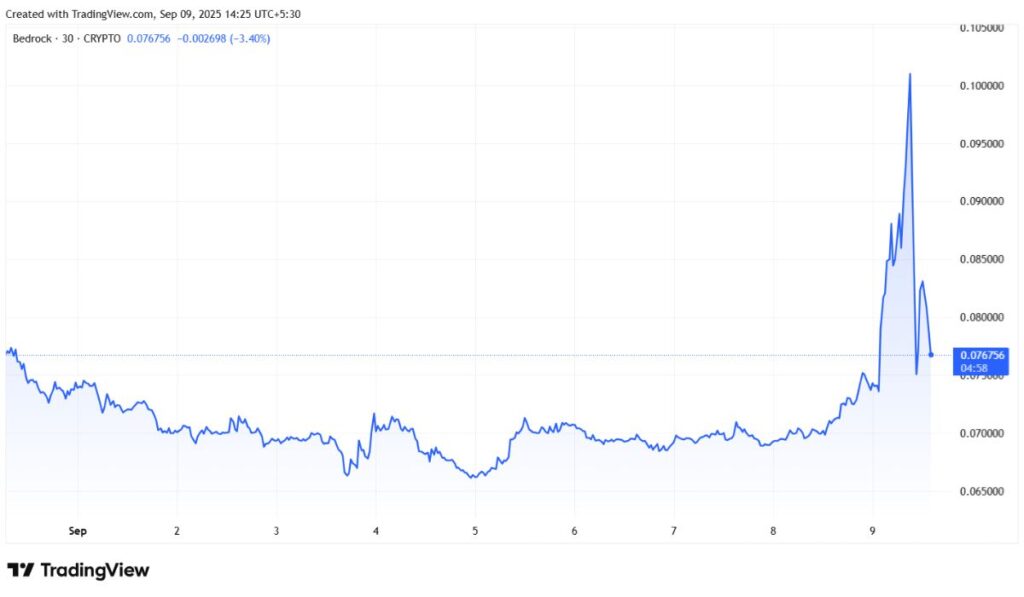

BR’s value rose 5.79% over the past 24 hours, extending its 5.8% weekly acquire and 47.8% month-to-month rally. The important thing drivers behind the surge are change itemizing increase, buying and selling incentives, and constructive technical momentum.

BR was listed on the INDODAX change on July 29, with deposits opening on July 30 and buying and selling going stay on July 31. This expanded Bedrock’s accessibility to over 7.5M+ of the platform’s customers in Asia. Trade listings typically set off short-term shopping for from new traders and arbitrage bots. BR’s 24-hour buying and selling quantity surged 495% to $48.5 million. Nonetheless, tokens paired with IDR typically see thinner liquidity, growing volatility dangers post-listing hype.

PancakeSwap’s BR/USDT pool provided a 50% price rebate for high-volume merchants till July 26, whereas Binance Alpha Factors marketing campaign incentivized BR accumulation. These applications helped increase BR’s buying and selling exercise, with the token dominating 64% of Binance Alpha token quantity final week. Whereas this created an upward value stress, it dangers wash buying and selling distortions. Its 1-hour value drop charge suggests profit-taking as rebates expired.

BR’s 14-day RSI at the moment sits at a impartial vary of 67.6, however its 7-day RSI is in overbought circumstances at 73.6. Its value continues to carry above the 30-day SMA at $0.0647, however the adverse MACD histogram indicators weakening momentum. Whereas the 30-day uptrend stays intact, short-term indicators warn of exhaustion. An in depth under the 7-day SMA of $0.0715 might set off deeper value corrections, with the 61.8% Fibonacci degree of $0.0696 serving as its subsequent assist zone.

On the time of writing, Bedrock (BR) is buying and selling at $0.0756, representing a 57% enhance within the final 24 hours. In response to our technical evaluation primarily based on its present market value, in 2025, BR is anticipated to vary palms in a buying and selling channel between $0.0561 (Low) and $0.0849 (Excessive), with a median annualized value of $0.0637. This might end in a possible ROI of +8.26% over its present charge.

Last Ideas on Finest Cryptos To Purchase At this time

At this time’s best-performing crypto belongings – $OPEN, $BOOST, and $BR – are rallying on the again of altcoins narrowly outperforming Bitcoin this week. BTC dominance dipped to 57.55% whereas the Altcoin Season Index rose to 51/100, suggesting that alts have a slight edge however lack momentum to set off a definitive alt season.

Whereas altcoins are gaining momentum, Bitcoin stays the market’s anchor. Merchants are constantly testing high-beta performs, however cautiously. In the meantime, centralized exchanges are funneling liquidity into newly listed tokens like OPEN, BOOST, and BR, creating concentrated alt rallies.

The September 9 U.S. jobs report revealed a 70%, amplifying bets for a 50-basis-point charge lower by the Federal Reserve on the September 16-17 assembly. Traditionally, cryptocurrencies outperform throughout rate-cut cycles on account of a weaker greenback and liquidity inflows into threat belongings, hinting at a possible altcoin rally within the playing cards.

Readers ought to word that cryptocurrencies are extremely speculative and risky belongings, and it is strongly recommended that you just conduct correct due diligence and search professional opinion earlier than investing choice. Moreover, the contents of this text are for informational functions and shouldn’t be construed as funding recommendation.