JPMorgan has simply dropped a daring goal for $BTC: $165K. The agency cited gold’s record-setting run and the rising ‘debasement commerce’ as tailwinds.

On the similar time, Uptober resides as much as its title, with Bitcoin blasting by way of $120K regardless of the U.S. authorities shutdown, proving simply how resilient this market has change into.

Traditionally, when Bitcoin asserts dominance like this, it doesn’t take lengthy for capital to rotate into the greatest altcoins, as that’s typically the place the bigger positive factors emerge.

With momentum constructing, sizzling alternate options like Bitcoin Hyper ($HYPER), Finest Pockets Token ($BEST), and Aster ($ASTER) are catching consideration as potential breakout performs throughout This autumn.

JPMorgan’s $165K Name + Uptober Momentum

JPMorgan analysts forecast $BTC climbing to $165K by benchmarking it in opposition to gold on a volatility-adjusted foundation.

Their thesis is straightforward: if gold can rip to report highs on foreign money debasement fears, Bitcoin (the tougher, extra transportable various) ought to ultimately catch up. That’s what analysts seek advice from because the ‘debasement commerce,’ the place buyers hedge in opposition to fiat erosion by piling into scarce property like gold and Bitcoin.

Establishments are nonetheless internet patrons through CME futures, although retail has been main the cost. JPMorgan’s mannequin suggests Bitcoin stays undervalued by about $45K in comparison with gold.

On the charts, Uptober is firing but once more. Bitcoin already broke $120K, extending a run that matches with historic October tendencies, the place Bitcoin has been inexperienced 10 out of 12 instances in existence.

Even the US authorities shutdown, which left the SEC and CFTC underpowered, hasn’t dented momentum. If something, it’s underscored Bitcoin’s resilience. When $BTC units the tone, liquidity typically rotates into the highest altcoins.

With structural assist for Bitcoin now clear, buyers are eyeing these three new cryptocurrency initiatives with outsized upside potential throughout the subsequent leg increased:

1. Bitcoin Hyper ($HYPER) – First Actual Bitcoin Layer 2

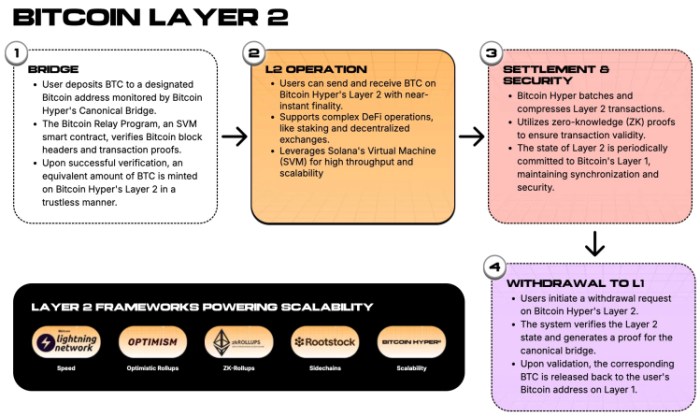

Bitcoin Hyper ($HYPER) is behind the primary real Bitcoin Layer 2. It’s not a facet chain, not wrapped $BTC, however a full execution layer powered by Solana’s Digital Machine (SVM).

The mission makes use of a trustless bridge to mint $BTC on Hyper, enabling sub-second transactions with near-zero fuel charges. ZK-proofs repeatedly anchor exercise again to Bitcoin Layer 1, holding the community safe whereas unlocking the pace and adaptability $BTC has all the time lacked.

Which means Bitcoin is now not only a ‘retailer of worth.’ It could lastly host dApps, meme cash, and DeFi. For merchants, that’s an enormous deal. If JPMorgan’s $165K projection performs out, $HYPER is positioned to soak up the following wave of liquidity as Bitcoin demand spills into higher-beta performs.

💡 Learn to purchase Bitcoin Hyper in our information.

Bitcoin Hyper is successfully attempting to present Bitcoin its ‘Ethereum 2017 second,’ by reworking it from a vault right into a usable monetary layer.

With Uptober momentum carrying $BTC increased, $HYPER’s narrative seems more and more aligned.

🏃♀️➡️Get in early on the official Bitcoin Hyper presale now.

2. Finest Pockets Token ($BEST) – Web3 Pockets Energy Play

Finest Pockets has already carved out a status as one of the crucial superior software program wallets available on the market, providing a cleaner, extra intuitive various to MetaMask.

With options like built-in presale entry, built-in portfolio monitoring, and top-tier Fireblocks MPC-CMP safety, it’s rapidly change into a go-to hub for crypto newcomers and veterans alike.

The Finest Pockets Token ($BEST) is designed to take that ecosystem to the following degree. Because the native asset, $BEST powers decreased transaction charges, early entry to new meme cash on presale, staking rewards, and ecosystem governance. It successfully ‘gamifies’ pockets engagement.

💡 Learn to purchase Finest Pockets Token in our step-by-step information.

One of the extremely anticipated additions is Finest Card, a crypto debit card that lets you spend instantly out of your pockets stability wherever Mastercard is accepted, full with cashback rewards.

Mixed with the presale hub, this may make Finest Pockets a one-stop store the place Web3 meets on a regular basis finance.

As Uptober drives contemporary adoption, crypto wallets are the primary gateway, and demand ought to explode.

🚀 Go to the Finest Pockets Token presale immediately to seize a stake on this development.

3. Aster ($ASTER) – Excessive-Quantity DEX Challenger

If Uptober retains fueling danger urge for food, decentralized exchanges are set to seize a serious share of the flows. And Aster ($ASTER) is already proving it could possibly deal with the surge.

The multi-chain DEX runs on BNB, Ethereum, Solana, and Arbitrum, providing perpetuals, spot buying and selling, and distinctive options like hidden orders.

Its huge draw is MEV-free, one-click execution in Easy Mode, whereas Professional Mode caters to superior merchants with inventory perps and grid methods.

The volumes inform the story. Aster processed $89B in perpetual trades during the last 24 hours and $463.1B over the previous week. Spot exercise is surging too, hitting $1.11B in quantity, whereas the mission’s market cap sits at $3.2B. Few DEXs outdoors of Hyperliquid can rival that tempo.

Aster is aiming to scale even additional. The workforce is rolling out Aster Chain, a blockchain constructed particularly for buying and selling utilities – not one other generalized EVM chain, however a community targeted on liquidity, transparency, and smoother UX.

They’re additionally planning community-guided buybacks that recycle revenue into $ASTER with out locking the mission into inflexible schedules.

With backing from YZi Labs and open endorsement from Binance founder CZ, Aster has heavyweight credibility.

And with $BTC momentum driving leverage demand, $ASTER seems primed to maintain absorbing liquidity throughout this Uptober rally.

This text isn’t monetary recommendation. Crypto carries inherent dangers so please do your personal analysis (DYOR) and by no means make investments greater than you might be prepared to lose.

Authored by Aidan Weeks, NewsBTC — https://www.newsbtc.com/information/best-altcoins-to-buy-jpmorgan-predicts-165k-bitcoin