The enterprise capital agency F-Prime launched their 2024 State of Fintech report at the moment. It makes for some very attention-grabbing studying.

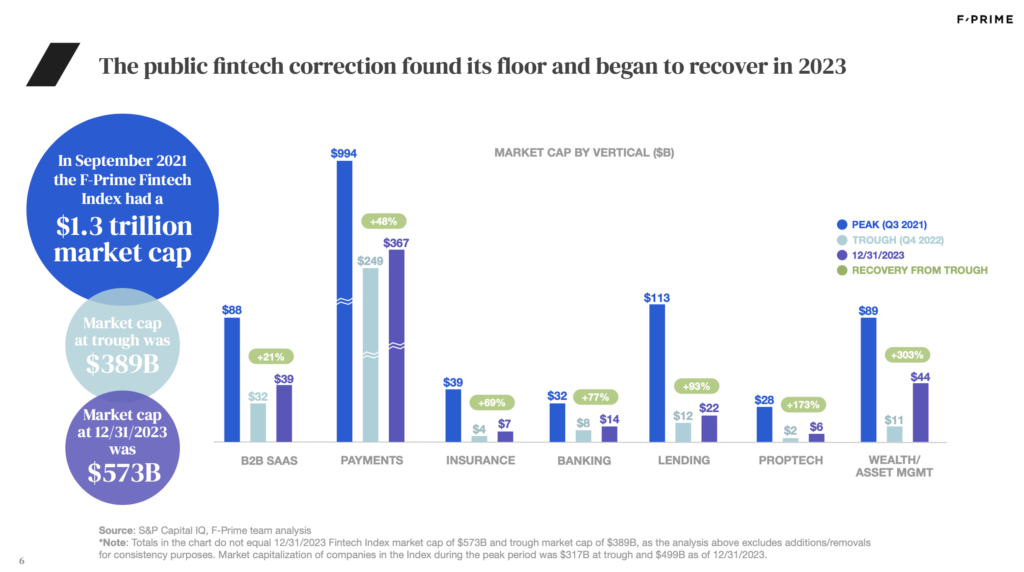

It takes us by means of the state of fintech at the moment with a deal with valuations and funding rounds. The graphic beneath reveals the correction in public fintech valuations throughout completely different segments. Whereas we’re a great distance away from the height of Q3 2021, we’re above the trough of This fall 2022 in all fintech segments.

This correction has not likely made it to the non-public markets but the place valuations are down and variety of funding rounds are additionally down throughout all phases besides seed.

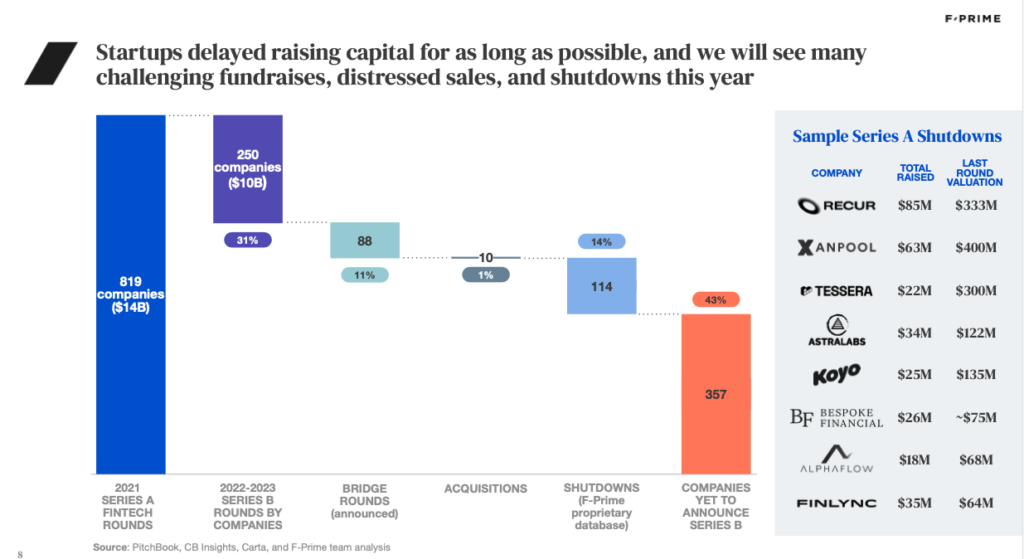

Essentially the most attention-grabbing chart of all is the one beneath. This reveals 819 fintech corporations elevating a collective $14 billion in Sequence A funding in 2021. Solely 250 of those corporations raised a Sequence B in 2022 or 2023. Some raised a bridge spherical, some have shut down however nearly half have but to announce any form of comply with on spherical. This portends lots of motion in M&A and certain shutdowns in 2024, with hopefully just a few profitable Sequence B rounds.

If your organization was in the marketplace in 2023 you had been probably out of luck with the least quantity of M&A exercise of the final 5 years. In 2023 M&A quantity was down a staggering 72% from 2021.

F-Prime additionally checked out fintech disruption throughout verticals breaking every down into how a lot disruption has taken place. It selected cell banking, enterprise banking and open finance because the three areas the place disruption has been embraced by each fintechs and incumbents. We’re nonetheless ready for significant disruption to occur in crypto, real-time funds and generative AI.

The six main fintech tendencies that F-Prime is monitoring for 2024 are:

- Funds tooling

- Vertical APIs

- Digitization of the wealth tech stack

- AI for skilled providers

- Rising markets fintech

- Stablecoins

F-Prime can be the creator the F-Prime Fintech Index, the main index for publicly traded fintech corporations. The index covers 49 international fintech corporations with a complete market cap of $561 billion. Whereas the index is understandably beneath its peak of late 2021, it noticed a rebound in 2023, with the index up 114% for the yr.

Now we have not seen a serious fintech IPO within the final two years however the tide may very well be turning with many giant fintechs contemplating an IPO within the close to future.

You possibly can obtain the total report by offering your e-mail tackle right here.