Following a rejection at $4,946 on August 24, Ethereum (ETH) is now buying and selling within the low $4,000 stage. Nevertheless, some analysts are nonetheless hopeful that ETH is prone to surge past $5,000 within the coming weeks, because of its rising illiquid provide and optimistic exchange-traded fund (ETF) momentum.

Ethereum To Hit $5,500 In September?

In response to a CryptoQuant Quicktake put up by contributor Arab Chain, Ethereum’s newest upswing in August which pushed the digital asset from a spread of $3,700 – $4,000 to its newest all-time excessive (ATH) of $4,946, was largely buoyed by broader market rally and optimistic ETF inflows.

Associated Studying

The analyst famous that ETH reserves on Binance crypto trade witnessed a pointy uptick in August. The fast surge in influx of tokens to the trade reveals that holders are selecting to promote or take earnings at larger costs.

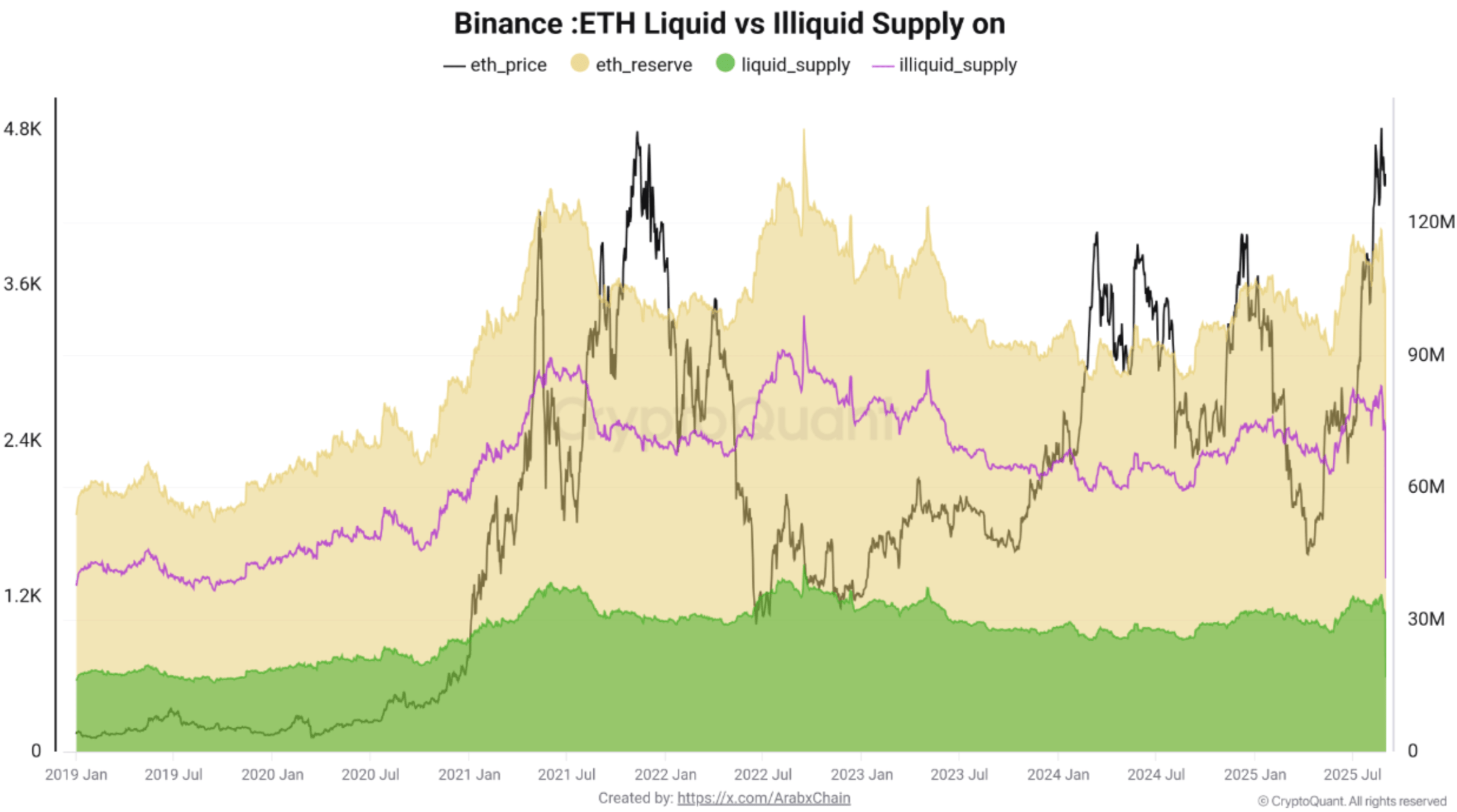

Arab Chain shared the next chart which reveals each liquid (inexperienced) and illiquid (beige) ETH provide. In response to the chart, the overwhelming majority of ETH provide stays illiquid, making a structural provide scarcity.

Then again, the chart reveals a slight improve within the liquid provide, suggesting {that a} portion of ETH has returned to circulation and will add to short-term promoting stress. The analyst remarked:

The general illiquidity of the provision reinforces the long-term bullish outlook. Quick-term cautionary indicators – rising Binance reserves mixed with a small improve in liquid provide – counsel a possible correction after the latest sturdy upswing.

If the expansion in ETH reserves on Binance reveals indicators of slowing down or withdrawals resume, the digital asset’s provide scarcity will stay pronounced. Consequently, a transparent and decisive break above the $4,800 resistance stage might propel ETH towards $5,200 – $5,500 within the close to time period.

The CryptoQuant analyst concluded by saying that September is prone to witness sideways to a barely bullish transfer for ETH between $4,300 to $5,000. Nevertheless, a failure to interrupt by way of the $4,800 stage – coupled with rising trade reserves – might elevate the potential for a correction to $4,200.

What’s In Retailer For ETH?

Whereas a breakout above $4,800 is feasible, some analysts are tempering their expectations by saying that ETH could check the psychologically necessary $4,000 stage earlier than resuming its uptrend.

Associated Studying

In the meantime, on-chain knowledge reveals whales accumulating ETH at report tempo. In response to a latest report, ETH whales added a whopping 260,000 ETH to their wallets on September 1.

Providing a extra bold prediction, Ethereum co-founder and ConsenSys CEO Joseph Lubin lately stated that “ETH will probably 100x from right here.” At press time, ETH trades at $4,429, up 2% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com