In accordance with CoinDesk Analysis’s technical evaluation information mannequin, Ether retreated 1.5% throughout Tuesday’s session as bears overwhelmed early bulls close to crucial resistance.

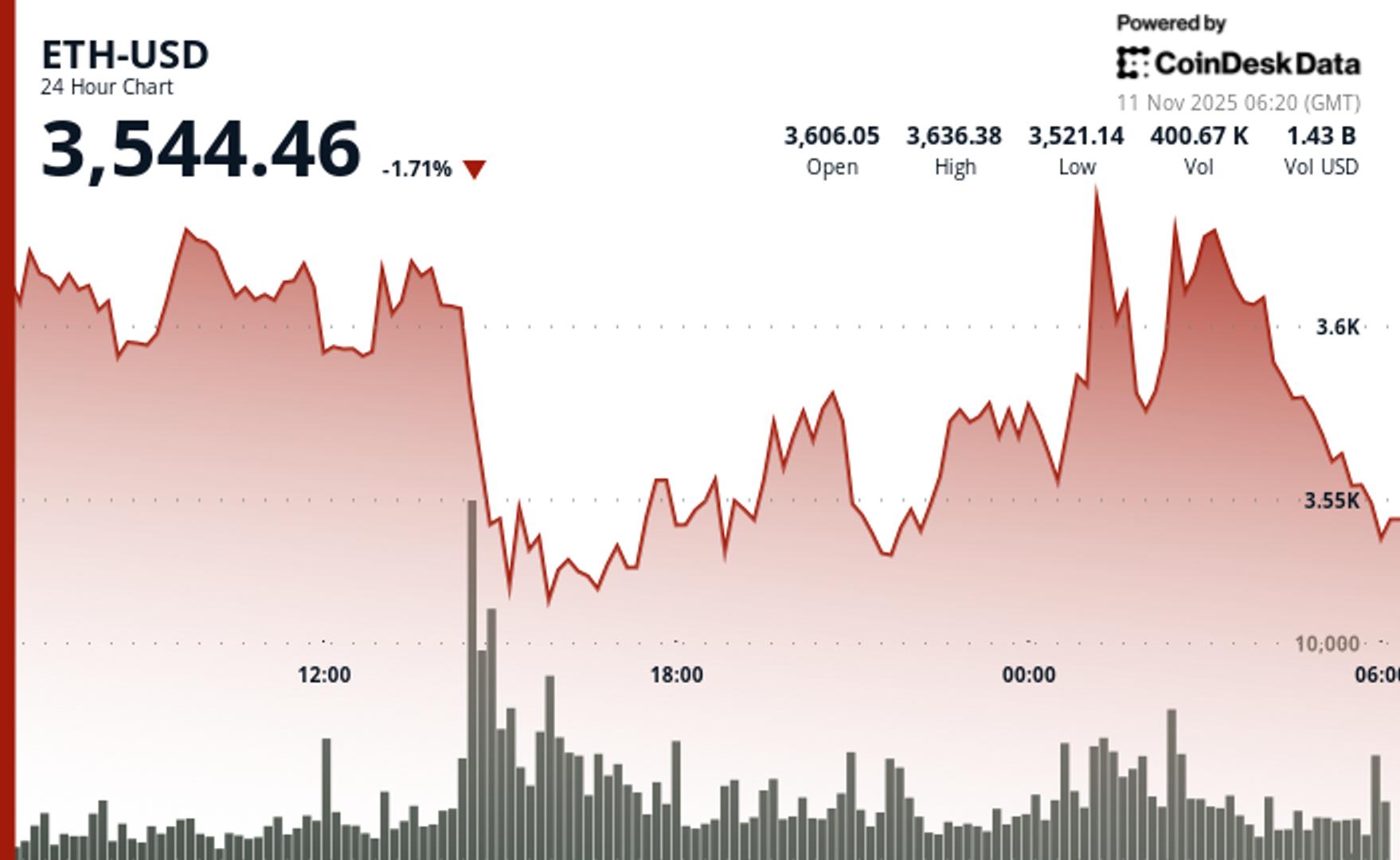

ETH plunged from $3,629 to $3,576 inside a $136 buying and selling vary as promoting quantity spiked 138% above regular ranges. The breakdown confirms bears now management the near-term route after weeks of consolidation.

The selloff accelerated after ETH rejected the $3,646 resistance stage throughout early morning buying and selling. Distinctive quantity of 338,852 contracts drove the decisive break under $3,590 assist. This key stage had beforehand offered dependable demand throughout latest volatility. ETH touched an intraday low of $3,532 earlier than stabilizing close to present ranges.

Value motion now exhibits decrease highs regardless of a number of restoration makes an attempt. The bearish construction emerged following the failed breakout try above $3,646. Quantity normalized in last hours, suggesting the brand new $3,565-$3,589 buying and selling vary displays real institutional promoting relatively than momentary liquidity gaps.

Technical Breakdown vs Institutional Accumulation: What Merchants Ought to Watch

Technical elements dominated Tuesday’s session as momentum indicators flashed warning alerts throughout a number of timeframes. The $3,646 rejection triggered cascading stops that overwhelmed latest institutional shopping for curiosity. Republic Applied sciences’ $100 million ETH allocation and BitMine’s 3.5 million token holdings offered inadequate assist in opposition to the technical breakdown.

The $3,590 assist failure marks a crucial shift in market construction for ETH bulls. This stage had served as a dependable demand zone throughout latest worth swings. With momentum deteriorating and quantity patterns confirming distribution, merchants now eye additional draw back testing earlier than any sustainable restoration emerges.

Key Technical Ranges Sign Warning for ETH

Help/Resistance: Main assist sits at $3,510-$3,530 cluster, with damaged $3,590 stage now performing as resistance

Quantity Evaluation: Breakdown quantity of 338,852 exceeded 24-hour common by 138%, confirming institutional promoting participation

Chart Patterns: Decrease excessive formation at $3,646 adopted by assist breakdown establishes bearish continuation setup

Targets & Danger/Reward: Speedy draw back goal sits at $3,510 assist, with additional weak spot towards $3,480-$3,500 zone doubtless

CoinDesk Index 5 (CD5) Market Evaluation – 10 November 03:00 UTC to 11 November 02:00 UTC

CD5 edged increased from $1,840 to $1,843 throughout unstable 24-hour buying and selling that featured excessive worth swings and distribution patterns throughout main crypto property, with the index touching $1,869 highs earlier than sellers emerged close to resistance ranges and drove costs again towards session averages.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.