Embedded Finance is remodeling the way in which monetary companies are delivered to prospects. In recent times, embedded finance has allowed non-financial suppliers to effortlessly combine monetary merchandise into their consumer journeys, growing the affect of fintech in our lives.

The ascendance of unicorns within the buy-now-pay-later area like Klarna and the dominance of cost options within the fintech agenda level to the overarching embedded finance pattern. The time period was first used within the funds business which is now making its manner as much as the worth chain of monetary companies like lending, wealth, playing cards and different associated areas. The recognition of embedded finance has drawn consideration to an unexplored marketplace for embedded wealth.

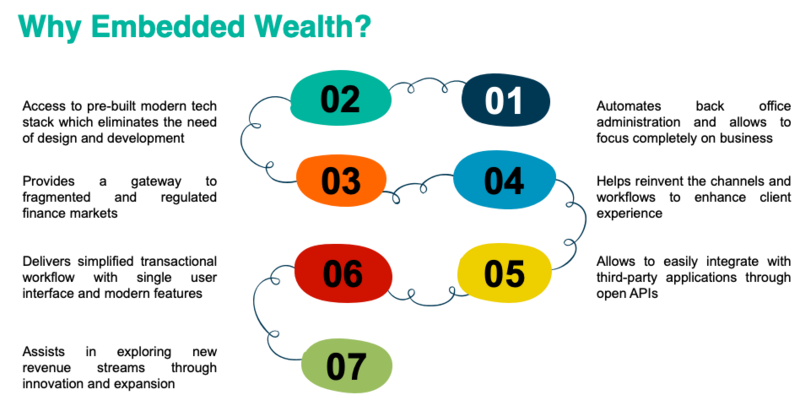

It permits platforms to effortlessly incorporate funding services into present presents or create new propositions primarily based on an investing stack given by API.

API-enabled wealth know-how is now broadly accessible at a decrease, extra inexpensive value for a lot of. Along with serving to firms to succeed in new and beforehand underserved prospects with their items and companies, embedded wealth suppliers are additionally enabling improved entry to capital markets, decrease value entry to portfolio administration, and robo-advisor know-how. Additionally, initiatives like PSD2 and open banking are popularising the creation and use of APIs fostering higher legal guidelines and innovation.

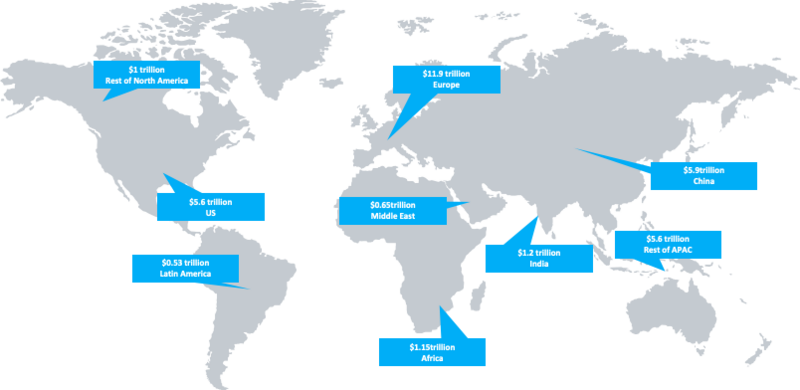

The embedded wealth market has the potential to deliver as much as $33 trillion in belongings. As per the analysis by Additiv, embedded wealth options would possibly generate $100 billion in charges. It couldn’t be lengthy till you should buy shares and shares collectively together with your meal deal of crisps, a sandwich, and a drink as a result of built-in wealth know-how is spreading its wings to broaden the affect to the smaller particulars of life.

Including Embedded Wealth To Your Buying Cart

As shoppers get accustomed to utilizing monetary merchandise supplied by well-known manufacturers, there’s a real alternative to extend entry to investing by embedded wealth.

Firms like Drivewealth and Alpaca are revolutionising the funding business each domestically and internationally. They supply B2B wealth platforms with modular options for fractional shares which can be accessible utilizing APIs. They now have non-financial gamers among the many tons of of firms which have built-in into their platforms.

The event of this open funding infrastructure facilitates enterprise product growth and shopper entry to the monetary markets. Drivewealth has thousands and thousands of subscribers within the UK and round 15 million buyer base worldwide regardless of not but being a family identify. Drivewealth additionally empowers the UK-based powers Tulipshare, the primary activist inventory brokerage that debuted in 2021.

Quite a lot of low-cost, mass-market brokerage companies that weren’t obtainable ten years in the past at the moment are in demand – facilitated by embedded wealth. Analysts foresee that monetary establishments, challenger banks, extra funds companies, and even firms like Walmart contemplate getting into the embedded wealth market. With the arrival of banking-as-a-service (BaaS), monetary and non-financial firms can simply combine banking companies into their ecosystem. A number of the BaaS suppliers equivalent to Railsbank, Solarisbank, Treezor, Inexperienced Dot, and so on. are disrupting the normal wealth administration choices by empowering fintech to innovate wealth choices for numerous buyer teams.

Nonetheless, challenger banks appear to be keen in embedding wealth as in comparison with conventional banks that are shifting slowly to adapt to the modifications introduced in by monetary know-how. A variety of wealth merchandise will probably be supplied by these platforms in direction of the top of 2022. A challenger financial institution finds it simple to combine an API into its banking app to supply a streamlined know-how stack and the power to design monetary merchandise swiftly. The product providing of a banking app could thus be simply expanded by embedded wealth, which ought to enhance person retention and probably appeal to new customers to the platform. A variety of merchandise and ongoing new options could also be each a key differentiation and a option to defend the price of the service in a market the place many service suppliers use a freemium mannequin.

For a enterprise (nearly all of fintech) seeking to monetize its prospects by subscriptions or recurring funds, including new items and companies will make the deal extra alluring and sticky for members that are essential for enhancing subscriber progress. Most significantly, funding has lifetime durations, thus this may present subscribers with long-term sustained worth.

Monetary companies have all the time had higher margins than different companies. For corporations that perceive the chance, billions of {dollars} await in earnings. New-age firms should not undervalue the extent of competitors and the regulatory complexity concerned in dealing with cash and belongings.

Existential points would possibly emerge if legacy monetary establishments lose market dominance and relevance within the new embedded panorama if they continue to be unaware of the menace.

In mild of this, a change is imminent and our notion of wealth and cash will change drastically.

Three Profitable Enterprise Alternatives for Embedded Wealth

The completely different use instances throughout the bracket of embedded wealth open the doorways to the excessive greenback worth market and spotlight the know-how that might be influential in driving embedded wealth options to the market.

The at the beginning use case includes the mixing of non-public finance administration options into purchasing and subscription administration experiences. Integrating options of non-public cash administration into purchasing and subscription administration experiences is the primary and most obvious use case. The inclusion of non-public finance administration parts would possibly actually assist the person by controlling their spending, in distinction to buy-now-pay-later programs that capitalise on emotions of urgency and promote impulsive purchases. The service provider would additionally profit for the reason that built-in wealth options would possibly help them in demonstrating to prospects that buying the product will save them cash by illustrating its high quality, sustainability, and longevity. Likewise, private finance administration options might stimulate the purchasers to pick the subscription fashions that are acceptable for his or her utilization – that would permit the service provider a possibility to realize secure money flows again and again.

Pension planning as a element of the job expertise is one other intriguing alternative/enterprise mannequin for embedded wealth options. The incorporation of pension planning toolkits into an organization’s intranet could profit the model recognition of the employer, the effectivity of the treasury’s pension accounting, and the proactive and productive retirement planning for workers. The worker could also be successfully guided by the nuances of the retirement financial savings selection by trendy interactive pension planning programs, they usually can then be assisted in selecting the choice that most closely fits their distinctive circumstances. Regardless that the accounting departments usually deal with the preparations for the workers’ retirement, growing worker data of pensions isn’t seen as a option to increase happiness amongst employees.

The third alternative focuses on offering seamless monetary administration for small companies. Smaller companies might battle with liquidity administration of their each day operations whereas bigger companies can afford to make use of expert groups of accountants. As an example, combining company credit score and funds helps assure the environment friendly and easy payback of small enterprises’ curiosity funds and loans. The plan is to make use of a portion of the proceeds from gross sales to repay the debt immediately. As an example, if a pizzeria spends €10,000 on a brand new range, they assure that 10% of every pizza bought would go in direction of repaying the credit score. On this state of affairs, embedded wealth would possibly help enterprise house owners in guaranteeing the viability of their operations by simplifying the mortgage phrases and payback schemes.

Embedded wealth has the potential so as to add important worth to the present system. Fintech is re-designing finance companies fostering innovation and altering the normal finance system. Evolving buyer expectations have supplied beneficial circumstances for this new probability to turn out to be broadly accepted. Adoption of this market will remodel the old-rooted set-up and make it useful for everyone- conventional banks, challengers and shoppers. It would empower each retailers and prospects with modern selections and alternatives within the embedded wealth space.