Key Takeaways

- El Salvador’s Bitcoin Workplace reported that it has bought 1098 BTC for almost $100 million over the previous week. This consists of 1,091 BTC purchased on Monday, the one largest transaction made by the nation since November 2022.

- The newest buy brings the Central American nation’s complete bitcoin holdings to 7,474 BTC, valued at roughly $676 million. This additionally contrasts with El Salvador’s $1.4 billion mortgage settlement with the IMF, which prohibits authorities acquisitions.

- IMF officers wrote in a latest report that El Salvador had not bought any new Bitcoin since February 2025, and the additions replicate consolidation throughout wallets managed by completely different authorities companies.

- Bitwise’s European head of analysis, Andre Dragosch, stated that continued bitcoin accumulation by sovereign nations like El Salvador and the Czech Republic might sign a possible shift in international monetary methods.

El Salvador is steadfast in sustaining its bitcoin accumulation technique. Amid a decline that noticed the apex crypto’s worth drop under the $90,000 mark for the primary time since April 2025, the Central American nation added 1098 BTC, price almost $100 million, to its coffers over the previous week.

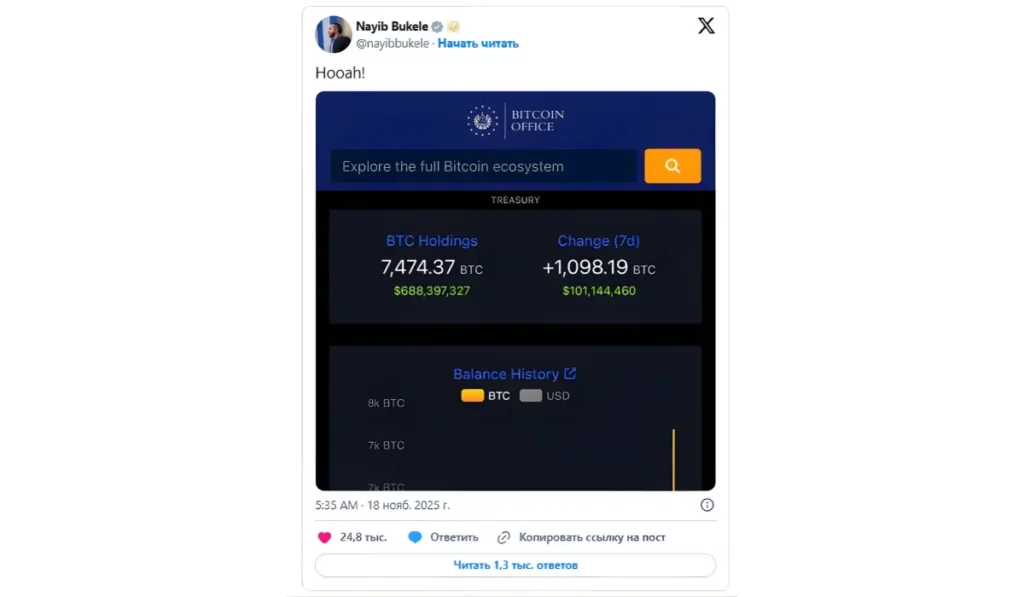

On Tuesday, President Nayib Bukele posted a screenshot on X exhibiting the federal government’s bitcoin holdings, which have elevated to 7,474 BTC, valued at roughly $676 million. The nation has been persistently shopping for 1 BTC day by day because the President first introduced the transfer in November 2022.

El Salvador Makes Largest Day by day Bitcoin Buy, the Nation’s Bitcoin Treasury Now Holds 7,474 BTC, Valued at $676 Million

In accordance with information from El Salvador’s Bitcoin Workplace, the federal government bought a complete of 1,098 BTC over the previous week, which incorporates the most important single-day buy of 1,091 BTC and ongoing day by day acquisitions.

Traditionally, El Salvador has continued to purchase Bitcoin even throughout market downturns, reflecting a long-term technique aimed toward enhancing the nation’s nationwide reserves. Nonetheless, the acquisition conflicts with the federal government’s mortgage settlement with the Worldwide Financial Fund (IMF). The $1.4 billion funding deal from December 2024 explicitly prohibits the general public sector from utilizing or accumulating any bitcoin.

In July, two IMF officers confirmed that the nation had not purchased any Bitcoin since February. An official report by the financial institution prompt that the rise in El Salvador’s holdings displays consolidation throughout varied authorities wallets, indicating that these weren’t recent purchases from the open market.

Stacy Herbert, director of El Salvador’s Bitcoin Workplace and co-host of the Orange Capsule podcast, beforehand declared that the nation won’t cease its bitcoin treasury technique, regardless of the IMF deal. In March, she wrote in an X submit that individuals are trusting the IMF’s empty phrases over El Salvador’s on-chain transactions.

She stated that bitcoin is the “reverse of presidency management” and President Bukele embraced it as authorized tender in September 2022, “to not consolidate energy, however to distribute it”. Stacy beforehand described bitcoin as “freedom, transparency, and particular person empowerment”.

Czech Republic Central Financial institution Provides $1 Million in Bitcoin, USD Stablecoins, and Tokenized Deposits to Digital Asset Treasury

El Salvador’s newest addition got here days after the Czech Nationwide Financial institution (CNB) introduced a $1 million digital asset treasury buy. In accordance with the central financial institution, its “take a look at portfolio,” providing first direct publicity to cryptocurrencies, consists of bitcoin, a tokenized financial institution deposit, and USD-pegged stablecoins.

The transaction, which was made exterior of the financial institution’s worldwide reserves, is aimed toward offering it with sensible expertise in dealing with crypto property moderately than a sign of a shift in its coverage course or reserve technique.

CNB governor Ales Michl stated the central financial institution began its “take a look at pilot” in early 2025 to discover how decentralized digital currencies could complement conventional asset holdings. The initiative was permitted by the financial institution’s board on October 30, following an inside evaluation that concluded that crypto property are rising in demand amongst institutional portfolios worldwide.

Michl famous that the venture’s objective is to check the processes concerned in managing digital property, from custody and personal key administration to safety and Anti-Cash Laundering (AML) compliance. The financial institution vows to share its findings over the subsequent two to 3 years.

The central financial institution has clarified that its bitcoin and crypto purchases won’t have an effect on its EUR €140 billion overseas reserves, because the $1 million allocation shields it from crypto market volatility.

The CNB will research how blockchain expertise influences funds, settlement, and accountability, whereas its technical group will take a look at pockets operations, multi-sig controls, and on-chain audit procedures.

Every token within the CNB’s digital asset reserve serves a definite objective, with bitcoin representing decentralized worth, stablecoins offering fiat-backed stability, and the tokenized deposit performing as a bridge to regulated monetary markets.

Michl reiterated that the Czech koruna will stay the nation’s authorized tender, however the central financial institution needs to arrange for the digital age by embracing new types of cash and investments.

Bitwise Analyst Suggests Nation-State Bitcoin Adoption May Sign a Shift in World Financial Insurance policies

Digital asset supervisor and ETF issuer Bitwise’s European head of analysis, Andre Dragosch, argued that the pattern of sovereign nations shopping for the dip might sign a possible shift in international monetary methods.

Bitcoin is at the moment buying and selling within the $90,000 – $91,000 vary, with the drawdown from the $100,000 mark triggered by panic promoting amongst short-term holders (STHs).

These wallets have been holding the asset for lower than three months and had been in a loss, leading to 148,000 BTC being bought in what has turn into the most important liquidation occasion since April 2025.

Whereas El Salvador’s $100 million bitcoin purchase gives a much-needed reduction within the quick time period, it was overshadowed by a broader de-risking occasion. The market is now testing if long-term holders (LTHs) will take in the promoting stress to purchase bitcoin from the open market at discounted costs.

On the time of writing, Bitcoin (BTC) is buying and selling at $91,456 – down 4.37% in 24 hours.