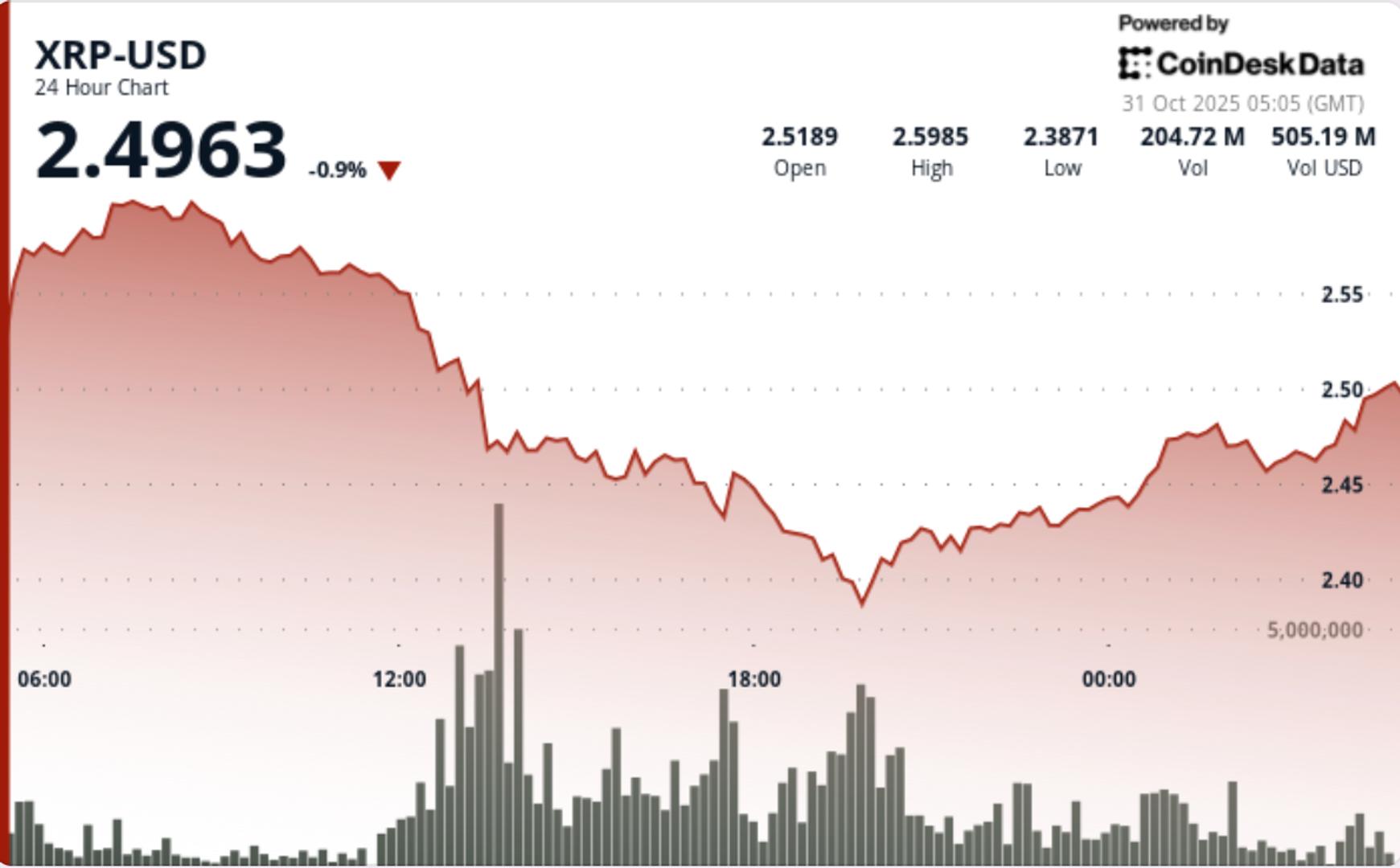

XRP broke under the $2.50 help throughout Tuesday’s session, sliding 5% to $2.47 as institutional promoting strain accelerated throughout main exchanges. The breakdown confirmed a decisive shift in construction following weeks of tight consolidation, with quantity and chart patterns now aligning towards a deeper corrective part.

Information Background

- The token’s 24-hour session noticed costs tumble from $2.60 to $2.47, marking one of many largest single-day declines this month.

- The breach of the $2.50 psychological stage triggered a wave of algorithmic and institutional promoting, propelling buying and selling exercise to 169 million tokens, up 158% versus the 24-hour common.

- XRP’s market underperformance contrasts with broader crypto energy, suggesting rotation away from altcoins as threat urge for food cools amid waning speculative participation.

- The breakdown strengthened robust overhead resistance at $2.60, the place repeated rejection factors over latest weeks had capped upside momentum.

Value Motion Abstract

- The selloff unfolded in structured phases by way of Tuesday’s buying and selling. The preliminary breakdown started at 13:00 UTC, when heavy promote quantity drove value decisively by way of the $2.50 help, igniting a cascade that prolonged to intraday lows close to $2.38.

- Subsequent value stabilization fashioned across the $2.43–$2.46 vary, suggesting the early phases of a possible consolidation base.

- Brief-term momentum readings indicated exhaustion as quantity tapered into the shut, a dynamic usually previous interim pauses in trending declines.

- On the microstructure stage, 60-minute knowledge confirmed two distinct distribution waves as XRP slipped from $2.472 to $2.466.

- Successive hourly quantity spikes of two.8M and a pair of.6M tokens—every exceeding 300% of hourly averages—confirmed continued institutional management over intraday flows.

Technical Evaluation

- XRP’s breakdown marks a continuation of its lower-high, lower-low construction that started after the failed retest of the $2.60 resistance.

- The session’s 8.8% volatility vary underscores aggressive liquidation and profit-taking from bigger holders, aligning with latest on-chain alerts of change inflows.

- Momentum indicators equivalent to RSI have shifted into neutral-to-bearish territory, whereas MACD reveals increasing draw back divergence. The $2.40–$2.42 space now acts as rapid technical help, and an in depth under this band might open additional draw back towards $2.30–$2.33.

- Quantity analytics stay pivotal— the 169M turnover throughout breakdown confirms institutional participation quite than retail panic, whereas declining late-session exercise implies that the majority of distribution might already be full.

What Merchants Ought to Watch

- Merchants are intently monitoring whether or not $2.43–$2.46 can evolve right into a secure accumulation zone or if a clear break under $2.40 accelerates capitulation.

- Reclaiming the $2.50 stage can be required to neutralize short-term bearish momentum and reestablish a constructive setup focusing on $2.60.

- Till then, rallies towards resistance are prone to face provide from trapped longs and short-term profit-takers.

- Broader sentiment stays cautious amid risk-off rotation, with derivatives positioning displaying declining open curiosity and modest upticks in brief publicity throughout perpetual futures markets.