Earlier than you begin (Should Learn!)

Welcome to the Drawdown Supervisor (DDM), an professional advisor utility designed to help merchants within the strategic administration of fairness drawdowns. Drawdowns, a decline from peak to trough within the worth of an funding or buying and selling account, might be notably difficult and dangerous, particularly for methods that make the most of grid techniques or martingale approaches. The DDM gives an answer to mitigate these dangers by offering an clever system to handle and exit positions in a drawdown state of affairs successfully. The use case for the DDM lies in its capacity to detect and counteract unfavorable fairness dips robotically, thus serving to merchants to stay to their danger administration plans and protect capital. It’s value mentioning that DDM won’t place any automated trades, but will leverage on any current or future trades, and use the inbuilt algorithm to chop loses, towards the winners.

Danger Administration Disclosure

The Drawdown Supervisor (DDM) is a complicated device designed to assist merchants in managing fairness drawdowns by trying to stability and mitigate losses by clever commerce administration. Nonetheless, it’s important to grasp that the efficacy of drawdown administration is contingent upon quite a few market situations and the specifics of your buying and selling technique. The DDM doesn’t assure the prevention of losses, notably in extremely leveraged positions the place market volatility can exponentially amplify each positive factors and losses. Excessive leverage can result in speedy losses that exceed the account stability and the DDM’s capability to handle in real-time. As such, customers ought to make use of the DDM inside a complete danger administration technique and never depend on it as a failsafe measure towards all types of drawdown. It’s the dealer’s duty to set acceptable leverage ranges and to grasp that the DDM operates throughout the constraints of the market and the parameters set by the consumer. All buying and selling methods and instruments carry the danger of loss, and the DDM isn’t any exception. Merchants ought to all the time be ready for the potential for monetary loss, whatever the instruments in use.

The Drawdown Supervisor Methodology

Grid, martingale, and place merchants are not any strangers to the nervousness that comes with watching a pattern transfer towards their positions, resulting in a number of trades deep in drawdown. Usually after such heavy traits, the market enters a interval of consolidation, ranging for a while. Throughout this part, the market could both reverse, doubtlessly favoring the preliminary buying and selling technique, or proceed in the wrong way, exacerbating the drawdown. The Drawdown Supervisor is your strategic ally in these important moments. It empowers merchants to harness any floating or realized earnings by intelligently closing parts of the shedding positions. This methodology successfully reduces the burden of unfavorable trades and may make it simpler to shut your complete cycle profitably if the value retraces. Conversely, ought to the market persist in the wrong way, the DDM ensures that your open positions have a lowered quantity, thus lessening the influence and retaining the drawdown inside extra manageable ranges. By configuring the DDM to behave on particular revenue thresholds, merchants can mitigate danger and navigate by market fluctuations with better confidence and management.

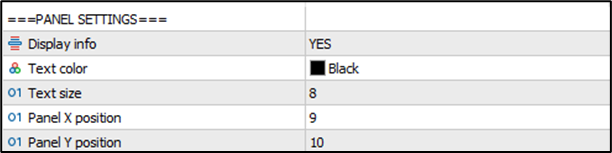

Panel Settings:

You’ll be able to customise whether or not to have a show on the chart or not, the textual content colour and dimension, and the panel place by adjusting the X and Y values.

Drawdown Supervisor Settings:

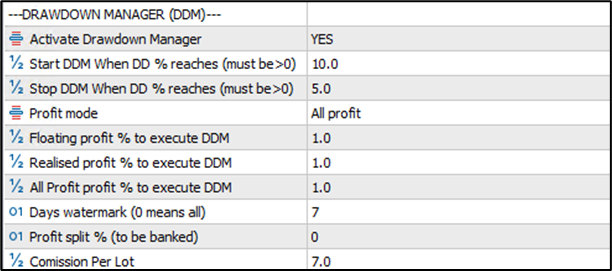

Activate Drawdown Supervisor: Toggle this to YES for the DDM to function robotically, adhering to the parameters you’ve arrange. Deciding on NO means the DDM gained’t run by itself, however you’ll be able to nonetheless handle it manually through the panel.

START Auto DDM when DD% reaches: Enter the precise share of your account drawdown at which level you need the DDM to start working robotically.

STOP Auto DDM when DD% reaches: Set the drawdown share at which you need the DDM to stop computerized operations.

Revenue mode: Select how the DDM will act when it comes to earnings to handle shedding trades. The choices are:

Floating revenue: The DDM will make use of earnings from at present open, however not but closed, worthwhile trades.

Realized revenue: The DDM will use earnings from trades which were closed at a achieve.

All revenue: The DDM will use a mixture of each floating and realized earnings to deal with shedding trades.

Floating Revenue % to Execute DDM: Set this share to outline the brink of floating revenue — revenue from at present open positions which can be but to be closed — relative to your account stability. When this share is reached, the DDM will activate, figuring out the biggest shedding commerce to cut back or shut utilizing the accessible floating revenue.

Realized Revenue % to Execute DDM: That is the share of realized revenue — revenue from positions which have already been closed — you want to allocate to offset shedding trades. As soon as your account’s realized revenue hits this share, DDM will take motion, focusing on probably the most vital shedding commerce to minimize or clear with the realized revenue.

All Revenue % to Execute DDM: When utilizing the all revenue mode, enter right here the mixed share of each floating and realized revenue relative to your stability. Reaching this mixed revenue share prompts the DDM to begin its seek for the shedding commerce that will likely be partially or fully offset by this cumulative revenue.

Days Watermark: This setting is essential if you’re using the realized revenue mode throughout the DDM. It means that you can specify the timeframe for the DDM to think about when evaluating realized earnings. As an illustration, setting this worth to ‘3’ directs the DDM to consider all realized earnings from the final 3 days and apply them in mitigating unfavorable positions. A setting of ‘0’ is an instruction for the DDM to take into consideration the whole thing of realized earnings on the account, with none time restriction. This flexibility lets you align the DDM’s operations along with your strategic buying and selling evaluation intervals and danger administration protocols.

Revenue Break up: This setting means that you can decide the portion of earnings from optimistic trades to allocate in direction of mitigating losses. As an illustration, by setting this to 50%, you direct the DDM to make use of solely half of the earnings for offsetting shedding positions, whereas securing the rest as your earnings. A price of 0 signifies that each one earnings needs to be utilized in addressing shedding trades, which can be notably helpful in situations of great drawdowns.

Fee per lot: On this part you should enter your dealer fee per lot, in order that the DDM think about it within the calculation when closing optimistic trades, towards unfavorable trades.

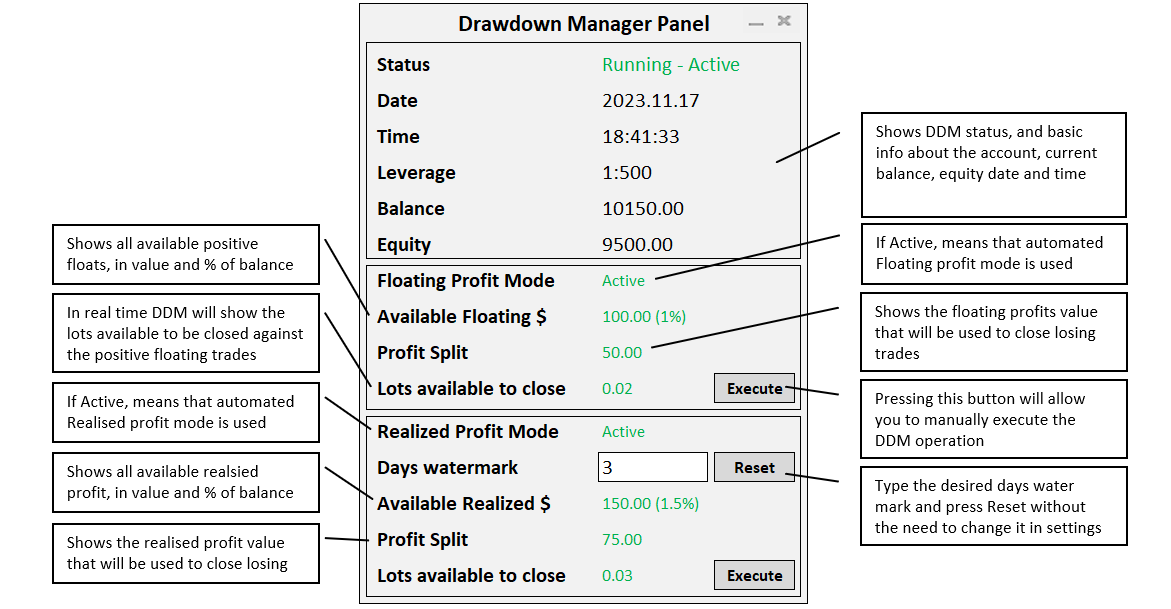

Drawdown Supervisor Panel:

Drawdown Supervisor comes with a really useful panel, that provides essential visibility, but in probably the most simplistic type. Allow us to delve in it:

Once you determine to execute the drawdown administration manually utilizing the Execute buttons within the panel, you’re going to get affirmation messages as under, sharing the complete particulars of the operation and as you to approve earlier than continuing, which is extraordinarily useful specifically if in case you have a number of grid positions open.

Affirmation message floating revenue execution:

Affirmation message realised revenue execution:

Methods and Set information

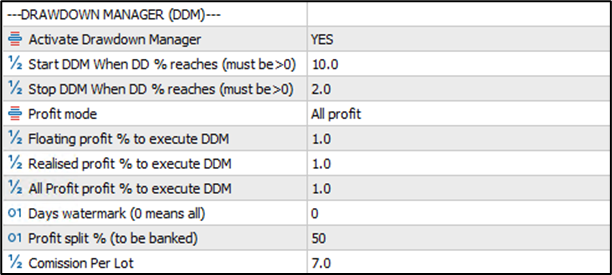

Technique 1 – Aggressive Drawdown Management

For account reaching heavy drawdowns, (above 10%), this set file will enable Drawdown Supervisor use 1% of each floating and realised revenue attained the previous 7 days of buying and selling to cut back the amount of the shedding trades. As soon as the Drawdown have lowered to five%, the DDM will cease.

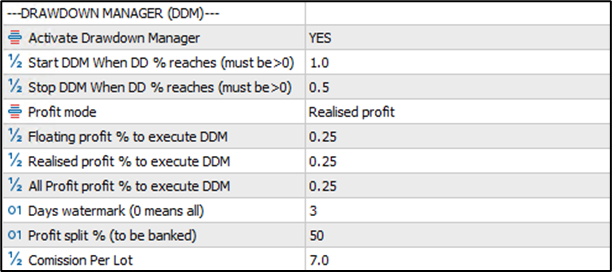

Technique 2 – Defender Drawdown Administration

If you wish to management any construct up of drawdowns, you can begin the method early on, this set is for you. It’ll provoke the DDM the second drawdown reaches 1%, and can cease with it’s again 0.5%. It’ll use 50% of realised earnings up to now 3 days to offset shedding trades. This technique, COULD be safer, however it should restrict your earnings early on as 50% of your earnings are going for use to offset shedding trades.