KEY

TAKEAWAYS

- Dow Jones Industrial Common and S&P 500 shut at file highs

- Know-how shares are again within the highlight, with the Nasdaq 100 closing up 1.95%

- Keep watch over momentum and volatility as earnings studies proceed to pour in

Tech shares are placing again after a tough begin within the first week of the buying and selling yr. Again then, it might need been inconceivable to assume that tech shares would lead a bullish rally, however that narrative has modified shortly. Immediately’s continuation of yesterday’s robust rally boosted the broader fairness indices, whereas the Dow Jones Industrial Common ($INDU) and S&P 500 ($SPX) closed at file highs, and the Nasdaq Composite ($COMPQ) clinched a brand new 52-week excessive.

Chip shares continued to realize momentum after yesterday’s explosive rally, which adopted Taiwan Semiconductor’s (TSM) robust earnings report and constructive steerage. Maybe traders are optimistic that different tech shares will comply with go well with, as some distinguished gamers report earnings subsequent week, and plenty of extra the next week. Early indications recommend that AI will proceed to be the buzzword in 2024 and the catalyst for the inventory market!

So far as financial situations go, the US economic system continues to be wholesome. Shopper sentiment is excessive, indicating that the patron is extraordinarily assured. Earlier within the week, we bought a better-than-expected December retail gross sales report displaying that customers are nonetheless procuring. There was some concern that the upper rates of interest forward of the vacations can be a headwind for retailers, however it seems to be like issues went higher than forecasted.

There’s plenty of euphoria surrounding the inventory market, which unfold to mid- and small-cap shares towards the tip of the buying and selling week. It is a risk-on setting, with traders gravitating towards the Know-how, Communication Providers, and Shopper Discretionary sectors. Defensive sectors, equivalent to Vitality and Utilities, had been this week’s weakest-performing sectors.

The Large Image

A look on the StockCharts Dashboard offers you an general view of the massive image. Equities led the rally, with all of the fairness indexes within the Market Overview panel within the inexperienced. The one purple is the CBOE Volatility Index ($VIX), which reveals that traders are extraordinarily complacent.

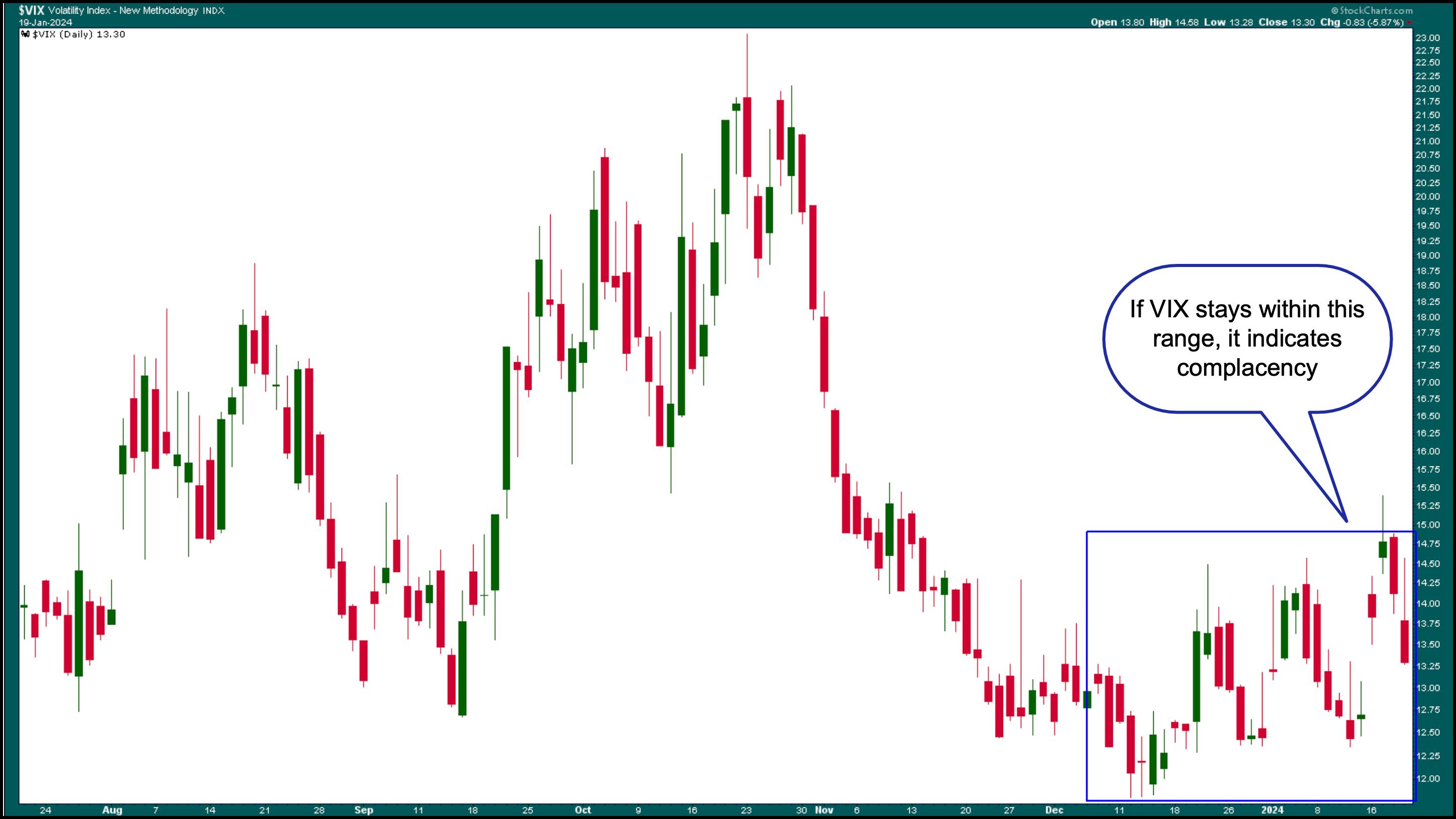

The chart of the VIX shows an fascinating sample of choppiness in the previous couple of weeks (see chart beneath). Earnings season is an thrilling time within the inventory market, and it is not uncommon to see some choppiness in volatility. When the VIX is low, it implies that traders aren’t involved about hedging their portfolios.

CHART 1. DAILY CHART OF CBOE VOLATILITY INDEX. The VIX is low, which signifies that traders aren’t anxious in regards to the inventory market. When the VIX begins climbing larger, it is time to develop into cautious, because it tends to spike shortly and with out a lot warning.Chart supply: StockCharts.com. For instructional functions.

The VIX, thought-about the concern gauge, is vital in figuring out shifts in investor sentiment, so it does not harm to recurrently assessment this chart as you undergo your inventory market evaluation. In case you return over ten years, you may see the VIX tends to spike shortly, and the very last thing you need is to get caught off guard.

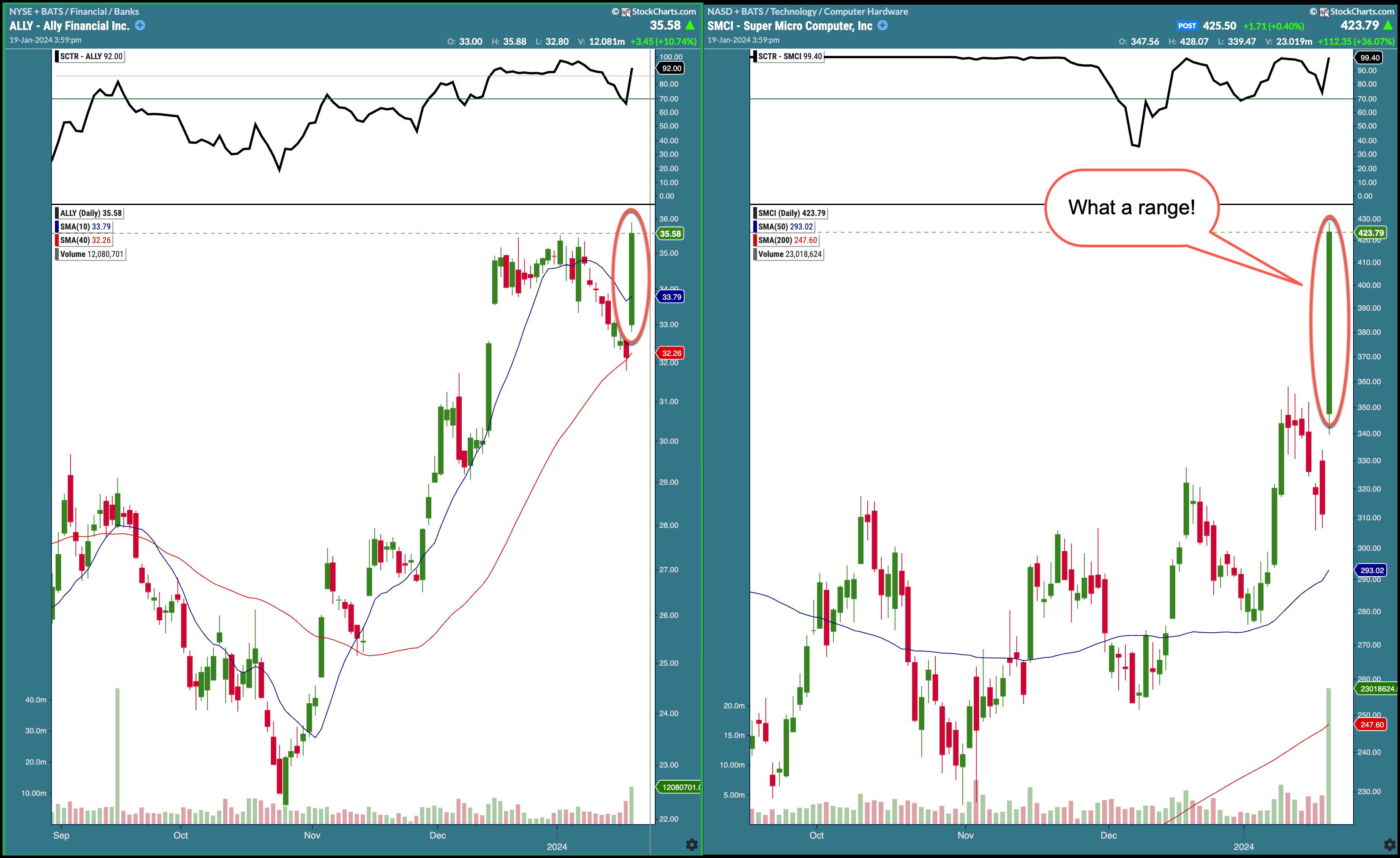

The StockCharts Technical Rank had a handful of shares that elevated by greater than 14 factors. Ally Monetary (ALLY) and Tremendous Micro Pc Inc. (SMCI) are the highest two within the Prime Up class for large-cap shares. The chart of those two shares (see beneath) reveals the magnitude of their transfer on Friday.

CHART 2. TWO BIG SCTR MOVERS IN FRIDAY’S TRADING. Some shares noticed comparatively massive proportion up strikes. Right here, you see a monetary and a tech inventory seeing substantial positive aspects.Chart supply: StockCharts.com. For instructional functions.

So, will the investor optimism proceed into subsequent week? There’s not a lot financial information that can be launched subsequent week apart from PCE, which is a crucial one. Extra vital are earnings. Along with these studies, regulate the momentum and the VIX.

Finish-of-Week Wrap-Up

US fairness indexes up; volatility down

- S&P 500 up 1.23% at 4839.81, Dow Jones Industrial Common up 1.05% at 37863.80; Nasdaq Composite up 1.70% at 15310.97

- $VIX down 5.87% at 13.30

- Finest performing sector for the week: Know-how

- Worst performing sector for the week: Utilities

- Prime 5 Giant Cap SCTR shares: Affirm Holdings (AFRM), Veritiv Holdings, LLC (VRT); Nutanix Inc. (NTNX); CrowdStrike Holdings (CRWD); Tremendous Micro Pc, Inc. (SMCI).

On the Radar Subsequent Week

- Earnings week continues with the primary of the Magnificent shares, Tesla (TSLA) reporting on Wednesday. Different firms reporting embrace Netflix (NFLX), Intel (INTC), Lam Analysis (LRCX), KLA (KLAC), United Airways (UAL), Abbott Laboratories (ABT).

- December PCE Value Index

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra