A big, dormant Bitcoin pockets moved an enormous quantity of cash to an change on Thursday, rattling merchants and reigniting debate about the place massive holders stand.

Associated Studying

Based on on-chain knowledge, a Satoshi-era pockets that had not moved funds for 13 years transferred roughly 12,000 BTC — about $1.4 billion at present costs — in a set of transactions that landed on an change ledger.

Whale Strikes Stir Markets

Experiences have disclosed that the transfers got here as Bitcoin hovered close to a key value band. The coin fell about 2% after the exercise, a fast response as merchants guessed the funds is perhaps put up on the market.

🚨 BREAKING

SATOSHI ERA WHALE JUST SOLD 12,000 $BTC AFTER 13 YEARS OF HODLING.

HE MADE A MIND BLOWING $1.4 BILLION – ONE OF THE MOST PROFITABLE ON-CHAIN SALES EVER.

MASSIVE CRYPTO SELL-OFF INCOMING?? pic.twitter.com/NvCo9mamzT

— 0xNobler (@CryptoNobler) November 13, 2025

Some market watchers warned that if bigger promote orders hit exchanges, positions utilizing borrowed cash could possibly be compelled to shut, which might make value strikes sharper.

Others mentioned the market’s temper was extra nervous than panicked; giant transfers typically spark nervousness even when no rapid sale follows.

Technical Strain Round Resistance

Outstanding analyst Ted commented that Bitcoin is going through stiff resistance round $104,000–$105,000. Based on his view, holding above $105,000 might encourage renewed shopping for and push costs towards $107,000.

If that fails, he warned that the subsequent clear assist sits close to $100,000. Merchants will watch order books and change flows intently in coming classes to see whether or not the transferred cash are transformed to fiat or just shifted between wallets.

Lengthy-Time period Holders Take Income

Based mostly on stories from Chris Kuiper, CFA, the broader promoting stress seems pushed extra by long-term holders than by panicked sellers.

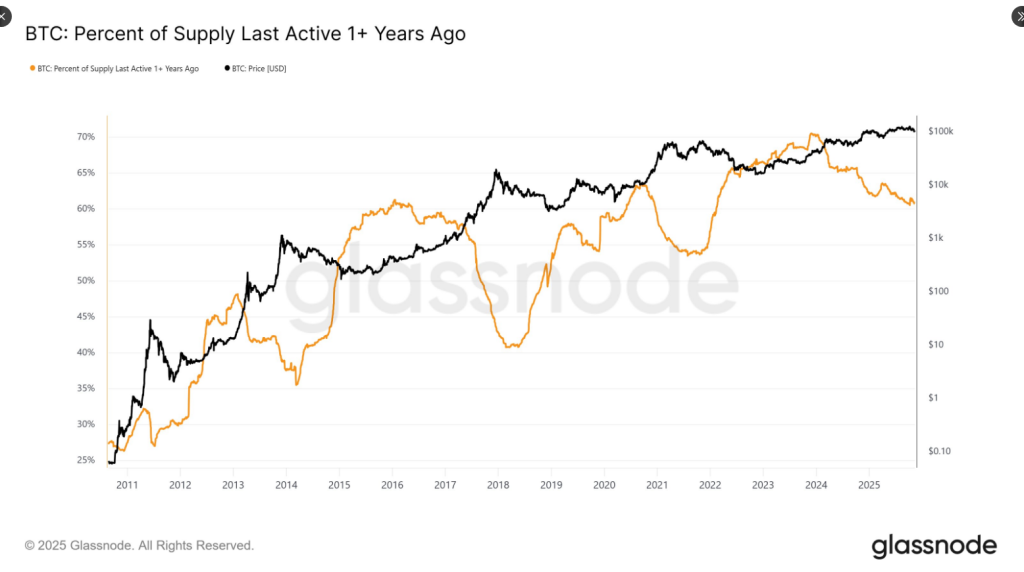

Kuiper pointed to the share of Bitcoin that has remained inactive for one 12 months or longer. That metric normally climbs in gradual markets and drops sharply throughout quick rallies.

This time, the decline has been gradual. The sample suggests regular profit-taking over time somewhat than a sudden exodus.

“Who’s promoting?”

Is the primary query I’ve been getting concerning #bitcoin‘s continued value stress towards a backdrop of seen shopping for (by ETPs, firms and so forth.)

I’m not distinctive in suggesting it’s the long-term holders (or HODLers).

However one knowledge level that offers… pic.twitter.com/9PVoolrtwm

— Chris Kuiper, CFA (@ChrisJKuiper) November 12, 2025

Market observers say gradual gross sales match a maturing market the place older holders lock in beneficial properties with out attempting to time an ideal high.

The place previous cycles noticed abrupt strikes from giant dormant wallets, the present pattern appears extra measured. That doesn’t rule out short-term volatility, but it surely modifications how merchants interpret massive transfers.

Associated Studying

For now, the market’s subsequent strikes will doubtless be set by a mixture of on-chain flows and the way value behaves across the $104,000–$105,000 space.

Brief-term merchants will react to change knowledge. Lengthy-term traders might watch the inactive-supply metric and modify plans extra slowly.

The switch of 12,000 BTC is an enormous piece of knowledge. How merchants act on it’s going to decide whether or not this turns into a headline occasion or simply one other second in Bitcoin’s lengthy rise.

Featured picture from Unsplash, chart from TradingView