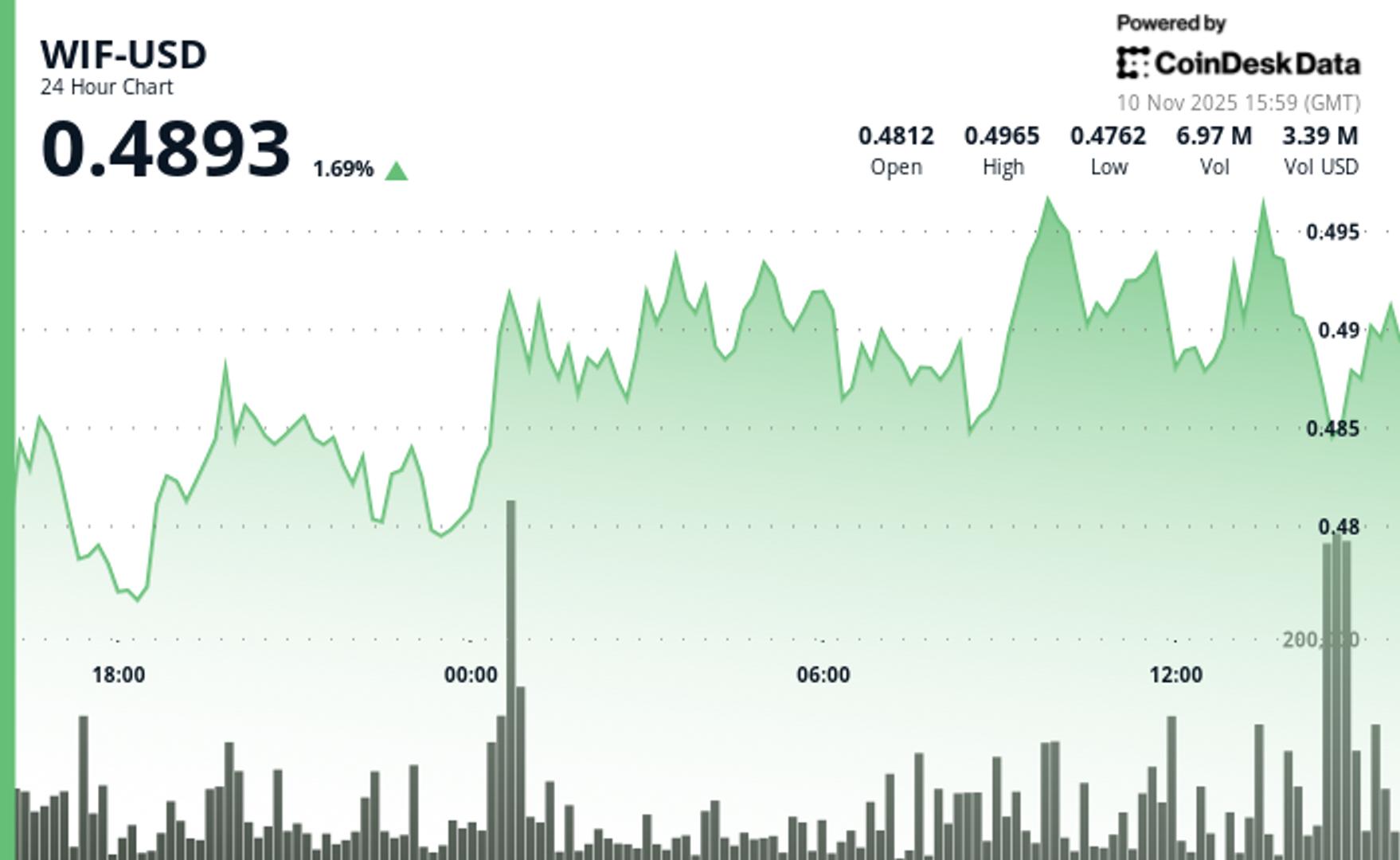

In keeping with CoinDesk Analysis’s technical evaluation knowledge mannequin, dogwifhat (WIF) staged a measured accumulation part earlier than explosive beneficial properties carried the memecoin to session highs close to $0.497 throughout Tuesday buying and selling. WIF spent a lot of the 24-hour interval consolidating between $0.4754-$0.4897 earlier than breaking out dramatically in in a single day hours with institutional-level quantity.

The breakout materialized at November 10 00:00 when buying and selling quantity exploded to 12.51M shares, marking a 98% surge above the session’s 5.62M common. WIF decisively cleared $0.4840 resistance whereas holding assist at $0.4775, confirming three consecutive increased lows from the session base. The quantity spike validated real shopping for curiosity because the token superior via technical resistance ranges.

Late-session motion turned aggressive as WIF surged from $0.491 to $0.497 at 13:37 earlier than profit-taking emerged. Quantity spiked to 437K shares at 14:02 as promoting stress compelled a retreat to $0.491 by session shut. The sharp reversal at $0.497 suggests institutional gamers took income at technical resistance.

Consolidation vs Breakout: What Merchants Ought to Watch

With elementary catalysts absent, technical ranges dominated value motion as WIF navigated between outlined assist and resistance zones. The in a single day breakout on real quantity confirms institutional participation whereas the $0.497 rejection establishes clear resistance for future checks.

The $0.490-$0.485 assist zone turns into essential for bulls defending the breakout construction. Hole situations via 14:13 point out incomplete value discovery at highs, positioning WIF for both continuation above $0.497 or deeper pullback relying on quantity follow-through.

Key Technical Ranges Sign Retest Potential for WIF

Assist/Resistance:

– Main resistance established at $0.497 (session excessive with profit-taking)

– Secondary resistance at $0.4897 (consolidation vary ceiling)

– Important assist zone: $0.490-$0.485 (breakout retest stage)

– Base assist confirmed at $0.4775 (validated throughout quantity surge)

Quantity Evaluation:

– Breakout affirmation: 12.51M shares (98% above 24h common)

– Resistance take a look at quantity: 437K shares at $0.497 peak

– Quantity contraction to 1.37M alerts momentum pause at highs

Chart Patterns:

– Tight consolidation: $0.4754-$0.4897 vary (5.0% unfold)

– Three consecutive increased lows establishing bullish base construction

– Hole situations close to session highs point out incomplete value discovery

Targets & Threat/Reward:

– Fast focus: $0.490-$0.485 assist retest for continuation setup

– Breakout goal: Clear break above $0.497 opens prolonged upside

– Cease loss: Under $0.4775 invalidates bullish breakout construction

CoinDesk 5 Index (CD5) Posts Strong Positive factors Regardless of Late-Session Consolidation

CD5 climbed from $1,783.62 to $1,848.07 for a $64.45 acquire (3.61%) with momentum reaching $1,850.33 earlier than sellers emerged at resistance.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.