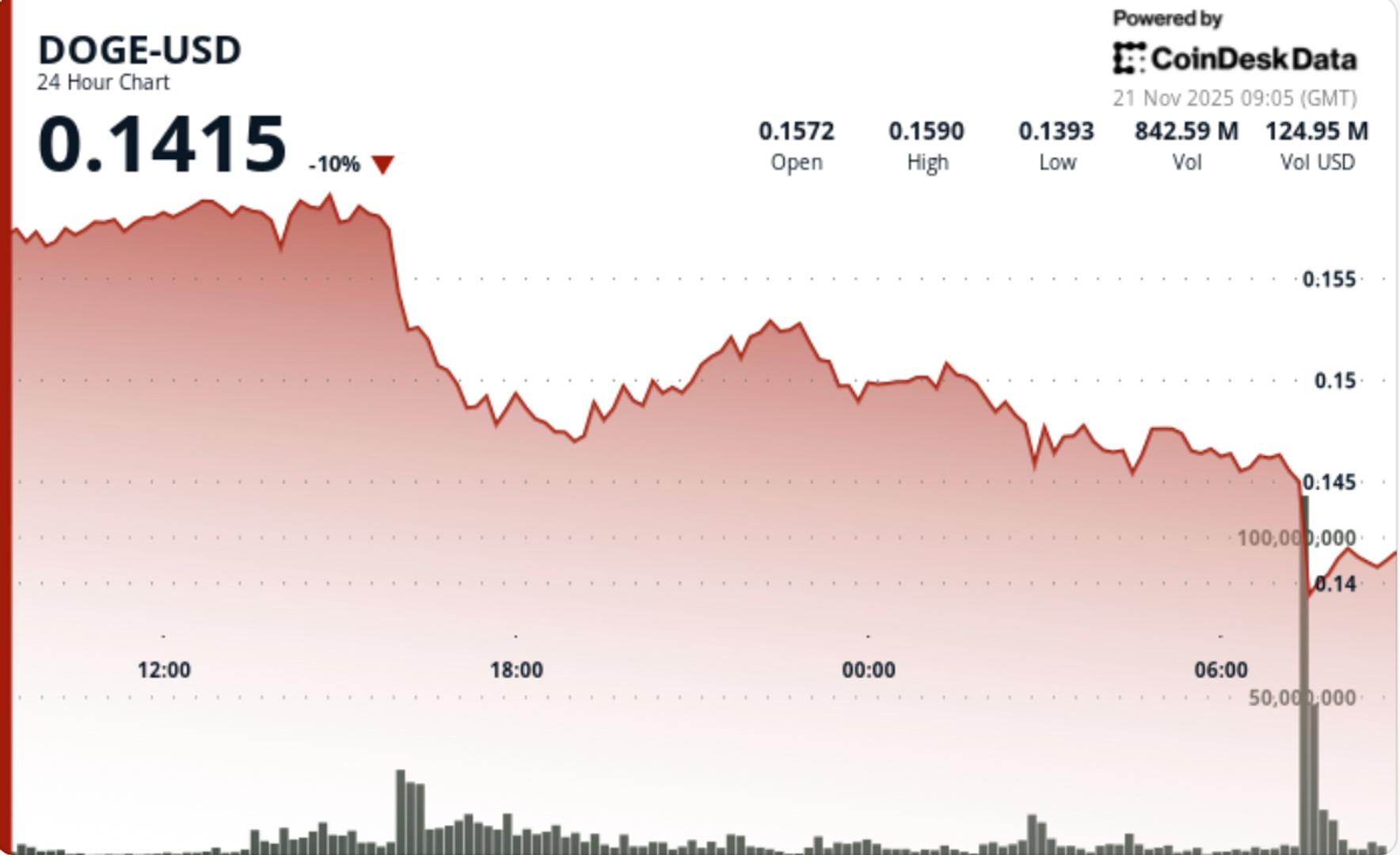

The memecoin crashes via the important $0.15 flooring on distinctive quantity, establishing new help close to $0.138 as bears tighten management throughout main timeframes.

Information Background

• Crypto markets stay in excessive concern, with Bitcoin sliding under $85,000.

• Whole market cap loses $120B in 24 hours as risk-off sentiment deepens

• Meme coin sector sees broad deleveraging; liquidity thins throughout main exchanges

• Whale accumulation exercise slows sharply after two-week shopping for spree

• Analysts word compelled liquidations throughout altcoins as macro flows weaken

Worth Motion Abstract

• DOGE collapses 11.2% from $0.1578 → $0.1401, breaking a number of help layers

• Whole quantity surges to 2.52B, an enormous 263% above the 24-hour SMA

• Breakdown ignites at 07:00 UTC, rejecting $0.1595 resistance and getting into managed descent

• Capitulation occasion hits at 07:33–07:36, with 500M+ turnover as value gaps from $0.144 → $0.138

• Makes an attempt to stabilize emerge close to $0.140, forming a tentative structural flooring

• Session construction prints consecutive decrease highs and decrease lows, confirming development deterioration

Technical Evaluation

Dogecoin’s chart suffered decisive structural injury, pushed by a cascade of technical failures reasonably than fundamentals. The early rejection at $0.1595 established clear bearish momentum, which intensified as liquidity thinned throughout meme coin order books.

The cascade from $0.144 to $0.138 revealed algorithmic or institutional promote applications executing in speedy succession. These minute-by-minute gaps decrease created technical voids, indicating displaced liquidity that sometimes requires future backfilling earlier than sustainable recoveries happen.

Quantity acceleration — 2.52B whole, with 500M in the course of the crash window — confirms that the transfer was pushed by large-scale distribution reasonably than retail panic. The stabilization round $0.140 suggests the preliminary exhaustion of promoting stress, but the structural development stays decisively bearish given the intact sample of decrease highs and decrease lows.

Momentum indicators now present deep oversold readings, however with out confirming divergences. DOGE trades under its 50D and 200D shifting averages, each now sloping downward — a traditional signal of continued development weak point.

What Merchants Ought to Watch

Dogecoin sits at a high-risk inflection zone the place volatility and liquidity circumstances can shift quickly:

• $0.138 is the road within the sand — failure invitations quick momentum towards $0.135, then $0.128

• Stabilization at $0.140 should convert into sustained demand to keep away from deeper structural breakdown

• Look ahead to backfill makes an attempt within the $0.144 hole zone — reclaiming this stage would sign early restoration makes an attempt

• Broader crypto sentiment stays fragile; additional Bitcoin weak point will disproportionately influence DOGE

• Absence of recent whale accumulation after the decline raises short-term warning

• If ETF information for DOGE re-emerges, anticipate volatility, however not essentially directional aid