Dogecoin pushes by way of vital technical limitations in a 2.4% rally as institutional flows elevate buying and selling exercise 68% above each day averages, signaling managed accumulation inside a broader Wyckoff part.

Information Background

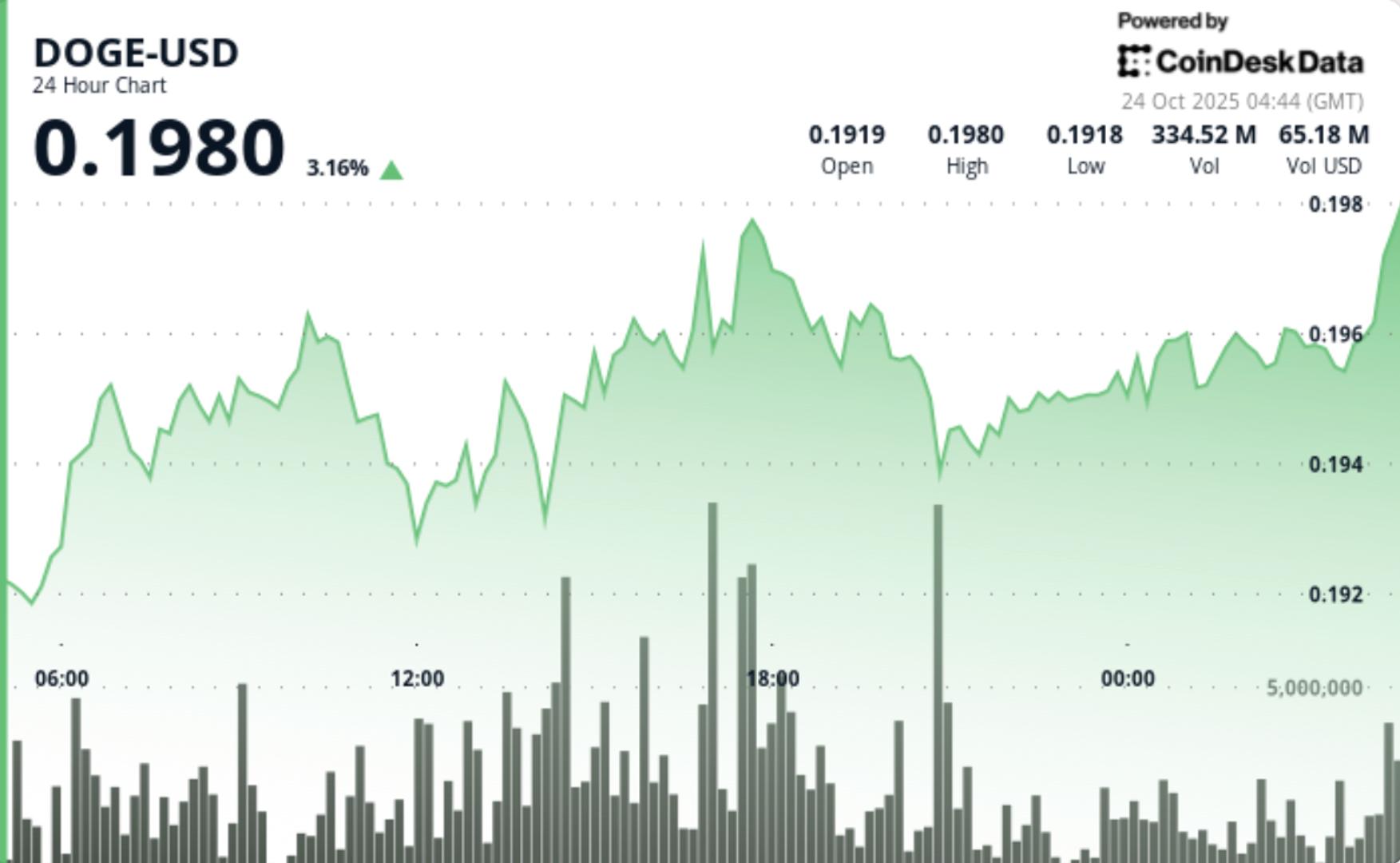

- DOGE climbed 2.4% over the 24-hour session ending October 24 02:00, advancing from $0.1911 to $0.1957 and marking a clear breakout above the $0.1953 resistance zone.

- The transfer occurred on distinctive quantity of 483 million—68% above the 24-hour common of 287 million—confirming robust institutional participation within the advance.

- The memecoin traded inside a good $0.0068 intraday vary (3.5% volatility) whereas constructing larger lows at $0.1931, $0.1936, and $0.1949, indicating regular shopping for curiosity by way of every minor retracement.

- Analysts recognized structural similarities to Wyckoff accumulation phases seen in prior Dogecoin market cycles.

- Regardless of restricted macro catalysts, merchants famous that DOGE’s transfer coincided with a broader uptick throughout high-beta altcoins as market sentiment improved alongside Bitcoin’s restoration above $67,000.

Worth Motion Abstract

- The breakout developed through the 23 October 11:00 session when DOGE surged by way of resistance at $0.1953 on the heaviest quantity of the day.

- The rally established new short-term assist at $0.1940 as consumers absorbed provide throughout successive retests.

- Within the last hours of buying and selling, value consolidated between $0.1954–$0.1960 with declining quantity, a sign that institutional accumulation had already occurred earlier within the session.

- Hourly information confirmed DOGE pushing from $0.1955 to $0.1960 at 01:57 on quantity close to 9.97 million earlier than retracing barely to $0.1956, the place assist held agency above breakout ranges.

- This managed consolidation sample signifies sustained demand throughout the new larger vary, aligning with ongoing institutional buildup.

Technical Evaluation

- DOGE’s value construction confirms a short-term ascending pattern with a sequence of upper lows and outlined assist at $0.1940.

- The breakout by way of $0.1953 validated the bullish setup, whereas the consolidation close to session highs suggests power fairly than exhaustion.

- Quantity profiles present institutional footprints concentrated through the breakout part, not throughout profit-taking—an indicator of early accumulation.

- Analysts additionally spotlight the resemblance to historic rounded-bottom formations noticed in earlier market cycles (2017, 2021), each of which preceded multi-week vertical rallies.

- Momentum indicators present gentle divergence however stay constructive, reinforcing the case for continuation if DOGE maintains the $0.194 assist flooring.

What Merchants Are Watching

- Market contributors are monitoring whether or not DOGE can maintain above $0.195 and transition into the markup part typical of Wyckoff accumulation.

- A decisive break above $0.20 may set off momentum-driven inflows and appeal to algorithmic pattern followers.

- On-chain information helps the bullish interpretation, exhibiting a continued decline in exchange-held DOGE reserves—an indication of long-term holder confidence.

- Quick draw back danger stays restricted whereas $0.194 assist holds, however failure to defend that stage may open a retracement towards $0.188.

- Institutional merchants are anticipated to observe for affirmation of continued quantity power on any retest of the $0.20 zone.