The S&P 500 gained 1.1% final week in a transfer that places this Index at a report excessive. Whereas that is thrilling information for traders, people who owned a few of final week’s prime performers are in even higher spirits, as the typical achieve for the highest ten movers on this Index was 10.3%. Much more uncommon was that nearly three quarters of those names had been from the identical business group.

The business group I am referring to is Semiconductors, which posted outsized beneficial properties after a optimistic earnings report from the world’s largest chip producer, Taiwan Semiconductor (TSM), sparked a rally in these shares. Previous to that, a bullish report for Superior Micro (AMD)’s outlook put this inventory on its path to posting nearly 20% for the week. Subscribers to my MEM Edge Report will probably be accustomed to this inventory, as we highlighted AMD as a powerful purchase on Sunday after which once more on Wednesday.

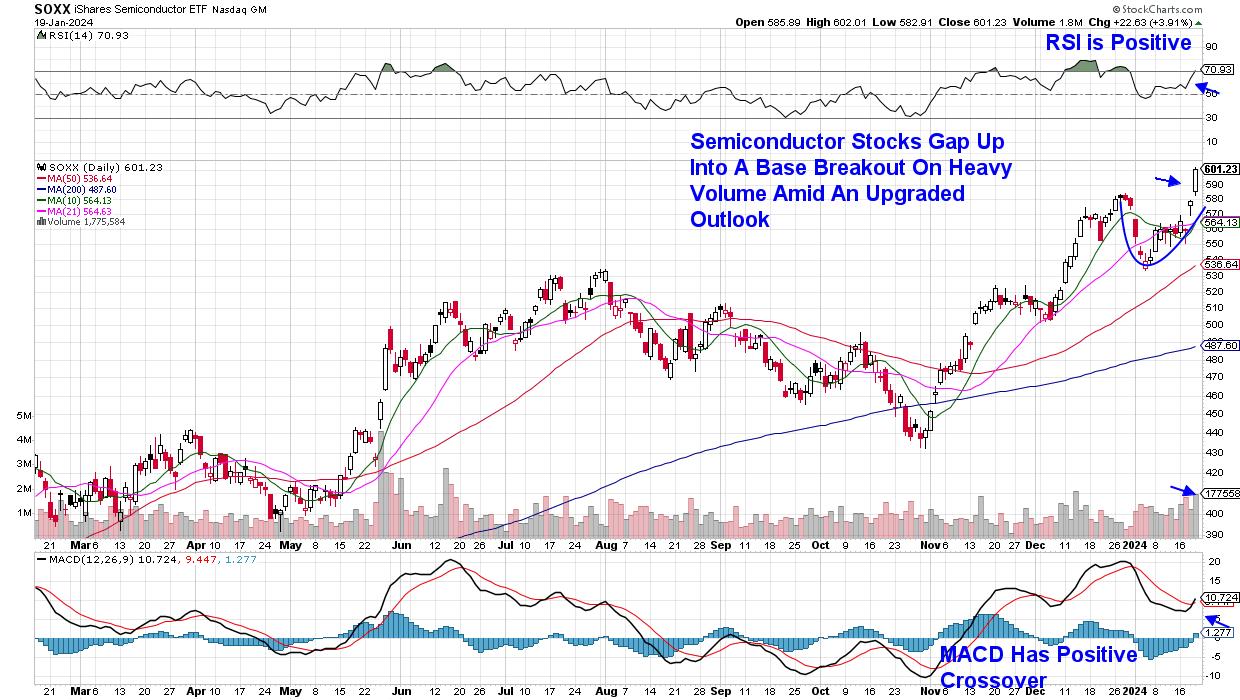

Every day Chart of iShares Semiconductor ETF (SOXX)

Every day Chart of iShares Semiconductor ETF (SOXX)

Software program shares additionally outperformed final week, with the names from this space which can be on our Steered Holdings Listing posting beneficial properties that hold them in confirmed uptrends; they’re poised to commerce increased from right here. If you would like instant entry to this Listing, use this hyperlink right here for a 4-week trial of my twice weekly report. Along with recommending management shares that usually go on to outperform the broader markets, this report retains you tuned into sector rotation, rate of interest outlooks, and different large image ideas that hold you on prime of what is transferring the markets and, extra importantly, what to look out for.

This Sunday’s MEM Edge Report will evaluate extra occasions happening within the markets which can be uncommon. Amongst them, Development shares are advancing, regardless of rates of interest remaining comparatively elevated, and whereas the S&P 500 is now at new highs, the Equal-Weighted S&P 500 has been languishing. Use the hyperlink above for insights into these and different counterintuitive actions shaping at present’s market.

Warmly,

Mary Ellen McGonagle

MEM Funding Analysis

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to turn into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra