KEY

TAKEAWAYS

- Not all is what it appears like contained in the Shopper Discretionary Sector

- Utilizing Cap-weighted vs. Equal-Weighted Sectors on RRG reveals underlying variations

- Mega-cap Shares are dragging XLY down

- Utilizing a Easy Scan Results in 4 attention-grabbing charts

Cap-Weighted vs. Equal-Weighted

Generally, it’s essential to look a bit of additional. And in regards to the rotations in Shopper Discretionary shares, that is a kind of “typically”.

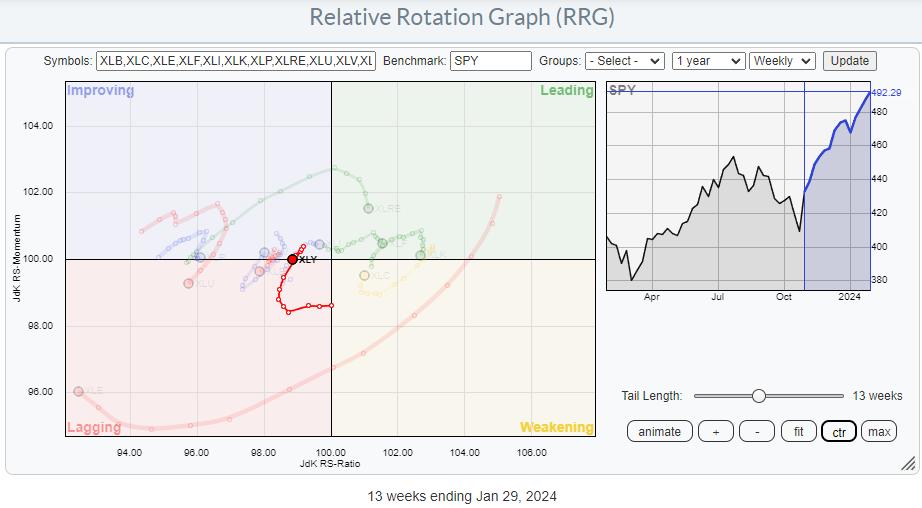

On this Relative Rotation Graph, holding the cap-weighted sectors, XLY is making a nasty flip again down into the lagging quadrant after a quick interval inside bettering. At first look, this may result in the suggestion or conclusion that Shopper Discretionary shares are rotating out of favor and are establishing for a brand new down-leg in an already established relative downtrend.

Nevertheless…

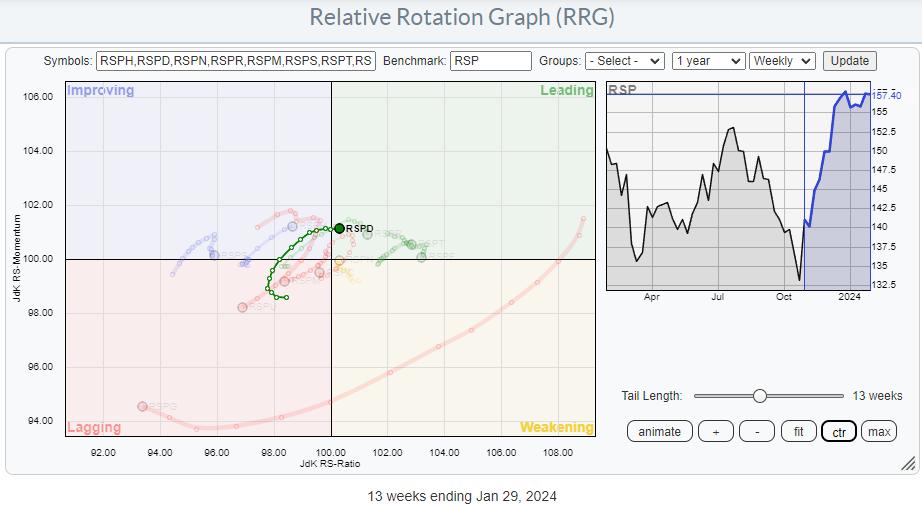

Trying on the RRG that reveals the equal weight variations of the S&P sectors the tail on Shopper Discretionary is travelling at a very completely different path. It is way more optimistic.

RSPD simply rotated into the main quadrant after a interval via lagging and bettering.

From this rotation, the Shopper Discretionary sector appears a lot more healthy than the cap-weighted rotation of XLY.

Mega-Caps Are Dragging XLY Down

The primary takeaway from this remark is that the heavy-weight names inside XLY are dragging the cap-weighted sector down. Consequently, we are able to conclude that the second or third-tier shares on this universe are doing fairly effectively.

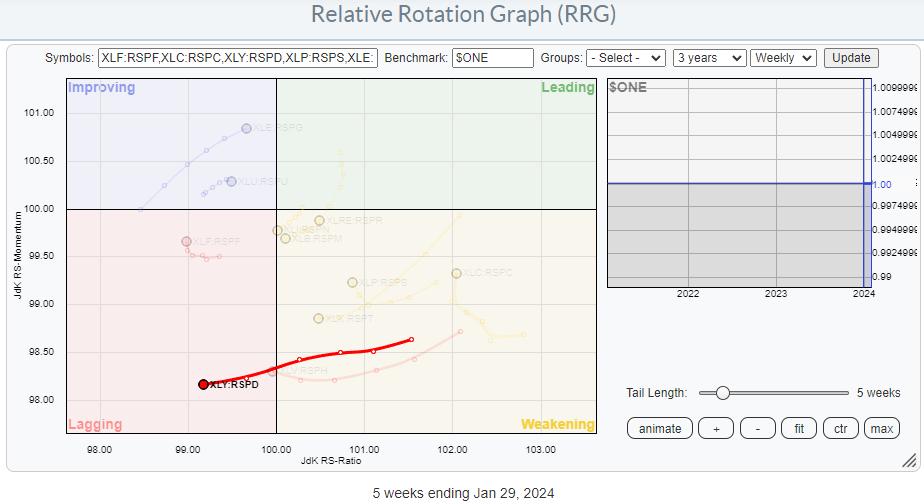

One other manner of visualizing this relationship, not just for Shopper Discretionary however for all cap-weighted vs. weighted sectors, is by plotting their rations on a Relative Rotation Graph and utilizing $ONE because the benchmark.

This reveals the tail for XLY:RSPD is quickly transferring into the lagging quadrant, confirming that rotation favors non-large/mega-cap shares within the shopper discretionary sector.

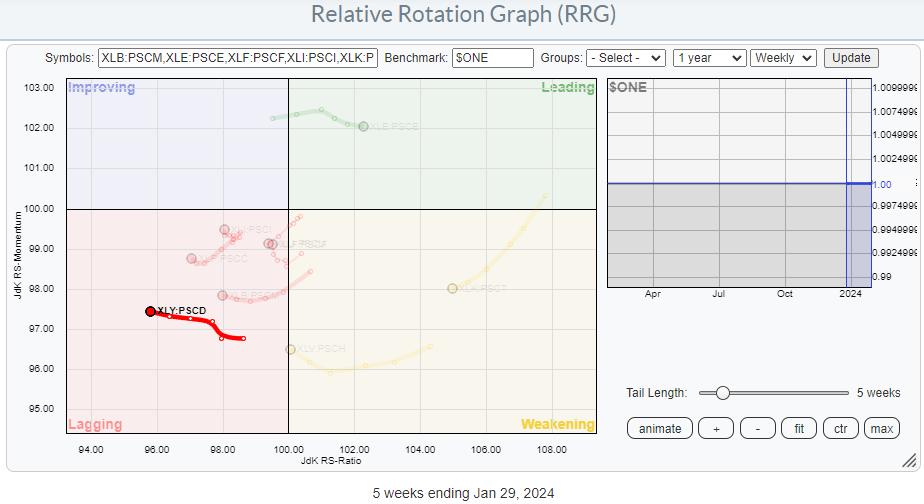

Lastly, we are able to take a look at the connection between large- and small-cap Shopper Discretionary equally.

This reveals the XLY:PSCD tail additionally transferring deeper into the lagging quadrant.

Trying For Shares

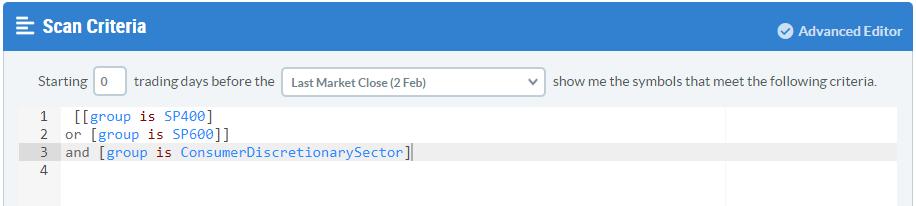

With this data, I need to see if I can discover some shares price . Due to this fact, my pool of shares to undergo is shares which can be both within the S&P 400 (MidCap) or S&P 600(SmallCap) AND within the Shopper Discretionary Sector.

I can simply discover these by utilizing the superior scan workbench.

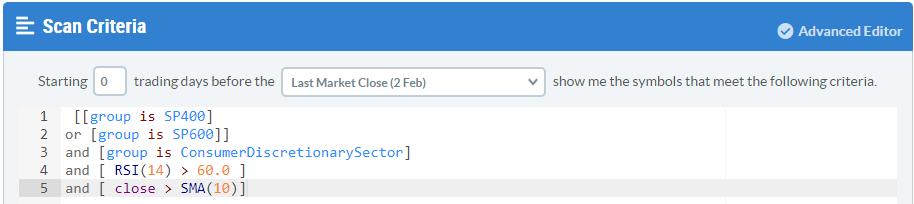

Operating this scan returns 172 symbols. So I must trim this record down a bit of additional. I’m going to try this by including a easy requirement, just like the RSI needing to be above 60. That ensures that the worth is already transferring larger, and I’m including the requirement that the Shut should be above its 10-day transferring common AND that the RSI should be above 60.

Operating this scan leads to an inventory of 33 symbols, which may be very manageable.

Plotting Them on a RRG

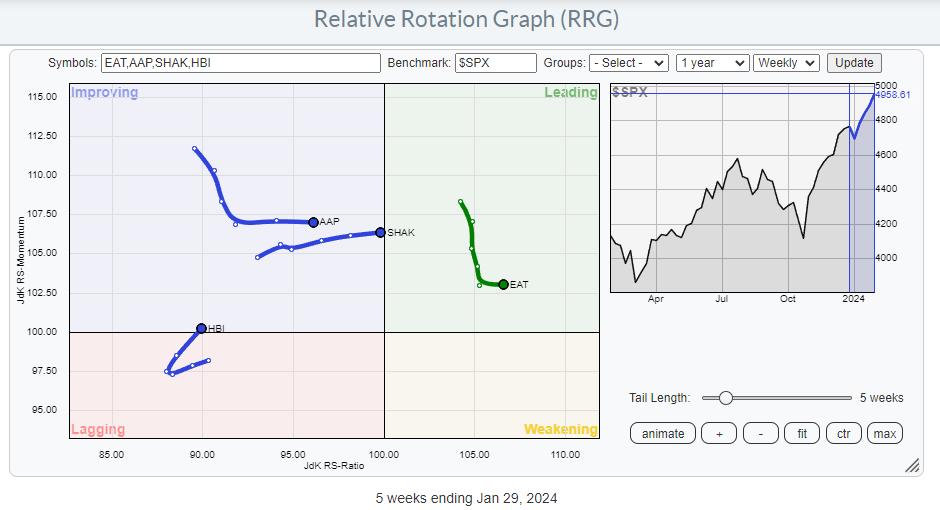

After saving that record as a ChartList, I can then plot them on a Relative Rotation Graph.

After visually inspecting the rotation of those tails and their worth charts, I ended up with 4 probably attention-grabbing shares.

HBI – HanesBrands Inc.

The chart that received my consideration is HBI. On the RRG, it’s displaying a pleasant rotation again right into a optimistic RRG-Heading and transferring into the bettering quadrant. Do not forget that the group as an entire is already displaying energy, so HBI is trailing that growth, which signifies that it has the potential to catch up inside the sector.

After an extended downtrend through which HBI misplaced round 80% of its worth in three years, the inventory began to backside within the second half of 2023, and this week it broke out above the resistance supplied by its earlier two highs.

This transfer opens the best way for an additional rise in the direction of the following resistance space, round 5.5-6.0. That’s roughly 20% upside potential, with assist solely 5-6% beneath present ranges.

#StayAlert and have an incredible weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll definitely learn them and, the place moderately potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra