A day after one other billion-dollar liquidation cascade, veteran crypto analyst Dealer Mayne says his core thesis is unchanged: the bull cycle’s high is “not in,” and the market is within the strategy of printing a weekly cycle low that might arrange yet one more leg larger into year-end. “I’ve been banging on the drum concerning the excessive not being in,” he stated in a November 5 video, including that he stays “a BTC maxi from the spot perspective,” regardless of tactical longs and shorts which have been hit-and-miss in the course of the latest volatility.

Is The Bitcoin Backside In?

Mayne framed the selloff—coming lower than a month after an nearly $20 billion wipeout on October 10—as a characteristic, not a bug, of late-cycle value discovery. He argued that speculative leverage quickly re-accumulated in altcoins and that majors nonetheless supply ample volatility with clearer construction. “Folks had been proper again on with the leverage… You actually can’t educate an outdated canine new tips,” he stated, whereas emphasizing he now “primarily focus[es] on the majors” and holds a core spot stack he hasn’t offered.

His near-term timing anchor is cycle concept. Drawing on the four-year template popularized by Bob Loukas, Mayne stated he expects the broader crypto high to land between late 2025 and early 2026, however he harassed the rapid setup is about nailing a weekly low inside a slender window that “extends till about mid subsequent week, November 10.”

Associated Studying

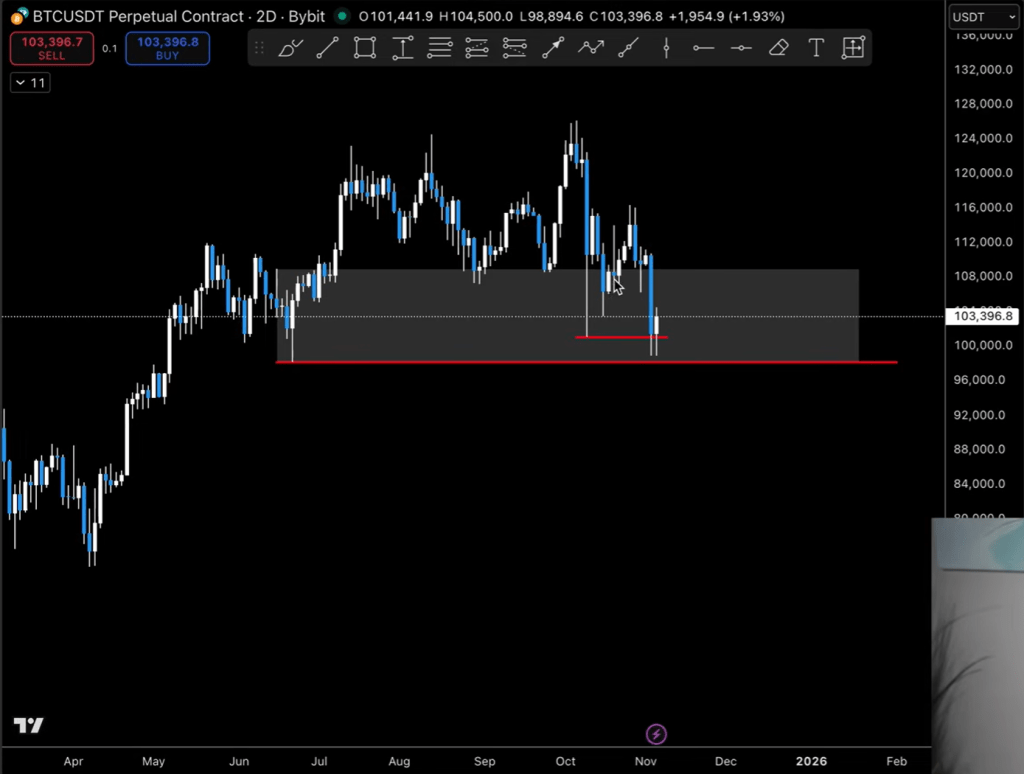

He desires to see “time and house away from this low” and a reclaim of the month-to-month open round $110,000–$112,000 to verify that the decline has been exhausted. If that construction varieties, he intends to deal with $98,000 because the operative bull-market invalidation on a weekly-closing foundation: “That can verify to me that that is our bull market invalidation… at the very least within the worst case you’ve a reduce level at like $100k Bitcoin.”

Mayne supplemented the timing view with a cross-asset learn that he says has been dependable in prior impulses: gold tends to rally first, with Bitcoin following “about 60 to 90 days later.” He cited chart work displaying gold’s advance now roughly 80–90 days outdated, which, if the connection holds, would “line up very nicely with Bitcoin being able to make its subsequent transfer.” He additionally expects the BTC-versus-gold cross to bounce, implying outperformance of Bitcoin over the dear steel by way of year-end: “I’m fairly assured this chart is due for a giant bounce and we’re going to see gold underperform Bitcoin for the rest of the yr.”

A extra subjective—however, in his telling, telling—enter is the absence of a real “blow-off” in Bitcoin versus the vertical arcs seen in AI-heavy equities and gold. With megacaps like Nvidia working exhausting because the spring and gold printing a pointy leg larger, he argued that “it simply doesn’t sit proper… that Bitcoin hasn’t had [its blow-off],” suggesting latent upside power stays to be launched if the weekly low locks in.

On market microstructure and seasonality, Mayne pointed to early-month dynamics. In lots of inexperienced months, he stated, the low varieties within the first third of the month, analogous to how Monday’s vary typically frames the week for intraday merchants. If November is destined to shut larger, an early-month low coupled with a monthly-open reclaim can be constant together with his cycle learn. “If we’re bullish for November… I need to be a bull above the month-to-month open,” he stated.

The situation evaluation was not one-sided. Mayne repeatedly acknowledged bear alerts which have emerged on larger timeframes, together with a weekly construction break, prior sweeps on the weekly and month-to-month, and constructing momentum divergences.

Associated Studying

He warned of the likelihood that the latest vary resolves as distribution—“perhaps the banks actually got here in… they usually’ve simply been distributing on us right here”—and laid out a lower-high path through which a rally fizzles beneath or simply above the prior peak earlier than breaking down. “There’s a world the place we make an all-time excessive, however it’s only a weak one… you’re going to have the most important bear div of all bear divs up right here,” he stated, cautioning {that a} marginal new excessive adopted by a swift rejection would flip his posture.

Within the medium-term, he stays open to 2 competing macro arcs. Within the base case, the traditional four-year rhythm holds, the late-2025 window marks the cycle high, and 2026 skews bearish, although he expects drawdowns on Bitcoin to be “truncated” relative to prior 80% collapses given deeper institutional participation.

Within the various, the market “right-translates”—an atypical extension through which a brand new all-time excessive may print as late as Q1 2026—forcing a reassessment of the four-year template. Both method, he stated, his plan is to promote power on the following leg and reassess if the market presents higher-low continuation after a brand new excessive: “If the market seems to nonetheless be bullish, guess what? I can get again on the bull prepare.”

Mayne additionally flagged the US greenback as a 2026 threat pivot, arguing the DXY is carving a “severe low” on multi-month and yearly buildings that might precede a “deflationary rally.” Whereas not a one-to-one driver, he stated a robust greenback tends to strain crypto and different threat property. That macro overlay, mixed with what he views as froth in AI-linked equities, underpins his warning past the following advance.

At press time, Bitcoin traded at $103,412.

Featured picture created with DALL.E, chart from TradingView.com