Within the second article of the sequence devoted to the Delta Fusion Professional indicator, we analyze two key features for studying market circulate: POC Delta (Level of Management based mostly on delta) and VWAP Delta (Quantity-Weighted Common Value weighted by delta).

These instruments assist determine intraday equilibrium ranges and directional bias utilizing a logic based mostly on the aggressive habits of market members.

1) What’s POC Delta

Idea

The Level of Management (POC) is the value degree the place the best quantity—or, on this case, the best delta—has been concentrated throughout the present session.

In Delta Fusion Professional, the POC just isn’t static: it’s dynamically calculated based mostly on the delta distribution throughout the session’s value vary.

Essential Parameters

EnablePOC = true → prompts the operate.

-

POC_DrawHLineMain = true → attracts the primary horizontal line on the chart.

-

POC_DrawBand = false (non-compulsory) → attracts a highlighted band displaying the dominant bin.

-

ResetHourCustom / ResetMinuteCustom → outline the session begin time.

-

POC_AutoStepModeSel → vertical step calculation mode:

-

AUTO_FD (Freedman–Diaconis) → based mostly on IQR and variety of bars,

-

AUTO_ATR → based mostly on common volatility (ATR).

-

-

POC_SnapToTick = true → aligns the step to the tick dimension.

-

POC_CenterLine = true → facilities the POC line within the dominant bin.

Calculation Workflow

Session Identification

The operate GetSessionStart() determines the session begin timestamp. All subsequent bars are thought-about for computation.

Step Auto-Tuning and Distribution

AutoTunePOCParams() analyzes the session vary and volatility to find out the optimum step dimension. It additionally decides whether or not to make use of absolute delta (when directional bias is weak) or internet delta (when one aspect clearly dominates).

Delta Accumulation per Bin

ComputeSessionPOC_DeltaProfile() distributes every candle’s delta throughout the value bins coated by its vary.

If distrib = 1 , delta is break up between the physique and the wicks, with a bias towards the candle physique ( bodyBias ).

Dominant Bin Choice

The bin with the best worth turns into the POC Delta. The code calculates the bin’s central value and attracts it as a horizontal line ( DrawOrUpdatePOCLine() ).

If enabled, it additionally attracts the band ( DrawOrUpdatePOCBand() ).

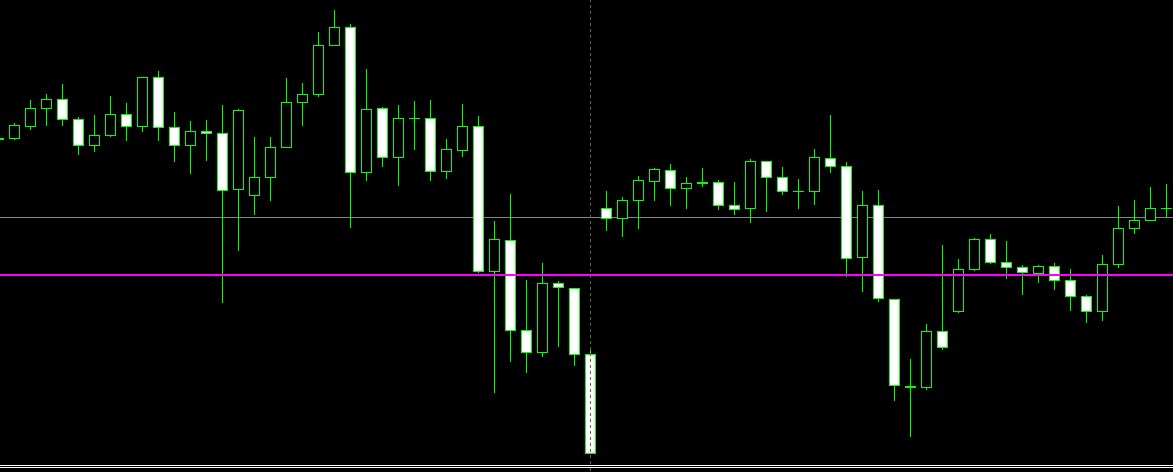

Interpretation

-

Excessive and secure POC Delta → signifies an intraday equilibrium degree the place aggressive exercise has concentrated.

-

POC shift → alerts institutional curiosity adjustments or accumulation/distribution zones.

-

Helpful for outlining dynamic help/resistance ranges and filtering entries in pattern or reversal setups

2) What’s VWAP Delta

Idea

The VWAP Delta is a complicated model of the traditional VWAP: as an alternative of weighting value by whole quantity, it weights it by aggressive delta (Ask vs Bid).

This offers a mean value weighted by directional stress, not simply by traded quantity.

Essential Parameters

-

EnableVWAP_OnChart = true → prompts the operate.

-

VWAP_OnChart_ShowBuy, ShowSell, ShowNet → management which curves are drawn:

-

Purchase = VWAP weighted solely on Ask quantity,

-

Promote = VWAP weighted solely on Bid quantity,

-

Web = VWAP weighted on internet delta.

-

-

VWAP_Net_Mode:

-

NET_DELTA_WEIGHTED → delta-weighted common,

-

NET_ALL_VWAP → traditional VWAP on Ask + Bid,

-

NET_AVG_BUY_SELL → common between VWAP Purchase and VWAP Promote.

-

-

Colours and Type: VWAP_Buy_Color, VWAP_Sell_Color, VWAP_Net_Color, VWAP_LineWidth

Calculation Workflow

Progressive Accumulation For every bar, the code calculates the everyday value tp = (excessive + low + shut) / 3 and updates the weighted sums:

-

sumP_Ask / sumAskW → VWAP Purchase,

-

sumP_Bid / sumBidW → VWAP Promote,

-

sumP_All / sumAllW → traditional VWAP,

-

sumP_Net / sumAbsNet → VWAP Web (delta-based).

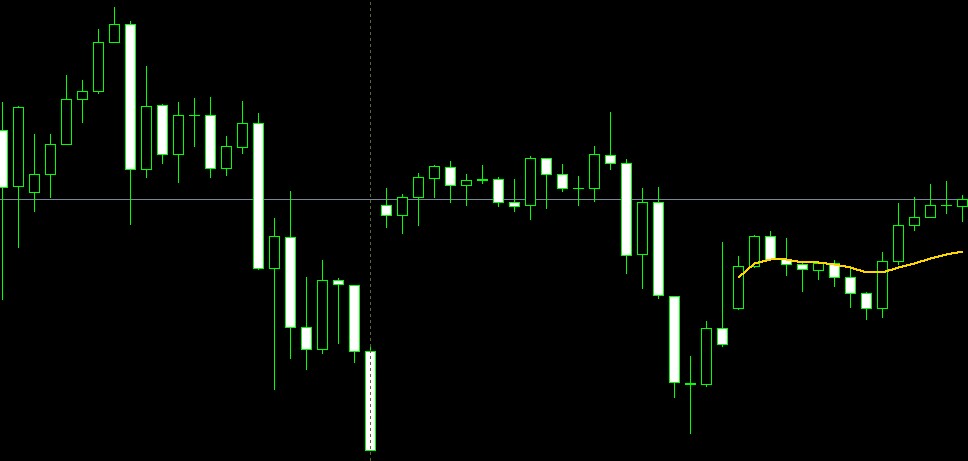

Chart Rendering

The curves are plotted as line segments ( OBJ_TREND ) for the final VWAP_MaxBarsOnChart bars. Colours and line thickness are outlined by the enter parameters.

Interpretation

-

VWAP Web above value → dominance of aggressive promoting (bearish bias).

-

VWAP Web under value → dominance of aggressive shopping for (bullish bias).

-

Distance between VWAP Purchase and VWAP Promote → measures circulate polarization: wider = extra imbalance.

Helpful for commerce location and intraday pattern affirmation.

3) POC Delta vs VWAP Delta: Synergy

Collectively, they supply a map of equilibrium and directional bias:

-

If value is above VWAP Web however removed from POC, the pattern is robust.

-

If value oscillates round POC and VWAP Web, the market is balanced.

Fast Setup

-

Allow/disable from the on-chart panel (“POC Session” and “VWAP Web”).

-

Customise colours and modes within the enter settings.

-

For scalping, hold VWAP_MaxBarsOnChart low for increased responsiveness.

-

For swing buying and selling, improve it for a broader view.

Within the subsequent article, we’ll delve into Delta divergences in DeltaFusionPro.

When you want to buy the indicator, you’ll find it right here: https://www.mql5.com/it/market/product/150494

Joyful buying and selling!