Customary Chartered supplies Precedence Banking companies in India, a premium banking answer tailor-made for the prosperous prospects. As part of this service, they problem the Customary Chartered Precedence Infinite Debit Card with engaging advantages.

Now, the financial institution has enhanced its options and advantages making it probably the most rewarding debit card within the nation for Excessive Web Value People (HNIs). Right here’s every thing that you must know:

Rewards

- 5 Level / 100 INR spend (Eff. 1st Feb 2024)

- Reward Fee: 2.2% (1 Level = 0.44 Ps)

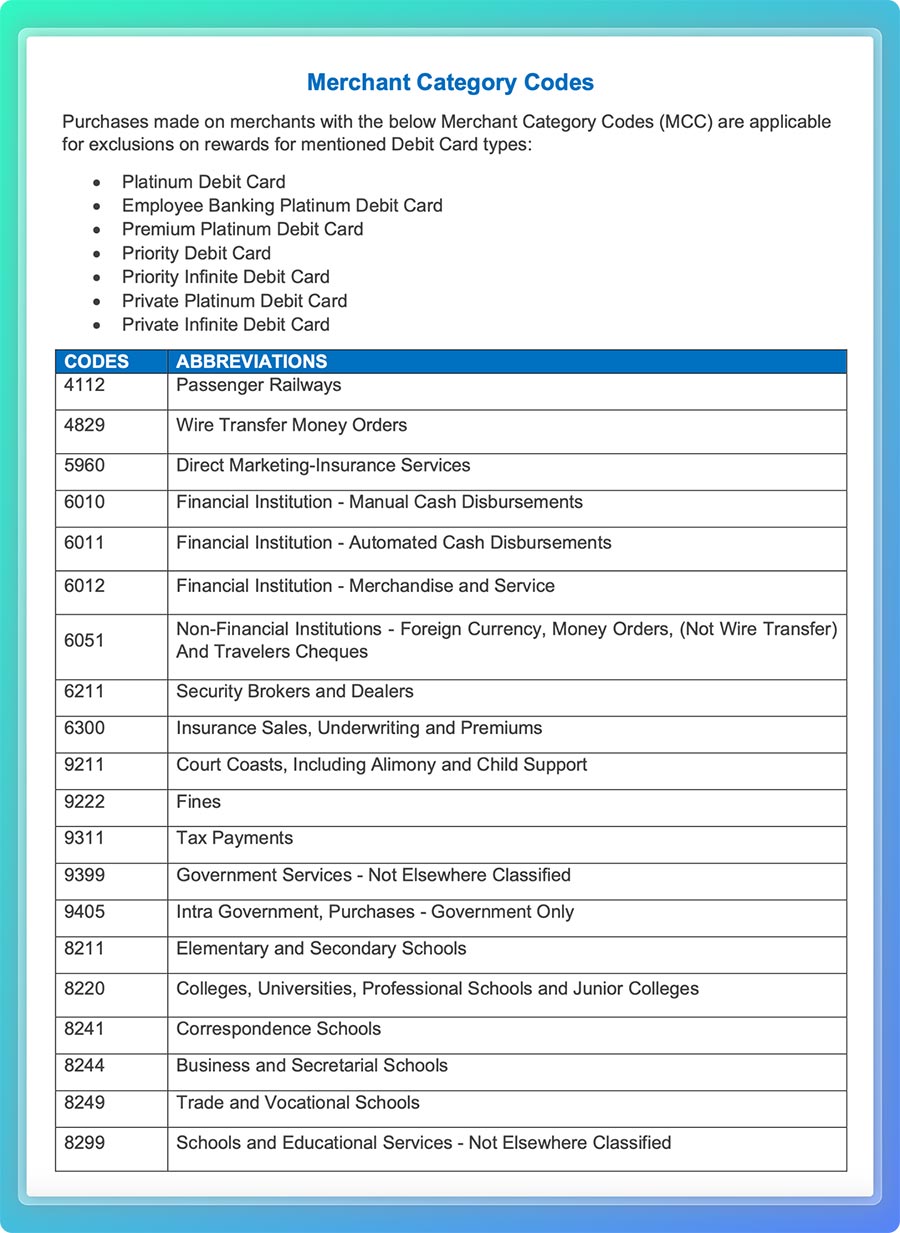

- Excluded MCC: Insurance coverage, Training, Authorities spends and few extra.

Simply incase if you happen to’re questioning, right here’s the e-mail communication on the revision of advantages and the t&c hyperlink to excluded MCC checklist.

For prime worth spends, even the IDFC First Wealth Debit Card can get you near 2.5% reward price nevertheless it not solely has the capping but in addition poor reward price on low spends.

So Customary Chartered’s providing is comparatively higher for an actual excessive spender.

Redemption

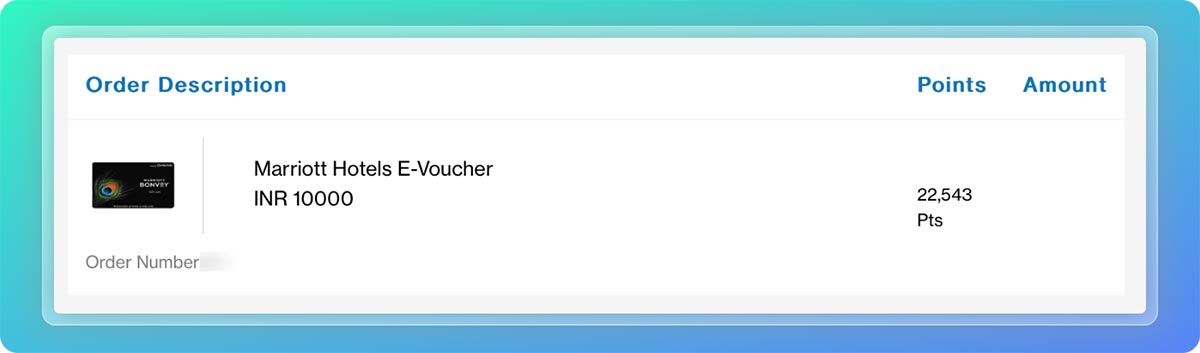

Whereas I’ve personally redeemed for Marriott Lodge eGift Playing cards, there are different choices as nicely. Right here’s a fast take a look at the choices:

- Marriott accommodations

- Taj

- ITC Resorts

- Uber

- Spar

- City ladder

- Luxe

- Levi’s

- Petter England

- Louis Philippe

- Fab India

- Lake & few extra

Advantages

- Becoming a member of/Annual Charge: Complimentary

- Complimentary airport lounge entry: 4 / Qtr (home)

- Every day POS restrict: 5 Lakhs

- Every day ATM restrict: 2 Lakhs

- INR 1,00,00,000 air accident cowl

- Buy safety price INR 55,000

Whereas the debit card doesn’t have capping on rewards, it does have POS spend restrict, which is able to technical cap the rewards as nicely, but it surely’s honest sufficient for many.

Eligibility

- Whole Relationship worth: 30 Lakhs (Financial savings, FD, Investments)

- Wage Credit score: 3 Lakhs

- Mortgage: >2 Cr

Clients has to keep up one of many above standards to pay money for the Precedence Banking relationship with Customary Chartered financial institution.

That mentioned, it’s to be famous that the financial institution additionally presents Non-public Banking companies for UHNW people at ~8 Cr TRV and that comes with a reward price of 4.4% on a debit card.

Sure, You heard that proper, 4.4% return with the SC Non-public Infinite debit card.

Bottomline

Customary Chartered Precedence debit card is probably the perfect ever debit card within the nation for HNI who need’s to spend so much on a debit card.

However why would anybody need to spend on a debit card whereas we will get lot extra on a bank card?

Nicely, some have their very own causes however for many others one could get a Credit score Card, maybe from Customary Chartered itself with their Customary Chartered Final Credit score Card that provides 3.3% reward price on most spends.

Nonetheless, it’s a great signal that the financial institution remains to be specializing in their premium playing cards and I hope sometime they give you an excellent/extremely premium bank card positioned in regards to the Final Credit score Card.

Till then, benefit from the profitable rewards on the debit card.

Make hay whereas the solar shines!