Glassnode co-founders Jan Happel and Yann Allemann, who publish below the @Negentropic deal with on X, argue that the present crypto crash is being pushed not by a broad narrative flip, however by a single, systematic supply of promote strain whose footprint is most seen in Bitcoin and is spilling into the broader advanced. Their core assertion is categorical: “What’s occurring in Bitcoin proper now isn’t a story shift: it’s a mechanical unwind.” In that framing, the tape is reflecting the compelled exit of 1 participant somewhat than an natural repricing of crypto danger.

Why Is The Crypto Market Crashing?

Negentropic’s thesis begins with momentum indicators behaving in methods they are saying are inconsistent with “pure markets.” They be aware that “the 1D MACD simply printed a brand new all-time low… but value is barely down ~33% from the highs,” and add, “This doesn’t occur in pure markets. You solely get this when somebody is dumping in a straight line.”

They pair that statement with capitulation-like oscillators that aren’t accompanied by the standard macro or leverage shock. As they put it, RSI is close to capitulation, “however there’s no macro stress, no credit score shock, no leverage detonation, no ETF outflows.” The mismatch issues to their conclusion: “It’s excessive momentum with out a catalyst: basic signature of mechanical promoting.”

Associated Studying

They then distinction at the moment’s setup with prior episodes the place MACD and RSI reached comparable extremes. In these historic instances, Negentropic says, “Value was down 60%, derivatives have been blowing out, funding was deeply destructive.” Against this, their learn of the current is that confirming stress isn’t there. “ETFs stay internet optimistic, their price foundation remains to be intact,” they write, they usually emphasize that “long-term holders are eradicating provide aggressively.”

In addition they level to cross-crypto resilience: “Solana ETF inflows are regular, altcoins are holding up comparatively nicely vs btc & eth,” and “eth is holding stronger than btc.” For Negentropic, these relative-strength alerts are the inform that this isn’t a systemwide risk-off occasion. “If this have been actual sentiment, all of that may be breaking. It isn’t,” they conclude.

Circulate regularity is the opposite pillar of the Glassnode co-founders’ case. They describe a sample that they are saying has repeated since October 10: “Identical timestamps, identical venue-specific thinness, identical lack of reflexive bids.” The implication is mechanical intent somewhat than discretionary buying and selling. “It’s a schedule, not a market,” they write, claiming “21 days of constant poisonous circulation.” That sequence, of their view, aligns with “one clarification”: “a liquidity supplier or fund was structurally broken on October tenth,” and “the entity tied to that failure has been decreasing danger in a compelled, rules-based method.”

Impartial tape watchers are describing a remarkably comparable cadence. Entrance Runners (@frontrunnersx) studies that a big vendor on Binance has been hitting the market with clock-like consistency. Over “two weeks straight,” they are saying, the entity “hit the promote button precisely at 9:30 EST, each US market open, with out fail.”

They add that “sort of consistency normally factors to a complicated actor working below particular mandates or time home windows,” and that it seems “much less like random circulation and extra like a single entity (or a tightly-coordinated group).”

Macro analyst Alex Krüger expands on how that would manifest throughout venues. He suggests the vendor could possibly be “dumping throughout US hours through a dealer or OTC desk that employs sensible order routing or hedging methods throughout a number of venues.” In his view, the dominance of Binance prints doesn’t require Binance to be the origin. “Most quantity naturally” would circulation there, he argues, “because it’s the place the majority of the liquidity resides.”

Associated Studying

Krüger additionally highlights venue asymmetries that match a routed-flow story: he has seen “comparatively little spot promoting routed through Coinbase this week,” whereas noting “extraordinary ranges of spot promoting through Bitfinex.”

Will The Crypto Crash Be Quick-Lived?

Delphi Ventures founding associate Tommy Shaughnessy focuses on the urgency implied by the tempo. If the circulation has been current since 10/10, he writes, “the velocity at which they’re promoting BTC is fairly loopy.” He interprets that as compulsion somewhat than technique: “Means they’re value insensitive and must exit, quick.” Shaughnessy characterizes the transfer as “violent,” however provides a key qualifier in step with Negentropic’s finite-seller framing: it’s possible “brief lived as a result of it’s not orderly.”

If there’s a physique from 10/10 the velocity at which they’re promoting $BTC is fairly loopy

Means they’re value insensitive and must exit, quick. (Somebody had that chart of all crimson candles for days)

Violent however means it’s hopefully brief lived as a result of it’s not orderly https://t.co/kaJAKh5Z4M

— Tommy (@Shaughnessy119) November 21, 2025

Multicoin Capital founder Tushar Jain likewise describes what he sees as compelled liquidation habits. “It seems like an enormous compelled vendor is out there,” he writes, including, “We’re seeing systematic promoting throughout particular hours.” Jain explicitly ties this to the identical October window Negentropic flags, calling it “in all probability a consequence of 10/10 liquidations,” and says it’s “laborious to think about this scale of compelled promoting continues for for much longer.”

He additionally situates the second inside an extended unwind course of, recalling a lesson from prior cycles: “it takes a while for all of the bankruptcies to disclose themselves after an enormous liquidation flush like this,” as a result of “retailers are working round making an attempt to determine what their publicity to bancrupt counterparties is.”

It seems like an enormous compelled vendor is out there. We’re seeing systematic promoting throughout particular hours. Most likely a consequence of 10/10 liquidations. Arduous to think about this scale of compelled promoting continues for for much longer. https://t.co/JO6kRmJUUb

— Tushar Jain (@tushar_jain) November 19, 2025

Taken collectively, the sources are presenting a coherent, internally constant learn: crypto’s draw back is being dominated by a single, time-boxed, price-insensitive vendor whose execution sample is systematic sufficient to warp momentum indicators and intraday construction.

Negentropic’s backside line is just not merely descriptive however interpretive: “This isn’t capitulation. This isn’t a development break.” It’s, as a substitute, “a constrained unwinding by way of a fractured market.” And since mechanical sellers finish when stock or mandate ends, the Glassnode co-founders argue that when it does, “the rebound will possible be far sharper than the decline that preceded it.”

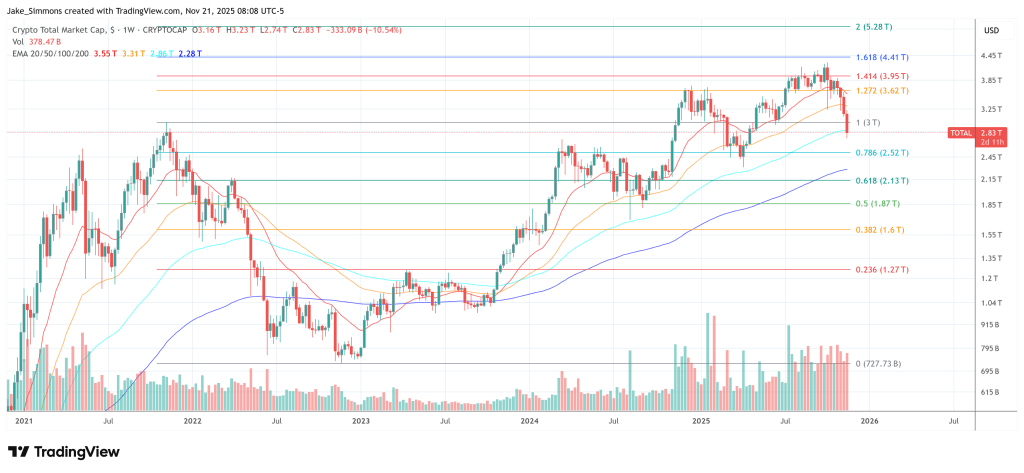

At press time, the whole crypto market cap was at $2.83 trillion.

Featured picture created with DALL.E, chart from TradingView.com