Key Findings

- Credit score unions are taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities providers, items, and actions.

-exempt nonprofit monetary establishments that have been initially organized to offer lending and saving providers to low-income working and rural households. - The Credit score Union Act of 1934 set out the essential guidelines governing the “area of membership” and the “widespread bond” that outlined credit score union membership.

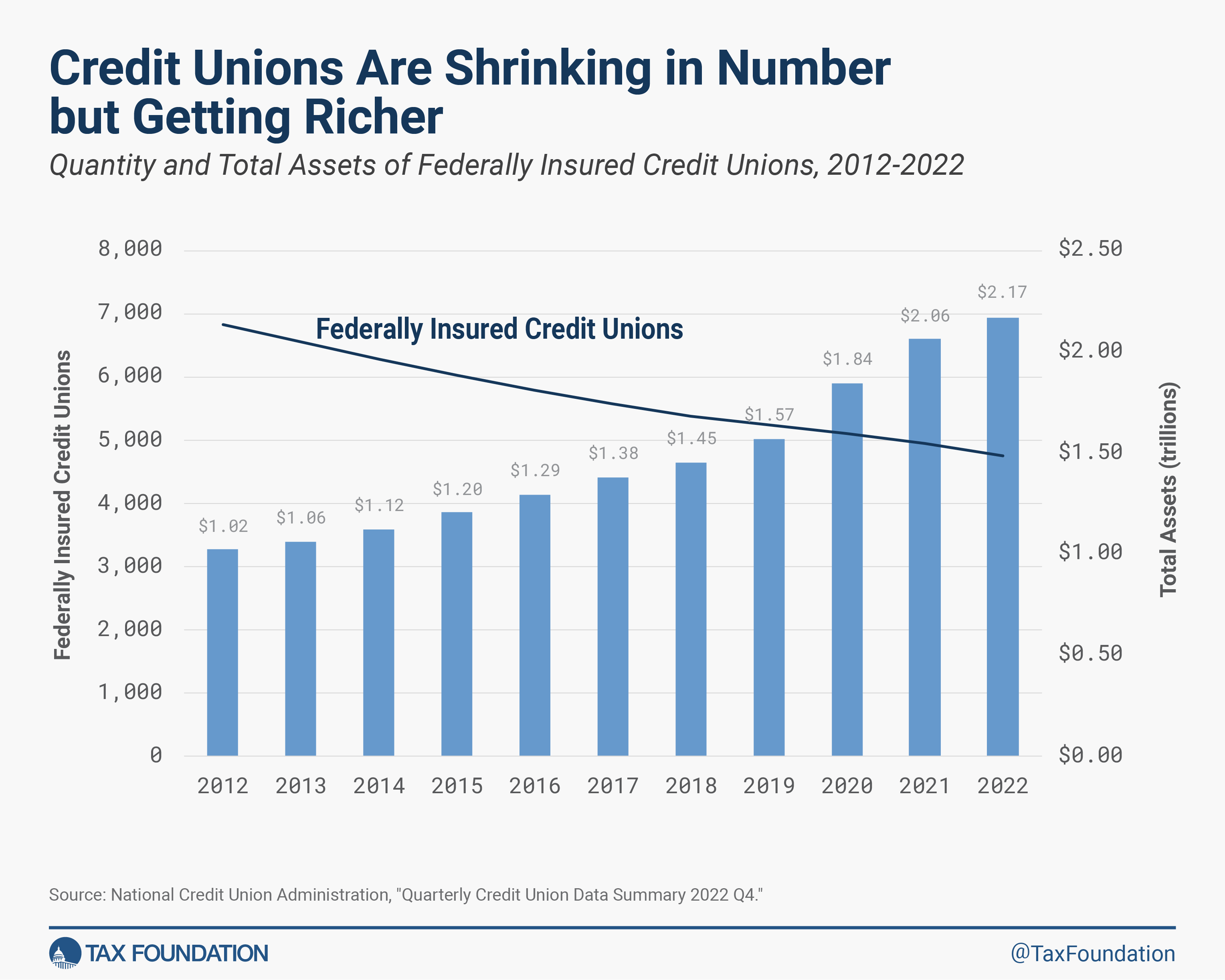

- Over the previous decade, the variety of credit score unions has declined by 30 p.c, however the quantity of credit score union belongings has greater than doubled, from $1.02 trillion to $2.17 trillion.

- Federal credit score unions are a particular class of nonprofit organizations that should not have to file a Type 990 tax return, which makes them much less clear and accountable than different nonprofits. State credit score unions do need to file a Type 990 tax return.

- Credit score unions profit from each a tax subsidy and a nonprofit subsidy. The tax subsidy is roughly $3 billion yearly, however research discover the mixed subsidy is many occasions the tax subsidy, as a lot as $21 billion yearly.

- Though credit score unions are imagined to give attention to people who find themselves “underserved” and of “modest means,” they don’t seem to be required to gather knowledge or report on their progress in assembly this mission. Research present that credit score unions more and more serve upper-income households and serve a smaller share of low-income clients than banks.

- The dual recessions throughout the early Eighties confirmed the vulnerability of the credit score union enterprise mannequin. Since then, lawmakers have repeatedly relaxed membership guidelines and expanded the kinds of monetary providers credit score unions can provide, a lot in order that credit score unions look and act extra like banks.

- Credit score unions are actually competing so efficiently in opposition to banks that they’re truly shopping for banks to additional broaden their membership and providers.

- Cellular and on-line banking have made the principles governing the sector of membership and customary bond anachronisms. Some credit score unions don’t have any membership guidelines—anybody can develop into a member.

- Equity and fairness demand that credit score unions be placed on the identical tax footing because the banks they compete with. In an period of $2 trillion deficits, subsidizing credit score unions is a luxurious taxpayers can not afford.

Introduction

When President Franklin Roosevelt signed into regulation the Credit score Union Act of 1934,[1] it’s unlikely the invoice’s sponsors imagined that these “child banks,” as Rep. Wright Patman (D-TX) known as them throughout the flooring debate,[2] would sometime develop as much as be worthwhile sufficient to purchase industrial banks, sponsor sports activities stadiums, and cater to prosperous clients. However 90 years later, that’s what credit score unions have develop into due to their privileged standing as tax-exempt nonprofit monetary establishments.

In an period of $2 trillion deficits, taxpayers can not afford to subsidize these profitable monetary establishments.

American credit score unions have been modeled on the “self-help monetary cooperatives”[3] began in Germany throughout the 1850s when poor and rural folks had little entry to banking or lending. The concept was for folks in a group—who’ve a “widespread bond”—to mix their assets right into a lending pool accessible to these in want.

As Rep. Henry B. Steagall (D-AL) stated within the minutes earlier than the ultimate vote on the invoice, credit score unions characterize “an effort to assist residents resolve their very own financial issues and meet their very own circumstances of misery out of their very own assets and by their very own efforts. The system loans on character, a factor tremendously to be desired.”[4]

Steagall and different supporters have been motivated by the assumption that increasing credit score unions would undercut the “mortgage sharks” and “shot-gun mortgage workplaces” that charged extreme charges on loans to the poor and dealing class throughout the Nice Melancholy.

That idealized picture of credit score unions didn’t protect them from criticism. By the Fifties, simply 20 years after the enactment of the Credit score Union Act of 1934, specialists started asking, “Do Federal credit score unions serve any helpful objective within the present-day American economic system? Haven’t Federal credit score unions expanded their providers past the world visualized for them by the founders of the credit score union motion? Shouldn’t the dimensions of Federal credit score unions be restricted as a result of some have grown past the purpose the place they will proceed to be a credit score union as outlined by the early philosophers of the motion?”[5]

Credit score unions might have survived these early challenges by lawmakers and enterprise teams—who claimed that the credit score unions’ tax exemptionA tax exemption excludes sure revenue, income, and even taxpayers from tax altogether. For instance, nonprofits that fulfill sure necessities are granted tax-exempt standing by the IRS, stopping them from having to pay revenue tax.

allowed them to unfairly compete with industrial banks—however the points haven’t modified with time.

As we are going to see, the aggressive hole between credit score unions and banks has widened within the years since. Research now present that credit score unions get pleasure from a taxpayer subsidy a lot bigger than the roughly $3 billion in forgone tax revenues estimated every year. The credit score unions’ personal affiliation places the whole tax and nonprofit subsidy at some $21 billion yearly. And regardless of their mandate to serve folks of “small means,” credit score unions are more and more serving upper-income households, partly as a result of that’s the place the earnings are, but additionally as a result of the variety of Individuals who’re unbanked or underserved has practically disappeared.

Certainly, many credit score unions don’t have any membership necessities—anybody can be part of. It stands to motive that if anybody in America generally is a member of a credit score union just by opening an account on-line, then there are not any extra “underserved” in America; anybody with an web connection or a telephone can develop into “banked.”

Lately, regulators and lawmakers have relaxed the principles governing credit score unions’ “area of membership” and customary bonds to such a level as to make the phrases meaningless. The unstated motivation behind these relaxed guidelines is that the normal credit score union enterprise mannequin is not viable.

The dual recessions of the early Eighties confirmed that pinning credit score union membership to a selected employer, occupation, or group was a recipe for extinction as a result of employers go bankrupt, professions develop into out of date, and communities hole out. The technique lawmakers used to make sure the survival of susceptible monetary establishments was to calm down their membership guidelines and permit them to broaden the monetary providers they provide. In different phrases, enable credit score unions to develop into an increasing number of like banks.

Now that regulators and lawmakers allow credit score unions to behave like banks, fairness, equity, and public finance require that they be taxed like the fashionable monetary establishments they’ve develop into.

Credit score Unions: Shrinking in Quantity however Rising in Measurement

As of December 2022, the latest full-year knowledge, there have been 4,760 federally insured credit score unions; 2,980 have been federal credit score unions and 1,780 have been federally insured state credit score unions. As Determine 1 illustrates, the variety of credit score unions has declined by 30 p.c since 2012, however the quantity of credit score union belongings has greater than doubled, from $1.02 trillion to $2.17 trillion.[6]

Whereas the variety of credit score unions declined throughout that interval, the variety of members grew. In 2012, credit score unions had roughly 94 million members. By 2022, that quantity had grown to greater than 135 million, a 44 p.c improve.

On account of consolidation and their enlargement by way of relaxed widespread bonds, credit score unions have develop into more and more greater. The everyday credit score union in 2012 had $150 million in belongings. In 2022, the everyday credit score union had $455 million in belongings, thrice bigger than the everyday credit score union a decade earlier.

Credit score Unions Are a Particular Class of Nonprofit Organizations

The unique 1934 Act known as for exempting credit score unions from taxation, however that provision was eliminated attributable to objections from some lawmakers earlier than remaining passage. Credit score union sponsors have been capable of go an modification in 1937 reinstating the supply exempting all state and federally chartered credit score unions from paying both federal or state revenue taxes. Credit score unions weren’t exempted from paying native property taxes or payroll taxes.

In 1998, Congress used the Credit score Union Membership Entry Act to bolster the notion that credit score unions are exempt from federal revenue taxes “as a result of they’re member-owned, democratically operated, not-for-profit organizations typically managed by volunteer boards of administrators and since they’ve the desired mission of assembly the credit score and financial savings wants of customers, particularly individuals of modest means.”[7]

Usually, nonprofit organizations are required to file a particular Type 990 federal tax return every year to report on their funds, operations, and government compensation. Type 990 tax returns are publicly out there so donors, members, and stakeholders can maintain nonprofits accountable, particularly since most nonprofits are charities.

Nonetheless, due to their particular constitution, federal credit score unions will be the solely totally non-public, non-religious organizations in America not required to file a tax return. Federal credit score unions are thought-about to be “instrumentalities” of the federal authorities and are tax-exempt underneath 501(c)(1) of the Inner Income Code. This designation is reserved for organizations created or chartered by an act of Congress, such because the Company for Public Broadcasting and regional Federal Reserve banks.

And since federal credit score unions are exempt from submitting Type 990 tax returns, they lack the type of transparency and accountability that members and taxpayers deserve. There isn’t any unbiased approach of figuring out if federal credit score unions are assembly their mandated missions.

Furthermore, federal credit score unions are exempt from unrelated enterprise revenue tax (UBIT) guidelines that require nonprofits to pay tax on revenue derived from industrial actions unrelated to the group’s mission. Admittedly, UBIT guidelines have numerous loopholes—for instance, they permit faculty sports activities associations to gather tens of millions of {dollars} in TV revenues tax-free—however exempting federal credit score unions from UBIT offers them much more freedom to broaden into companies unrelated to serving underserved clients.

State credit score unions are handled otherwise than federal credit score unions. They’re tax-exempt underneath 501(c)(14) of the IRS code and should file annual Type 990 tax returns. They aren’t exempt from UBIT. Whereas tax returns don’t require info on the composition of a credit score union’s membership or outreach to the underserved, they do present members and the general public with clear details about the group’s funds and operations.

In 2006, the Authorities Accountability Workplace (GAO) printed a report extremely important of credit score unions’ lack of transparency. The report highlighted credit score unions’ failure to doc which constituencies they serve and the compensation preparations they’ve with their senior managers.

GAO warned, “Government compensation for federal credit score unions isn’t clear, as a result of credit score unions should not required to file publicly out there experiences such because the IRS Type 990 that disclose government compensation knowledge.”[8] And state credit score unions usually file tax returns as a gaggle, which permits them to keep away from documenting government compensation.

GAO advisable that the Nationwide Credit score Union Administration (NCUA) develop the means to systematically monitor the efficiency of credit score unions in serving underserved populations and supply transparency about government compensation.

NCUA has not satisfactorily addressed both of the suggestions throughout the previous 17 years.

Credit score Unions Profit from Express and Implicit Subsidies

Credit score unions are each tax-exempt and nonprofit which, as we discover, supplies them with each specific and implicit subsidies. Probably the most generally understood specific subsidy is the “tax expenditureTax expenditures are a departure from the “regular” tax code that decrease the tax burden of people or companies, by way of an exemption, deduction, credit score, or preferential price. Expenditures may end up in vital income losses to the federal government and embody provisions such because the earned revenue tax credit score, baby tax credit score, deduction for employer health-care contributions, and tax-advantaged financial savings plans.

” estimated yearly by economists at Congress’s Joint Committee on Taxation (JCT) and the U.S. Treasury. JCT’s estimate assumes that if all credit score unions misplaced their tax exemption and have been required to pay the 21 p.c company tax price on their internet earnings, they’d owe $2.8 billion in company revenue taxA company revenue tax (CIT) is levied by federal and state governments on enterprise earnings. Many firms should not topic to the CIT as a result of they’re taxed as pass-through companies, with revenue reportable underneath the particular person revenue tax.

in 2024 and $15.2 billion over 5 years. Utilizing a barely totally different methodology, Treasury economists estimate the credit score union tax exemption ends in forgone tax revenues of $34.7 billion over 10 years.

These estimates are tough calculations of what credit score unions would pay in revenue tax on internet earnings in the event that they have been company entities. For instance, in keeping with NCUA knowledge, in pre-COVID 2019, all federally insured credit score unions (each federal and state-chartered) loved collective internet revenue—i.e., earnings—of $14 billion,[9] which might have meant a $2.9 billion tax legal responsibility. In 2022, all federally insured credit score unions loved a collective internet revenue of $18.8 billion,[10] which might translate to a tax legal responsibility of $3.9 billion.

An instance of this tax subsidy at work will be present in a 2010 examine printed within the Southern Enterprise Assessment evaluating the return on funding (ROI) of credit score unions versus the ROI of banks in Georgia. The examine discovered that banks have been typically extra worthwhile than credit score unions, “however, because of the credit score unions tax exempt standing, banks wind up incomes much less revenue as a share of belongings.”[11]

Nonetheless, a severe limitation of tax expenditure estimates is that they’re a slender try to approximate the company revenue taxes a credit score union would pay on e book earnings, however don’t account for the implicit subsidies afforded tax-exempt organizations due to their nonprofit standing. For instance, federal credit score unions save vital administrative prices by not having to file state and federal revenue tax returns. Nor do credit score unions need to adjust to different regulatory burdens industrial banks should account for, such because the Group Reinvestment Act. These exemptions ought to be thought-about implicit subsidies. Credit score unions additionally might profit from a perceived “good will” due to their nonprofit standing.

Extra broadly, nonprofits get pleasure from quite a few untaxed revenue streams outdoors of the bounds of UBIT, together with funding and endowment revenue, sure hire and royalty revenue, and revenue from ticket gross sales and tuition, to say a number of examples. All of those revenue streams are taxable for company entities however not for nonprofits. Thus, they’re ignored within the official calculation of tax expenditures.

To make certain, the nonprofit subsidy is tougher to estimate. However as a 2021 examine by economists Jordan van Rijn, Shuwei Zeng, and Paul Hellman demonstrates, it’s many occasions bigger than the straightforward tax expenditure estimate.[12] The researchers in contrast automobile mortgage charges charged by credit score unions versus banks and located that the mixture distinction between them was 163 p.c bigger than the estimated worth of the credit score union tax exemption over an 18-year interval. This implies that even within the absence of the tax exemption, credit score unions might nonetheless provide decrease auto mortgage charges than banks attributable to their nonprofit standing.

There’s a bigger macroeconomic implication of the implicit subsidy for nonprofits. As economist Don Fuller noticed in a examine on nonprofit museums, the “taxes levied on the remainder of the economic system serve to boost the price of different actions relative to the price of [nonprofit] actions. On this sense, we will say that there’s an ‘implicit subsidy.’ With restricted financial assets to go round, a tax system that daunts sure makes use of of assets essentially encourages different untaxed makes use of of assets.”[13] In different phrases, the tax exemption encourages extra nonprofit actions over profit-making (and tax-paying) actions than would in any other case be the case.

Subsidies Permit Credit score Unions to Be Much less “Revenue Environment friendly” than Banks

In a 2022 examine, economists Robert DeYoung, John Goddard, Donal G. McKillop, and John O.S. Wilson (DeYoung et al.) measured the “revenue inefficiency” gaps of credit score unions and comparably sized banks.[14] In different phrases, they checked out how far beneath revenue maximization every monetary establishment was. Not surprisingly, credit score unions have been discovered to be extra “inefficient” (which means they maximized earnings much less) due to their tax-exempt and nonprofit standing.

The revenue inefficiency hole between credit score unions and industrial banks was discovered to be 75 foundation factors per greenback of belongings. The primary query DeYoung et al. sought to reply was what was the reason for the hole? Was it because of the tax subsidy, the nonprofit subsidy, or one thing else?

Subsequent, the examine’s authors wished to find out how credit score unions use the revenue inefficiency hole. Do they spend extra on staffing, overhead, or government salaries than banks? Do they supply depositors with greater rates of interest on financial savings? Do they cost much less on loans and bank cards? Or some mixture of all three?

DeYoung et al. discovered that credit score unions profit from each the tax and nonprofit subsidies, though the tax subsidy was barely extra highly effective than the nonprofit subsidy, resulting in greater than half (55 p.c) of the advantages to credit score union members.

Their mannequin additionally indicated that the 2 subsidies largely flowed to depositors by way of greater charges on financial savings automobiles resembling certificates of deposit, particular person retirement accounts, and private financial savings accounts. They didn’t discover that the subsidies benefited debtors or bank card customers to any sizable diploma. Credit score unions have been discovered to make use of extra personnel than banks however didn’t have extreme overhead prices in comparison with banks.

“Therefore, we [DeYoung et al.] conclude that many of the tax and non-profit subsidies loved by credit score unions are merely redistributions, handed by way of from taxpayers to credit score union depositors within the type of greater curiosity funds.”

The Congressional File means that lawmakers’ objective in granting credit score unions a tax exemption was an acknowledgment of their self-help construction, not as a way of redistributing revenue from taxpayers to depositors.

The Price of the Taxpayer Subsidy Is Bigger than the Tax Expenditure

Now that we all know that each the tax subsidy and the nonprofit subsidy clarify the “revenue inefficiency hole” between credit score unions and banks, what’s that hole price? Because it seems, it’s way more than the quantity of forgone tax revenues estimated within the tax expenditure tables.

The Credit score Union Nationwide Affiliation (CUNA)—the credit score unions’ foyer—publishes an everyday report on advantages to members that gives a extra full measure of the dimensions of the mixed tax and nonprofit subsidy.

The CUNA report[15] compares the typical rates of interest credit score unions provide on financial savings automobiles and the rates of interest they cost on lending (auto loans, mortgages, and bank cards) with the averages offered by industrial banks. As DeYoung et al. confirmed of their examine, the revenue hole between credit score unions and banks is extra than simply the tax subsidy; it additionally contains the nonprofit subsidy. Measuring the whole greenback worth of the distinction between the charges supplied by credit score unions and banks ought to give us a more true measure of the mixed tax-exempt and nonprofit subsidy.

As Desk 1 illustrates, as of September 2023, credit score unions charged rates of interest 0.62 share factors much less on new auto loans and 4.70 share factors much less on bank cards than what industrial banks sometimes charged. Credit score unions supplied higher charges on most different mortgage merchandise as nicely. Consequently, CUNA estimates that based mostly on the mixed mortgage balances of credit score unions, the speed differentials totaled practically $9.5 billion in monetary advantages to members as of September 2023.

Desk 1. Estimated Credit score Union Monetary Advantages September 2023

| Common Stability at Credit score Unions (billions) |

Proportion Level Price Distinction vs. Banks (%) | Whole Monetary Advantages to Members (billions) |

|

|---|---|---|---|

Loans |

|||

| New automobile loans | $172.93 | -0.62 | $1.067 |

| Used automobile loans | $317.17 | -0.69 | $2.192 |

| Private unsecured loans | $64.79 | 0.69 | ($0.450) |

| 5-year adjustable price 1st mortgage | $162.54 | -0.92 | $1.492 |

| 15-year mounted price 1st mortgage | $101.16 | -0.09 | $0.090 |

| 30-year mounted price 1st mortgage | $298.34 | -0.19 | $0.564 |

| Residence fairness / 2nd mortgage loans | $113.79 | -0.78 | $0.890 |

| Bank cards | $746.57 | -4.7 | $3.611 |

| Curiosity rebates | $0.024 | ||

Whole CU member profit arising from decrease rates of interest on mortgage merchandise: |

$9.947 | ||

Financial savings |

|||

| Common shares | $638.45 | 0.01 | $0.045 |

| Share draft checking | $386.59 | 0.25 | $0.947 |

| Cash market accounts | $380.02 | 0.42 | $1.577 |

| Certificates accounts | $353.67 | 1.96 | $6.918 |

| Retirement (IRA) accounts | $841.53 | 1.19 | $0.998 |

| Bonus dividends in interval | $0.000 | ||

Whole CU member profit arising from greater rates of interest on saving merchandise: |

$10.484 | ||

Payment Earnings |

|||

Whole CU member profit arising from fewer/decrease charges: |

$1.500 | ||

Whole CU member profit arising from rates of interest on mortgage and financial savings merchandise and decrease charges: |

$21.464 |

Supply: CUNA https://www.cuna.org/content material/dam/cuna/advocacy/cu-economics-and-data/analysis-and-calculators/Nationwide-MemberBenefits.pdf

Credit score unions additionally supplied higher charges on financial savings merchandise. For instance, credit score unions paid 1.19 share factors extra on particular person retirement accounts and 0.42 share factors extra on cash market accounts than banks. Throughout all the assorted financial savings merchandise, the speed differentials added as much as practically $10.5 billion in monetary advantages to members.

As well as, CUNA estimates the advantages to members of the decrease charges charged by credit score unions totaled $1.5 billion.

Mixed, CUNA estimates the whole monetary advantages to members at greater than $21 billion yearly. The advantages are stated to equal $156 per member and $328 per family.

Nonetheless, what CUNA touts because the monetary advantages members obtain is definitely an excellent approximation of the mixed tax and nonprofit subsidies loved by credit score unions. Thus, the true taxpayer subsidy to credit score unions totals greater than $21 billion per yr.

Though CUNA’s figures differ barely from the figures of DeYoung et al.—for instance, CUNA estimates that the advantages of decrease mortgage charges are bigger than the advantages from the upper financial savings charges—the figures nonetheless illustrate that the true taxpayer subsidy to credit score unions is many occasions bigger than the forgone tax revenues estimated by JCT.

The mixed subsidies will proceed to develop as credit score unions get greater over time.

Credit score Unions Subsidies Drive down Financial institution Charges—and Income

Research additionally present that competitors from credit score unions causes banks to cut back their rates of interest and costs. Because the authors of a examine commissioned by the Nationwide Affiliation of Federally-Insured Credit score Unions (NAFCU) clarify, “In step with fundamental microeconomic concept, rising the variety of corporations in a market tends to decrease costs supplied by sellers; equally, the elevated availability of substitute items supplies aggressive stress.”[16] Thus, “the presence of credit score unions not solely helps members get higher charges, but additionally serves as a test on the rates of interest banks provide clients.”

The NAFCU examine decided that the competitors from credit score unions brought on banks to supply decrease charges on loans and better charges on deposits. From 2011 to 2020, the authors estimated the advantages of the speed differentials to financial institution clients totaled roughly $81 billion.[17]

That is, after all, one-column accounting, specializing in the advantages whereas ignoring the liabilities. What NAFCU calls advantages to clients are the revenues misplaced to banks. In different phrases, the taxpayer subsidies to credit score unions price banks greater than $80 billion in decreased earnings over a decade. Fewer earnings imply much less staffing, fewer providers, and fewer tax revenues for the federal government.

Taxpayer Subsidies for Credit score Unions Don’t Profit Low-Earnings Clients

The Credit score Union Membership Entry Act reiterated that credit score unions have been granted their tax-exempt standing “as a result of they’ve the desired mission of assembly the credit score and financial savings wants of customers, particularly these with modest means.”

Little doubt this may be a noble mission, however because the Authorities Accountability Workplace has steadily lamented, there isn’t any established definition of “modest means” nor has there been any sustained effort to measure how nicely credit score unions are serving low- and modest-income clients.[18] GAO factors out that not one of the common-bond standards to federally chartered credit score unions refers back to the financial standing of their present or potential members. Certainly, virtually by default, the members of credit score unions affiliated with giant firms, universities, skilled organizations, and even Congress are likely to have above-average incomes.

NCUA produces no publicly out there knowledge on the financial standing of credit score union members, so the job of estimating the attain of credit score unions to low-income clients has been left to GAO, lecturers, and numerous surveys.

In a current tutorial examine, professors Pankaj Okay. Maskara and Florence Neymotin discovered that “unbanked” or “underbanked” households have been much less prone to be members of credit score unions. Certainly, they discovered that credit score union members usually tend to be “employed, high-education, and dual-income people.”[19]

To Maskara and Neymotin, the information means that “credit score unions should not truly serving the wants of the underserved sector of society.” They surmise that the credit score union sector “has grown to the dimensions that it’s merely incapable of serving the ‘underserved’ as the vast majority of its members.”

In a separate examine, the identical authors discovered that credit score unions did little to offer customers in troubled states liquidity within the type of dwelling fairness traces of credit score throughout the monetary disaster of 2008, opposite to their picture as a lender for these in want.[20]

In an evaluation of information from the 2019 Survey of Shopper Finance, Filene’s Middle for Shopper Monetary Lives in Transition discovered that credit score union members tended to be extra educated and older than financial institution clients and the final inhabitants.[21] Amongst credit score union households, 66 p.c had some faculty or a bachelor’s diploma or greater in comparison with 24 p.c of households total.

Noting that the unbanked are almost certainly to have decrease academic attainment than the banked inhabitants, the survey discovered that “credit score unions serve a smaller share of members with no highschool diploma (6%) when in comparison with the general inhabitants and financial institution households (11% every).”

On common, the survey discovered that financial institution major households had a median revenue of $81,449, whereas credit score union major households had a median revenue of $74,801. Nonetheless, a smaller share of credit score union members have been self-employed (9 p.c) in comparison with financial institution clients (12 p.c). The report famous that “[s]elf-employed people appear to desire banks.”

Of their evaluation of the Survey of Shopper Finance, van Rijn et al. additionally discovered that financial institution clients had greater incomes and better internet worths than credit score union clients. Nonetheless, credit score unions served extra middle-income clients than banks, whereas banks served a larger share of consumers on the decrease finish and higher finish of the revenue scale.[22]

Prior research by GAO discovered that the proportion of upper-income members of credit score unions had been rising and that fewer credit score union members have been of “modest means” or low-income than financial institution clients. Utilizing knowledge from the 2004 Survey of Shopper Finance, GAO discovered that 14 p.c of credit score union clients have been low-income in comparison with 24 p.c for banks. Equally, 31 p.c of credit score union members have been of “modest-means” in comparison with 41 p.c of financial institution clients. Against this, practically half (49 p.c) of credit score union clients have been upper-income in comparison with 41 p.c for banks.[23]

Credit score Unions’ Continued Failure to Measure Service to the Underserved

As GAO reported in 2005, “Whereas credit score union fields of membership have expanded, the extent to which they serve folks or communities of low or reasonable incomes isn’t definitively identified.”[24] Nothing has modified within the practically 20 years since GAO’s examine as a result of credit score unions are nonetheless not required to gather and report this info.

Greater than 20 years in the past, NCUA launched the Low-Earnings Credit score Union (LICU) program to permit credit score unions to broaden their area of membership past what is restricted by their widespread bond into “underserved” areas. For instance, GAO found {that a} Maryland-based credit score union was allowed to broaden its service space to an “underserved” neighborhood in close by Washington, D.C.

At present, greater than half of all credit score unions (2,585 out of 4,686) have been designated as “low-income” establishments, in keeping with NCUA knowledge.

This designation seems to be little greater than a signaling gadget to permit credit score unions (and NCUA) to assert they’re serving underserved populations with out having to offer any documentation to again it up. The NCUA web site supplies no knowledge to show that credit score unions are in truth reaching the underserved.

A great instance is the Congressional Federal Credit score Union (CFCU), which was granted low-income standing in 2022. Since 1953, CFCU’s membership has catered to members of Congress and their employees—hardly low-income clients.[25]

With its new low-income designation, CFCU’s service area[26] now spans a gerrymandered swath of Washington, D.C., from poor neighborhoods within the East and Southeast elements of town to the campus of George Washington College (only a few blocks from the White Home) and the White Home itself. But, regardless of its service space containing low-income neighborhoods, CFCU doesn’t function any branches in poor areas.

The State Division Federal Credit score Union (SDFCU) has additionally been designated as a low-income establishment regardless that it primarily serves international service officers overseas.[27] There are, nonetheless, dozens of “Choose Worker Teams” (SEGs) whose members can be part of the State Division credit score union regardless that they appear to have no widespread bond with State Division staff.[28] This contains the workers of Alexandria Animal Hospital, the Broadcasting Board of Governors, the Better Baltimore Board of Realtors, the Motley Idiot, and the Worldwide Republican Institute, to say a number of.

Low-Earnings Designation Is a Boon to Credit score Unions on the Expense of Banks

Economists Stefan Gissler, Rodney Ramcharan, and Edison Yu (Gissler et al.) studied how the low-income designation for credit score unions impacted the credit score market within the affected service areas.[29] The consequences have been dangerous for some banks, good for others, and combined for customers.

The examine discovered that banks inside a 5- or 10-mile radius of an elevated variety of low-income credit score unions noticed a “mirror decline in lending and deposit taking.” Financial institution failure charges elevated in such areas, particularly in states with greater taxes. This illustrates the function the tax exemption performs in permitting credit score unions to out-compete native banks.

Nonetheless, the competitors in client lending from credit score unions sarcastically made some banks extra worthwhile as they shifted their enterprise mannequin away from client to enterprise lending. However this additionally illustrates how the tax exemption allowed credit score unions to encroach into the buyer lending market and take market share away from banks.

Gissler et al. did discover that competitors between credit score unions and non-bank lenders drove every of them to extend the variety of new loans they prolonged to debtors within the “backside half of the danger distribution.” Not surprisingly, nonetheless, their examine additionally discovered that “this reallocation in automotive credit score to riskier debtors on account of elevated competitors is related to a major improve in non-performing loans.”[30]

It could be a mistake, nonetheless, to attribute the destructive results to competitors per se as a result of the “competitors” is pushed by distortion: taxpayer-subsidized credit score unions pushing the lending market into riskier practices.

Credit score Unions’ Susceptible Enterprise Mannequin Necessitated the Rest of Frequent Bonds

Sponsors of the Credit score Union Act of 1934 boasted that no credit score unions failed following the monetary crash of 1929, in contrast to lots of of business banks. Regardless of the motive for his or her survival then, the identical couldn’t be stated for the destiny of many credit score unions throughout the double-dip recessions within the early Eighties. The financial downturns of the ‘80s uncovered the vulnerability of the credit score union enterprise mannequin to its slender buyer base.

In a regulation overview article charting the authorized battles between banks and credit score unions, “Banks v. Credit score Unions: The Turf Battle for Shoppers,” Kelly Culp experiences that the slender guidelines governing the widespread bond of credit score unions virtually turned the business’s undoing.[31]

In keeping with Culp, the regulation required that federal credit score union membership “be restricted to teams having a typical bond of occupation or affiliation, or to teams inside a well-defined neighborhood, group, or rural district.” For years, regulators interpreted the requirement narrowly to imply, for instance, staff of a single firm or troopers at a specific navy base.

Consequently, Culp experiences that by the Eighties, some 80 p.c of credit score unions have been linked to particular employers, lots of of which went bankrupt throughout the twin recessions. In 1981, 222 credit score unions failed, which put an amazing pressure on the insurance coverage fund supporting the business.

Recognizing the vulnerability and unsure viability of the credit score union enterprise mannequin, the NCUA started to calm down the widespread bond requirements that tethered them to slender buyer bases.

Within the years since, NCUA and Congress have relaxed the requirements even additional and allowed credit score unions to create a number of widespread bonds that seemingly don’t have any logic aside from to allow credit score unions to broaden their buyer base.

Credit score Unions Are Utilizing Taxpayer Subsidies to Purchase Banks

Nothing illustrates extra how credit score unions have ditched their mission of serving the underserved than the rising efforts by credit score unions to purchase industrial banks. This development additionally speaks to the money credit score unions can accumulate by being tax-exempt nonprofits and that not all of their earnings accrue to the good thing about members.

Over the previous decade, credit score unions have bought greater than 80 banks, and a sizeable variety of credit score unions have bought a number of banks.[32] Admittedly, 80 isn’t a lot of acquisitions in comparison with the lots of of mergers between credit score unions, or a good bigger variety of financial institution mergers throughout the interval, nevertheless it nonetheless alerts the ambitions of credit score union managers to broaden their membership, geographic footprint, and enterprise traces. Some credit score unions have bought banks as a defensive measure to maintain a rival from increasing into their geographic space.[33]

The development towards financial institution purchases by credit score unions additionally alerts the constraints of the credit score union enterprise mannequin. MarketWatch experiences that the thought for the primary credit score union buy of a financial institution in 2012 got here out of a dialog between deal lawyer Michael M. Bell and one in every of his shoppers in regards to the challenges of natural progress. “It’s a must to scale,” he informed MarketWatch. “It’s a reality of our economic system [and] that’s occurring on this business. The small are disappearing and the large are getting greater.”[34] The best way credit score unions are being inspired to get greater is by buying banks.

A current instance is the Michigan-based Dearborn Federal Credit score Union (DFCU), which was accredited by NCUA to buy two Florida financial institution branches from MidWestOne Financial institution of Iowa Metropolis, Iowa. In keeping with the Credit score Union Instances, DFCU “now has 5 branches within the Tampa space and one in St. Petersburg following its buy of the Tampa-based First Citrus Financial institution in January.”[35] Practically 25 p.c of the Michigan-based DFCU’s branches are actually in Florida.[36]

One other instance is Lake Michigan Federal Credit score Union, which has been increasing its attain into Florida because it opened a mortgage workplace in Bonita Springs in 2015.[37] Bonita Springs occurs to be one of many wealthiest areas in Florida, with a median revenue of practically $85,000 in keeping with the U.S. Census Bureau. Greater than 80 p.c of the group’s residents are White, and it has a really low poverty price.

Since its 2015 enlargement, Lake Michigan Federal Credit score Union has bought a variety of industrial banks, together with a 2021 buy of Pilot Bancshares’ Pilot Financial institution and Nationwide Plane Finance Co., which focuses on financing plane.[38] Financing plane is kind of a departure from the mission of serving underserved Michigan residents.

Credit score unions are excellent consumers, say specialists, as a result of they are typically all-cash consumers, whereas industrial consumers desire to make use of inventory or fairness for the deal. Since many group banks are family-owned or have a modest variety of shareholders, they like the money deal. And credit score unions have a tendency to supply the next value for the acquisition as a result of they don’t have to fret in regards to the tax implications.

However states and the federal authorities ought to fear in regards to the tax implications. The transactions are distinctive in that the credit score unions are buying the belongings of the financial institution, however not the constitution. Thus the belongings develop into a part of the nonprofit credit score union whereas what’s left of the taxpaying financial institution is successfully dissolved. Whereas the income losses may not be giant for state and federal treasuries, they’re nonetheless a troubling consequence of permitting such offers.

Even inside the credit score union business, complaints come up that the phrases of the offers are hardly ever made public and that members should not knowledgeable why their capital is getting used to buy a financial institution reasonably than returned to members. Frank J. Diekmann, co-founder of CUToday.information, additionally says members must know if CEOs—whose contracts usually tie their compensation to asset measurement—are getting raises out of the offers. “Members have a proper to find out about that,” he writes, “particularly since—once more—it’s their cash getting used to goose the comp.”[39]

Diekmann reminds readers that industrial financial institution consumers must report such info to shareholders, so why are there totally different requirements for credit score unions?

Is There Nonetheless a Want for Credit score Unions?

When President Roosevelt signed the Credit score Union Act of 1934, solely about 40 p.c of U.S. households had a phone. Telephones have been thought-about a luxurious. At present, practically half (48.8 p.c) of underbanked households use cell banking as their major technique of accessing their checking account. In keeping with the 2021 FDIC Nationwide Survey of Unbanked and Underbanked Households, the speed of cell banking for the underbanked is bigger than amongst totally banked households (42.5 p.c).[40]

Greater than phone entry has modified since credit score unions have been considered a salvation for the poor and dealing class. Practically each American has entry to banking at the moment due to expertise and monetary innovation.

The FDIC survey experiences that the proportion of unbanked households has declined significantly since 2009, the primary yr of the examine. In 2021, the unbanked price stood at 4.5 p.c of households (roughly 5.9 million), the bottom price since 2009 and a 3.7 share level drop since 2011—the final peak. This corresponds to a rise of 5 million banked households over a decade and implies that greater than 95 p.c of households are actually banked.

That stated, the charges of the unbanked are typically greater amongst lower-income, less-educated, Black, and Hispanic households, in keeping with FDIC. Curiously, entrepreneurs are stepping as much as attain underserved minority markets, which is one other signal that credit score unions have failed to fulfill the wants of those teams.

For instance, MoCaFi.com is a Black-owned on-line financial institution targeted on the Black group. Majority.com presents all-in-one cell banking for migrants. The cell app “en.Comun.app” is concentrated on serving the Latino group. Lastly, myTotem.app is an app aimed toward serving the Native American group.

On-line and cell banking—which most banks and credit score unions now provide—utterly removes the necessity for a typical bond or location-specific membership necessities. Certainly, the notions of “area of membership” and “widespread bond” are anachronistic in at the moment’s digital economic system.

Nobody who has a pc or cellphone will be thought-about “underserved.” PenFed, the nation’s third-largest credit score union, has a uncommon “open constitution,” which suggests there are not any restrictions on its membership. Consequently, PenFed can draw clients from a nationwide market. Thus, it’s honest to say that there are not any “underserved” markets within the U.S., apart from these individuals who can’t entry PenFed’s web site.

To make certain, there’ll all the time be people who find themselves “unbanked” as a result of—because the FDIC survey signifies—they “don’t belief banks,” are unemployed, are undocumented employees, or don’t suppose they come up with the money for to fulfill the minimal necessities for an account. However due to expertise and fashionable improvements in monetary providers, it’s protected to say that just about each American now has entry to banking providers, thus fulfilling the unique impetus for creating credit score unions in 1934.

Conclusion

Credit score unions’ privileged standing as tax-exempt nonprofit organizations might have crammed a market want throughout the Nice Melancholy, however 90 years later, there isn’t any longer a justification to subsidize these establishments. Credit score unions not serve the underserved. Their true taxpayer subsidy is many occasions the estimated forgone tax revenues. And their relaxed widespread bonds and expanded product choices are a telling indication that their authentic enterprise mannequin isn’t viable and that they should be extra like banks to outlive.

This isn’t the primary time that lawmakers have needed to deal with unfair competitors in monetary markets. In 1951, lawmakers repealed the tax exemption for mutual financial savings banks and financial savings and mortgage associations, which have been created to assist low-income working clients, “to be able to set up parity between competing monetary establishments.”

The Senate report accompanying the Income Act of 1951 highlighted how mutual financial savings banks actively competed with “industrial banks and life insurance coverage firms for the general public financial savings, they usually compete[d] with many kinds of taxable establishments within the safety and actual property markets.”[41] Their tax-exempt standing gave these establishments “the benefit of having the ability to finance progress out of untaxed retained earnings,” in contrast to competing industrial banks who should pay tax on their retained revenue. Thus, the report concluded, persevering with the “tax-free remedy now accorded mutual financial savings banks can be discriminatory.”

What was true for mutual financial savings banks in 1951 is true for credit score unions at the moment. Equity, fairness, and public finance demand that credit score unions be placed on the identical tax footing because the industrial banks they compete with. Contemplating the nation’s $34 trillion nationwide debt, subsidizing credit score unions is a luxurious taxpayers can not afford.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

[1] John T. Croteau, “The Federal Credit score Union System: A Legislative Historical past,” Social Safety Bulletin 19:5 (Might 1956): 10. https://www.ssa.gov/coverage/docs/ssb/v19n5/v19n5p10.pdf.

[2] 73 Cong. Rec. H12225 (1934), https://www.govinfo.gov/content material/pkg/GPO-CRECB-1934-pt11-v78/pdf/GPO-CRECB-1934-pt11-v78-3-2.pdf.

[3] Erdis W. Smith, “Federal Credit score Unions,” Social Safety Bulletin 11:10 (October 1948): 4, https://www.ssa.gov/coverage/docs/ssb/v11n10/v11n10p13.pdf#nameddest=article.

[4] 73 Cong. Rec. H12223 (1934).

[5] Erdis W. Smith, “Federal Credit score Unions: Origin and Improvement,” Social Safety Bulletin 18:11 (November 1955): 3, https://www.ssa.gov/coverage/docs/ssb/v18n11/v18n11p3.pdf.

[6] Nationwide Credit score Union Administration, “Quarterly Knowledge Abstract Stories,” December 2022, https://ncua.gov/recordsdata/publications/evaluation/quarterly-data-summary-2022-This fall.pdf.

[7] Credit score Union Membership Entry Act, Pub. L. No. 105-219 (1998), https://www.congress.gov/invoice/One hundred and fifth-congress/house-bill/1151/textual content.

[8] U.S. Authorities Accountability Workplace, “Credit score Unions: Better Transparency Wanted on Who Credit score Unions Serve and on Senior Government Compensation Preparations,” GAO-07-29, Nov. 30, 2006, https://www.gao.gov/merchandise/gao-07-29.

[9] NCUA, “5300 Name Report Mixture Monetary Efficiency Stories (FPRs),” December 2019, https://ncua.gov/recordsdata/publications/evaluation/financial-performance-aggregate-report-dec-2019.zip.

[10] NCUA, “5300 Name Report Mixture Monetary Efficiency Stories (FPRs),” December 2022, https://ncua.gov/recordsdata/publications/evaluation/financial-performance-aggregate-report-dec-2022.zip.

[11] Thomas G. Noland and Edward H. Sibbald, “100 Years of Credit score Unions: Impression of Tax Exempt Standing The Case for Georgia,” Southern Enterprise Assessment 35:1 (January 2010): 1-14, https://digitalcommons.georgiasouthern.edu/cgi/viewcontent.cgi?article=1117&context=sbr.

[12] Jordan van Rijn, Shuwei Zeng, and Paul Hellman, “Monetary Establishment Targets & Auto Mortgage Pricing: Proof from the Survey of Shopper Finance,” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3520630.

[13] Don Fullerton, “Tax Coverage Towards Artwork Museums,” Nationwide Bureau of Financial Analysis, June 1990, https://www.nber.org/system/recordsdata/working_papers/w3379/w3379.pdf; see additionally: https://intranet.americansforthearts.org/by-program/reports-and-data/legislation-policy/naappd/tax-policy-toward-art-museums.

[14] Robert DeYoung, John Goddard, Donal G. McKillop, John O.S. Wilson, “Who Consumes Credit score Unions Subsidies?,” QMS Analysis Paper, Might 10, 2022, https://www.econstor.eu/bitstream/10419/271258/1/qms-rp2022-03.pdf.

[15] Credit score Union Nationwide Affiliation, “U.S. Membership Advantages Report Mid-Yr 2023,” https://www.cuna.org/content material/dam/cuna/advocacy/cu-economics-and-data/credit-union-snapshot/Nationwide-MemberBenefits.pdf

[16] Robert M. Feinberg and Douglas Meade, “Financial Advantages of the Credit score Union Tax Exemption to Shoppers, Companies, and the U.S. Economic system,” Nationwide Affiliation of Federally-Insured Credit score Unions,” September 2021, https://www.nafcu.org/system/recordsdata/recordsdata/NAFCUpercent202021percent20CUpercent20Taxpercent20Study-FULL-Net.pdf.

[17] Id.

[18] GAO, “Credit score Unions: Better Transparency Wanted.”

[19] Pankaj Okay. Maskara and Florence Neymotin, “Do Credit score Unions Serve the Underserved,” Jap Financial Journal 47:4 (January 2021): 184-205, https://hyperlink.springer.com/article/10.1057/s41302-020-00183-3.

[20] Pankaj Okay. Maskara and Florence Neymotin, “Credit score Unions Through the Disaster: Did They Present Liquidity?,” Utilized Financial Letters 26:3 (Might 2019): 174-179, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3353559.

[21] Salma Mohammad Ali, “Who Makes use of Credit score Unions? Fifth Version,” Middle for Shopper Monetary Lives in Transition, Mar. 31, 2021, https://www.filene.org/experiences/who-uses-credit-unions-fifth-edition.

[22] Jordan van Rijn et al., “Monetary Establishment Targets & Auto Mortgage Pricing.”

[23] GAO, “Credit score Unions: Better Transparency Wanted.”

[24] Authorities Accountability Workplace, “Monetary Establishments: Points Relating to the Tax-Exempt Standing of Credit score Unions,” GAO-06-220T, Nov. 3, 2005, https://www.gao.gov/merchandise/gao-06-220t.

[25] Congressional Federal Credit score Union, https://www.congressionalfcu.org/.

[26] CFCU Service Area Map, https://www.congressionalfcu.org/photographs/default-source/default-album/mapfb4bf3ecffa460b09f66ff3800d28eef.jpg.

[27] State Division Federal Credit score Union, https://www.sdfcu.org/.

[28] SDFCU.org, “Organizational, Affiliation, Firm and Group Affiliations (Choose Worker Teams),” https://www.congressionalfcu.org/photographs/default-source/default-album/mapfb4bf3ecffa460b09f66ff3800d28eef.jpg.

[29] Stefan Gissler, Rodney Ramcharan & Edison Yu, “The Results of Competitors in Shopper Credit score Market,” Nationwide Bureau of Financial Analysis, August 2019, https://www.nber.org/papers/w26183.

[30] Gissler et al., “The Results of Competitors in Shopper Credit score Market.”

[31] Kelly Culp, “Banks v. Credit score Unions: The Turf Battle for Shoppers,” The Enterprise Lawyer 53:1 (November 1997): 193-216, https://www.jstor.org/steady/40687781.

[32] Lauren Seay and Ronamil Portes, “Credit score unions launch financial institution shopping for spree with 5 offers in 1 week,” S&P International Market Intelligence, Sep. 5, 2023, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/credit-unions-launch-bank-buying-spree-with-5-deals-in-1-week-77281711.

[33] Wilary Winn, “Credit score Unions Buying Group Banks,” https://wilwinn.com/useful resource/credit-unions-purchasing-community-banks/.

[34] Steve Gelsi, “Credit score Unions shopping for banks? Sure certainly, says this deal lawyer,” MarketWatch, Aug. 12, 2022, https://www.marketwatch.com/story/credit-unions-buying-banks-yes-indeed-says-this-deal-lawyer-11660304804.

[35] Jim DuPlessis, “Detroit Credit score Union Motors South,” Credit score Union Instances, Mar. 17, 2023, https://www.cutimes.com/2023/03/17/detroit-credit-union-motors-south/.

[36] Jim DuPlessis, “Michigan CU Financial institution Purchase Deal Would Place Practically 25% of Its Branches in Florida,” Credit score Union Instances, Sep. 27, 2023, https://www.cutimes.com/2023/09/27/michigan-cu-bank-buy-deal-would-place-nearly-25-of-its-branches-in-florida/.

[37] Mark Sanchez, “Lake Michigan Credit score Union continues Florida enlargement with deliberate acquisition,” Crain’s Grand Rapids Enterprise, Jun. 16, 2021. https://www.crainsgrandrapids.com/information/banking-finance/lake-michigan-credit-union-continues-florida-expansion-with-planned-acquisition/.

[38] Ibid.

[39] Frank J. Diekmann, “Why NCUA Ought to Require CUs to Disclose What They’re Paying for Banks,” CUToday.information, Sep. 20, 2023, https://www.cutoday.information/THE-tude/Why-NCUA-Ought to-Require-CUs-to-Disclose-What-They-re-Paying-for-Banks.

[40] FDIC, “2021 FDIC Nationwide Survey of Unbanked and Underbanked Households,” Jul. 24, 2023, https://www.fdic.gov/evaluation/household-survey/index.html.

[41] United States Senate, “The Income Act of 1951: Report of the Committee on Finance to Accompany H.R. 4473 a Invoice to Present Income, and for Different Functions,” Sep. 18, 1951, https://www.govinfo.gov/content material/pkg/SERIALSET-11489_00_00-137-0781-0000/pdf/SERIALSET-11489_00_00-137-0781-0000.pdf.

Share