The Fed’s most popular gauge of inflation was launched right this moment and, in accordance with Fed chief Jerome Powell, “it was good,” as there have been no ugly surprises. This information may increase the markets, as sticky inflation knowledge has had traders on edge amid rates of interest which have remained comparatively excessive. The inventory and bond markets have been in fact closed right this moment, nevertheless, so we cannot see a response from merchants till subsequent week.

Total, we’re heading into subsequent week on good phrases, with the Dow, Nasdaq and the S&P 500 at new highs with small-cap shares in an uptrend after posting a formidable 2.5%. In different optimistic information, we’re persevering with to see a broadening out of participation effectively past the Magnificent Seven shares which dominated final 12 months’s high efficiency lists.

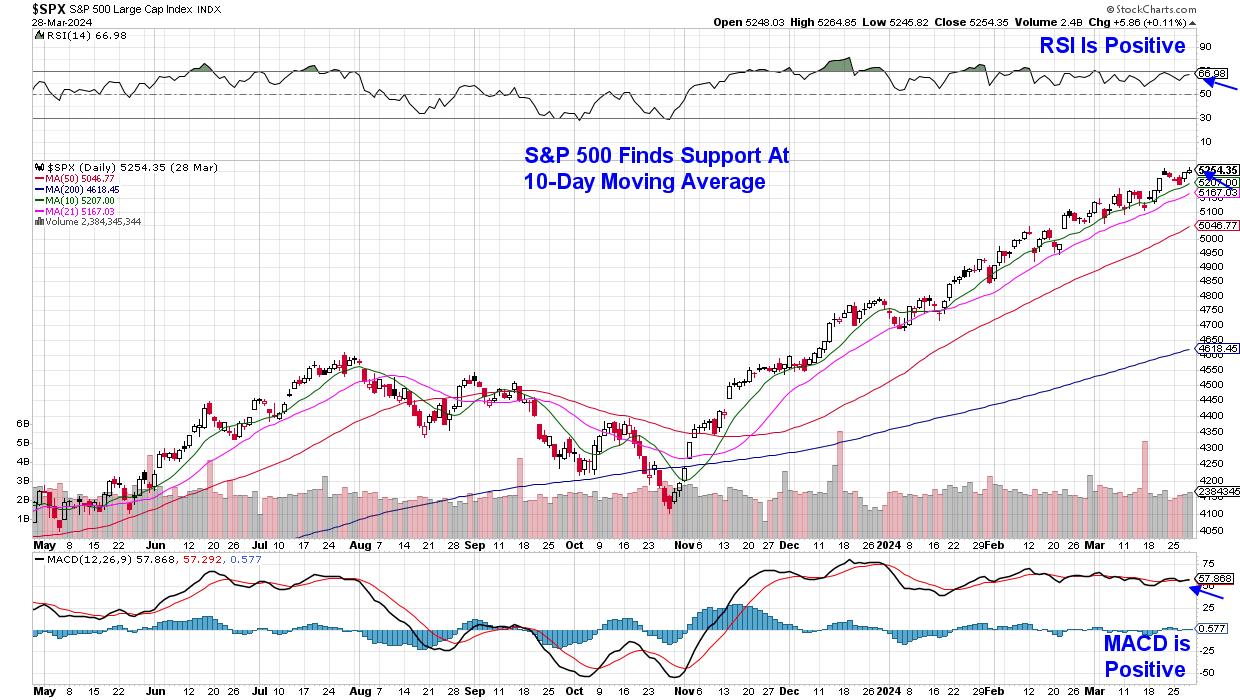

Every day Chart of S&P 500 Index

Every day Chart of S&P 500 Index

With a lot bullish conduct, it might be tough to find out the place to focus your efforts so that you could outperform these sturdy markets. From my work, honing in on firms which have sturdy development outlooks will all the time repay, notably throughout a bull market section akin to now.

Many of those faster-growing firms — notably in Know-how — have seen spectacular returns year-to-date already, with consolidation phases wanted earlier than one other leg up. As an alternative, I am on the lookout for shares in areas akin to Healthcare, which have entered a brand new uptrend after trending sideways over the previous 3 weeks. Whereas usually seen as a defensive space of the markets, there’s loads of fast-growing firms amid the event of latest medication and medical merchandise.

Every day Chart of Healthcare Sector (XLV)

Every day Chart of Healthcare Sector (XLV)

A primary instance is Eli Lilly (LLY) which was added to my MEM Edge Report’s advised holdings checklist in early January. Along with the corporate’s standard weight reduction drug Zepbound, which was authorised late final 12 months, The corporate is on monitor to see their Alzheimer’s drug authorised subsequent quarter.

LLY has been trending upward in a good buying and selling vary in anticipation of this FDA approval, and this current interval of consolidation has allowed the inventory to recuperate from an overbought situation throughout February. A detailed above its current excessive of $800, coupled with a bullish MACD crossover, would put the inventory into a powerful purchase zone.

Every day Chart of Eli Lilly (LLY)

Every day Chart of Eli Lilly (LLY)

Different newer areas are additionally starting to emerge, and if you would like to be alerted to new purchase concepts in these areas, use this hyperlink right here to trial my twice weekly MEM Edge report. You may additionally obtain in-depth data relating to broader market circumstances in addition to sector rotation that is happening and why. I hope you may make the most of this provide!

Warmly,

Mary Ellen McGonagle

MEM Funding Analysis

Mary Ellen McGonagle is knowledgeable investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to turn out to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra