You’ll have itemized your tax deductions prior to now if you’re, as an example, a house owner. However now, you might profit from taking the usual deduction if the brand new customary deduction quantity on your submitting standing is greater than your itemized tax deductions.

Should you’re unsure which is the higher choice this yr, try our Commonplace vs Itemized Tax Deduction Interactive.

In simply 5 fast screens, you’ll perceive the adjustments in the usual deduction and itemized deductions, and also you’ll get an estimate of your deductions based mostly on inputs. The software additionally tells you when you might declare customary vs. itemized and makes suggestions for end-of-year tax strikes you may make to extend your itemized deductions.

Ought to I take the usual vs. itemized deduction

Are you debating on whether or not to stay with the usual deduction or go for the itemized deduction route? Which is able to supply the larger tax benefit for you’ll rely in your circumstances. Beneath, we’ll provide you with an outline of what situations usually swimsuit the usual or itemized deduction finest.

When you need to take the usual deduction

Navigating your taxes can appear to be a frightening activity, however we’re right here to assist. When deciding whether or not you need to take the usual deduction vs. an itemized deduction, it actually comes all the way down to what deductions you’d qualify for.

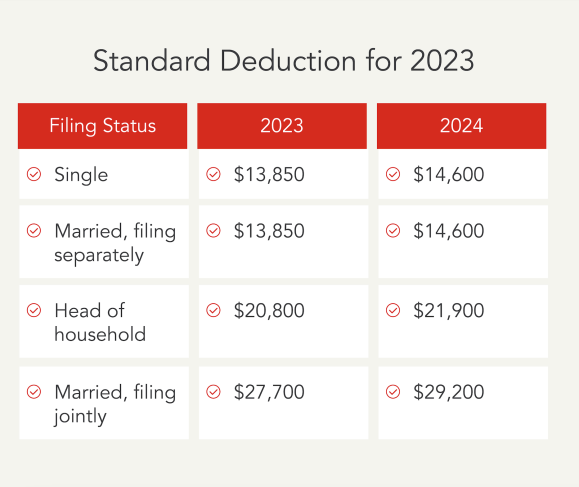

The usual deduction is a set quantity based mostly on the way you file your taxes, with extra advantages for many who are 65 and older or visually impaired. The present customary deduction is:

- $13,850 for single filers

- $13,850 for married, submitting individually

- $20,800 for heads of households

- $27,700 for married, submitting collectively

The IRS adjusts the usual quantity annually to maintain up with inflation, so annually, you’ll doubtless must reexamine your bills to resolve which method is best for you.

Put merely, choosing the usual deduction makes essentially the most sense when itemized eligible bills don’t surpass the usual deduction quantity. Should you’re contemplating taking the usual deduction, eligible deductions equivalent to mortgage curiosity, medical bills, and charitable donations come into play when making this tax submitting alternative.

Often, when you have extra tax credit vs. deductions, the usual deduction is probably going the higher choice.

When you need to take the itemized deduction

So, when are you speculated to itemize deductions? Nicely, in case your eligible bills – like medical prices, mortgage curiosity, or charitable donations – add as much as greater than the usual deduction quantity, itemizing your deduction may be the higher choice to decrease your tax invoice if the eligible bills surpass the usual deduction.

While you’re making an attempt to determine which varieties of bills would possibly qualify, ensure to learn up on probably missed deductions.

You should use the tax deduction calculator to assist present extra readability so you may make an knowledgeable resolution.

Itemized vs. customary deduction calculator

Take a look at our Commonplace vs Itemized Tax Deduction Interactive. In simply 5 fast screens, you’ll perceive the adjustments in the usual deduction and itemized deductions; you’ll get an estimate of your deductions based mostly on inputs; it tells you when you might declare customary vs. itemized and makes suggestions for end-of-year tax strikes you may make to extend your itemized deductions.

*Word, the Commonplace versus Itemized Interactive Calculator is for estimation functions solely and doesn’t embrace all deductions.

What are the professionals and cons of taking the itemized deduction?

Itemizing deductions in your tax return generally is a game-changer for some folks since it could additional helps scale back their tax invoice. Nevertheless it’s not at all times as simple because it appears – understanding what itemizing tax deductions entail is vital earlier than deciding to go that route.

Itemized deduction execs

Opting to itemize your deductions over taking the usual deduction route generally is a useful tax transfer. Not like the mounted customary deduction, itemizing lets you declare particular bills like mortgage curiosity, medical prices, or massive charitable donations, to call just a few, probably decreasing your taxable revenue additional in case your eligible bills surpass the usual deduction for that tax yr.

Utilizing instruments like an itemized deduction calculator lets you account for and calculate all of the deductions that apply to your distinctive circumstances, ensuring that you’ve got a extra customized method in comparison with the usual deduction.

Itemized deduction cons

There aren’t any main drawbacks essentially, however for some, the itemized deduction seems to be a little bit of a problem since you’ll have to go looking information on your eligible bills. Whereas itemized deductions give you extra flexibility by letting you declare particular bills to cut back your taxable revenue, it takes a bit extra effort throughout tax prep.

Itemizing requires thorough record-keeping, and for some, the attract of an easier method with customary deductions might outweigh the potential advantages–particularly if the quantity you assume you qualify for over the usual deduction is minimal.

What are the professionals and cons of taking the usual deduction?

When considering your tax technique, understanding how every deduction impacts your tax state of affairs is vital.

Commonplace deduction execs

Lots of people go for the usual deduction on their tax returns for a handful of causes. Firstly, it’s a faster course of, streamlining tax preparation. Moreover, the usual deduction tends to extend yearly for inflation, because of Congress, which in flip goals to scale back taxable revenue in relation to rising inflation.

The usual deduction varies relying in your submitting standing (single, married submitting collectively, head of family) and is larger for people 65 or older and/or blind. Word that married {couples} selecting to file individually can’t take the married submitting collectively customary deduction if their partner chooses to itemize deductions; each spouses must

decide for a similar method—both itemizing or taking the usual deduction.

Commonplace deduction cons

Taking the usual deduction simply because it’s simple could cause you to overlook out on writing off bills that would scale back taxable revenue additional.

Selecting between customary and itemized deductions boils all the way down to numbers. In case your itemized deductions surpass the usual deduction, then go for it. If the usual deduction is extra useful, take that route and save a while.

Don’t fear about understanding how to determine whether or not you’ll be able to declare the usual or itemized deductions. It doesn’t matter what strikes you made final yr, TurboTax will make them depend in your taxes. Whether or not you need to do your taxes your self or have a TurboTax skilled file for you, we’ll ensure you get each greenback you deserve and your greatest potential refund – assured.