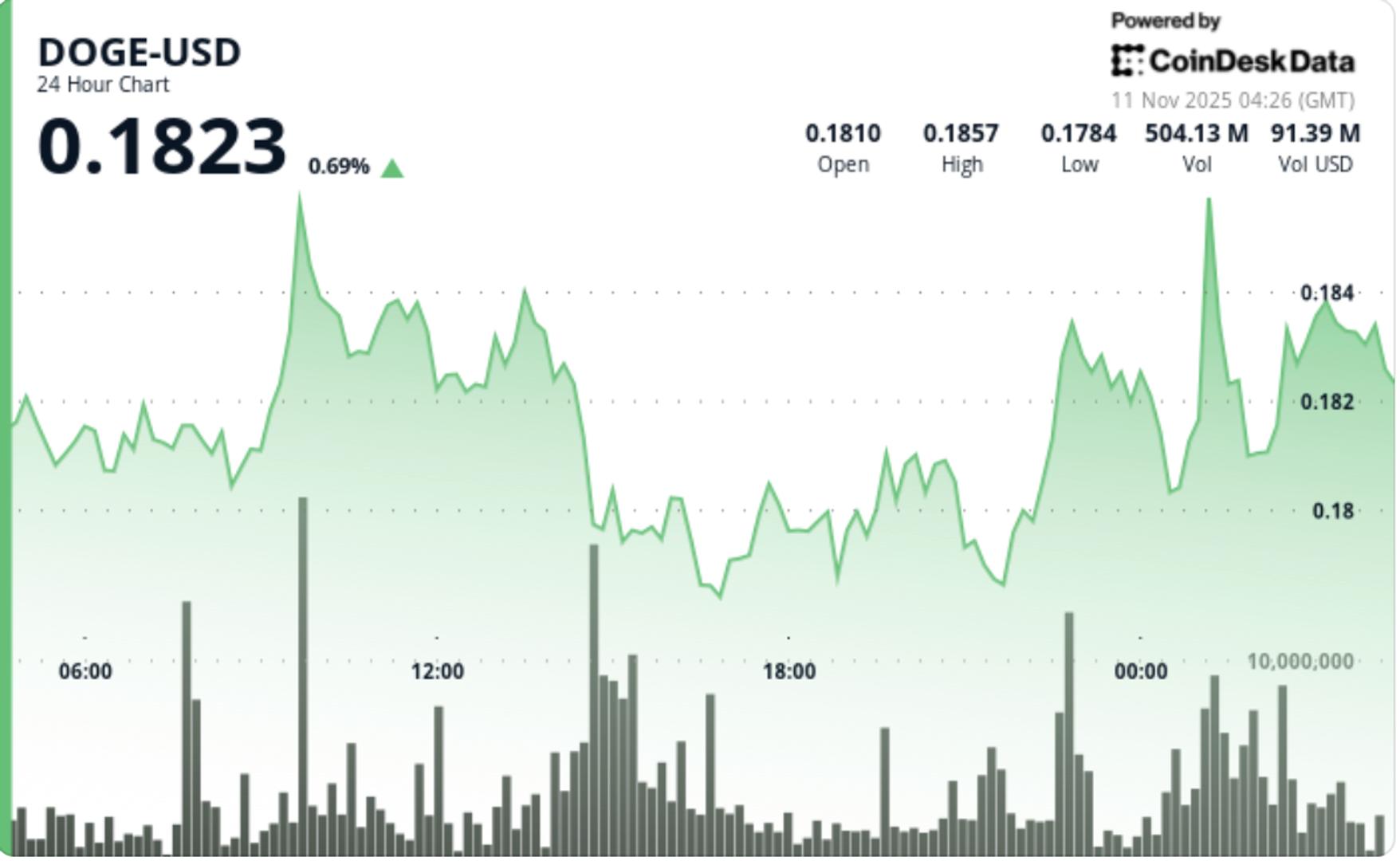

DOGE broke above key $0.1815 resistance throughout Tuesday’s session as quantity surged 96% above common earlier than a late-session reversal erased most intraday beneficial properties. The transfer created a decrease excessive formation that alerts a possible short-term shift in momentum.

Information Background

- Dogecoin superior 3.1% to $0.1824 in Tuesday’s buying and selling, extending a multi-session restoration earlier than encountering promoting stress close to the $0.184 zone.

- The meme coin traded between $0.1769 and $0.1838, carving a 3.9% vary as merchants examined higher channel boundaries.

- The Bitwise spot DOGE ETF might launch inside 20 days by way of an automated approval course of, making it a catalyst for dogecoin worth predictions.

- Bitwise’s strategy locations the memecoin ETF on a 20-day countdown to automated approval beneath Part 8(a) of the Securities Act, barring SEC intervention.

- DOGE consolidated between $0.1810 and $0.1835 throughout mid-session commerce, with patrons defending $0.1800 assist.

- Nevertheless, the late-session reversal indicated exhaustion amongst short-term merchants after repeated assessments of intraday highs.

Value Motion Abstract

- DOGE’s rally stalled abruptly at 14:00 GMT as profit-taking triggered a 1.1% pullback from $0.1842 to $0.1821. The correction unfolded on elevated quantity of seven.8 million tokens, puncturing interim assist close to $0.1830 and disrupting the sooner ascending channel construction.

- The shift established a decrease excessive formation at $0.1842/$0.1821, a typical early sign of weakening bullish momentum.

- Regardless of general intraday beneficial properties, the market’s lack of ability to carry above breakout ranges suggests the transfer could have been fueled by short-term liquidity quite than sustained accumulation.

Technical Evaluation

- Dogecoin’s short-term construction stays constructive above $0.1800 however weak to renewed promoting under $0.1820. The ascending channel seen on 4-hour charts was compromised by the late-session breakdown, introducing a neutral-to-bearish bias heading into midweek buying and selling.

- Momentum indicators present waning energy: RSI eased from 64 to 52, whereas MACD narrowed towards convergence. The elevated turnover throughout the reversal section factors to energetic distribution, although assist zones close to $0.1800 proceed to draw shopping for curiosity.

What Merchants Ought to Know

- DOGE’s near-term path hinges on its means to defend $0.1800 assist and reclaim resistance round $0.1835–$0.1840.

- A detailed above this band might restore momentum towards $0.1860–$0.1880, whereas failure to carry assist dangers retesting the $0.1760 base.

- Analysts word that ETF hypothesis stays a background catalyst however short-term worth habits seems pushed primarily by technical positioning and profit-taking flows from current whale accumulation.