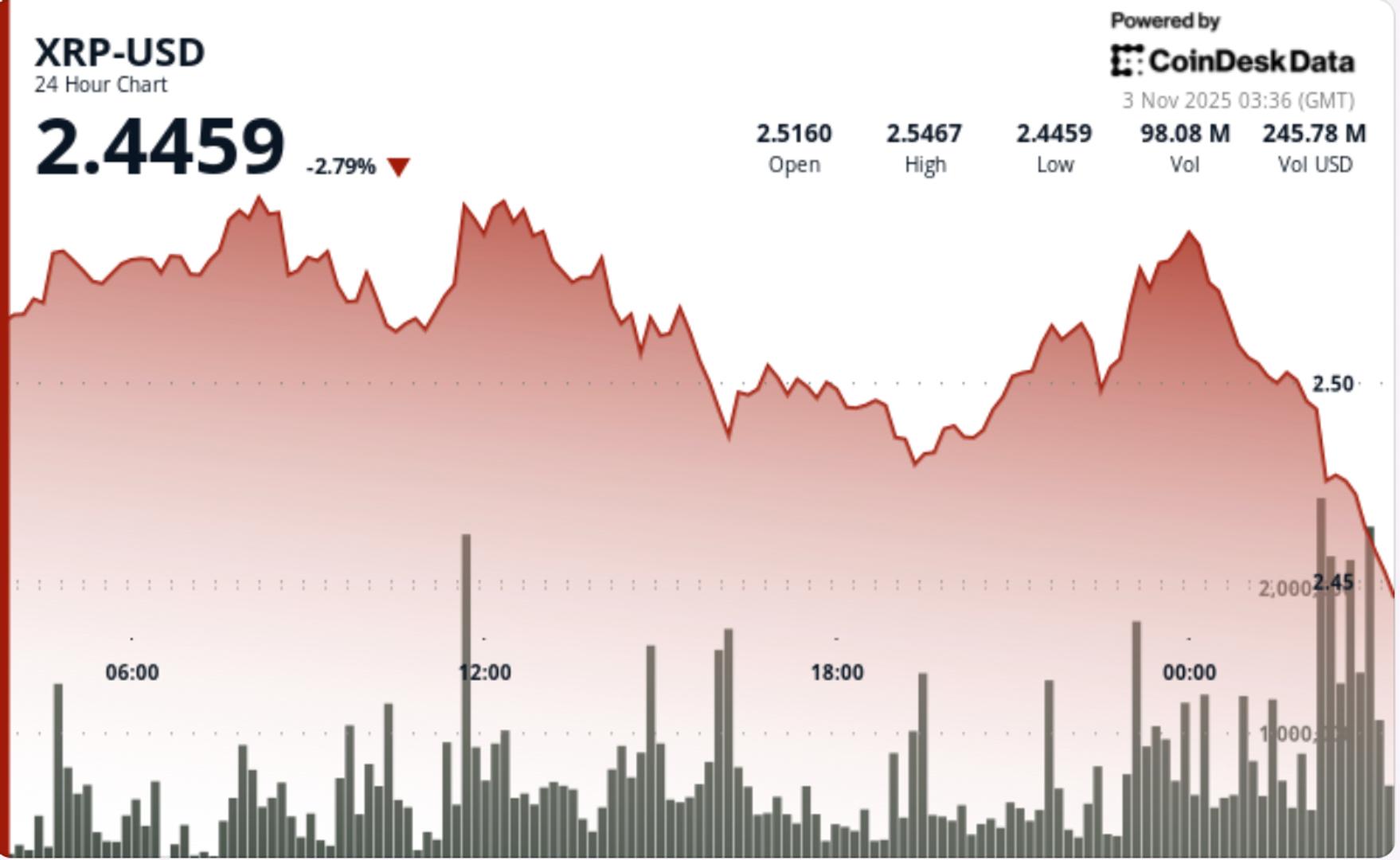

XRP slipped beneath the $2.50 mark throughout Tuesday’s session, falling 1.2% to $2.49 as repeated rejections at $2.55 confirmed robust resistance. The decline got here on heavy institutional exercise, with quantity surging 85% above the current common as sellers consolidated management on the higher finish of XRP’s buying and selling vary.

Information Background

- The digital asset traded between $2.49–$2.55 over the 24-hour session, with value motion dominated by technical flows somewhat than basic drivers.

- Three failed breakout makes an attempt at $2.54–$2.55 outlined the session’s tone, every accompanied by elevated sell-side quantity.

- General exercise climbed 85% above the 7-day common, as whole turnover reached 50.3 million tokens through the decline — confirming institutional-scale distribution at resistance ranges.

- Market sentiment stays blended after current features, with merchants watching whether or not XRP can keep assist above $2.49 amid broader consolidation in high-beta crypto belongings.

Value Motion Abstract

- XRP’s 24-hour session noticed value fluctuate inside a $0.07 vary, stabilizing close to $2.497 after dipping to intraday lows of $2.49. The 60-minute chart revealed temporary makes an attempt to reclaim $2.50.

- This conduct suggests institutional reaccumulation across the $2.50 mark — a degree traditionally related to short-term liquidity traps. Regardless of the pullback, patrons have defended the psychological ground by a number of retests.

- Nonetheless, market microstructure evaluation reveals a shift in momentum as promote orders cluster above $2.54, limiting near-term upside till quantity profiles realign with prior bullish patterns.

Technical Evaluation

- The session’s repeated rejections at $2.55 confirmed a growing lower-high formation on day by day charts, indicating fading momentum following October’s rally.

- The $2.50 assist continues to behave as a key psychological and structural pivot; sustaining closes above this threshold stays important for preserving the medium-term bullish bias.

- Momentum indicators, together with RSI and MACD, hover close to impartial territory, suggesting a possible pause part somewhat than outright reversal.

- Quantity focus at higher resistance ranges — notably the 50.3M spike through the selloff — confirms energetic profit-taking from bigger holders.

- Declining quantity within the subsequent consolidation implies early indicators of accumulation, with institutional patrons probably layering bids close to the $2.49–$2.50 zone.

What Merchants Ought to Watch

- XRP’s near-term trajectory hinges on whether or not the $2.49 assist can stand up to additional assessments.

- Sustained closes beneath this degree may open draw back towards $2.46, whereas a clear breakout above $2.55 would reset short-term sentiment and goal the $2.60 extension.

- Merchants are looking forward to affirmation by quantity alignment: growth on upward strikes would validate renewed demand, whereas continued fading exercise would reinforce a range-bound outlook.

- Till directional affirmation emerges, positioning stays tactical — with liquidity pockets at $2.49–$2.50 providing short-term alternatives for each mean-reversion and breakout merchants.