Centralized and Decentralized Blockchains are each vital sorts of blockchain, however selecting the best-suited one for you primarily depends upon the Enterprise wants of the challenge.

Decentralized Exchanges (DEX)

A DEX or Decentralized Alternate is a peer-to-peer market the place customers can commerce cryptocurrencies with out the necessity for an middleman like a Financial institution or monetary establishments to facilitate the switch and custody of funds. DEXs, not like conventional establishments like banks, brokers, and fee processors, use blockchain-based sensible contracts that allow the alternate of property.

Sorts of DEXs

- Automated Market Makers (AMMs): Automated market makers are a kind of decentralised alternate that makes use of algorithmic “Cash robots” to make it straightforward for merchants to purchase and promote crypto property.

- Order E book DEXs: Comparable to dYdX and Serum, combine the pace of centralised buying and selling with the advantages of decentralisation, giving customers the most effective of each worlds.

- DEX aggregator: is a service that brings collectively liquidity from varied decentralised exchanges and market makers, aiding customers find an optimum worth for a commerce.

Advantages of Buying and selling on Decentralized Crypto Exchanges

- Anonymity: Buyers who select cryptocurrency for its anonymity could be defeating the entire goal by buying and selling on a centralised crypto alternate, since they should register and bear a verification course of.

- Safety: Decentralised crypto exchanges are a safer choice since there’s restricted sharing of information with any third occasion. Moreover, the very setup makes it not possible for hackers to interrupt in.

- Non-custodial buying and selling: Such platforms don’t maintain a crypto dealer’s passwords or funds. They let the customers commerce instantly from their wallets utilizing sensible contracts. This fashion, customers can swap their crypto funds instantly with out depositing them into the DEX platform.

- Decrease Charges: DEXs perform by way of self-executing sensible contracts, which permits them to cost much less in comparison with centralized exchanges.

Centralized Exchanges(CEX)

A centralized cryptocurrency alternate, or CEX, is similar to conventional fee methods like banks and different monetary establishments. They behave like intermediaries between consumers and sellers, offering a safe house with a user-friendly interface with varied different providers to boost the buying and selling expertise.

Main CEX platforms

- Binance

- Bybit

- Coinbase

- Upbit

- OKX

- Bitget

- Gate

- MEXC

- KuCoin

- HTX

Options of Centralized Exchanges

- All customers should create accounts and supply their private data, and full identification verification (KYC) processes as a way to have entry to centralised alternate methods.

- Because of a bigger person base, Centralised exchanges have comparatively increased liquidity. This permits quicker transactions and higher worth stability.

- Superior buying and selling instruments like charts, Indicators, Cease-loss, and many others., that are important for buying and selling, can be found on centralised Exchanges

- CEXs present buyer help to help customers with points or inquiries.

Disadvantages of Centralized Exchanges

- Threat of single-point failure or lack of funds. In case of cyber assaults, customers can lose all property saved of their wallets if the corporate lacks ample assets and safety measures to guard itself.

- No full management over your funds. On a CEX, you switch your cryptocurrency to wallets managed by the alternate, which signifies that in conditions like chapter or account suspension, recovering property could also be tough.

- KYC procedures and decreased anonymity. Most Centralized exchanges require necessary identification verification, which considerably reduces anonymity and demoralizes those that worth privateness.

- Excessive charges on transactions. Every commerce, deposit, and withdrawal from a centralised alternate requires charges.

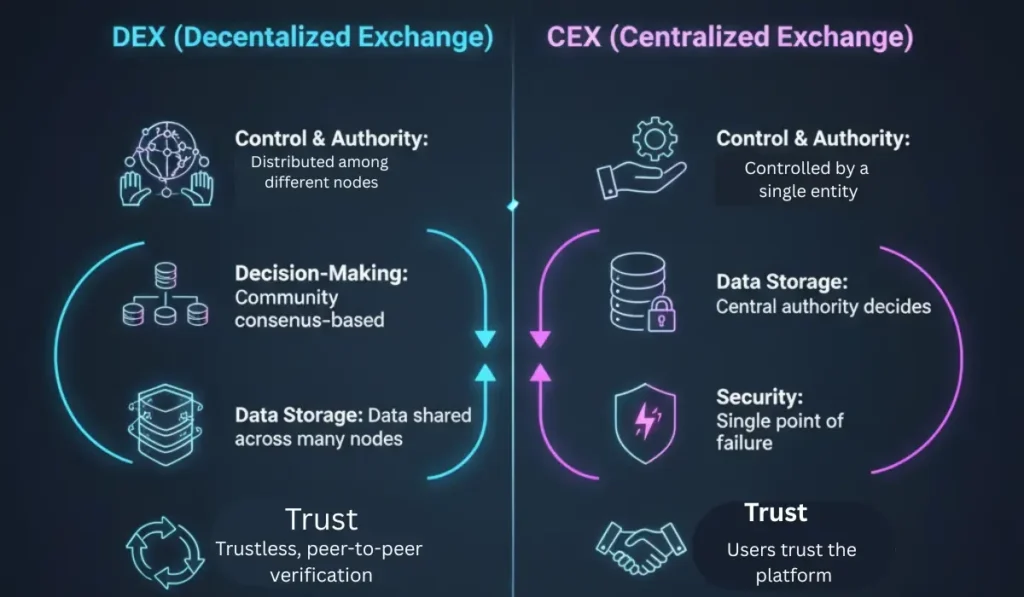

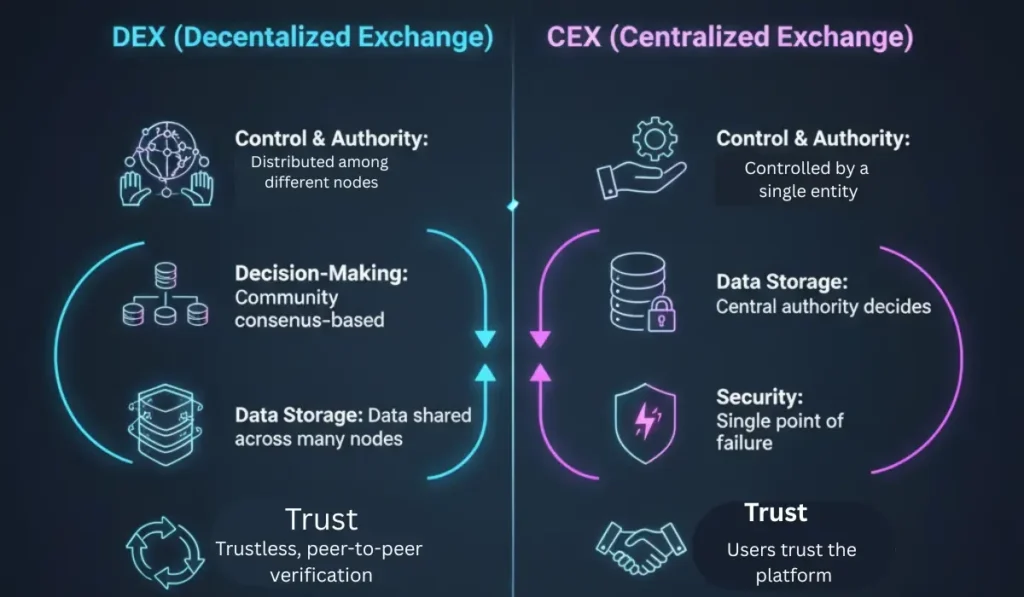

Variations Between Decentralized Blockchain and Centralized Blockchain

Decentralised and centralized blockchains aren’t the identical factor; they each have their very own areas the place they serve their goal to their respective enterprise wants. The primary elements that may inform them aside embrace management, knowledge dealing with, safety, transparency, and operational mechanisms.

Management and Authority

A single Authority or entity controls the centralized blockchain. Decentralized blockchain, nonetheless, distributes management amongst a number of individuals or nodes. No single entity has full management.

Resolution-Making

There’s a central authority that makes choices in a centralized blockchain system. Decentralised system, choices are made collaboratively. It’s a consensus course of.

Knowledge Storage and Transparency

Centralized blockchain methods function by saving all their knowledge in a single place, which will be the central server or their Database. Decentralised Blockchains are clear, which means they retailer their knowledge throughout a number of nodes or individuals within the community. This helps guarantee knowledge transparency and knowledge safety, therefore any individuals can view any transactions or processes on the decentralised blockchain.

Safety and reliability

A centralised Blockchain has a single level of failure as a result of the information is saved in a central system or database. If the system is attacked or will get corrupted, it’ll have an effect on the complete blockchain system. Not like a decentralized blockchain system, the place all customers contribute to the system’s database, and every person has a duplicate of every transaction that happens within the system.

Belief

There is no such thing as a must belief anybody on the decentralised blockchain earlier than finishing up any transaction as a result of there exists a peer-to-peer mechanism that permits every person to confirm the transparency of any transaction; every participant or node has a duplicate of any transaction.

Upkeep

Centralized blockchain acts like a financial institution or different centralized establishments. There may be an entity that has management over each transaction and each side of a centralised blockchain. There’s a single individual or organisation answerable for managing the complete blockchain. Decentralised blockchains are fully completely different. There is no such thing as a single level of management or a centralised authority. Knowledge travels throughout a number of nodes or computer systems, and every one in all them holds a duplicate of each transaction. To make a change within the community coordination between tens of millions of nodes is required, and this makes sustaining them a fancy process.

Comparability Desk of Centralized Blockchain (CEX) and Decentralized Blockchain (DEX)

| The central authority makes all main choices. | Centralized Blockchain (CEX) | Decentralized Blockchain (DEX) |

|---|---|---|

| Management and Authority | Managed by a single authority or entity. | Management is distributed amongst a number of individuals or nodes; no single entity has full management. |

| Resolution-Making | Central authority makes all main choices. | Choices are made collaboratively by way of a consensus course of. |

| Knowledge Storage and Transparency | Knowledge is saved in a single central location (server or database). | Knowledge is saved throughout a number of nodes, guaranteeing transparency and safety. Any participant can view transactions. |

| Safety and Reliability | Has a single level of failure — if the central system is attacked or corrupted, the entire community is affected. | Safer and dependable — each participant holds a duplicate of the ledger, decreasing the chance of complete failure. |

| Belief | Customers should belief the central authority managing the system. | No want for belief — transactions are verified by way of peer-to-peer mechanisms, and all individuals can validate them. |

| Upkeep | Managed by a single group or authority, just like a financial institution. Simpler to take care of however much less clear. | No single level of management; upkeep requires coordination throughout a number of nodes, making it extra advanced however extra democratic. |

Conclusion

Decentralized exchanges and centralized exchanges are each vital fee exchanges, and selecting between them primarily hinges on particular person priorities. Centralized exchanges are the go-to choices if you find yourself prioritizing comfort, anonymity, liquidity, and regulatory compliance. Nonetheless, for those who worth privateness, management, and transparency, use decentralized exchanges.

FAQs

Bitcoin is a decentralized cryptocurrency

Belief Pockets is a decentralized pockets, because it lets customers have full management over their personal key.

ETH is a decentralized cryptocurrency.

Sure, Solana is decentralized.

Based on our knowledge, Uniswap is probably the most rated decentralized alternate.