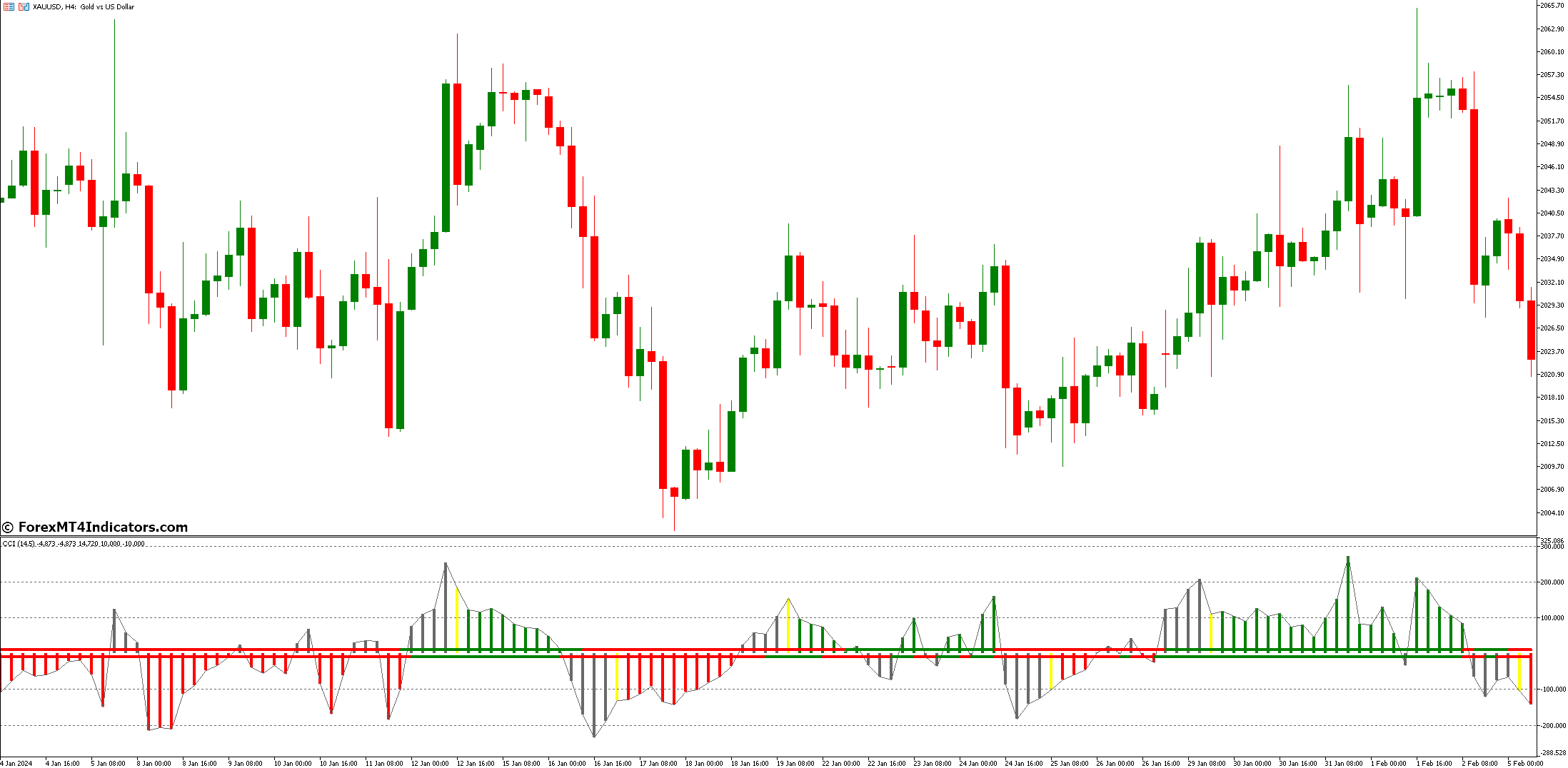

The CCI Woodies Indicator attracts its energy from the underlying CCI. Launched by esteemed technician Donald Lambert, the CCI measures the present worth stage relative to its common historic worth vary. Consider it as a gauge that signifies how “stretched” costs are from their typical habits.

Right here’s a breakdown of the CCI’s core functionalities:

- Value Deviation: The CCI calculates the distinction between the present worth and its historic transferring common. This deviation is then statistically normalized to account for market volatility.

- Overbought/Oversold Ranges: Historically, CCI readings above +100 are thought of overbought zones, suggesting a possible worth correction. Conversely, readings beneath -100 signify oversold territories, hinting at a attainable worth rebound.

- Cyclical Indicator: In contrast to absolute pattern indicators, the CCI oscillates above and beneath the zero line, reflecting the cyclical nature of worth actions.

Now that we’ve grasped the essence of the CCI, let’s see how the CCI Woodies Indicator builds upon this basis.

Methods With the Cci Woodies Indicator

The great thing about the CCI Woodies Indicator lies in its versatility. It empowers you to establish potential entry and exit factors based mostly on varied buying and selling methods. Listed below are a couple of in style approaches:

- Zero Line Rejections: A worth reversal candlestick sample, like a hammer or engulfing bar, occurring close to the zero line can sign a possible pattern change. If the value bounces off the zero line after dipping beneath it (indicating oversold situations), it would counsel a bullish reversal. Conversely, a rejection on the zero line after reaching overbought territory may trace at a bearish reversal.

- Breakouts and Breakdowns: When the value breaks decisively above a resistance stage with a concurrent bullish CCI sign (e.g., the indicator line crossing above the zero line), it would counsel a possible shopping for alternative. Conversely, a worth breakdown beneath a help stage accompanied by a bearish CCI sign (e.g., the indicator line dipping beneath the zero line) may point out a possible promoting alternative.

Elevate Your Buying and selling Recreation

The CCI Woodies Indicator is a robust software, however its true potential unfolds when mixed with different technical evaluation methods and a nuanced understanding of market situations. Listed below are some methods to raise your buying and selling recreation:

- Merging with Different Instruments: The CCI Woodies Indicator shines brightest when it performs alongside different technical evaluation devices. As an illustration, utilizing transferring averages may also help verify pattern path. A worth breakout above a resistance stage coinciding with a bullish CCI sign and a rising transferring common strengthens the potential for a continued uptrend.

- Adapting to Market Circumstances: The CCI Woodies Indicator will be tailored for varied market environments. In trending markets, the main focus may be on figuring out breakouts and breakdowns aligned with the general pattern path. Conversely, throughout range-bound markets, the emphasis may shift to figuring out overbought/oversold indicators utilizing the CCI readings along with worth habits close to help and resistance ranges.

- Backtesting with Historic Information: Earlier than deploying any technique stay, backtesting it on historic information is essential. This lets you assess the technique’s effectiveness in numerous market situations and refine your strategy. The MT5 platform itself presents backtesting functionalities, permitting you to check your CCI Woodies-based methods on previous worth information and analyze their efficiency metrics.

Benefits and Limitations of the Cci Woodies Indicator

No technical evaluation software is a magic bullet, and the CCI Woodies Indicator is not any exception. Let’s delve into its strengths and weaknesses that will help you make knowledgeable choices.

Benefits

- Simplicity: The visible illustration of the CCI readings makes it user-friendly, even for novice merchants.

- Adaptability: The indicator can be utilized for varied buying and selling methods and market situations.

- Early Warning Indicators: The CCI can present early indications of potential pattern reversals or overbought/oversold situations.

Limitations

- False Indicators: Like all technical indicator, the CCI Woodies Indicator can generate false indicators, particularly during times of excessive market volatility.

- Affirmation Bias: Merchants may subconsciously interpret worth actions to suit their expectations based mostly on the indicator’s readings. All the time prioritize affirmation from different technical evaluation instruments and worth motion.

- Not a Standalone Instrument: The CCI Woodies Indicator is finest used along with different buying and selling methods and threat administration practices.

Methods to Commerce with CCI Woodies MT5 Indicator

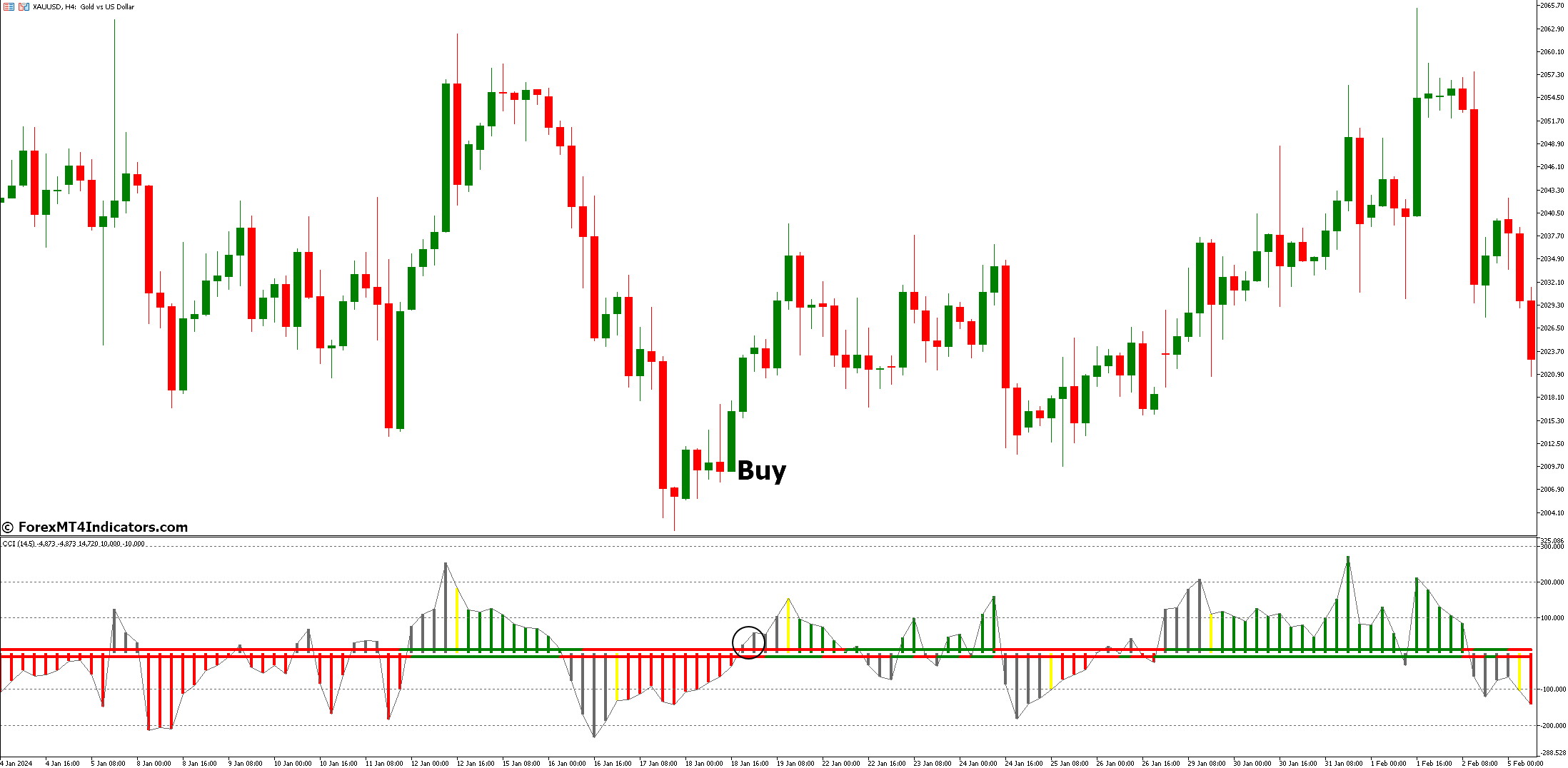

Purchase Entry

- Bullish Value Motion + CCI Breakout: Search for a bullish candlestick sample (e.g., hammer, engulfing bar) close to help. If the value decisively breaks above the help stage and the CCI Woodies indicator line crosses above the zero line concurrently, it suggests a possible shopping for alternative.

- Cease-Loss: Place your stop-loss order beneath the current swing low or help stage.

- Take-Revenue: Contemplate taking revenue on the subsequent resistance stage or based mostly on a pre-determined risk-reward ratio (e.g., 1:2 risk-to-reward).

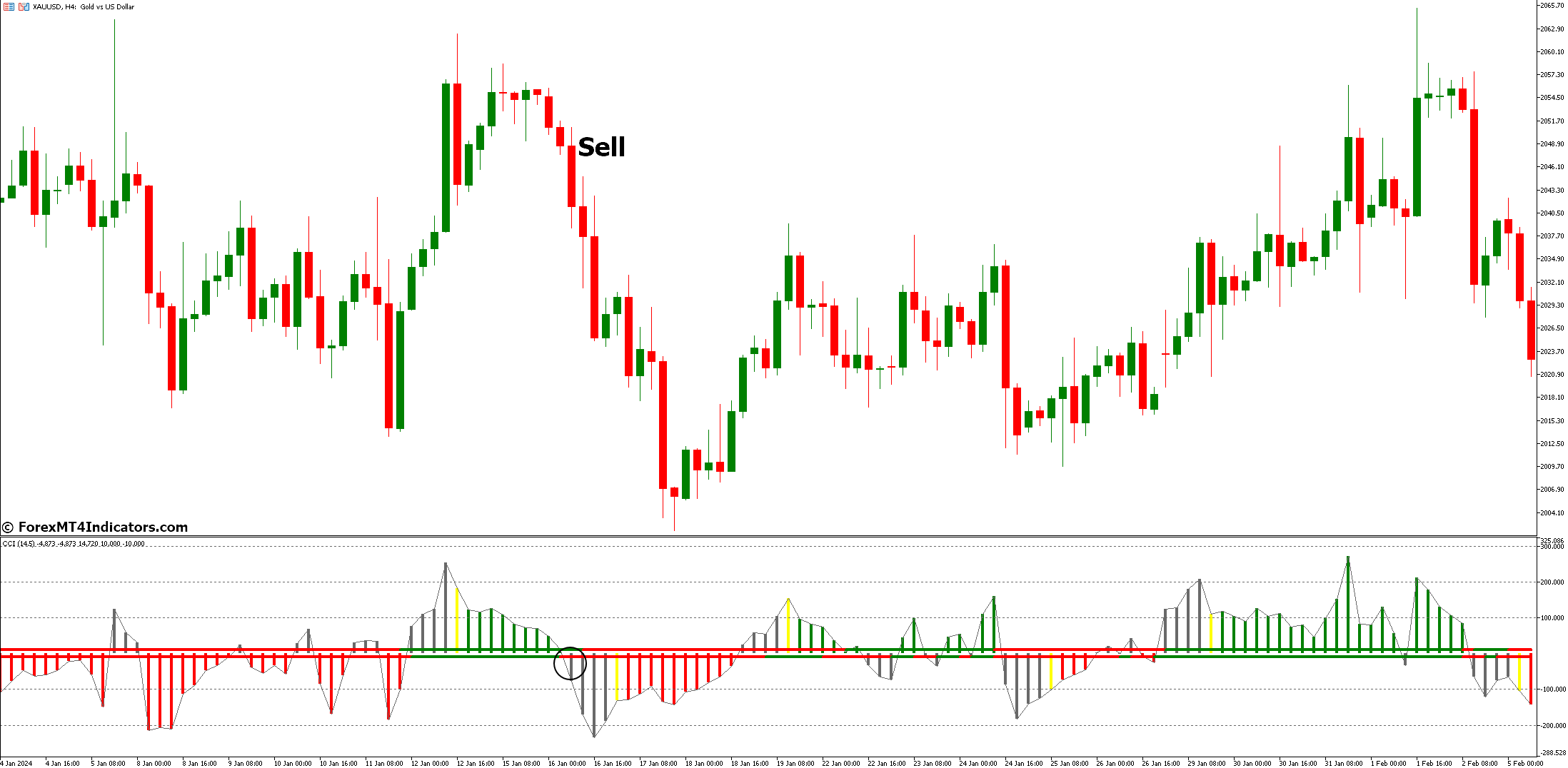

Promote Entry

- Bearish Value Motion + CCI Breakdown: Search for a bearish candlestick sample (e.g., capturing star, bearish engulfing bar) close to resistance. If the value decisively breaks beneath the resistance stage and the CCI Woodies indicator line crosses beneath the zero line concurrently, it suggests a possible promoting alternative.

- Cease-Loss: Place your stop-loss order above the current swing excessive or resistance stage.

- Take-Revenue: Contemplate taking revenue on the subsequent help stage or based mostly on a pre-determined risk-reward ratio.

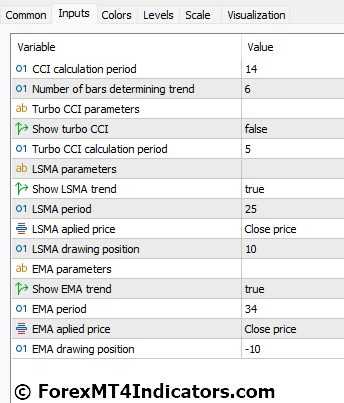

CCI Woodies MT5 Indicator Settings

Conclusion

CCI Woodies MT5 Indicator is usually a invaluable companion for merchants looking for to establish potential entry and exit factors within the foreign exchange market. By understanding its core functionalities, implementing strategic entry strategies based mostly on worth motion affirmation, and adhering to sound threat administration practices, you may harness the ability of this indicator to navigate the ever-shifting tides of the market with better confidence.

Really useful MT4/MT5 Brokers

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Signal Up for XM Dealer Account right here <<

FBS Dealer

- Commerce 100 Bonus: Free $100 to kickstart your buying and selling journey!

- 100% Deposit Bonus: Double your deposit as much as $10,000 and commerce with enhanced capital.

- Leverage as much as 1:3000: Maximizing potential earnings with one of many highest leverage choices obtainable.

- ‘Greatest Buyer Service Dealer Asia’ Award: Acknowledged excellence in buyer help and repair.

- Seasonal Promotions: Get pleasure from a wide range of unique bonuses and promotional presents all 12 months spherical.

>> Signal Up for FBS Dealer Account right here <<

(Free MT4 Indicators Obtain)

Click on right here beneath to obtain: