Avalut X1 — From thesis to a strong, institutionally examined Gold EA

In late 2022 we shaped a easy thesis: the approaching years would grant Gold (XAUUSD) unusually wealthy, tactical alternatives. The suitable response wouldn’t be a single “magic rule”, however a disciplined, multi-phase system that survives regime shifts.

The way it began (2022): the thesis behind Avalut

Inflation waves, shifting charge cycles and episodic risk-off conduct made volatility a structural characteristic reasonably than a bug. A one-pattern method would both overfit the previous or underperform in dwell buying and selling. We due to this fact set a distinct objective: construct a framework that may intentionally tackle development, vary, and volatility phases — with tight execution self-discipline and with out dependence on any single sign.

From concept to design: robustness over “fairly curves”

Avalut X1 is a multi-strategy EA: 4 complementary logics dwell in a single framework in order that strengths in a single regime can offset weaknesses in one other. The execution layer is specific and conservative: arduous SL/TP on each commerce, non-obligatory trailing, unfold/slippage caps, and broker-time session dealing with. We developed on GMT+3 and added automated broker-offset detection so the system aligns to server time reliably.

AI-assisted sign analysis — instrument, not crutch

We use AI to speed up analysis and enhance diagnostics — to not exchange guidelines with a black field:

- Characteristic discovery: systematic mining of volatility states, session results, and micro-regimes to generate testable hypotheses.

- Clustering & regime indication: mapping when a given logic has a relative edge, serving to the ensemble keep diversified throughout circumstances.

- Bayesian / evolutionary hyperparameter search: guided exploration that favors secure areas over slender peaks.

- Monitoring & drift checks: dwell telemetry flags distribution shifts; changes are thought-about solely when diagnostics justify them.

Selections stay rule-based and auditable. AI hastens analysis; it doesn’t market “secret sauce.”

Check methodology (institutional type, bias-aware)

Somewhat than a single shiny backtest, we layer a number of adversarial checks:

- Stroll-Ahead with out-of-sample affirmation: optimize → freeze → verify on unseen information to cut back look-ahead bias.

- Monte Carlo resampling: permute return/commerce paths to show path threat, drawdown clustering and restoration occasions.

- Stability & sensitivity maps: desire parameter areas with broad resilience; keep away from knife-edge peaks.

- Execution stress: unfold/slippage stress, latency tolerance and diversified fill insurance policies (FOK/IOC/RETURN).

- Knowledge hygiene: enough warm-up, day rolls and holidays dealt with, clear session cut-offs and timezone sanity checks.

4 methods, one framework

The ensemble combines trend-following parts, mean-reversion elements, breakout logic and volatility conditioning. Every technique follows the identical threat and execution requirements, and the interplay is tuned so that they complement — not crowd out — each other.

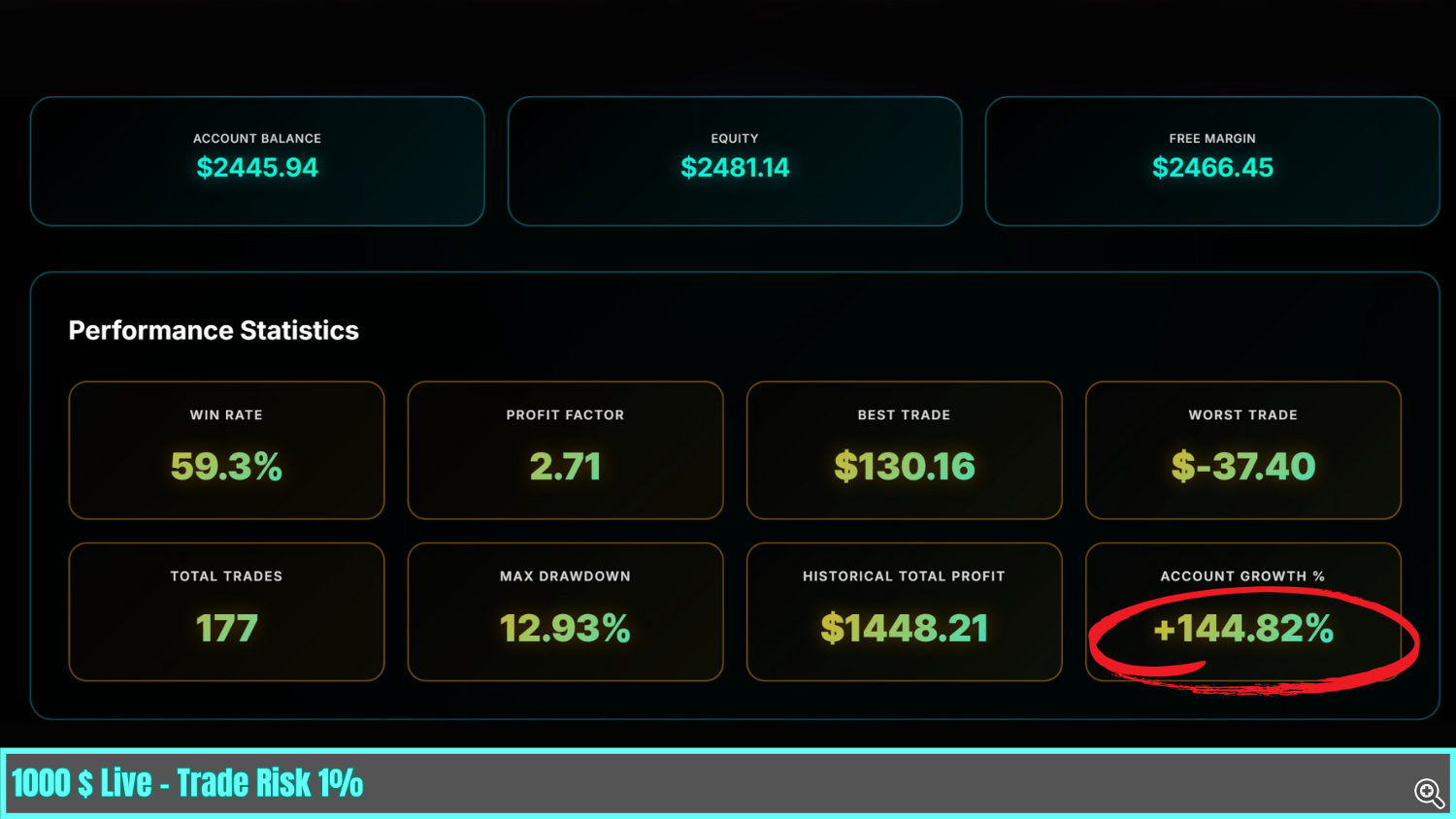

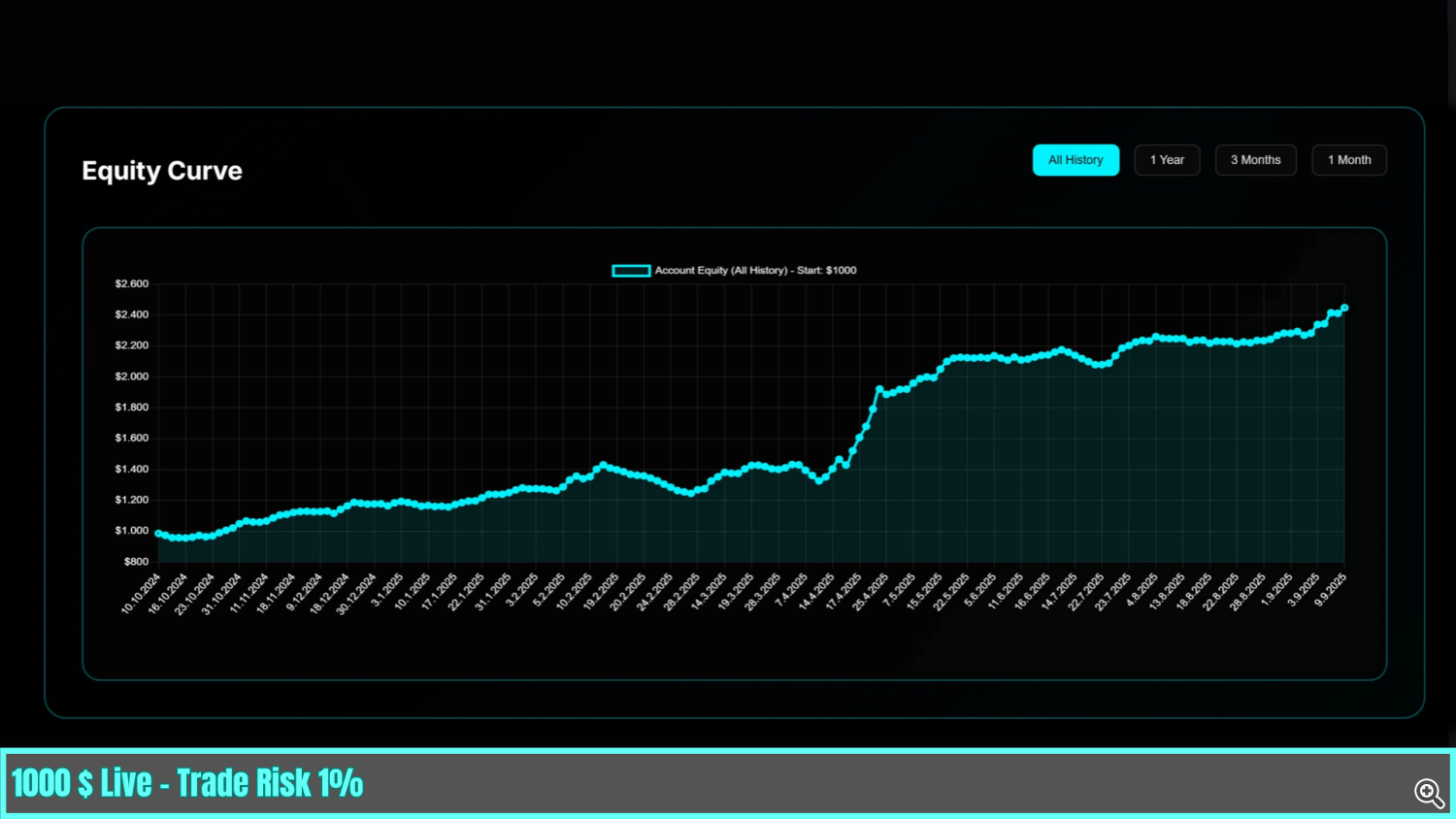

Reside operation (since 2023) and an illustration

We’ve operated Avalut X1 on a number of dwell accounts (inner and consumer) since September 2023. Our philosophy is minimal change: on this interval, one optimization was required. The next photos illustrate one instance observe: beginning stability EUR 1,000 (October 2024), at present about +144% with roughly 13% most drawdown. These figures are illustrative, not guarantees; outcomes range.

A sober distinction: find out how to spot over-engineered traps

There’s a class of methods optimized to look good on paper: slender parameter peaks, hindsight filters, “AI-washed” advertising and marketing, high-risk cash administration to easy backtest curves, and evaluate manipulation. Logic gaps are hidden by leverage till dwell friction arrives. The everyday outcomes are delayed stops, fairness cliffs, or gradual bleed with occasional blow-ups.

- Inform-tales: curve “magic” that disappears out of pattern, unstable parameters, reliance on excessive compounding, and explanations that change post-hoc.

- Our stance: clear guidelines, adversarial validation, conservative sizing, and modifications solely when justified by diagnostics — not by advertising and marketing cadence.

Unbiased references

For readers preferring third-party reference factors, we keep a observe file on an independently hosted dwell brokerage account. Extra context, background and documentation can be found on our web site (hyperlink under). Exterior assets are non-obligatory; all the pieces important is contained right here.

Conclusion: sense over spectacle

Markets are aggressive and, after prices and slippage, behave near a zero-sum recreation. Sturdy outcomes come from methodology, self-discipline and readability — not from louder narratives or AI buzz. Avalut X1 displays that view: a number of complementary methods, traceable assessments, and restrained changes. In the event you worth methods constructed with motive, not spectacle, that is the type of engineering we follow.

Danger discover: Buying and selling includes threat. Don’t make investments capital you can not afford to lose. Previous efficiency doesn’t assure future outcomes. All the time check in a demo setting earlier than dwell buying and selling.

Extra info: https://www.edgezone.consulting/